KEYTAKEAWAYS

-

Ethereum Layer 2 adoption surges, hitting 13.6 million unique addresses and dominating mainnet in transaction volume and speed.

-

Arbitrum, Base, Optimism, and zkSync lead Layer 2 growth with innovations in Rollups, DeFi, and developer tools.

-

Layer 2 TVL hits $31.21 billion, reflecting a strong shift in user activity and capital toward Ethereum scalability solutions.

CONTENT

Recently, the number of unique addresses in the Ethereum Layer 2 ecosystem has soared to 13.6 million — a new all-time high.

In just 7 days, it increased by 74%, showing a sharp rise in user adoption. Layer 2 networks now handle 6.69 times more activity compared to the Ethereum mainnet.

Weekly transaction volume on Layer 2s has surpassed 832,000, which is 11 to 12 times higher than the mainnet. This marks a clear shift of Ethereum’s focus toward Layer 2.

LAYER 2: THE KEY TO ETHEREUM SCALING

Ethereum is the leading smart contract platform, but it has long struggled with high gas fees and low throughput (around 15 transactions per second).

Layer 2 technology helps solve this by moving transactions off-chain while still relying on Ethereum’s security. This reduces costs and increases speed.

According to L2BEAT, by the end of April 2025, total value locked (TVL) on Layer 2 networks reached $31.21 billion — up 13.2% in a week — showing strong growth in both capital and users.

Layer 2 networks mainly use Rollup technology, including:

-

Optimistic Rollups (e.g., Arbitrum, Optimism): Assume transactions are valid unless challenged. Good for general-purpose dApps.

-

ZK-Rollups (e.g., zkSync, StarkNet): Use zero-knowledge proofs for fast, secure verification. Better for high-value transactions.

Now let’s look at the top Layer 2 projects.

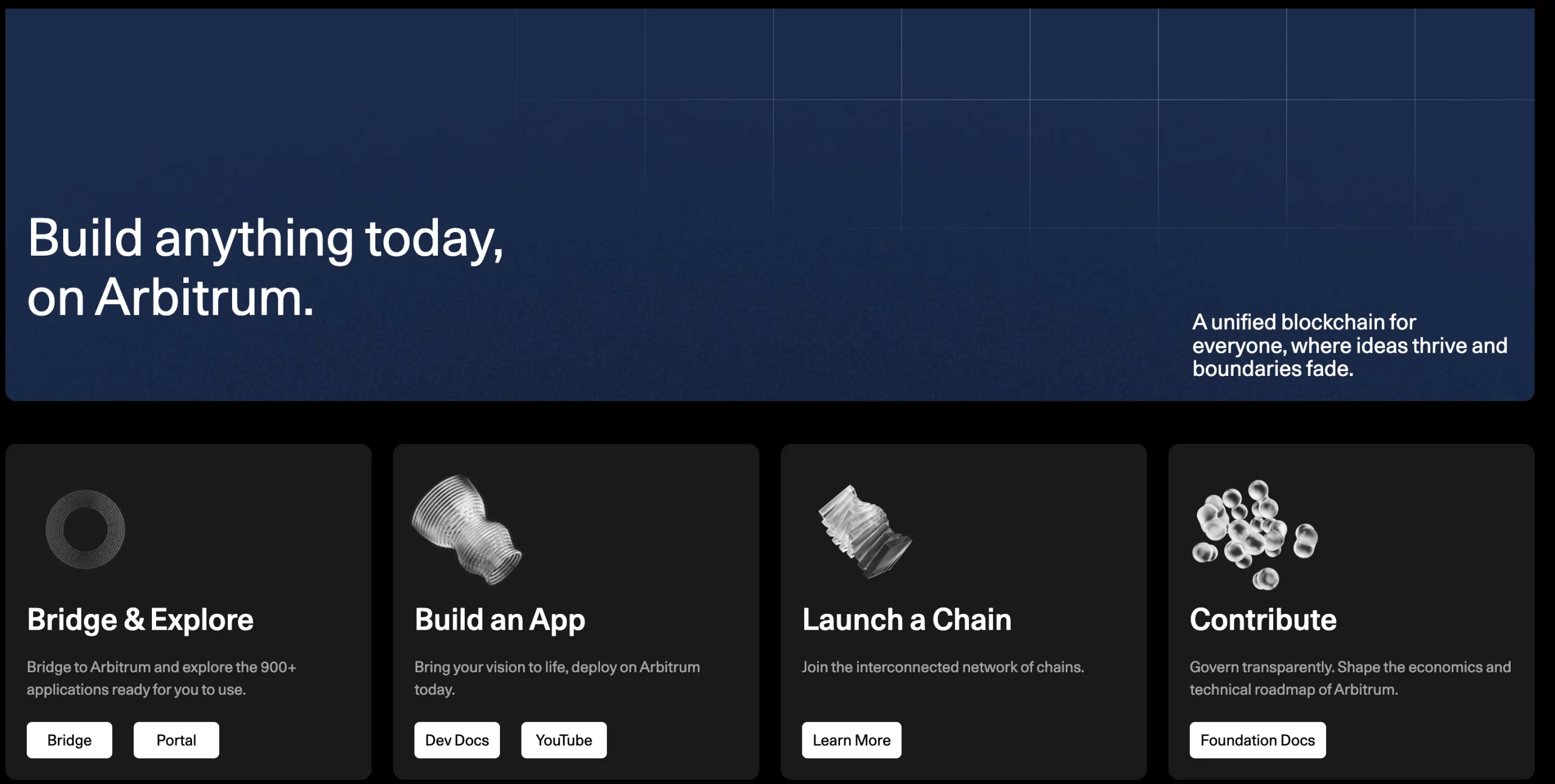

1. ARBITRUM: A LEADING LAYER 2 NETWORK

Arbitrum is built on Optimistic Rollup and holds around $11.46 billion in TVL — 36.7% of the Layer 2 market. It supports top DeFi apps like Uniswap V3, Aave, and Curve.

In March 2023, a large airdrop brought in many new users. Arbitrum also launched the Orbit framework, which allows developers to build Layer 3 networks like the Xai gaming chain.

-

Pros: High performance (9.5–10 TPS), fees 3–10% of mainnet costs, rich DeFi/NFT ecosystem.

-

Challenges: Single sequencer creates centralization risk and has caused downtime.

-

Trend: Growing with developer funding, but faces competition from new networks like Base.

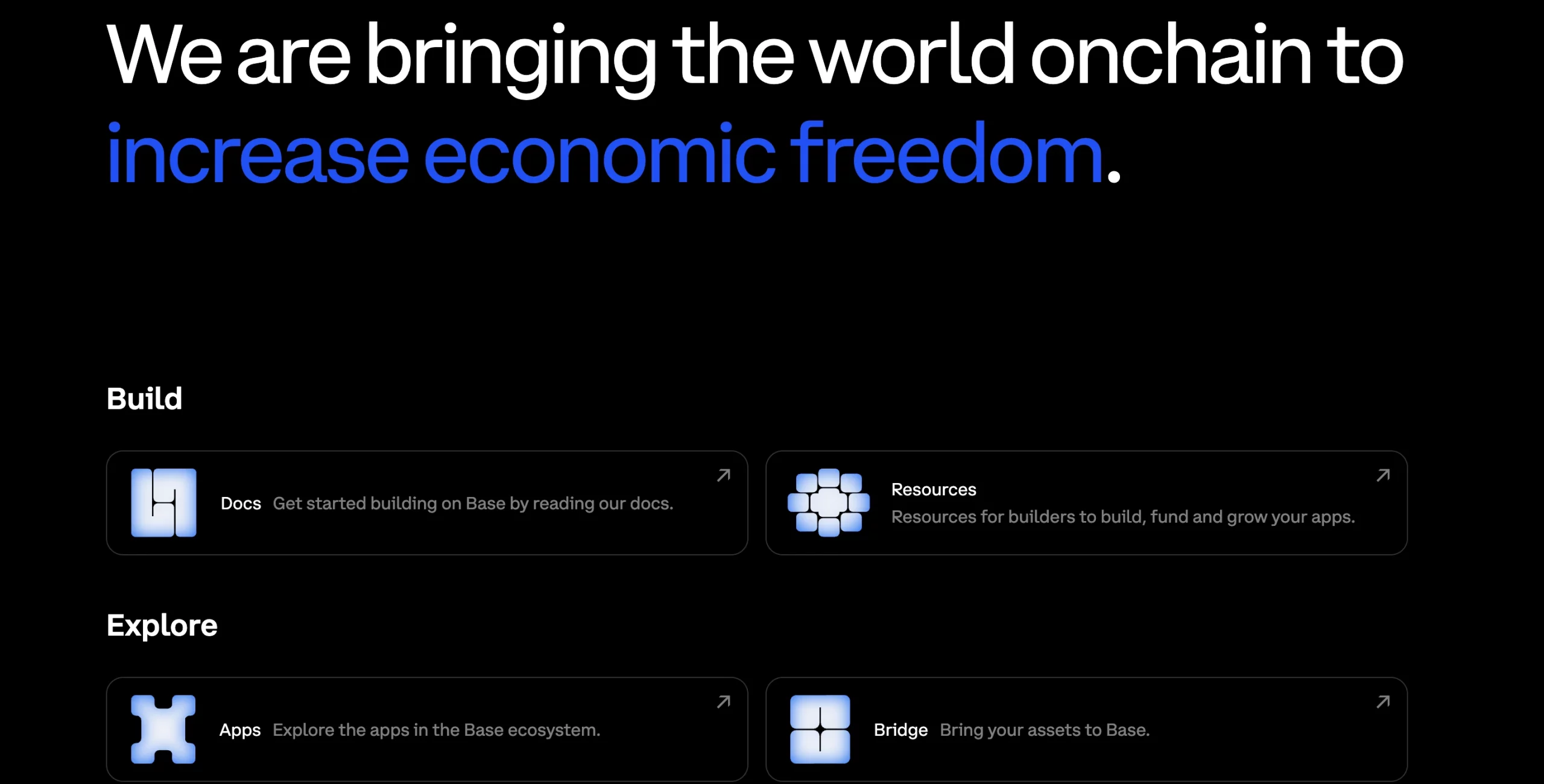

2. BASE: THE RISING STAR BACKED BY COINBASE

Base, launched by Coinbase, uses Optimistic Rollup and has reached $11.7 billion in TVL — up 16.1% in 7 days, now the top Layer 2 by TVL.

Since launching in July 2023, Base gained users quickly through its deep integration with Coinbase Wallet. Its user activity and transaction volume now surpass Optimism and Polygon zkEVM.

-

Pros: Easy for beginners, great for DeFi and NFTs, low fees, 8.2% market share.

-

Challenges: Ecosystem is mostly DeFi and meme coins; needs more diverse dApps.

-

Trend: Strong brand and user base make it a major competitor to Arbitrum.

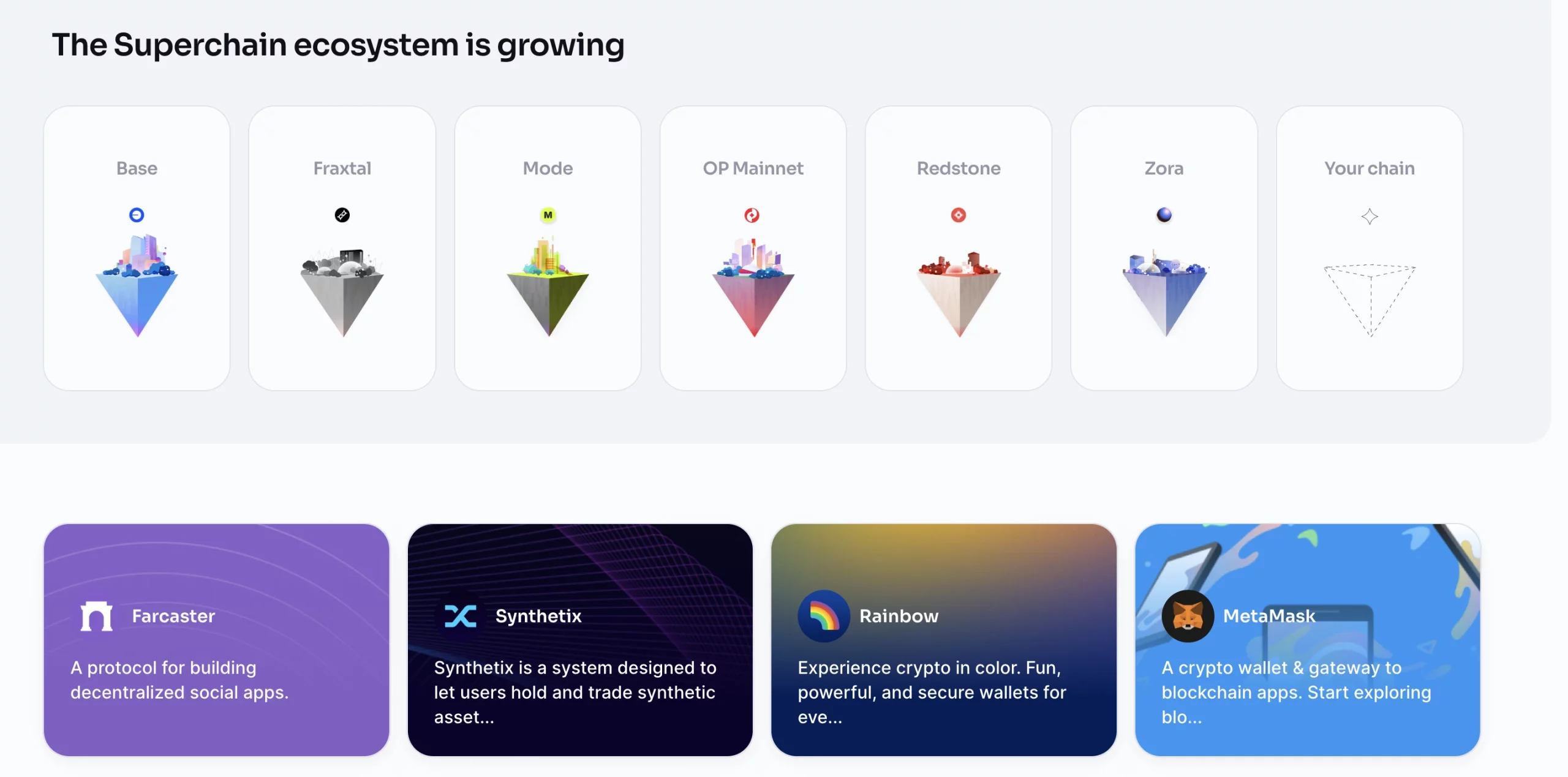

3. OPTIMISM: PIONEER OF THE “SUPERCHAIN” CONCEPT

Optimism has $2.598 billion in TVL (20% market share), ranking third. It introduced the OP Stack, an open-source framework that supports the “Superchain” idea — allowing developers to build custom Layer 2s like Base and Soneium. Key apps include Synthetix and Lyra.

-

Pros: Good cross-chain cooperation, EVM compatibility for easy dApp migration.

-

Challenges: Liquidity is scattered; cross-chain experience needs improvement.

-

Trend: Soneium (by Sony, launched in August 2024) boosted Optimism’s visibility in traditional industries.

4. ZKSYNC: LEADING THE ZK-ROLLUP MOVEMENT

zkSync uses ZK-Rollup and has $720 million in TVL with 2.67 million unique users — 37.1% of all Rollup users.

Matter Labs has invested $200 million into its DAO to support infrastructure growth. Its 2023 airdrop brought high daily activity and cross-chain usage.

-

Pros: High security for valuable transactions, very active users.

- Challenges: TVL dropped 8.8% in August 2024; needs new apps to keep users engaged.

-

Trend: ZK-Rollups are seen as the future of scaling, and zkSync has long-term potential.

FUTURE OUTLOOK

The rise of Ethereum Layer 2 marks a new chapter in blockchain scalability. Competition between Arbitrum and Base, Optimism’s Superchain plan, and innovations from zkSync and StarkNet are all pushing the Ethereum ecosystem forward.

In the future, Layer 2 networks will need to focus more on decentralization, cross-chain compatibility, and user experience to stay ahead of growing competition from new blockchains like Solana and Aptos.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!