KEYTAKEAWAYS

- Crypto market liquidity affects trade efficiency, price stability, and risk. High liquidity means lower costs and smoother transactions for investors and projects.

- Key liquidity drivers include trading volume, exchange listings, regulations, and market sentiment. Better regulations and more participants improve market depth and liquidity.

- Measuring liquidity involves analyzing bid-ask spreads, order book depth, trading volume, and slippage. Projects can improve liquidity with market makers and liquidity mining.

CONTENT

As the crypto industry continues to grow rapidly, crypto market liquidity has become a major concern for both investors and project teams. Whether it’s Bitcoin, Ethereum, or newly launched DeFi tokens, crypto market liquidity directly affects how easily assets can be traded, how stable their prices are, and the overall health of the market. In simple terms, crypto market liquidity refers to how quickly and efficiently assets can be bought or sold in the market at a fair price, without causing major price swings.

Especially in 2025, as blockchain adoption grows and global regulatory frameworks evolve, understanding crypto market liquidity is more important than ever. It is not only a key factor in evaluating a crypto asset’s investment value, but also a sign of how mature and stable a market is. For both short-term traders and long-term holders, crypto market liquidity impacts transaction costs and risk management strategies directly.

WHAT IS CRYPTO MARKET LIQUIDITY AND WHY IT MATTERS

Crypto market liquidity refers to how efficiently crypto assets can be traded without significantly affecting their prices. A liquid market generally has higher trading volume, tighter bid-ask spreads, and more stable price movements. For example, Bitcoin and Ethereum typically show strong crypto market liquidity due to broad trading activity and deep market participation.

The importance of crypto market liquidity lies in its direct impact on transaction costs and market efficiency. For investors, a highly liquid market allows quick entry and exit with minimal loss due to price fluctuations. For project teams, tokens with strong crypto market liquidity are more attractive to investors and more likely to gain broader recognition in the market.

In contrast, low crypto market liquidity can lead to sharp price changes during trades and result in slippage—when the actual executed price differs from the expected price—which increases investment risk.

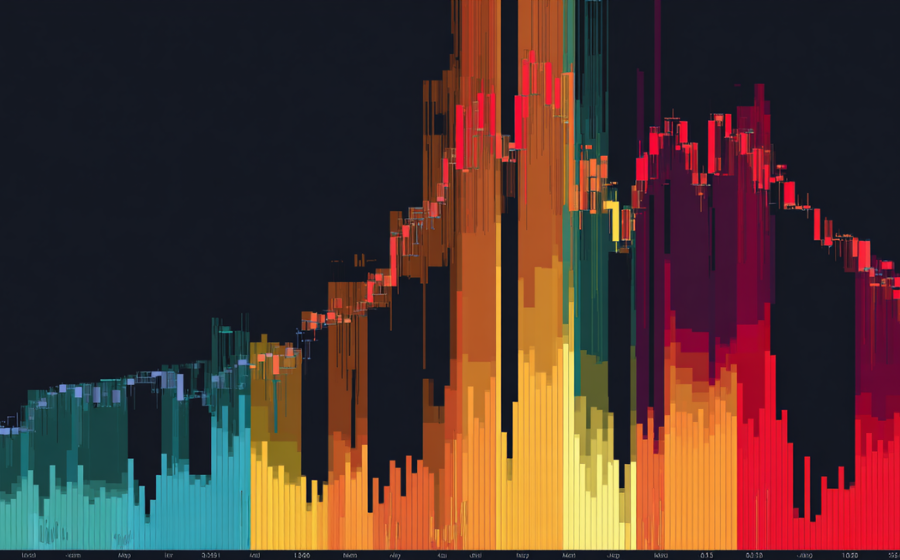

Source: Binance

LIQUIDITY AND MARKET DEPTH

Market depth is a major component of crypto market liquidity. It describes the number of buy and sell orders at different price levels within an exchange’s order book. A deep market can absorb large orders with little impact on the price. For instance, in a market with strong depth, an investor can buy or sell a large amount of Bitcoin with minimal price change. On the other hand, in a shallow market, even a small trade might cause significant price movement.

Market depth is often evaluated using data from exchange order books. By checking the distribution of buy and sell orders, investors can judge how resilient a market is. Market depth is also closely related to the scale and user base of an exchange. Leading platforms like Binance and Coinbase usually have deeper markets, while smaller or newer exchanges may offer weaker crypto market liquidity.

KEY FACTORS THAT AFFECT CRYPTO MARKET LIQUIDITY

Trading volume and market participants

Trading volume is one of the most important drivers of crypto market liquidity. A high-volume market means there are many buyers and sellers, creating a more active and efficient trading environment. Bitcoin, for example, often has daily trading volumes in the billions of dollars, making it the most liquid crypto asset. The number and diversity of market participants also play a big role. Institutional investors, retail traders, market makers, and algorithmic traders all help boost crypto market liquidity.

Additionally, the availability of a token across multiple exchanges affects liquidity. If a token is listed on only a few exchanges, its crypto market liquidity is likely limited. In contrast, tokens that are widely available across major platforms tend to be more liquid. In 2025, as more institutions enter the crypto space, the overall level of participation is rising, pushing crypto market liquidity higher.

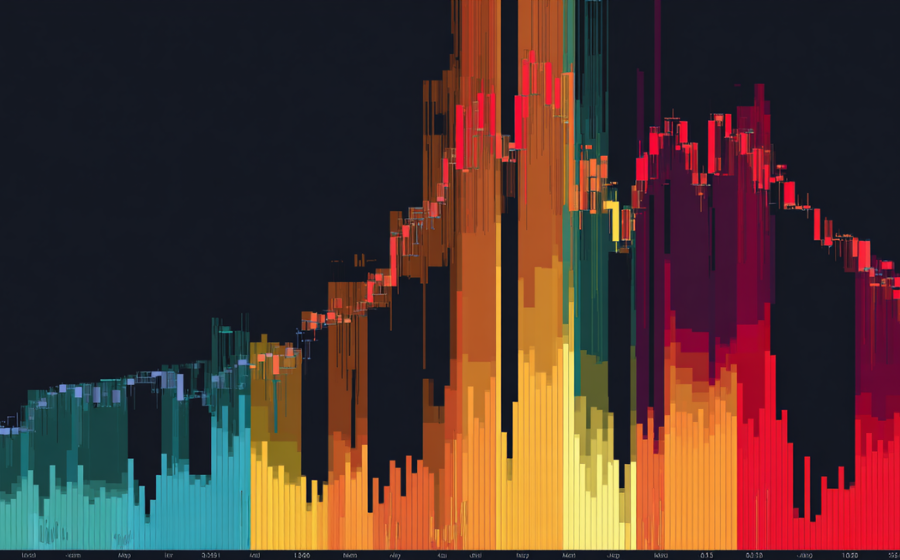

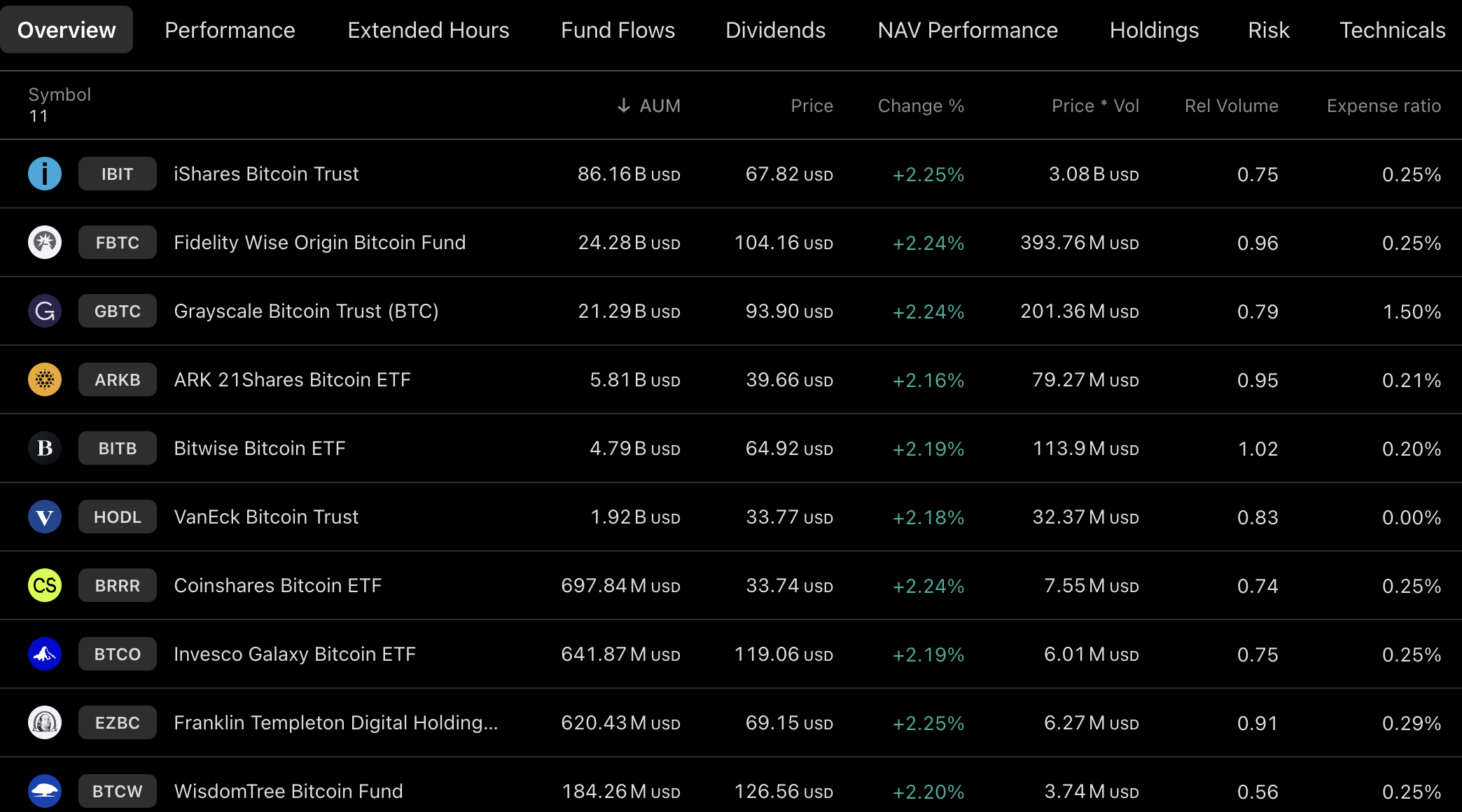

Source: TradingView

Regulatory environment and market confidence

Regulatory policies also have a major impact on crypto market liquidity. Clear and supportive regulations improve investor confidence and attract more capital to the market, which enhances crypto market liquidity. For instance, in 2024, the regulatory frameworks in the U.S. and the EU became more structured, bringing more institutional money into the market and increasing the liquidity of assets like Bitcoin and Ethereum.

On the other hand, uncertain or harsh regulation can drive investors away and reduce market activity. Market sentiment is another key factor. During bull markets, enthusiasm runs high, trading activity surges, and crypto market liquidity improves. In bear markets, when participation declines, crypto market liquidity often drops as well. Therefore, understanding how regulation and sentiment influence crypto market liquidity is crucial for shaping smart investment strategies.

HOW TO MEASURE AND IMPROVE CRYPTO MARKET LIQUIDITY

How to measure crypto market liquidity

To evaluate crypto market liquidity, investors can refer to several key quantitative indicators. First is the bid-ask spread, which is the price difference between the highest buy order and the lowest sell order. A smaller spread generally indicates better crypto market liquidity. Another important factor is order book depth, which reflects how much trading volume the market can absorb at different price levels.

For example, by analyzing the amount of buy and sell orders within ±1% of the current price, investors can understand how easily large trades can be executed without impacting price too much. Trading volume and volatility also offer important insights. Markets with high trading volume and low price swings tend to have better crypto market liquidity.

Additionally, slippage—meaning the difference between the expected trade price and the actual executed price, especially in large trades—is another way to assess how strong or weak crypto market liquidity is. In 2025, data platforms like CoinMarketCap and Glassnode provide real-time liquidity analysis tools to help investors better track and evaluate these conditions.

Strategies and tools to improve liquidity

For crypto projects, improving crypto market liquidity is key to attracting users and gaining a competitive edge. One common approach is to work with market makers who provide constant buy and sell orders to build deeper markets. Another effective method is launching liquidity mining programs, where users are rewarded for supplying liquidity to decentralized exchanges like Uniswap or SushiSwap.

Cross-chain technology and the growth of DeFi also open new possibilities. By bridging tokens across multiple blockchains, a project can expand its reach and improve crypto market liquidity. For investors, choosing highly liquid tokens and trading on large, active exchanges helps reduce slippage and trading risk.

WHAT CRYPTO MARKET LIQUIDITY MEANS FOR INVESTORS

Crypto market liquidity is not just a technical concept—it is a major factor that influences investment strategy. In a high-liquidity market, investors have more flexibility. Whether you’re day trading or holding for the long term, you can adjust positions quickly and at a lower cost. However, low-liquidity tokens come with higher risks, including price manipulation and significant slippage.

In 2025, as institutional involvement increases and DeFi ecosystems mature, overall crypto market liquidity is improving. But crypto market liquidity still varies greatly between different assets and platforms. That’s why investors should always check liquidity indicators like volume and order book depth before making decisions.

Also, keeping an eye on regulatory changes and market sentiment can help investors anticipate shifts in crypto market liquidity. In short, deeply understanding and using crypto market liquidity to your advantage can give you an edge in the dynamic world of digital assets and help you build a more stable investment portfolio.