KEYTAKEAWAYS

-

ETH/BTC breaks above 0.028, signaling potential trend reversal amid Ethereum's growing institutional appeal and market momentum.

-

SharpLink Gaming becomes Ethereum's largest institutional holder, staking 99.7% of its ETH and boosting confidence in ETH as a reserve asset.

-

Ethereum’s staking yield and ecosystem growth attract institutional capital, positioning ETH as a tech-driven alternative to Bitcoin’s “digital gold” narrative.

CONTENT

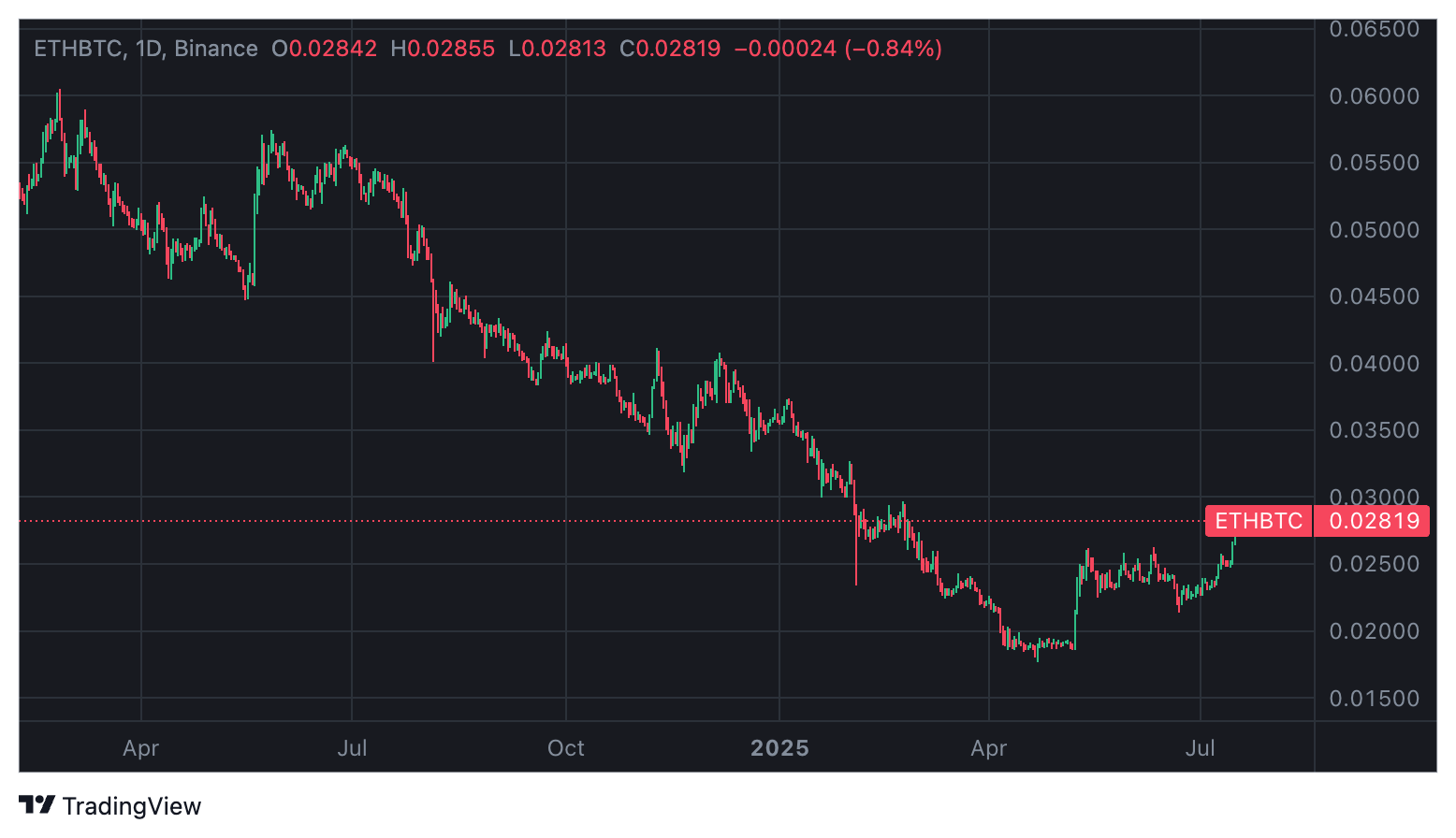

In July 2025, the ETH/BTC exchange rate broke through 0.028, reaching 0.028284—a new high since late February—sparking intense discussion about Ethereum’s (ETH) relative strength against Bitcoin (BTC).

This breakout not only prompted investors to reassess Ethereum’s potential, but also raised the question of whether a long-term trend reversal is underway.

Meanwhile, institutions such as SharpLink Gaming have made decisive moves—redirecting core asset reserves toward Ethereum—highlighting its growing appeal.

RECENT PERFORMANCE AND MARKET CONTEXT OF ETH/BTC

As of July 17, 2025, the ETH/BTC exchange rate stands at 0.028284, up approximately 9.59% over the past 30 days, demonstrating Ethereum’s notable momentum in the market.

At the beginning of the year, the ratio had dropped to a low of 0.01805, before gradually recovering to a mid-year high of 0.03676. The recent break above the 0.028 resistance level marks a strong rebound for Ethereum.

From a historical perspective, ETH/BTC peaked at 0.04109 in November 2021, but later declined under Bitcoin’s dominance, entering a downward channel until April 2025 when it hit a macro bottom not seen since 2019.

Many analysts now predict that ETH/BTC may soon test the 0.029 to 0.03 resistance zone, reflecting growing market optimism about Ethereum. However, confirming a true trend reversal requires a broader view—especially regarding institutional behavior.

INSTITUTIONAL DRIVERS FOR CHOOSING ETHEREUM AS A RESERVE ASSET

Ethereum’s rise is not only due to its technological strengths and ecosystem growth, but also its increasing recognition among institutional investors as a strategic reserve asset.

Institutions like SharpLink Gaming have made large-scale ETH acquisitions and designated it as a core reserve holding, signaling strong confidence in Ethereum’s long-term value.

Below are the key factors driving institutions to choose ETH—factors that also provide deeper support for ETH/BTC’s upward trajectory.

ETHEREUM’S ECOSYSTEM ADVANTAGE AND FINANCIAL INNOVATION

As the world’s leading smart contract platform, Ethereum’s ecosystem showed remarkable vitality in 2025.

The widespread adoption of Layer 2 solutions (such as Arbitrum, Optimism, and Base) has significantly reduced transaction costs and improved network efficiency, positioning Ethereum as the infrastructure for decentralized finance (DeFi), non-fungible tokens (NFTs), and AI data marketplaces.

According to CoinGecko, on July 16, Ethereum recorded $48.176 billion in 24-hour trading volume, up 21.60% year-over-year—indicating active on-chain usage.

In contrast, Bitcoin’s role as “digital gold” limits its functional expansion, relying primarily on institutional investment and ETFs. This functional difference makes Ethereum more appealing to institutions seeking technology-driven growth.

The case of SharpLink Gaming is particularly noteworthy.

As a NASDAQ-listed sports betting marketing company, SharpLink announced in May 2025 that it would hold ETH as its primary reserve asset, amassing 280,706 ETH—surpassing the Ethereum Foundation and becoming the world’s largest corporate ETH holder.

Its chairman, Joseph Lubin—founder of ConsenSys and co-founder of Ethereum—stated that the strategy is not merely an investment but a reflection of confidence in Ethereum’s long-term potential in DeFi and smart contracts.

By staking 99.7% of its ETH holdings, SharpLink not only supports the security of the Ethereum network but also earns passive income through staking rewards.

This yield mechanism makes ETH more attractive to institutions by transforming it from a purely speculative asset into a yield-generating financial instrument.

Lubin emphasized that Ethereum is “the foundation of next-generation financial infrastructure,” echoing SharpLink’s vision of ETH as “the base layer of global finance.”

STAKING RETURNS AND ASSET APPRECIATION POTENTIAL

Ethereum’s staking mechanism is a key reason why institutions are choosing ETH as a reserve asset. Since Ethereum’s transition to Proof of Stake (PoS) in 2022, staking has become central to its network security and revenue generation.

SharpLink, by staking its ETH holdings, has earned a cumulative 415 ETH in rewards since June 2, with returns that are stable and transparent.

For institutions, this passive income model is similar to bond yields in traditional finance, while ETH’s price appreciation potential provides equity-like growth.

In contrast, Bitcoin lacks a comparable yield mechanism, and its value is primarily influenced by market sentiment and macroeconomic factors.

OUTLOOK AND INVESTMENT STRATEGY

The ETH/BTC breakout above 0.028 reflects Ethereum’s ecosystem strength and the surge in institutional interest.

Institutions like SharpLink are selecting ETH as a reserve asset due to its ecosystem advantages, staking yield, liquidity support, and improved regulatory environment.

These factors are not only driving ETH/BTC higher, but also laying the foundation for a potential trend reversal. However, Bitcoin’s resilience and macro uncertainties remain important to watch.

ETH/BTC is not just a price ratio—it represents institutional confidence and technological innovation. Investors should remain flexible and seize the opportunities brought by Ethereum’s ascent.