KEYTAKEAWAYS

-

SPYx enables 24/7 blockchain-based trading of the S&P 500, offering low barriers and high flexibility compared to traditional stock markets.

-

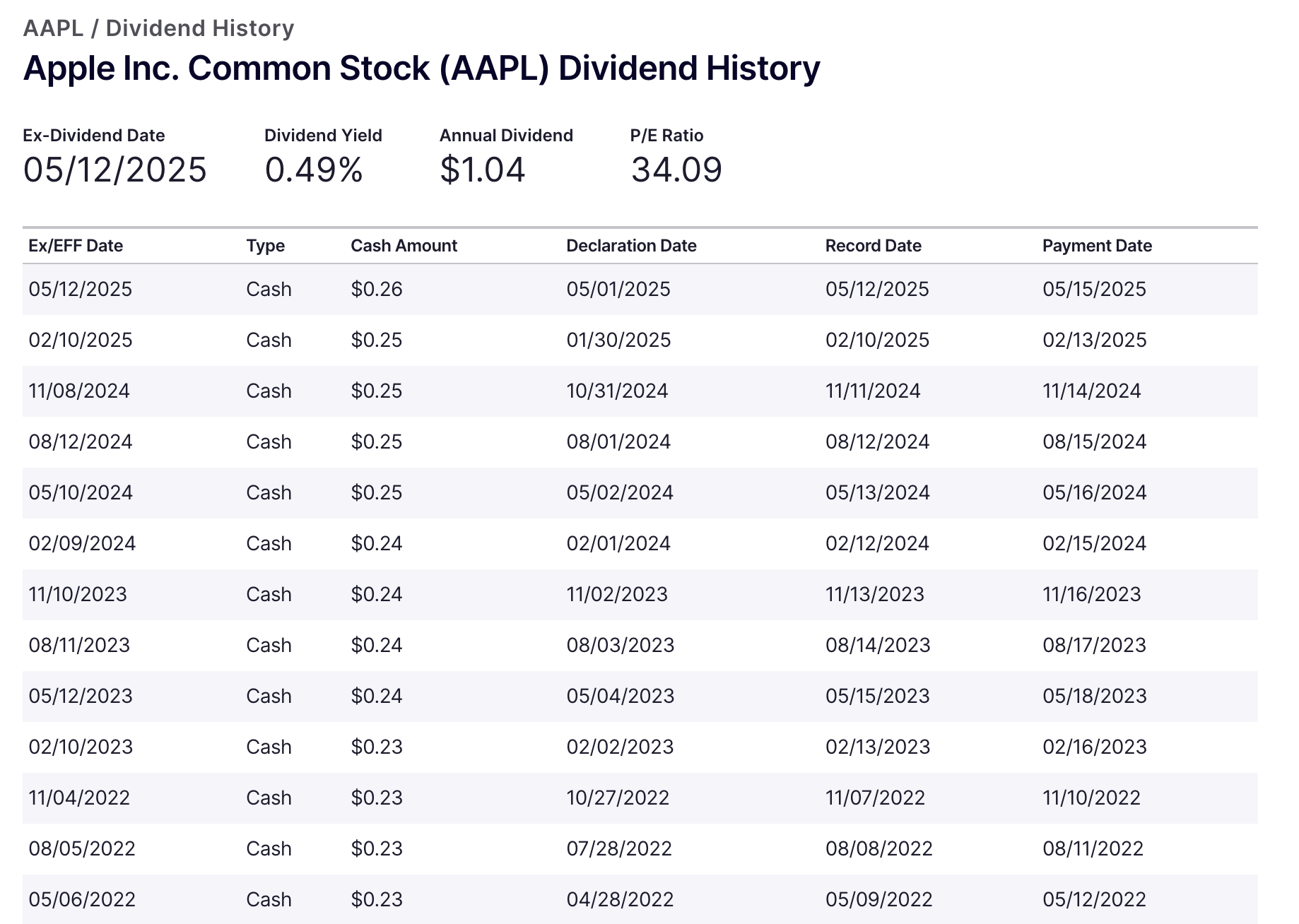

Unlike traditional stocks, SPYx doesn’t provide dividends or ownership rights—it's a price-tracking token, not an equity asset.

-

On-chain transparency gives retail traders access to real-time data, but risks remain due to low liquidity and regulatory uncertainty.

- KEY TAKEAWAYS

- STOCK TOKENS: THE BLOCKCHAIN VERSION OF “STOCKS”?

- DIFFERENCE #1: TRADING STYLE – TRADITIONAL VS MODERN

- DIFFERENCE #2: OWNERSHIP RIGHTS – WHO’S THE REAL OWNER?

- DIFFERENCE #3: TRANSPARENCY – ON-CHAIN DATA AS “SUPER VISION”

- DIFFERENCE #4: RISK VS REWARD – WHICH IS MORE EXCITING?

- CONCLUSION: WILL STOCK TOKENS TRANSFORM THE FUTURE OF INVESTING?

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Imagine being able to “invest” in the S&P 500 with just a few hundred dollars—trading 24/7, even on weekends! This isn’t science fiction; it’s the magic of stock tokens. On the Solana blockchain, the S&P 500 index token SPYx is gaining serious momentum.

But what’s the real difference between stock tokens and traditional stocks? Could this be your next big investment opportunity? Let’s take SPYx as an example and dive into this new financial frontier!

STOCK TOKENS: THE BLOCKCHAIN VERSION OF “STOCKS”?

Traditional stocks are like a company’s “shareholder pass.” When you buy Apple or Tesla stock, you become a partial owner of the company.

You may receive dividends and get to vote at shareholder meetings. Stock trading happens on big, regulated platforms like the NYSE or Nasdaq—rule-heavy, high-barrier, and locked into fixed trading hours.

Stock tokens are a completely different story! Take SPYx on Solana, for example—it’s a “digital replica” of the S&P 500 index, built using blockchain tech to track its price.

Think of it as a “price mimic”: it mirrors the ups and downs of the S&P 500, but you don’t become a real shareholder and won’t get dividends or voting rights. In simple terms, SPYx is a price token, not an equity token.

Why is it so appealing? Because SPYx lets you “play” the S&P 500 with just a few hundred dollars—anytime, anywhere. It’s as flexible as a rocket ship.

DIFFERENCE #1: TRADING STYLE – TRADITIONAL VS MODERN

To buy traditional stocks, you first need a brokerage account, fill out lots of paperwork, and then keep an eye on market hours (9:30 AM to 4:00 PM EST).

Investing in S&P 500 ETFs like SPY also often requires a sizable sum. It’s like lining up for train tickets—slow, tedious, and rule-bound.

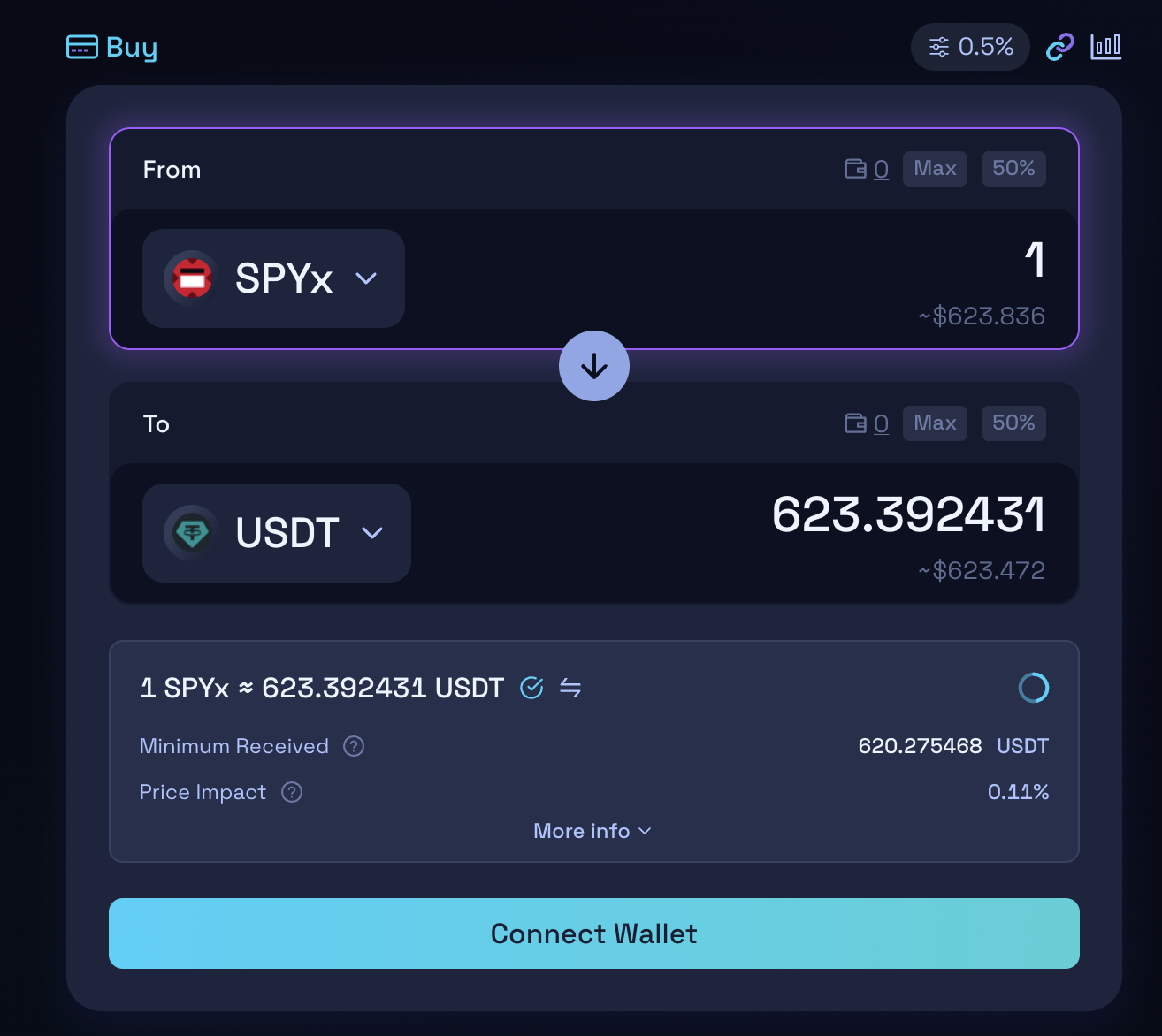

SPYx, by contrast, is like a “supercar” in the blockchain world! It trades on Solana’s decentralized exchange Raydium, open 24/7. All you need is a crypto wallet loaded with some USDC (a stablecoin) or Solana’s WSOL, and you can buy SPYx anytime.

Even cooler: SPYx can form trading pairs with other tokens, like SPYx/USDC or SPYx/WSOL—something completely unheard of in traditional stock markets.

Real-world case: Someone used 100 USDC to buy SPYx on Raydium and caught the S&P 500 rally—earning 10% in a few days. This kind of low entry barrier and high flexibility makes traditional markets feel outdated.

DIFFERENCE #2: OWNERSHIP RIGHTS – WHO’S THE REAL OWNER?

When you buy a stock, you’re a company shareholder. You have rights to dividends, voting, and legal protections. Institutions like the SEC closely monitor all transactions to ensure compliance.

But what about stock tokens like SPYx? It’s more like a “price game.” When you buy SPYx, you’re really just speculating on the price of the S&P 500—you don’t actually own any shares.

Why? Because blockchain addresses are typically anonymous, and the issuer of SPYx can’t assign shareholder rights like voting or dividends to those anonymous holders.

Even if they claim to have bought the actual S&P 500 stocks off-chain, the rights remain theirs, not yours.

If SPYx scales up, the issuer may “proxy hold” all the voting rights—essentially gaining free influence. In the traditional market, this would be unthinkable!

DIFFERENCE #3: TRANSPARENCY – ON-CHAIN DATA AS “SUPER VISION”

One big problem in traditional markets is information asymmetry. Big institutions have advanced data terminals, while regular investors rely on news and earnings reports—mostly guesswork. The blockchain world of stock tokens flips that script.

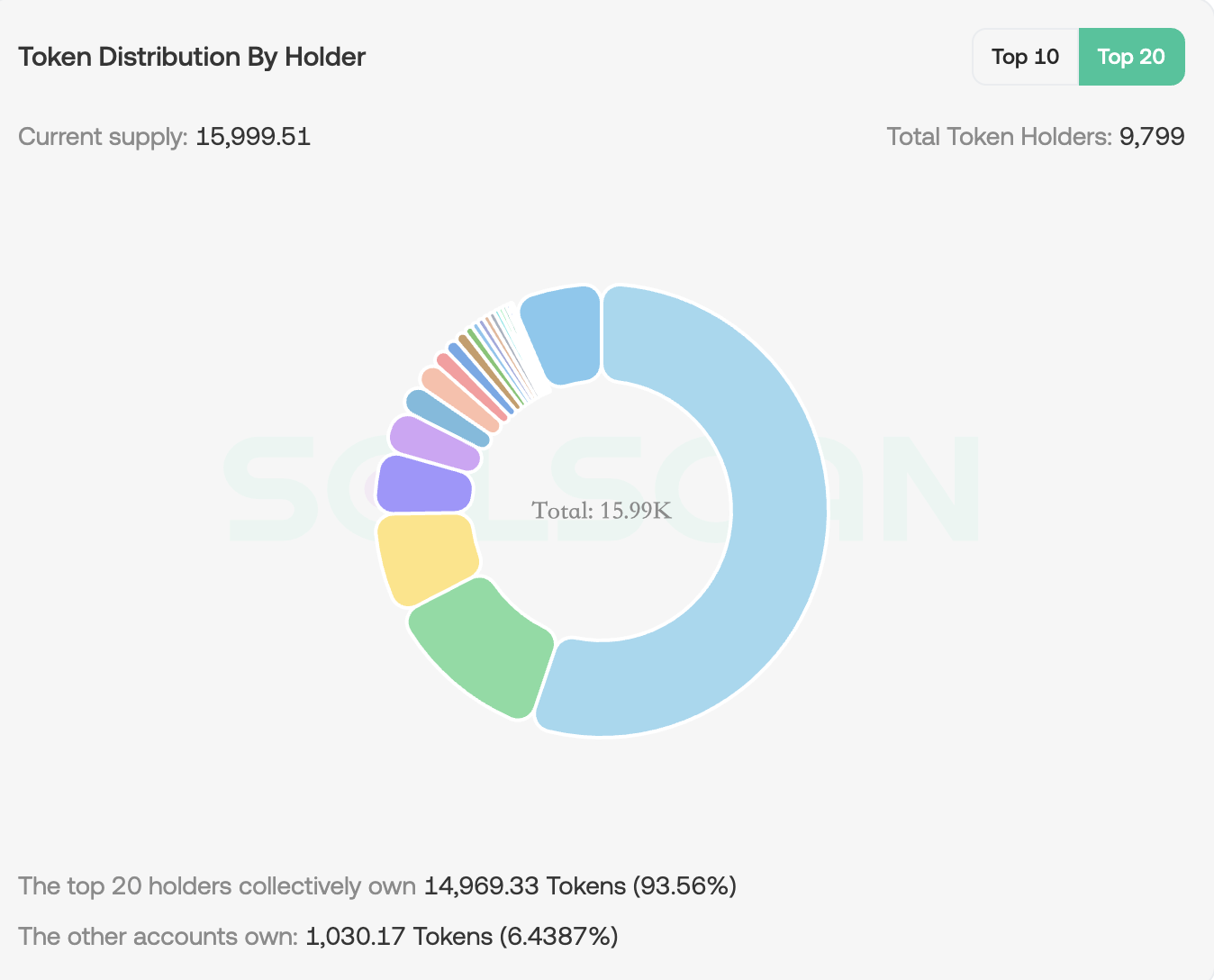

Take SPYx: Solana’s on-chain data is like a public ledger. Anyone can see how SPYx is issued, traded, and where the money flows. For example:

- Issuance process: SPYx is minted by the issuer, distributed to large addresses, and then flows into Raydium’s trading pools.

- Market making mechanism: Market makers provide two-way quotes in the SPYx/USDC pool to earn spreads. The USDC they earn flows back to the issuer, likely to buy more S&P 500 assets.

- Official vs Unofficial Pools: Official pools are price-stable but yield less; unofficial pools (e.g. when someone buys SPYx from Kraken and sets up their own liquidity) are riskier but more lucrative.

With tools like Dune Analytics or SolanaFloor, retail investors can analyze this data and find opportunities—giving small players “big player vision”!

DIFFERENCE #4: RISK VS REWARD – WHICH IS MORE EXCITING?

Traditional stock markets are mature—but not risk-free. The SPY ETF alone manages over $100 billion and is highly liquid, but still exposed to market cycles.

SPYx, in contrast, is more like a daring “rookie.” As of July 2025, SPYx has only $6.9 million in assets under management but is growing fast—market size jumped from $15 million to $48.6 million in just two weeks.

Tokenized stock markets on Solana already make up 3.9% of the global share, showing huge potential. But risks remain:

- Low liquidity: Small markets can swing wildly.

- Regulatory pressure: The SEC has warned that tokenized securities must comply with securities laws.

- Issuer risk: If SPYx’s issuer lacks transparency, the off-chain asset backing could be questionable.

Some see SPYx as “the future of blockchain finance”; others call it an “empty shell with no equity.” What do you think?

CONCLUSION: WILL STOCK TOKENS TRANSFORM THE FUTURE OF INVESTING?

Stock tokens like SPYx are reshaping investing with blockchain’s flexibility and transparency. They offer easier access and faster trading—but bring along regulatory and structural challenges.

Will they become the new normal or fade away? The answer may lie hidden in Solana’s on-chain data.

If you’re curious about SPYx or blockchain investing, check out real-time trades on Raydium—or dig into the data yourself and uncover new opportunities!