KEYTAKEAWAYS

- Institutional Innovation Over Technology: WFOE revenue rights isolation architecture enables compliant cross-border tokenization, reducing financing costs from 8.7% to 5.2% for energy infrastructure assets.

- Two Chains One Bridge Solution: Ant Chain's cross-border infrastructure uses ZKP to transmit desensitized value data while keeping sensitive information onshore, solving data sovereignty issues.

- SME Financing Revolution: 83% of previously unbanked charging pile operators gained access to financing through IoT data credit scoring, replacing traditional collateral-based lending models.

CONTENT

China’s first cross-border new energy RWA breaks through regulatory barriers. Longshine Technology tokenizes 9,000 charging pile revenue rights, raising 100M yuan in Hong Kong’s HKMA sandbox with innovative compliance architecture.

1.FOREWORD: THE NEW ENERGY ASSET FINANCING REVOLUTION IN THE RWA ERA

Against the backdrop of the global Real World Assets (RWA) tokenization wave dominated by U.S. Treasury bonds and commercial real estate, China is pioneering a unique digitalization path—abandoning financial asset speculation and anchoring blockchain technology to the capillary networks of the real economy. From the NFTization of Dunhuang Grottoes to the tokenization of delivery rights for Shanghai Malu vineyards, a lightweight RWA model focusing on “lifestyle-oriented physical assets” is activating the dormant value of micro-entities. Its core logic lies in using technological rigor to break through real economy financing bottlenecks rather than creating financial bubbles.

The Longshine Technology charging pile RWA project exemplifies this path. In August 2024, the project was launched within the Hong Kong Monetary Authority’s Project Ensemble sandbox, completing China’s first cross-border tokenization of new energy physical assets—converting revenue rights from 9,000 charging piles in the Yangtze River Delta into on-chain assets and raising 100 million yuan in Hong Kong.

Its ultimate value lies in revealing that the essence of RWA is institutional innovation rather than technological revolution. When the revenue flow from every kilowatt-hour can be converted into on-chain credit certificates, the financing history of small and medium enterprises will be completely rewritten.

This is not merely a technological experiment, but also the first regulatory sandbox compliance paradigm that China has exported in the global RWA competition, marking the official international debut of China’s characteristic “entity-anchored RWA.”

Using Longshine Technology as a sample and deconstructing its RWA practice, this article aims to answer two major propositions:

- The Inevitability of Institutional Constraints: Why must China’s RWA accept non-typical characteristics such as investor rights restrictions and liquidity sacrifices?

- The Reconstructive Nature of Capital Ecosystem: How does RWA systematically break through the triple dilemma of “expensive financing, slow turnover, and cross-border difficulties” for small and medium enterprises?

By clarifying the dialectical relationship between technological ideals and regulatory reality, this provides a replicable strategic blueprint for the digital upgrade of China’s physical assets.

2.TECHNOLOGICAL GUARANTEE: HOW DOES ANT CHAIN’S “TWO CHAINS ONE BRIDGE” SOLVE CROSS-BORDER DATA ISSUES?

The Longshine charging pile RWA project is not a simple technological transplant, but a precisely designed institutional innovation project.

2.1Asset Selection

In the asset selection and evaluation phase, Xindiandu, as Longshine’s new energy digitalization platform, first needs to identify the most valuable assets from the charging piles operated on its aggregated charging platform.

The project focuses on charging pile clusters with 35% high utilization rates in the Yangtze River Delta region (such as Shanghai Hongqiao Hub Station), comprehensively considering multiple dimensions including charging pile usage frequency, geographical location advantages, historical revenue stability, and future profit expectations. From the 170,000 devices operated on the Xindiandu platform, 9,000 high-quality targets were selected as the underlying assets for RWA.

Subsequently, authoritative financial institutions in Hong Kong conduct third-party evaluations of these assets to ensure objective and accurate market value assessments, while completing necessary risk assessments and legal compliance reviews.

2.2Data Collection and Technical On-Chain Processing

First, in terms of data collection, Ant Chain achieves an innovative “power-on-chain” model through its MaaS module technology, with each charging pile establishing connections with the asset chain through IoT devices.

These smart devices can collect real-time operational data from charging piles, including transaction records for each charging session, equipment operating status, maintenance information, and actual revenue conditions. All data is encrypted through trusted root technology based on unique device characteristics, ensuring immutability and verifiability from the source.

Ant Chain’s digital-physical twin technology system provides strong support for this process. Its architecture can support performance of 100,000+ transactions TPS, achieving an average 2.4-second transaction on-chain delay, and possesses PB-level data ledger storage and processing capabilities.

Second, after data collection is completed, technical infrastructure needs to be built first. “Two Chains One Bridge” is the core of this infrastructure and the key innovation point of the project.

In this system, the Asset Chain is deployed in mainland China, specifically responsible for digitalizing and standardizing Longshine Technology’s charging piles and other physical assets, using consortium chain format to ensure data security and regulatory compliance.

Underlying Logic: The Data Security Law requires sensitive data not to leave the country, but RWA needs to display asset information to international investors. The Asset Chain is responsible for achieving physical separation—original data remains on the mainland Asset Chain, only transmitting desensitized value information to Hong Kong.

The Transaction Chain is based on Hong Kong compliant public chains (such as Ethereum) to issue ERC-1400 tokens, embedding KYC rules to restrict trading to professional investors only, complying with Hong Kong’s Securities and Futures Ordinance. It mainly undertakes fund tokenization functions, particularly enabling efficient circulation and trading of funds from traditional financial institutions through blockchain technology.

Underlying Logic: The Hong Kong Monetary Authority has strict KYC/AML requirements for tokenized assets. The Transaction Chain deployed in Hong Kong is directly supervised by HKMA, with investor identity verification conducted on-chain.

The Ant Chain Trusted Cross-Chain Bridge (Hainan Hub) connecting the two chains plays a crucial bridging role, generating “revenue summaries” (such as daily average revenue values per pile) through Zero-Knowledge Proof (ZKP), achieving value cross-border verification under desensitization premises, ensuring secure and compliant cross-border circulation of data and assets between the mainland Asset Chain and Hong Kong Transaction Chain.

Underlying Logic: In terms of compliance, according to foreign exchange management and anti-money laundering regulations in mainland China and Hong Kong, the cross-chain bridge records all capital flow trajectories, providing complete audit trails for regulatory authorities. Technically, the two regions have different technical standards and network environments, so the trusted cross-chain bridge provides standardized cross-chain protocols and data format conversion.

The entire “Two Chains One Bridge” architecture design cleverly solves technical challenges and compliance requirements in cross-border RWA projects, laying a solid foundation for subsequent asset tokenization and cross-border trading.

2.3COMPLIANCE DESIGN

The real institutional innovation lies in the WFOE revenue rights isolation architecture, successfully solving core ownership and compliance issues in cross-border financing.

Longshine Technology established a Wholly Foreign-Owned Enterprise (WFOE) in Hainan Free Trade Port. Through legally binding agreement arrangements, this WFOE received transfers of specific revenue rights generated by charging piles over the next three years from 1,600 small and medium operators owning physical charging pile equipment. These revenue rights mainly include charging service fees and possible government subsidies.

The agreement clearly states that physical ownership of equipment remains with the original small and medium operators, ensuring their operational autonomy, while future revenue rights are legally clearly separated and transferred to the WFOE, making them independent, disposable financial assets.

A Special Purpose Vehicle (SPV) is established in Hong Kong as the cross-border issuing entity, controlling mainland WFOE revenue rights through agreement control.

This structure successfully isolates and securitizes the revenue flow of underlying assets at the legal level, while establishing revenue buffer mechanisms according to industry practices, purchasing China Ping An’s “Equipment Failure Insurance + Revenue Interruption Insurance” covering regional risks such as typhoons and power restrictions.

Underlying Logic: Circumventing restrictions of the Foreign Exchange Management Regulations, complying with the definition of “unlisted structured products” in Schedule 5 Part 2 of Hong Kong’s Securities and Futures Ordinance, and obtaining license exemption (SFO Article 114).

2.4Asset Tokenization

Converting the future revenue rights of charging piles held by the WFOE into digital tokens that can be held, transferred, and traded on blockchain through technical means. The project issues ERC-1400 standard security tokens with an annualized benchmark yield of 6%, daily revenue automatic aggregation (charging fees + government subsidies), and monthly distribution to token holders’ wallets (automatic execution by smart contracts).

Each token represents partial ownership or revenue distribution rights to future revenue flows from specific underlying charging piles (or asset packages). This enables originally large and difficult-to-divide physical infrastructure assets to be fragmented into small, standardized investment units.

2.5Financing and Trading

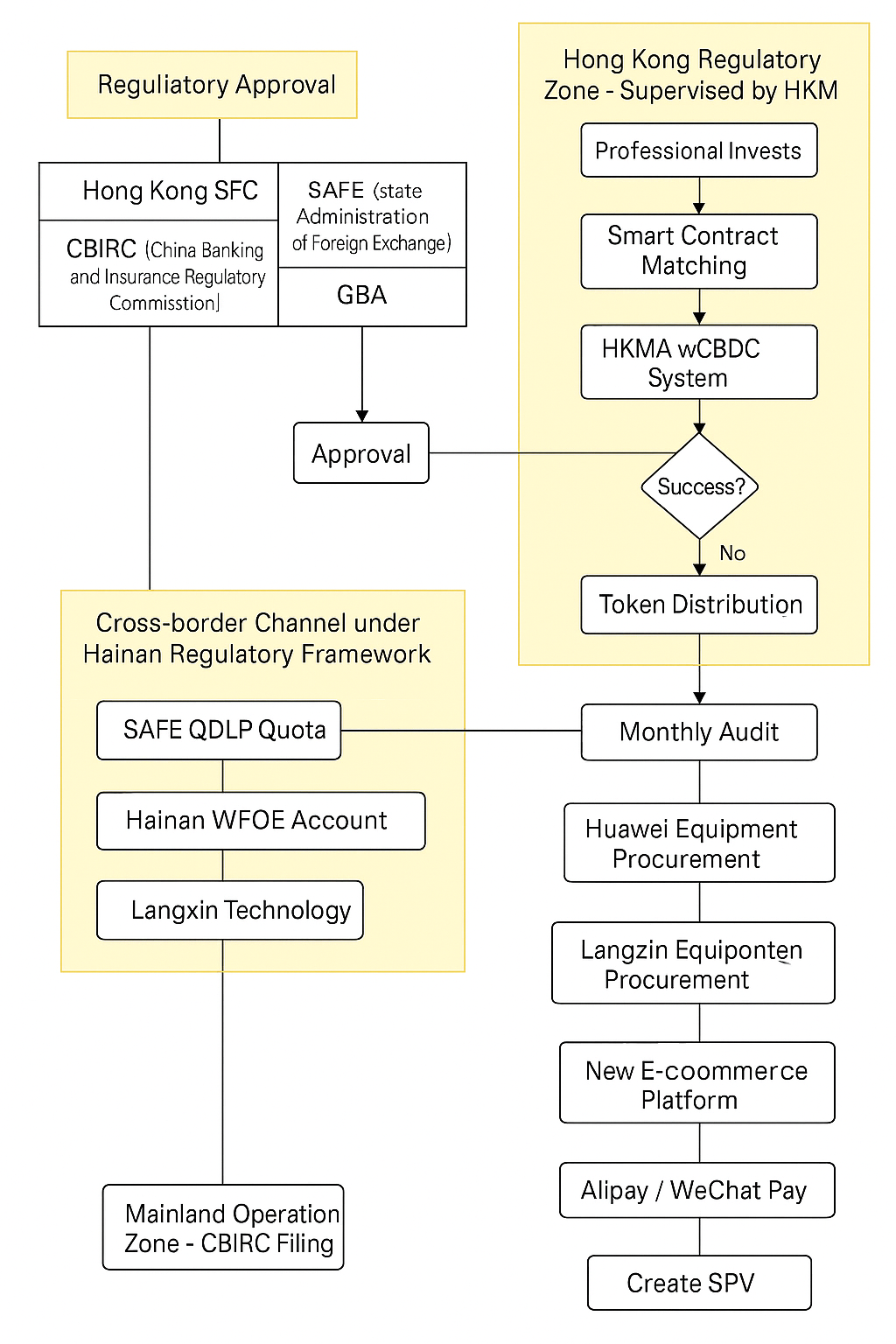

After asset tokenization is completed, the project enters the market-oriented financing phase, with the entire process strictly following Hong Kong regulatory requirements as follows:

2.5.1Issuance Targets

- Traditional financial institutions (banks, insurance companies, etc.)

- Professional investment funds (hedge funds, private equity, etc.)

- Individual investors meeting high net worth conditions (requiring personal net assets ≥ HK$8 million)

2.5.2Subscription Mechanism and Thresholds

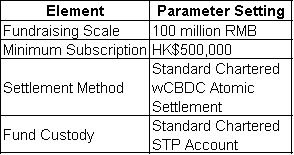

- Setting high subscription thresholds (HK$500,000), 10% higher than the Hong Kong Monetary Authority’s (HKMA) minimum requirements, aimed at screening investors with stronger risk tolerance

- All participants must pass strict KYC (Know Your Customer) and AML (Anti-Money Laundering) review procedures

2.5.3Issuance Scale and Use of Funds

This issuance successfully raised approximately 100 million yuan RMB.

Raised funds are specifically used for Longshine Technology’s business expansion in the new energy sector, particularly providing energy storage facility construction, charging pile equipment upgrades, and operational support for thousands of cooperating small and medium charging pile operators, forming a closed loop between capital and industrial development.

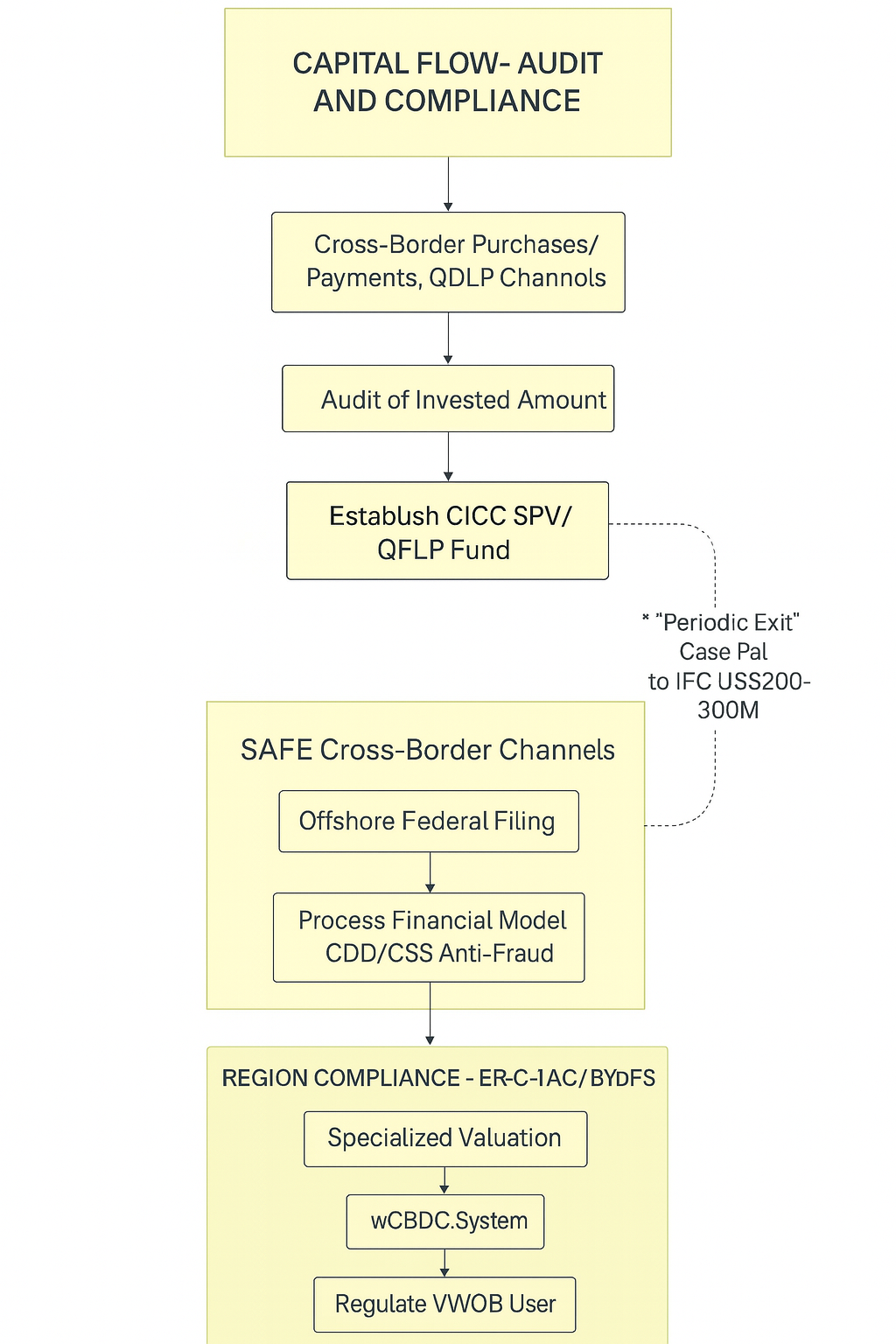

2.5.4Fund Security Guarantee

- Raised funds are deposited in Standard Chartered Bank’s STP (Straight Through Processing) accounts, achieving physical isolation from Longshine Technology’s own operational funds, ensuring dedicated fund use and fund security

- Utilizing the Hong Kong Monetary Authority’s ongoing wCBDC (wholesale Central Bank Digital Currency) pilot project for fund settlement

wCBDC combined with smart contracts achieves “Delivery vs Payment” (DvP) atomic settlement, where investor payment (wCBDC) and receiving corresponding tokens are completed synchronously and inseparably on-chain. If any step fails (such as unconfirmed payment or token issuance failure), the entire transaction will automatically roll back, completely eliminating settlement risks in traditional finance of “payment received but tokens not issued” or “tokens issued but payment not received.”

2.5.5Trading Process

- Investors complete KYC/AML verification through Fireblocks institutional wallets

- Subscription funds are locked in smart contracts in wCBDC form

- Token issuance and fund clearing are completed atomically on-chain (error <3 seconds)

- Targeted disclosure of fund use: 60% for adding 5,000 liquid-cooled supercharging piles (Huawei cooperation), 40% invested in V2G (Vehicle-to-Grid) energy storage system R&D

2.6Operations and Management

-

Dynamic Dashboard System:Real-time display of key indicators: single pile utilization rate (≥65% is healthy), revenue per kWh (0.42-0.58 yuan range), fault response speed (<4 hours)

-

Intelligent Settlement Engine:Daily automatic revenue aggregation, triggering contract dividends according to T+1 distribution rules. Alipay/WeChat Pay → SPV offshore account → reserve fund account

-

Risk Circuit Breaker Mechanism: Regional power outages exceeding 8 hours trigger insurance claim processes; single pile revenue <¥30 for 3 consecutive days triggers maintenance alerts

- Risk Prevention and Control: PwC conducts monthly verification of revenue data and Reserve fund coverage ratio <1.0x triggers warnings to HKMA and investors

Read more: