KEYTAKEAWAYS

-

Bitcoin hits new all-time high of $111,871 driven by institutional inflows, regulatory optimism, and post-halving supply dynamics while altcoins lag significantly behind.

-

Altcoins struggle with weak performance due to capital concentration in Bitcoin and lack of strong narratives, despite historical patterns suggesting potential future rotation.

-

Market cycle analysis indicates possible altcoin season later in 2025 if Bitcoin sustains above $110K, though current conditions favor Bitcoin dominance.

CONTENT

On May 22, 2025, Bitcoin reached a new all-time high of $111,871, breaking its previous record of $109,720 set on January 20. This 1.96% increase marks another milestone for the crypto market. The rally is not random—it’s supported by multiple factors.

One key driver is positive sentiment around crypto regulation. In the U.S., discussions on stablecoin regulation, such as the GENIUS bill, are seen as signs of growing industry acceptance.

Politicians like Donald Trump and JD Vance have shown interest in Bitcoin, with some even suggesting it could be treated as a “strategic reserve asset.”

While still speculative, such talk has fueled market excitement. Continued inflows from institutions have also strengthened Bitcoin’s rally.

In Q1 2025, spot Bitcoin ETFs like BlackRock’s IBIT saw over $10 billion in net inflows. Companies like MicroStrategy continued to buy more Bitcoin, reinforcing the idea of BTC as “digital gold.”

Technically, breaking the $110,000 level triggered strong FOMO (fear of missing out), drawing in retail and short-term traders.

The April 2024 halving also reduced new BTC supply, supporting the price in line with past bull market patterns. On the macro side, a weaker U.S. dollar and rising inflation fears have pushed more investors to treat Bitcoin as a hedge.

All these factors together helped Bitcoin reach a new record and highlight its dominant position in crypto.

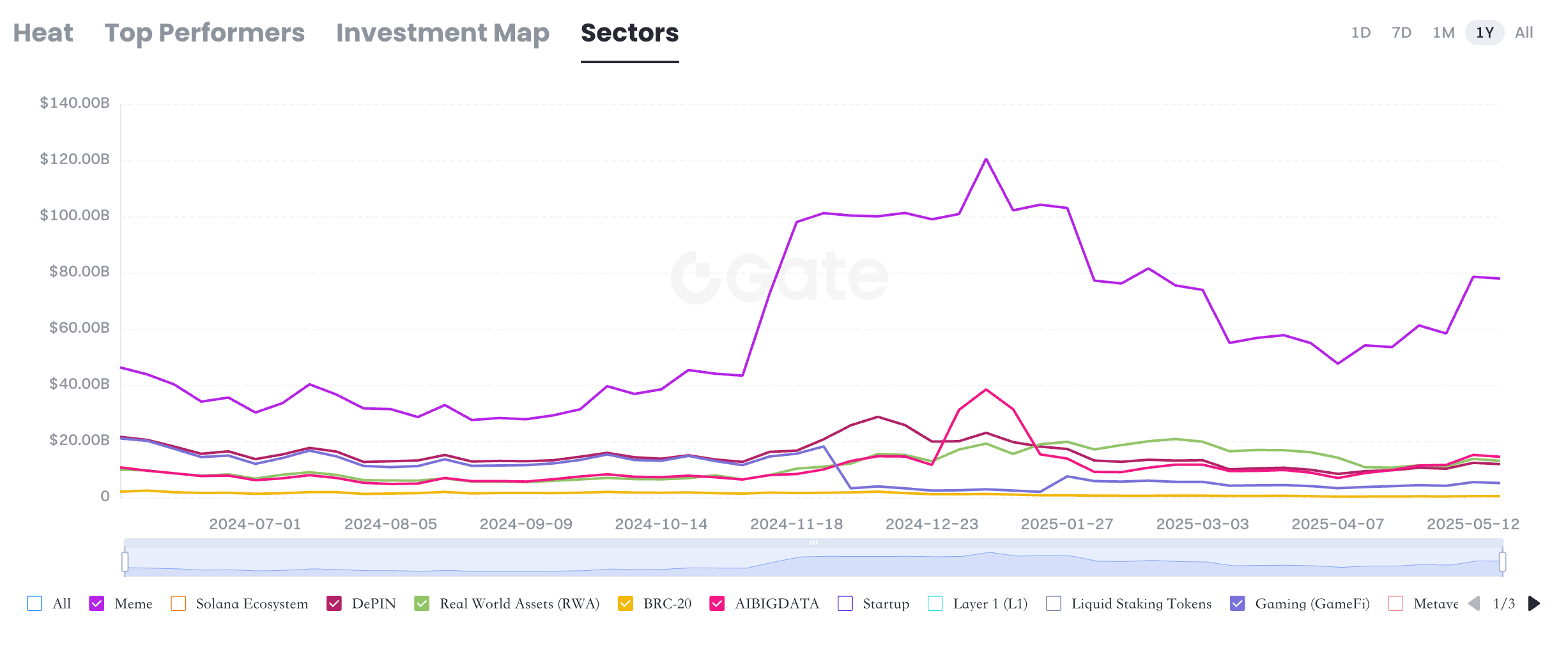

WHY ALTCOINS ARE STRUGGLING DESPITE BITCOIN’S SURGE

While Bitcoin is rallying, most altcoins are still far below their highs. Coins like Ethereum, Solana, BNB, and XRP are down 20% to 75% from their peaks.

For example, ETH is around $2,562—about 47.6% below its 2021 high of $4,891.7. Solana is at $171.8, down 41.6%. Dogecoin and Cardano are down 68.7% and 75.2%, respectively.

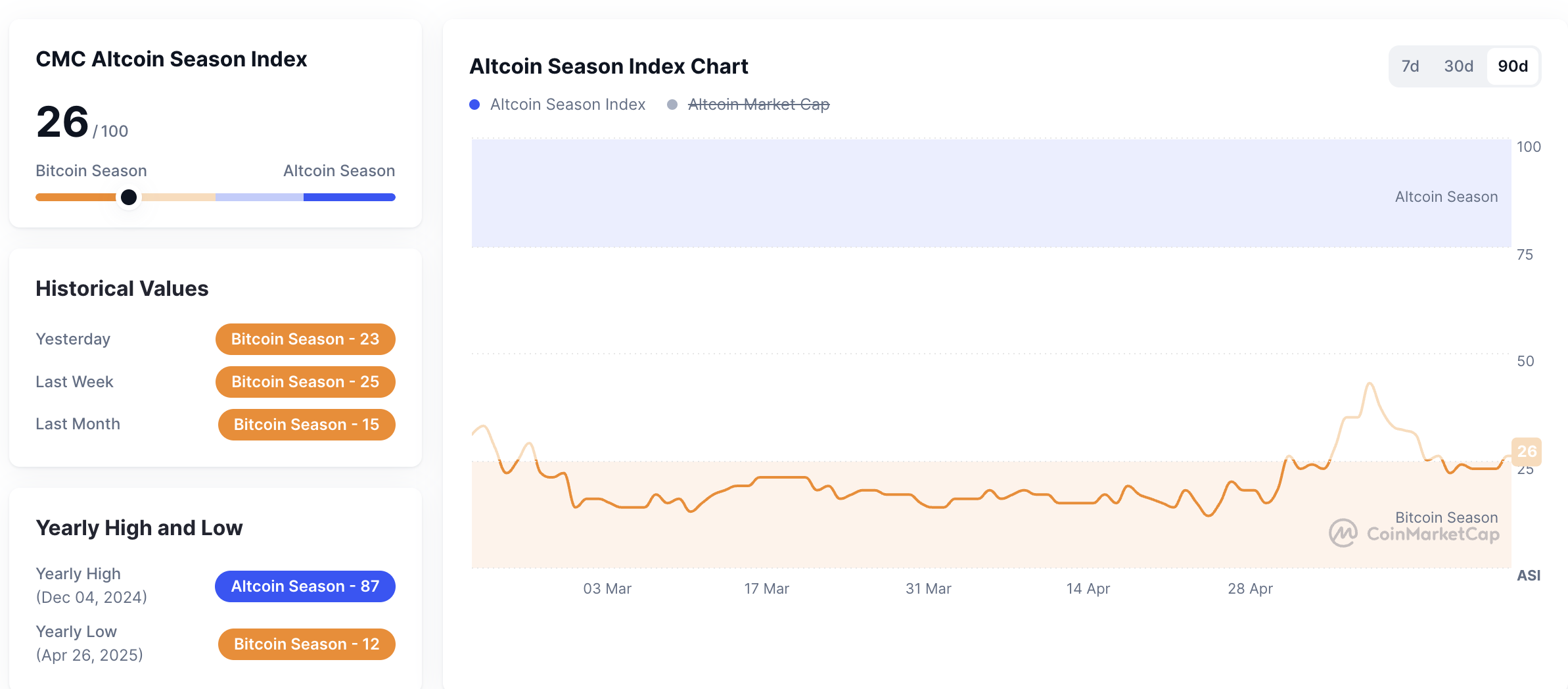

This weakness is mainly because money is flowing heavily into Bitcoin. Its dominance in the crypto market is now around 58–60%, close to early bull market levels in 2021.

Investors see Bitcoin as the “safe” choice in crypto, while altcoins need more hype or liquidity to rise. Right now, most altcoins lack strong new narratives or triggers.

Ethereum’s move to proof-of-stake hasn’t brought major user growth. Solana’s NFT and DeFi ecosystem is active but hasn’t regained the buzz of 2021.

XRP is still recovering from long SEC legal issues. And coins like DOGE and ADA don’t have strong fundamentals. Uncertainty around regulations is another issue, keeping institutions away from many altcoins.

Overall, we’re still in a “Bitcoin-first” phase. Altcoins may need more time and stronger market interest to move up.

WILL ALTCOIN SEASON COME NEXT? A LOOK AT MARKET CYCLES

Crypto markets often follow a pattern. In past bull markets (like in 2017 and 2021), Bitcoin hit new highs first.

Then, a few months later, money started flowing into altcoins, causing big gains there too. Now that Bitcoin has broken $110,000, some analysts think this could happen again in late 2025.

If Bitcoin stays above that level, investors may begin rotating into altcoins like ETH and SOL. Ethereum could bounce back if Layer 2 networks or DeFi projects gain momentum.

Solana’s GameFi and NFT projects could attract attention too. Newer chains like Sui and Aptos might also benefit from innovation and hype.

However, altcoin rallies come with risks. In 2021, many small coins pumped and dumped quickly. Investors need to be cautious. A true altcoin season needs more catalysts—such as tech breakthroughs, positive regulation, or strong retail interest.

INVESTMENT STRATEGY AND RISK: HOW TO NAVIGATE THE CURRENT MARKET

The current market offers both opportunity and risk. Bitcoin’s breakout shows long-term strength, but short-term pullbacks are possible.

Key support levels are around $109,720 and $100,000. Long-term investors could consider buying in on dips, but should manage risk carefully.

For altcoins, it’s best to focus on stronger projects like ETH and SOL. Wait for lower entry points and watch for signals like on-chain activity or ecosystem growth.

For example, rising Layer 2 usage on Ethereum or hot NFT projects on Solana could be entry signs. Be especially careful with highly speculative coins like DOGE—don’t chase pumps.

Keep crypto exposure between 5–10% of your total assets and always set stop-loss levels.

LOOKING AHEAD: WHAT’S NEXT FOR CRYPTO

Bitcoin’s new high of $111,871 reflects its strong position in the crypto world, supported by policy hopes, institutional money, and halving effects.

But the weak performance of altcoins shows that money is still concentrated and narratives are lacking. Many altcoins are down 20–75% from recent highs. If Bitcoin stays above $110,000, altcoins may catch up in the second half of 2025.

Still, they’ll need clear catalysts like tech innovation or regulatory clarity. Macro trends and regulation will continue to shape the market. Investors should stay alert and use both on-chain data and market sentiment to guide their strategy.