KEYTAKEAWAYS

-

Robinhood launches tokenized trading for 200+ U.S. stocks and private equity, sparking global attention and a 13% surge in its stock price.

-

Tokenized stocks offer 24/7 trading, fractional ownership, and fast settlement, democratizing access to traditional and private assets through blockchain.

-

Regulatory uncertainty and technical risks challenge tokenized stock adoption, but global efforts signal long-term growth potential and institutional interest.

CONTENT

On June 30, 2025, Robinhood announced a groundbreaking move at the “To Catch a Token” event in Cannes, France.

It launched tokenized trading of over 200 U.S. stocks and ETFs for EU users, including private equity in unlisted companies like OpenAI and SpaceX.

This news sent Robinhood’s stock soaring nearly 13%, hitting a record high. It also sparked global excitement about tokenized stocks in financial markets.

As a platform known for zero-commission trading, Robinhood is using blockchain technology to break down financial barriers. This move blends traditional finance (TradFi) with decentralized finance (DeFi), pointing to a future of financial democratization.

TOKENIZED STOCKS: A NEW LIFE FOR TRADITIONAL FINANCE

Stock tokenization turns traditional stocks or equity into digital tokens on a blockchain. Each token represents a portion of ownership in the underlying asset.

These tokens are issued and traded via smart contracts, keeping economic benefits like price changes and dividends but usually not voting rights.

Compared to traditional stock markets, tokenization uses blockchain’s distributed ledger for transparency and security.

It cuts intermediary costs and speeds up settlement times. Robinhood’s service runs on Arbitrum, an Ethereum Layer-2 network, with plans to move to its own blockchain by late 2025 or early 2026.

This reduces fees and lets global investors easily access U.S. stocks. Robinhood’s move is part of a global trend, with crypto exchanges and traditional financial institutions exploring stock tokenization.

Robinhood’s service includes major U.S. companies like Apple, Microsoft, and Nvidia, plus tokenized equity in unlisted firms like OpenAI and SpaceX.

This is especially notable in the EU, where looser regulations allow non-accredited investors to trade private equity, unlike the U.S., where strict rules apply.

However, OpenAI stated it did not partner with Robinhood and does not endorse its tokenization, highlighting legal and compliance challenges. Still, Robinhood’s move is seen as a milestone, suggesting tokenized stocks could be the next big financial tool after ETFs.

HOW TOKENIZATION TRANSFORMS INVESTING

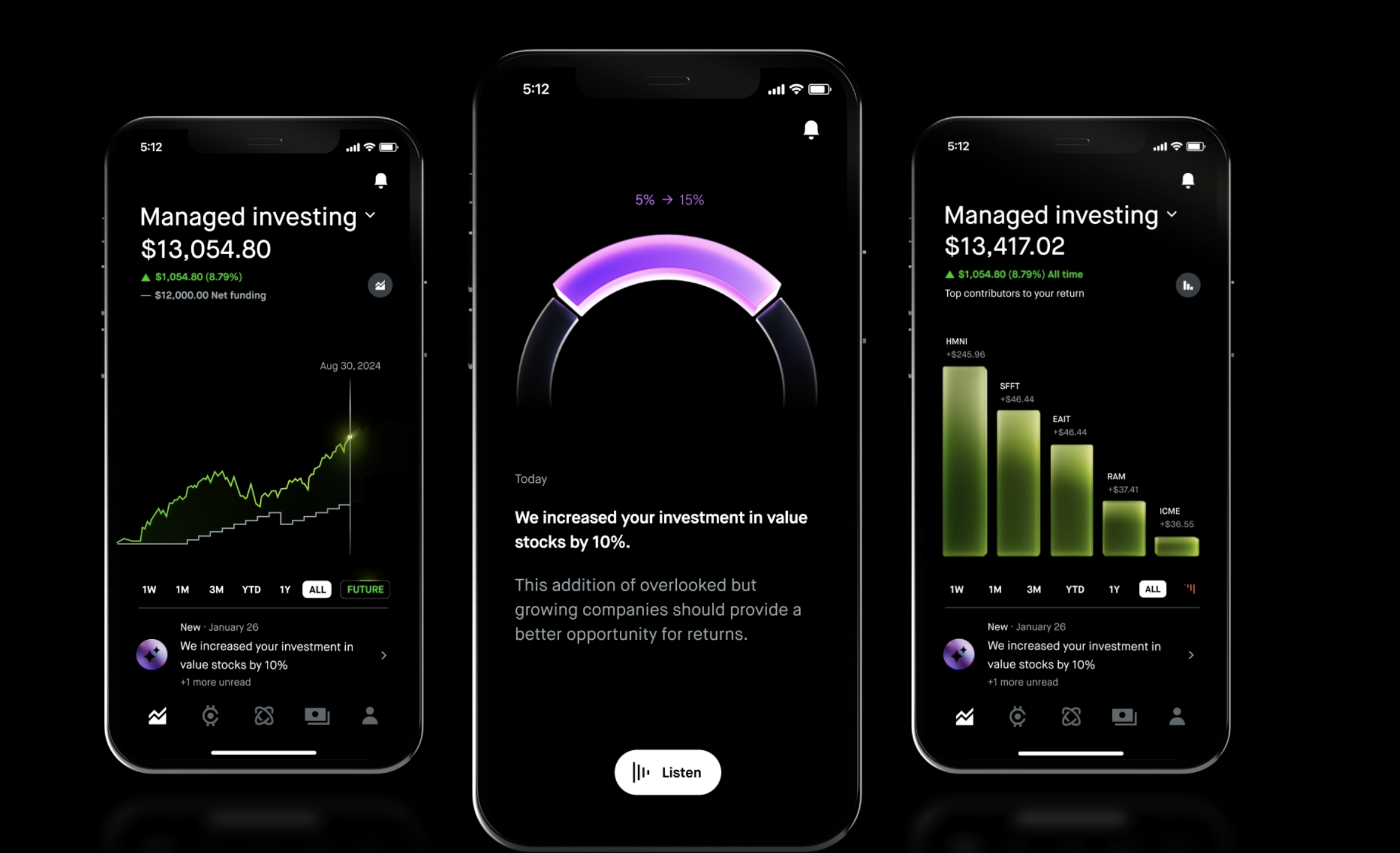

Tokenized stocks revolutionize the investment experience. First, they lower barriers to entry. By splitting stocks into smaller tokens, everyday investors can afford high-value assets.

For example, a SpaceX share might cost thousands, but tokenization lets investors buy a fraction, making markets more inclusive.

This appeals to young investors and those in emerging markets. EU users can now invest in U.S. stocks and private companies at low cost through Robinhood.

Tokenization also boosts trading efficiency. Traditional stock trades involve brokers, exchanges, and clearinghouses, with settlements taking up to two days (T+2). Blockchain enables near-instant settlements, and Robinhood’s zero-fee model cuts costs further.

This attracts both retail and institutional investors. Tokenized stocks also allow 24/7 trading, unlike traditional markets with fixed hours. Robinhood offers 24/5 trading now and aims for 24/7 in the future, meeting global demand.

Blockchain’s transparency and security add value. Distributed ledgers make transactions verifiable, reducing fraud risks.

Smart contracts automate trades, increasing reliability. Robinhood’s use of Arbitrum ensures stability and delivers dividends directly to users. This transparent, efficient model is reshaping trust in financial markets.

CHALLENGES AND CONCERNS

Despite its promise, stock tokenization faces hurdles. Regulation is the biggest issue. Tokenized stocks are securities and must follow financial laws.

The EU’s MiCA framework supports Robinhood’s service, but U.S. regulations are stricter, limiting similar offerings.

OpenAI’s opposition shows the legal risks of tokenizing private equity without permission, which could lead to disputes or invalid assets. Platforms must balance innovation with compliance, which may raise costs and slow growth.

Technical risks are another concern. Blockchain security and stability are critical. Past hacks and smart contract flaws show the potential for losses.

Robinhood’s shift to its own blockchain will face integration challenges. Balancing blockchain’s transparency with privacy needs is also tricky.

Market acceptance is a challenge too. Many traditional investors are unfamiliar with or distrust blockchain. Tokenized stocks often lack voting rights, which may deter institutional investors who value governance.

Traditional markets’ familiarity keeps some investors hesitant, and tokenization needs time to build trust.

THE FUTURE OF TOKENIZED STOCKS

Tokenized stocks have huge potential. Industry forecasts predict the tokenized real-world asset (RWA) market could reach $16 trillion by 2030, with stocks as a key part.

Robinhood’s CEO, Vlad Tenev, called tokenization a “massive trading revolution,” making assets more accessible via blockchain.

This vision is taking shape globally. Hong Kong’s securities regulator supports tokenized investment products, and Taiwan’s stock exchange is exploring RWA tokenization. These moves signal growing legitimacy.

Competition and collaboration are driving progress. Coinbase is seeking SEC approval for tokenized stocks in the U.S., while Kraken launched xStocks on Solana.

Traditional firms like JPMorgan and Société Générale are testing tokenized assets on private blockchains.

These efforts standardize technology and boost blockchain ecosystems. Robinhood’s work with Arbitrum shows cross-chain potential, and future multichain integration could enhance flexibility.

Robinhood’s vision stands out. Beyond stocks, it offers crypto futures and Ethereum/Solana staking, aiming for a platform blending traditional and crypto assets. Its $2 billion acquisition of Bitstamp strengthens its crypto capabilities.

Robinhood’s planned Layer-2 blockchain will support more tokenized assets, like international stocks, private equity, and bonds, giving it a first-mover edge.

CONCLUSION: A NEW FINANCIAL ERA

Robinhood’s tokenized stock service marks a turning point for traditional finance and blockchain. By tokenizing U.S. stocks and private equity, it offers EU investors low-cost, efficient access while setting a standard for digital financial markets.

Despite regulatory, technical, and acceptance challenges, tokenized stocks’ liquidity, 24/7 trading, and transparency make them a rising star.

Looking ahead, maturing blockchain tech and clearer regulations could break down financial barriers, offering fairer investment opportunities. Robinhood’s leadership and blockchain partnerships fuel this trend.

OpenAI’s objections highlight compliance challenges, but the industry must balance innovation and regulation for sustainable growth.

The tokenized stock wave is here, and Robinhood’s move is just the start. At the intersection of blockchain and finance, a more open, efficient capital market is emerging.

How will tokenization reshape global finance in the next decade? Robinhood’s blockchain blueprint may hold the first clues.