KEYTAKEAWAYS

- TRUMP coin exemplifies meme market manipulation: 80% of supply controlled by insiders who accumulated pre-launch and dumped at peak prices, leaving retail investors devastated.

- Most memecoins share fatal flaws: highly centralized holdings, zero intrinsic value, aggressive social media promotion, and predatory high-leverage trading options.

- Sustainable solutions require transparency tools, exchange-level risk classifications, KOL accountability frameworks, and community governance structures similar to established DAOs.

CONTENT

$TRUMP coin scandal exposes meme market vulnerabilities: Analysis of insider trading patterns, centralized distribution models, and regulatory gaps enabling 97% of coins to ultimately fail despite explosive growth.

On April 23, the website for US President Trump’s personal memecoin “TRUMP coin” announced that Trump would host a dinner on May 22 at a private club in Washington, DC. The top 220 holders by coin quantity would receive “the world’s most exclusive invitation” to dine with Trump, where they could “listen to Trump discuss the future of cryptocurrency up close.” The top 25 holders would also get the opportunity to tour the White House with VIP treatment.

After the announcement, TRUMP coin shot straight up, doubling from $8 to a high of $16. One clever whale purchased 407,467 TRUMP coins for $5 million, sold them half an hour later, and pocketed a net profit of $732,000.

In January this year, before Trump took office, he suddenly “endorsed” his namesake memecoin, causing the token to surge 400 times in a short period, reaching a high of $77. It then plummeted all the way down to $7, a 90% drop, turning many late buyers and bottom fishers into retail casualties.

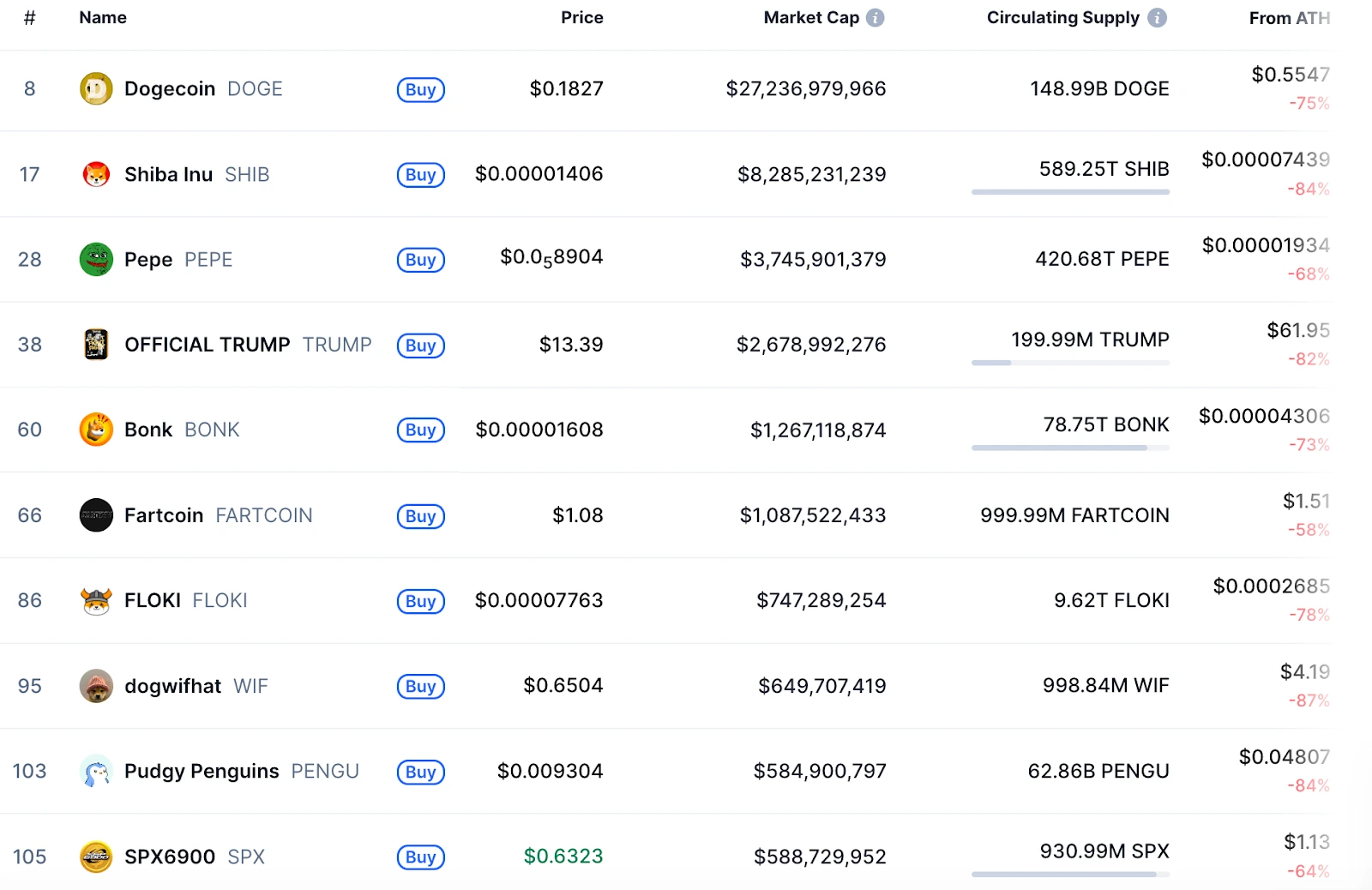

Looking back further, in late 2024, the crypto market once again experienced a wave of memecoin fever. The successive performances of DOGE, PEPE, and BONK ignited speculators’ enthusiasm, while TRUMP coin’s rise pushed memecoin speculation to a climax. But just a few months later, market confidence instantly collapsed after TRUMP coin’s suspected insider trading was exposed (with signs of “project team building positions early + social media-driven hype + cashing out at the peak”), and numerous copycat projects went to zero as memecoins collectively entered “crash mode.”

What’s the underlying logic behind the memecoin crash? How should regulation and market governance respond to the cyclical chaos of these high-risk assets? And what should investors do?

CASE STUDY: HOW TRUMP COIN BECAME A TEXTBOOK CASE OF “INSIDER TRADING”

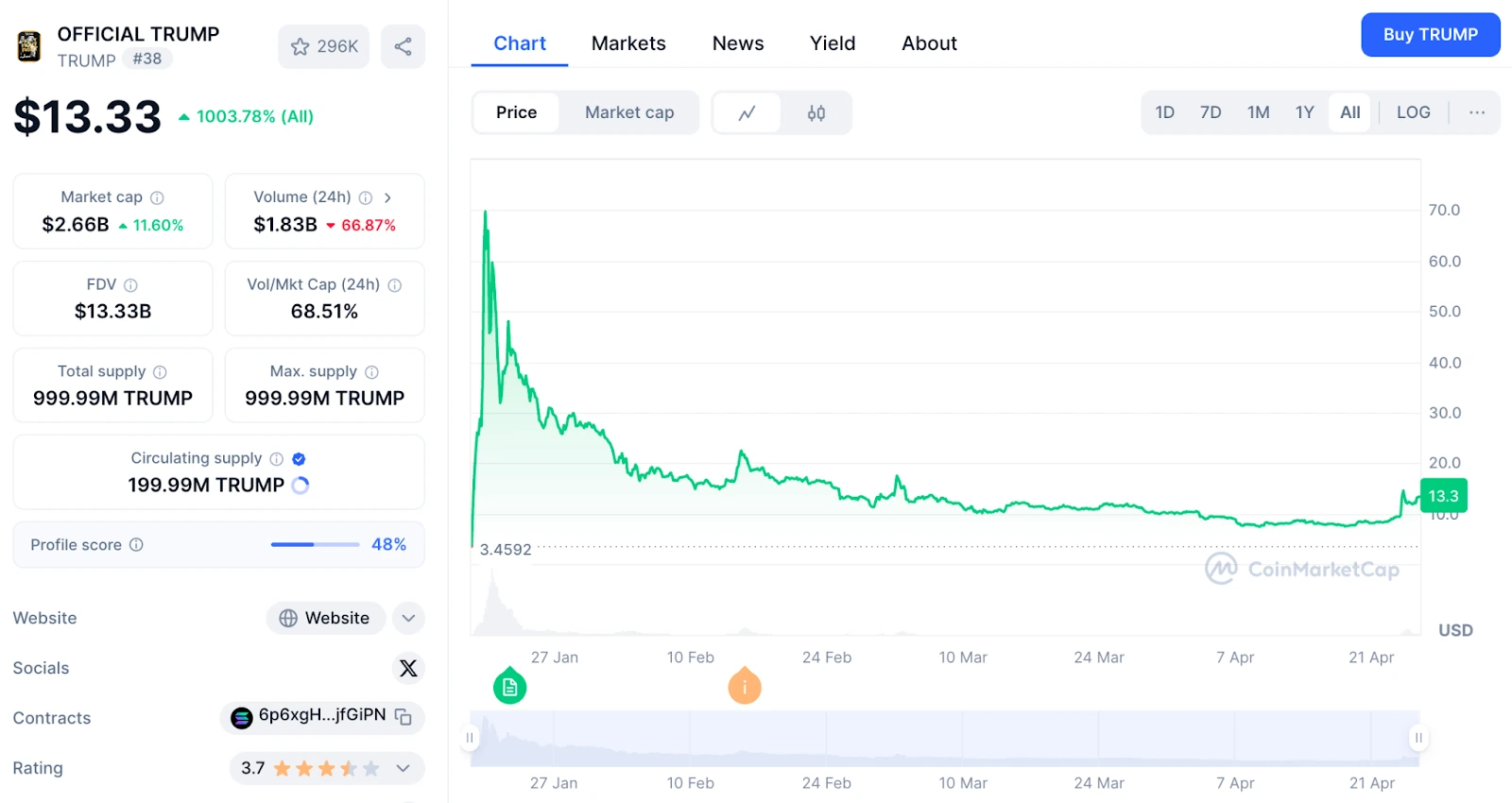

TRUMP coin’s rise was originally inevitable, combining Trump’s personal brand with the 2024 US election narrative, boosted by celebrity endorsements on X and meme culture. In January 2025, the Trump family’s memecoin emerged with “political aura.” On its first day of trading, the price soared from less than $10 to $77, briefly pushing its market cap above $12 billion. It subsequently halved to $35 when funds were diverted to Melania‘s “First Lady Coin,” resulting in nearly $100 million in liquidations in a single day.

However, according to subsequently disclosed information, 80% of TRUMP coin’s supply was held by companies affiliated with the Trump Group, and the project team could manipulate the market by minting additional tokens, creating a centrally controlled token economy. TRUMP coin’s deployment address and several early wallets had accumulated large positions before the launch and continuously sold at high prices, earning hundreds of millions in profits.

TRUMP Coin Price Trend and Related Parameters

(Source: CoinMarketCap)

This distribution mechanism allowed early holders (such as the internal team) to easily cash out while retail investors became bagholders. Additionally, numerous wealth-building scams flooded social media, enticing investors to participate through high-leverage contracts, further accelerating the downward price spiral after the price collapsed.

The key issues in this event include:

- Were the token deployers’ addresses affiliated with market manipulators or crypto influencers?

- Did certain influencers use social media to create hype in advance, attracting retail FOMO?

- Did the trading behavior constitute “insider trading” or “market manipulation” in the crypto market?

Although there is currently no mandatory regulatory framework defining illegal behavior, this incident fully exposes the governance defects in the memecoin ecosystem and the lack of investor protection. It also fully exposes the typical characteristics of memecoins: short-term speculation, emotion-driven trading, and control by interest groups.

According to data from pump.fun, over the past six months, millions of memecoins have appeared in the market, but only one in fifty thousand tokens ultimately achieved a market cap exceeding $100 million. memecoins have a very low long-term success rate, with 97% eventually going to zero and an average lifespan of less than one year. Many tokens disappear in even shorter timeframes, leaving nothing but losses for retail investors.

UNDERSTANDING THE MEMECOIN COLLAPSE: WHAT’S BEHIND THE CRASH?

There are many reasons for memecoin crashes, and each has its own collapse pattern, but there are some common issues we can learn from to avoid repeating the same mistakes in future memecoin investments.

Looking at token distribution models, most memecoins have highly centralized allocations with extremely unbalanced initial distribution ratios. Deployers reserve large portions through zero-cost addresses and begin selling as soon as the coins list on exchanges, creating an extremely asymmetric game between project teams and retail investors.

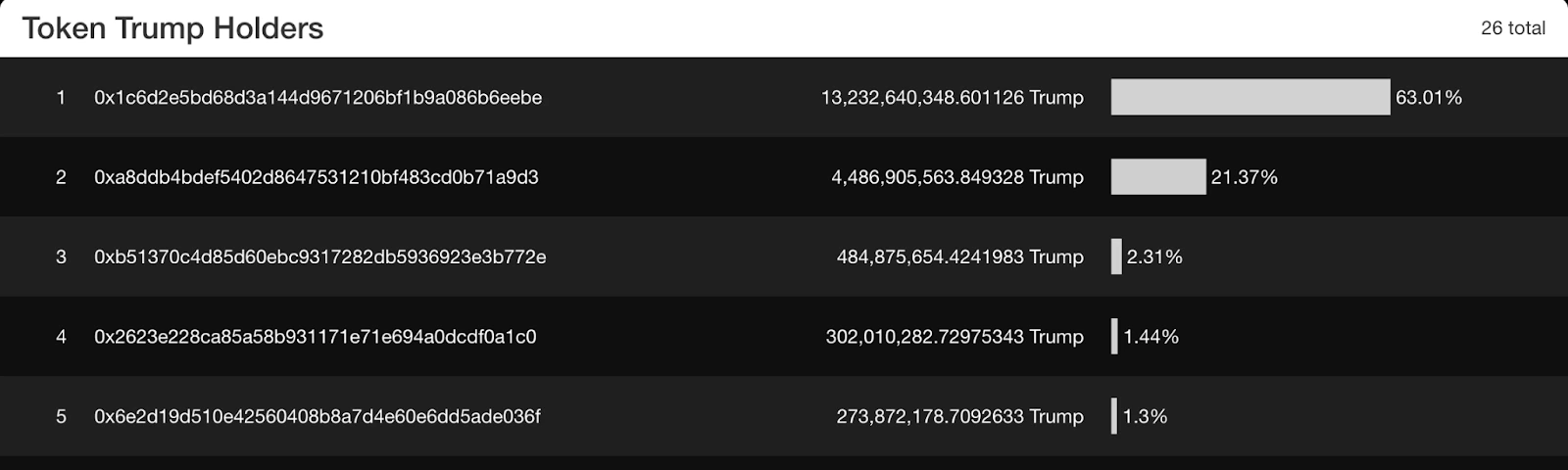

For example, on-chain data shows that the top 5 addresses held over 90% of TRUMP coin, while retail investors mostly entered at high prices through secondary markets, easily becoming targets for dumping, left holding the bag when prices collapsed.

Top Five TRUMP Token Holders

(Source: Ethplorer)

Currently, many memecoins open high-leverage contracts on multiple exchanges immediately after launch, sometimes with multipliers exceeding 50x. Such leverage easily triggers cascading liquidations when negative news suddenly appears (such as influencers selling), exacerbating price crashes. The opening of the derivatives market essentially gives project manipulators more tools for profit-taking, allowing them to profit not only from spot market dumps but also from short positions.

From a regulatory and market governance perspective, memecoins are almost all initially released on DEX platforms with no screening, no KYC, and no governance constraints. Although some CEXs conduct reviews before listing, the vast majority of meme projects have no legal entity, do not disclose their team, and have no governance structure. They follow a pattern of “anonymous deployment → social media hype → dumping at the peak → project abandonment.” This structure is easily manipulated by KOLs and whales, leaving retail investors defenseless.

Even if regulatory authorities want to regulate, they face numerous challenges. For instance, project teams are usually anonymous, making accountability difficult; KOLs are not licensed financial institutions, making it hard to restrict their statements; and most trading occurs on-chain, making enforcement extremely costly. The current regulatory vacuum has made memecoins a harvesting tool that claims to be “decentralized” but in reality exists to exploit retail investors.

Although the SEC categorizes memecoins as “collectibles” rather than securities, regulatory attitudes vary across countries. China explicitly prohibits virtual currency trading, while US policy implementation lags, allowing projects like TRUMP coin to operate in gray areas. Additionally, project teams often circumvent scrutiny through offshore exchanges, making it difficult for investors to seek redress.

In terms of value support, most memecoins can be described as having no underlying value—they’re essentially speculative bubbles. The core logic of memecoins is “cultural symbols + community consensus,” but they lack technological or application scenario support.

For example, TRUMP coin relies on Trump’s personal brand, while Pepe and DOGE rely on internet meme culture. This model destines their prices to be entirely driven by market sentiment. Once the hype fades or negative events occur (such as regulatory intervention or celebrity statement reversals), the bubble quickly bursts.

Some memecoins attempt “self-redemption” by linking to AI, NFTs, or payment scenarios, but most remain at the conceptual stage. For example, SHIB‘s metaverse project Shibaverse has progressed slowly, and DOGE’s payment functionality has not become widespread. Technological enhancements have not offset the speculative nature but instead become buzzwords for new rounds of hype.

Looking at the investor groups, they are almost all dominated by irrational retail investors. The main participants are young retail investors, with Generation Z accounting for over 30% according to relevant data. They pursue short-term wealth, lack risk awareness, are more easily influenced by “FOMO emotions” on social media, and blindly follow trends.

It can be said that the vast majority of memecoins are essentially emotional assets without intrinsic value support, relying on communities, celebrities, trending topics, and social media’s diffusion capability to create value.

The common characteristics of memecoins that go to zero can be summarized as:

- Short life cycles, with speculation periods ranging from a few days to a few weeks, rarely surviving long-term

- FOMO-driven, relying on early community “hype” to create the illusion of price increases that attract latecomers

- Market manipulator-dominated, with most being accumulated at extremely low cost by project teams or large holders who control initial liquidity

- Lacking fundamental support, with no protocol revenue, DeFi connectivity, or application ecosystem for long-term backing

Therefore, once market enthusiasm wanes or a crisis of trust occurs (such as insider trading or influencers selling), rapid price drops quickly trigger a liquidation cascade.

MARKET INSIGHTS: MEME IS NOT “ORIGINAL SIN,” BUT MARKETS NEED GOVERNANCE LOGIC

Although most memecoins currently end up as worthless tokens that exploit retail investors, the existence of memecoins is not entirely negative. They represent the combination of decentralized communities, social networks, and crypto culture—a manifestation of “cultural capital” in the Web3 world. However, the current meme ecosystem has been widely misused as a tool for exploitation by numerous manipulators and KOLs, completely losing the spirit of fairness, openness, and transparency.

Overall, memecoins themselves are not the source of market chaos; the real problem lies in the disorderly environment and lack of governance mechanisms in which they exist.

Meme is not considered an “original sin” mainly because it fulfills a genuine market need, such as the financialization of emotional expression. Memecoins are among the few “emotional assets” in the crypto market, carrying multiple meanings including community culture, humor, satire, and identity. For example, DOGE represents the satirical spirit of “anti-mainstream finance,” while TRUMP coin binds to political trends and group emotions.

Additionally, meme greatly lowers the participation threshold. Unlike complex DeFi protocols or L1 projects, memecoins have no technical barriers. Users only need to know how to use a DEX to participate in speculation. This combination of “no barriers + high risk/high return” attracts many new crypto users and Generation Z.

The essence of memecoins is a kind of “cultural asset” that embodies the consensus, meme culture, and values of the crypto community in token form. They are not completely valueless but instead have value that is extremely dependent on community enthusiasm and propagation energy.

So, meme is not wrong; it’s a product of market freedom and community self-governance.

What then is the real problem behind the current memecoin chaos in the market? The main issue is the lack of governance logic and market structures that make it extremely easy to abuse and manipulate. For instance, because projects have no barriers to issuance, many projects lack accountability. Anyone can deploy a memecoin on-chain with zero cost, without needing to register an entity, disclose team members, or explain the purpose. The problem lies in the lack of a responsibility framework and transparency mechanism for token issuance.

Another problem is the lack of a supervision mechanism for influencer behavior, resulting in extreme information asymmetry. The core driver of memecoin price increases is not fundamentals but tweets, hot topics, and traffic. Some influencers build positions before a project launches, then drive traffic and pump prices on social platforms under the guise of “recommendations” or “education,” before dumping at high prices to profit from retail investors.

Meme-Related Comments on Reddit Platform

(Source: Reddit)

In this process, DEXs and contract markets become accelerators, lacking platform review and risk control mechanisms while allowing high-risk tools to be used on low-quality assets. Most memecoins open contract trading immediately after launch, even offering high leverage, working with KOL rhetoric to create price FOMO. Contract liquidations and spot selling interact to form a downward price spiral, with users getting liquidated while manipulators profit.

For memecoins to truly play the positive role of “cultural assets,” a new balance needs to be established between freedom and governance.

First, there’s a need to enhance the popularity of on-chain transparency tools, such as promoting wallet risk identification plugins (like DeBank, Bubblemaps) to identify pre-mining addresses and KOL addresses before launch, increasing user vigilance.

Then, CEXs/DEXs need to introduce risk classification and responsibility reviews, setting “speculative asset” tags for memecoins to indicate contract leverage risks, strengthen risk warnings for leveraged contracts, limit high leverage multiples, and combat fraudulent behavior by fake trading platforms.

Next, a supervision model for influencer statements and on-chain behavior needs to be established, recording the relationship between influencer interactions with tokens and the timing of their posts, building a community-driven reputation system for crypto content creators.

Finally, community self-governance mechanisms need to be promoted, similar to PleasrDAO and Nouns DAO, granting meme token holders governance rights and project direction control, transforming meme projects from pure speculation toward “community creativity + cultural operation.”

Of course, investor education is also essential, popularizing the “zero-sum game” nature, warning about social media stock recommendation traps, and advocating long-term value investment.

In the alternating cycles of bear and bull markets, meme will not die out, but the market must learn to “coexist rationally” with it.

The popularity of memecoins reflects crypto users’ desire for freedom, culture, and group identity. But when this freedom lacks governance constraints, it can be exploited by speculators, evolving into a scheme for wealth transfer.

To make meme culture sustainable, a new order of “decentralized governance + transparent supervision + community-driven” must be established. Meme is not an original sin, but if the market does not address the underlying systemic issues, memecoins will remain trapped in bubble cycles, becoming the most dazzling yet most dangerous fireworks in the crypto world.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!