KEYTAKEAWAYS

-

OKX burns 65M OKB, fixes supply at 21M, ends OKT Chain, and upgrades X Layer as its core ecosystem strategy.

-

X Layer boosts speed to 5000 TPS, near-zero fees, with OKB as sole gas token; ecosystem growth hinges on DeFi, payments, stablecoins.

-

CEXs pivot to on-chain ecosystems: Binance on BNB Chain, Coinbase on Base, Bybit with DEX push; OKX bets on X Layer.

- KEY TAKEAWAYS

- X LAYER & OKB: BORN FOR THE PLATFORM, EVOLVING FOR GROWTH

- OKB’S SUPPLY REDUCTION AND MARKET IMPACT

- CHALLENGES FACING X LAYER

- THE NEW COMPETITION AMONG CEXS: ON-CHAIN BECOMES THE CORE BATTLEGROUND

- OKX STRATEGY: INTEGRATING EXCHANGE, WALLET, AND PAYMENTS

- CONCLUSION: OKB & X LAYER IGNITE THE NEXT INDUSTRY SHOWDOWN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

On August 13, OKX officially released an announcement that reignited a new round of industry competition among exchanges.

On the one hand, OKX decided to burn all 65,256,712.097 OKB reserved from historical buybacks in one go, thereby fixing the total supply at 21 million tokens (Odaily note: identical to Bitcoin’s total supply). On the other hand, OKX chose to shrink its on-chain footprint by eliminating OKT Chain, converting OKT tokens to OKB at a fixed rate, and fully focusing on developing the Layer 2 network X Layer, upgrading network performance and achieving ecosystem integration.

The news shook the market: within just 2 hours, OKB’s price soared from around $46 to $142, a gain of about 208%. Its fully diluted valuation (FDV) once surged to $7.45 billion (Coingecko data). On August 14, OKB’s 24-hour trading volume reached about $1.44 billion, with OKX alone accounting for $275 million. Other exchange tokens such as GT, BGB, and MX also saw notable increases. Meanwhile, Hong Kong-listed company OKG Technology (1499.HK) surged 26.09% intraday on August 14, with its stock price once hitting HK$0.73.

On August 15, OKB’s token burn and X Layer upgrade were officially completed. Odaily now analyzes the competitive dynamics among centralized exchanges (CEXs).

X LAYER & OKB: BORN FOR THE PLATFORM, EVOLVING FOR GROWTH

In 2023, amid the Ethereum Layer 2 boom, OKX partnered with Polygon to launch an L2 chain based on zkEVM, leveraging zero-knowledge proofs to enable lower-cost transactions. OKB served as its native token. At launch, the chain was named OKX’s L2.

In April 2024, OKX’s L2 was officially rebranded as X Layer. With infrastructure projects like The Graph, QuickSwap, Curve, and Wormhole joining, the ecosystem expanded rapidly.

According to the official block explorer, as of August 18, 2025, X Layer recorded 13.06 million transactions, with a total transaction volume of 1.33 million OKB (≈$150 million). Its TVB (Total Value Bridged) stood at 378,000 OKB (≈$43.09 million). OKX CEO Star stated:

“X Layer has been upgraded, boosting performance to 5,000 TPS with near-zero transaction fees, while fixing OKB’s supply at 21 million. Moving forward, X Layer will adopt a ‘one chain, one token’ model, supporting DeFi, global payments, and RWA, and aiming to build all-chain infrastructure.”

Clearly, OKX places great strategic importance on X Layer, which targets some of the hottest sectors. Coupled with OKX’s 60+ million user base, this strategy offers a significant advantage in ecosystem growth and liquidity.

OKB’S SUPPLY REDUCTION AND MARKET IMPACT

With OKB’s supply now capped at 21 million, the token is expected to benefit from ecosystem growth.

Back in February 2020, when OKChain’s testnet launched, OKB surged 40% in a single day, jumping from around $3 to $5.5 on token burn news. At that time, total circulation was about 286 million.

Today, after 28 token burns, OKB has climbed to nearly $100, a 20x increase. As the only gas token and native asset of X Layer, demand for OKB may surge again, potentially fueling another major price rally.

CHALLENGES FACING X LAYER

Despite its progress, X Layer still faces three major challenges:

-

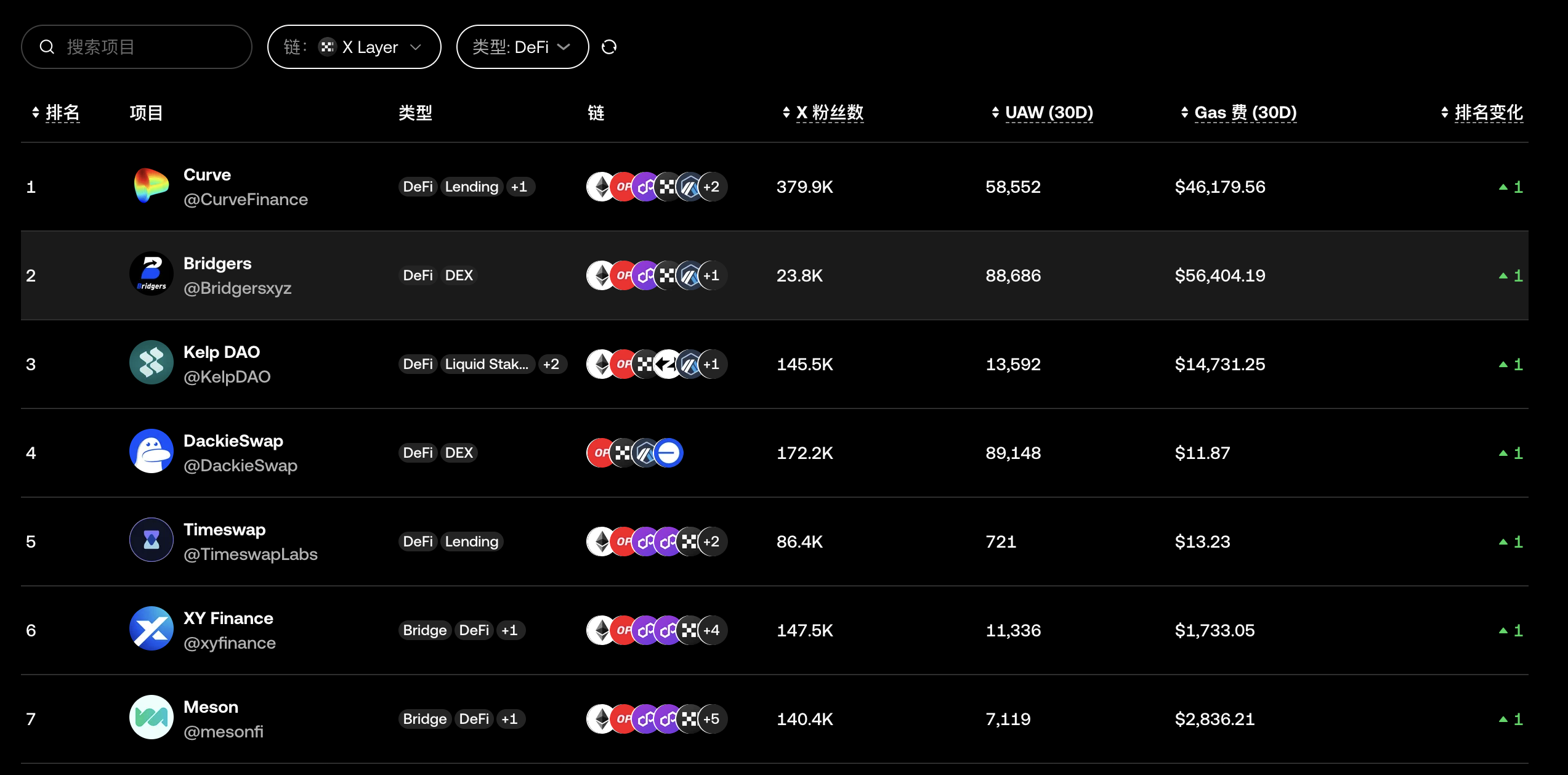

Defi Protocol Gap: According to the official site, X Layer currently hosts only 7 major DeFi protocols (Curve, KelpDAO, Meson, etc.), far fewer than other L1 or L2 chains that boast dozens.

-

Payment User Gap: While OKX has a massive user base, converting them into active X Layer users—especially in payments—remains a hurdle. Compared to Base, Arbitrum, and Optimism, X Layer has a long way to go.

-

Stablecoin Issuance Gap: Stablecoins are a key metric of ecosystem strength. Unlike TRON (USDT supply > $80B) or Solana (USDC issuance > $5.5B in the past month), X Layer suffers from late entry and limited resources. Other RWA assets also require development.

These challenges, however, also represent opportunities. Being early-stage means X Layer has growth potential, and OKX’s resources could help it catch up quickly.

THE NEW COMPETITION AMONG CEXS: ON-CHAIN BECOMES THE CORE BATTLEGROUND

In this cycle, major CEXs are pivoting toward native on-chain ecosystems. Each is pursuing its own strategy:

-

Binance: After setbacks with Binance Wallet, Binance introduced the Alpha + Wallet dual-track model. Alpha’s token launch features and scoring system drive liquidity, while BNB Chain provides stable support, with 11.8M active addresses in June and daily actives surpassing 3M.

-

Coinbase: Focused on Base (Ethereum L2), Coinbase launched BaseAPP (one-stop dApp platform) and integrated DEX trading. According to L2Beat, Base TVL reached $16.1B (Aug 15), while Dune reports 229M addresses and 1.2M daily active users.

-

Bybit: Expands its ecosystem via (1) DEX launches (Byreal gained 100k users in 3 days; Fragmetric raised $8.18M); (2) Ethena’s USDtb mint/redeem services; (3) Bybit U-Card payments, which gained traction for generous cashback (even attracting “farmers” exploiting rewards).

-

Others (Bitget, Gate, MEXC, etc.): Rushed to launch Alpha sections, speeding up token listings and integrating wallet access to capture users.

-

OKX: Taking a measured approach, aiming to deeply integrate X Layer with its three core businesses: Exchange, Wallet, and Payment.

OKX STRATEGY: INTEGRATING EXCHANGE, WALLET, AND PAYMENTS

-

DeFi: OKX Wallet, a “one-stop on-chain gateway,” has gained traction thanks to fast updates and smooth DEX trading. Combined with OKX’s massive user base, this could accelerate X Layer adoption and liquidity.

-

Payments: OKX Pay, built on X Layer, may prove revolutionary. CEO Star noted it is the first crypto wallet with full compliance systems, supporting instant, secure global USDT/USDC transfers with zero fees and 5% APY on USDT. This could attract new users and cement OKX’s position.

-

RWA: After retiring OKT Chain, X Layer saw explosive growth: addresses exceeded 1.85M, with daily increases of 50k. According to L2Beat, X Layer assets grew 103% in 7 days, hitting $84.89M. On Aug 16, X Layer processed 2.05M transactions, surpassing Ethereum for the first time.

This was partly fueled by a meme coin boom within X Layer, despite OKX emphasizing neutrality. Community enthusiasm suggests meme tokens may remain a strong sector in its ecosystem.

CONCLUSION: OKB & X LAYER IGNITE THE NEXT INDUSTRY SHOWDOWN

As Bitcoin turns 16 and Ethereum celebrates its 10th anniversary, with traditional finance entering via ETFs and accumulation strategies, crypto exchanges are entering their “second half.”

For Binance, OKX, and Coinbase, winning the next round depends not only on converting exchange resources into on-chain ecosystems, but also on understanding user demand, industry trends, and driving product innovation.

Whether BNB Chain, X Layer, or Base emerges as the ultimate winner will require time and market validation. But one thing is clear: this “on-chain ecosystem war” will be longer and fiercer than many expect.