KEYTAKEAWAYS

- Binance's Latest Launchpool Deposits Exceed 18.4 Million BNB

- More Than 15,000 Bitcoins Net Outflow from CEXs Over Past Week

- sUSD Depegging Intensifies to as Low as $0.6825

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

BINANCE’S LATEST LAUNCHPOOL DEPOSITS EXCEED 18.4 MILLION BNB

According to official page information, Binance Launchpool’s 68th project Initia (INIT) mining pool has already received deposits exceeding 18.4 million BNB, 2.291 billion USDC, and 555 million FDUSD. This round of Launchpool opened at 8:00 on the 18th and will end at 8:00 on the 24th.

Analysis:

Initia is a platform for an omni-chain Rollup network, built by integrating a novel L1 with application-specific L2 infrastructure systems. After LBank launched pre-market trading, it became a Binance Launchpool project, generating high market interest and becoming a market hotspot.

MORE THAN 15,000 BITCOINS NET OUTFLOW FROM CEXS OVER PAST WEEK

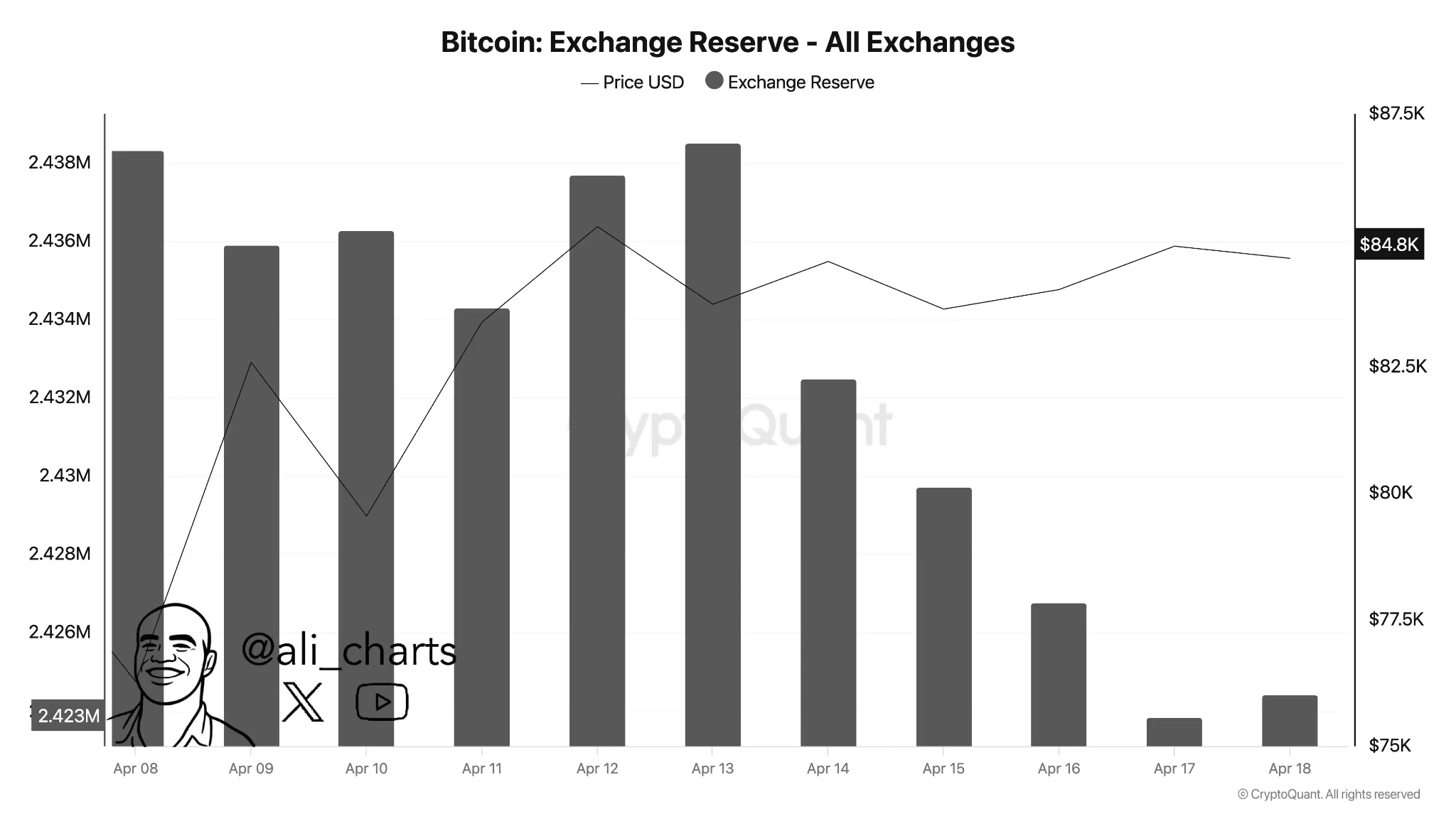

On April 18, according to on-chain analyst @ali_charts’ monitoring, more than 15,000 bitcoins have flowed out from centralized exchanges (CEXs) over the past week.

Analysis:

This may indicate two trends: first, long-term holders (HODLers) are optimistic about future market performance and choosing cold storage; second, preparations for participating in on-chain activities such as DeFi or staking. Current CEX balances have dropped to their lowest levels since 2021, and tightening exchange liquidity may amplify market volatility.

SUSD DEPEGGING INTENSIFIES TO AS LOW AS $0.6825

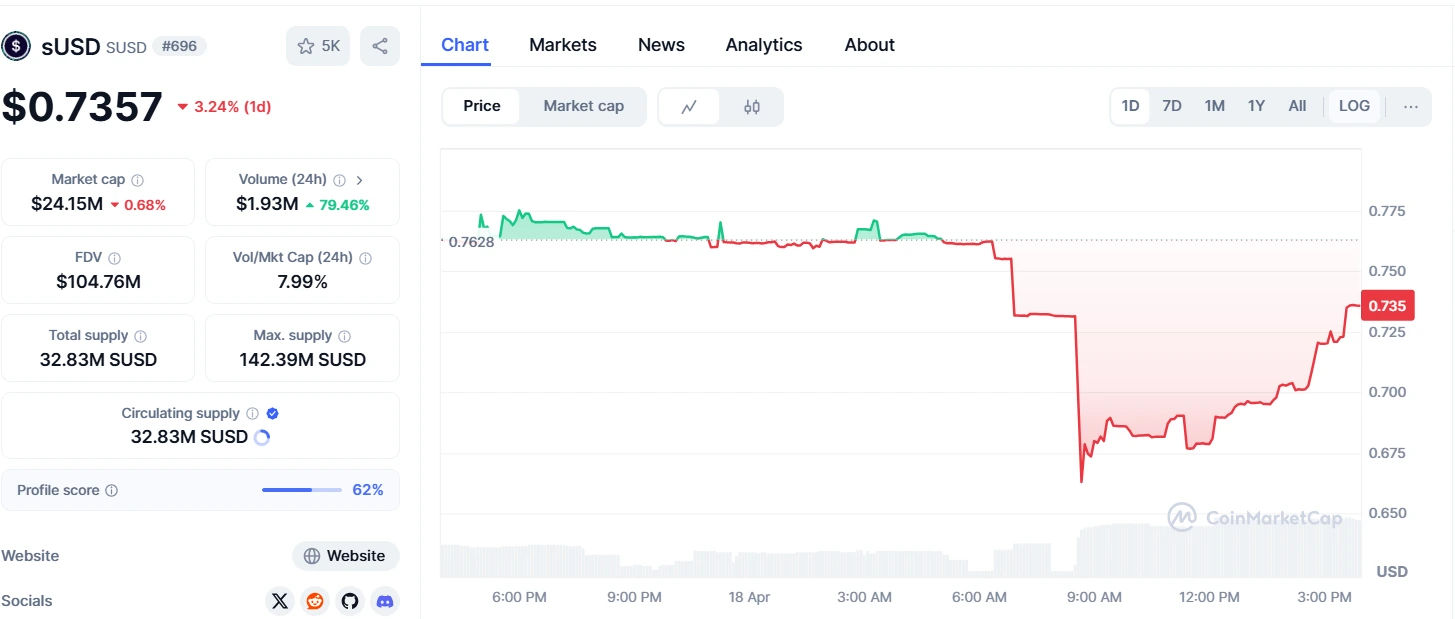

Market data shows that Synthetix ecosystem stablecoin sUSD has experienced intensified depegging, dropping to as low as $0.6825, with a maximum 24-hour decline of 16.5%. It currently trades at $0.7357, with market cap falling to $24.15 million.

Analysis:

sUSD’s severe 16.5% depeg reflects the systemic fragility of algorithmic stablecoins in extreme market conditions. This depegging may be driven by three factors:

- Insufficient overcollateralization in the Synthetix debt pool

- Failure of arbitrage mechanisms leading to a downward price spiral

- Liquidity stampede triggered by market panic

The current price of $0.7357 still deviates 26.5% from the peg value. If the protocol cannot restore balance through mechanisms like debt auctions, it could trigger a more serious confidence crisis.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!