KEYTAKEAWAYS

-

Bitcoin breaks $100K again, fueled by institutional inflows (MicroStrategy, ETFs) and macro tailwinds, signaling growing mainstream adoption.

-

Technical indicators show overbought conditions (RSI 75) amid bullish momentum, with key support at 98Kandresistanceat109K.

-

Long-term outlook remains strong (ARK: $710K by 2030), though regulatory and macro risks could trigger volatility.

CONTENT

On May 9, 2025, Bitcoin (BTC) decisively broke through the $100,000 mark once again, stabilizing around $102,000.

This milestone comes after its initial breakout above $100K in December 2024, and it reaffirms Bitcoin’s position as a leading global asset while reigniting investor enthusiasm across the crypto market.

MARKET OVERVIEW: FROM CONSOLIDATION TO BREAKOUT

In December 2024, Bitcoin crossed the $100,000 threshold for the first time, peaking at $109,000 and setting a new all-time high. However, the rally was followed by a period of correction, with prices dipping back into the $80,000 range in early 2025.

As May began, BTC regained bullish momentum. It initially traded in a narrowing range between $94,537 and $96,907, forming a “symmetrical triangle” pattern — a classic signal of a consolidation phase before a breakout.

On May 8, Bitcoin surged past $95,000, triggering a rapid rally. By the morning of May 9, it had convincingly reclaimed $100,000, hitting an intraday high of $103,500 before consolidating above the key $98,000–$100,000 support zone.

Technical indicators show a Relative Strength Index (RSI) of 75, suggesting short-term overbought conditions.

This breakout is more than a price event — it signifies Bitcoin’s growing influence within the global financial ecosystem.

DRIVERS BEHIND BITCOIN’S BREAKOUT

The surge of Bitcoin past $100,000 in May 2025 was driven by a confluence of multiple factors. The continuous inflow of institutional capital served as the primary catalyst.

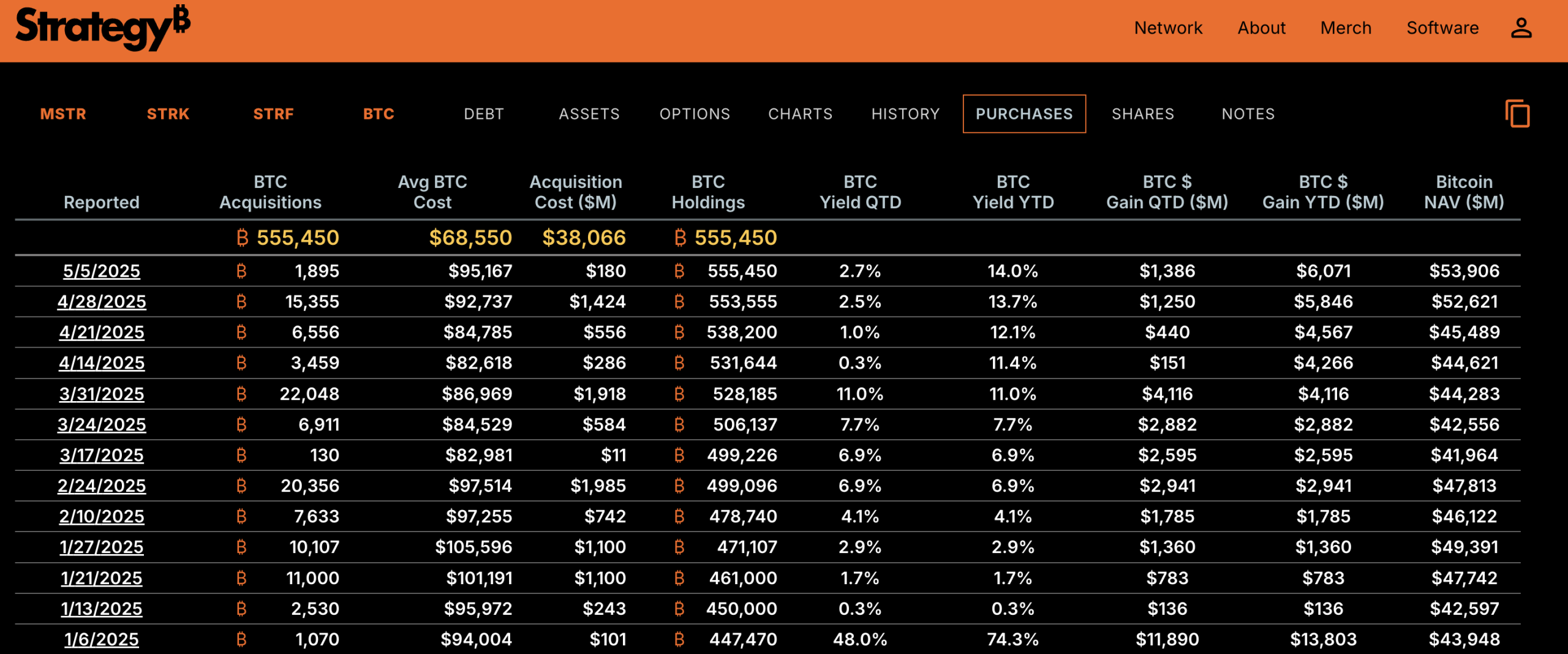

MicroStrategy, the world’s largest corporate holder of Bitcoin, recently acquired an additional 6,911 BTC, bringing its total holdings to over 500,000 BTC — with a market value exceeding $50 billion. Its “Bitcoin-first” strategy has inspired other companies to follow suit.

Since the U.S. approved spot Bitcoin ETFs in 2024, capital inflows have accelerated, with ETF holdings projected to surpass 1.5 million BTC in 2025, becoming a major driver of price appreciation.

Traditional financial institutions such as Morgan Stanley and Citigroup have also launched Bitcoin-related investment products. Meanwhile, the global macroeconomic environment has provided favorable conditions for Bitcoin.

Declining yields in China’s bond market, a growing wave of maturing U.S. Treasuries, and abundant global liquidity have all supported high-risk assets.

Heightened geopolitical tensions and inflation expectations have further strengthened demand for Bitcoin as a “digital gold” safe-haven asset. Additionally, a weakening U.S. Dollar Index in early 2025 has pushed capital flows toward alternative assets like Bitcoin.

Fundamentally, Bitcoin’s price has also been supported by improvements in its blockchain infrastructure and the growth of decentralized finance (DeFi).

Technological advancements such as the Lightning Network have significantly enhanced transaction efficiency and increased Bitcoin’s potential in payment applications.

At the same time, deeper integration between Bitcoin and DeFi protocols is attracting more developers and users, fueling the expansion of the broader Bitcoin ecosystem.

MARKET DYNAMICS AND POTENTIAL RISKS

The breakout past $100,000 has sparked a surge in market enthusiasm. Social media chatter is at a high, and both retail and institutional investors are showing strong confidence.

Some bullish forecasts now expect Bitcoin to reach between $120,000 and $200,000 by the end of 2025.

Trading volume on global crypto exchanges has surged, and leverage in futures and options markets has risen significantly. However, increased leverage also brings higher liquidation risks for overexposed traders.

Despite prevailing optimism, caution is warranted:

- Profit-Taking Pressure: The $98,000–$100,000 zone is a key short-term support level. A break below this range could see BTC retest $92,000.

- Technical Risks: The RSI nearing 70–75 indicates possible short-term overbought conditions, increasing the probability of a pullback.

- Regulatory Uncertainty: While U.S. policy currently favors crypto, Europe’s stricter regulatory stance and China’s continued crackdown on mining may pose headwinds. The growing push for central bank digital currencies (CBDCs) could also challenge Bitcoin’s relevance in the payment sector.

- Macroeconomic Volatility: Should the Federal Reserve tighten monetary policy in response to inflation, risk assets like Bitcoin may face selling pressure. In addition, a global recession or worsening geopolitical conflicts could trigger capital flight from high-risk assets.

- Whale Activity: Large holders — such as MicroStrategy — could trigger market volatility if they begin selling. Recent rumors of potential sell-offs have already caused brief price disturbances.

OUTLOOK: WHERE IS BITCOIN HEADED?

Short-Term:

If bullish momentum continues, Bitcoin may soon challenge the $102,000–$109,000 resistance zone. A successful breakout could pave the way for a run toward $120,000.

However, if BTC falls below the $98,000 support, a deeper pullback to around $92,000 is possible. Key variables include U.S. monetary policy, institutional inflows, and global liquidity trends.

Long-Term:

The long-term outlook for Bitcoin remains highly optimistic. ARK Invest projects that by 2030, Bitcoin could reach $710,000 in a base-case scenario, or even $1.5 million in a highly bullish case — driven by institutional adoption, blockchain innovation, and shifts in global monetary structures.

Bitcoin’s role as a decentralized, scarce digital asset — and a hedge against traditional financial risks — is likely to strengthen. Sovereign wealth funds and major corporations may increasingly allocate capital into BTC.

However, regulatory crackdowns or technological stagnation could keep prices range-bound below $100,000 for extended periods.

Investment Strategy:

Long-term investors might consider accumulating BTC during dips in the $92,000–$95,000 range, focusing on its scarcity and decentralized nature. Short-term traders can capitalize on the $98,000–$102,000 range but should employ tight stop-losses to manage volatility.

Regardless of strategy, portfolio diversification, careful risk management, and close monitoring of macro developments — including U.S. Federal Reserve policies and Trump administration strategies — are essential.

CONCLUSION

Bitcoin’s breakthrough above $100,000 on May 9, 2025, marks not only a price milestone but a symbolic affirmation of the digital asset era.

Fueled by institutional adoption, favorable U.S. policy, global liquidity, and technical advancements, this surge is a testament to Bitcoin’s evolving role in global finance.

However, as always, markets are dynamic. Regulatory risks, macroeconomic uncertainties, and profit-taking could trigger volatility. Going forward, Bitcoin’s trajectory will be shaped by policy decisions, institutional behavior, and the broader economic landscape.

Whether as a store of value or a speculative instrument, Bitcoin has proven its staying power. This breakout is just the beginning of a new chapter — and its potential to reshape financial history is far from over.