KEYTAKEAWAYS

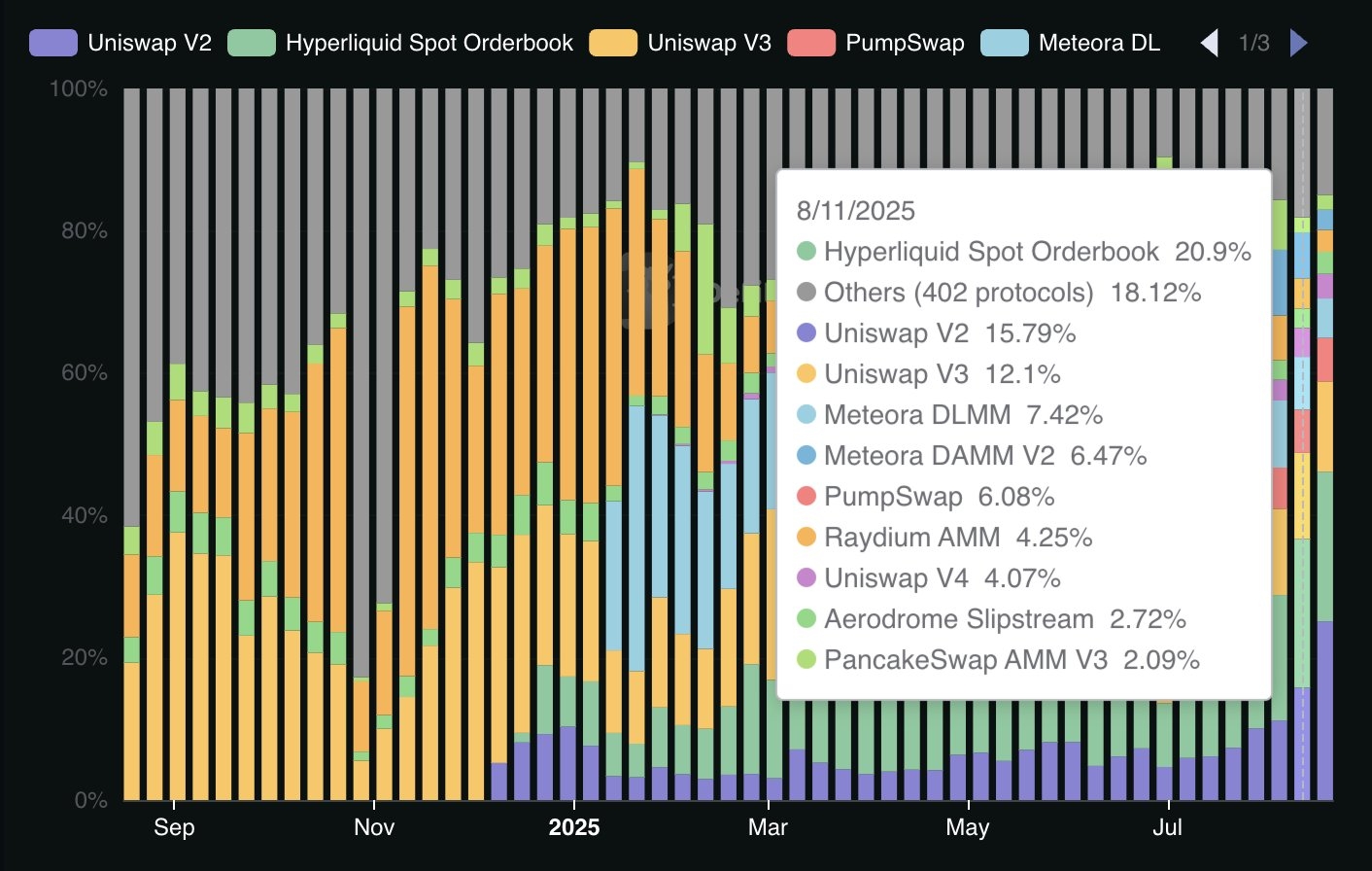

- DefiLlama reveals more than 80% of decentralized exchange fees are generated by the top ten protocols, highlighting a highly concentrated DEX market structure.

- Uniswap remains the leading DEX, capturing over $45 million in weekly fees with strong liquidity, multi-chain support, and unmatched adoption across the DeFi ecosystem.

- Hyperliquid emerges as a fast-growing competitor, generating nearly $30 million weekly fees through derivatives-focused trading, innovative incentives, and rapidly expanding market participation.

CONTENT

DefiLlama data shows over 80% of DEX fees come from the top 10 protocols, with Uniswap and Hyperliquid dominating recent volumes and shaping DeFi’s future landscape.

INTRODUCTION

The decentralized exchange (DEX) landscape continues to evolve, but one aspect remains crystal clear: trading fees are heavily concentrated among a few dominant platforms.

According to DefiLlama’s latest data, over 80 % of all DEX fees originate from the top ten protocols — and this concentration intensifies at the very top.

In the past week, the vast majority of DEX fees were generated through Uniswap and Hyperliquid Spot trading.

This article delves into that concentration, explores what it means for the broader DeFi ecosystem, and highlights implications for users, liquidity providers, and protocol developers alike.

THE CONCENTRATION OF DEX FEES AMONG TOP PROTOCOLS

DefiLlama’s analytics reveal a striking skew: more than 80 % of total DEX trading fees come from only ten protocols.

This implies that the remaining hundreds — if not thousands — of DEX platforms contribute to a mere fraction of the total fee revenue.

The result is a remarkably top-heavy market structure that rewards scale, liquidity, and brand recognition.

Such concentration is not accidental.

Leading protocols like Uniswap and Hyperliquid benefit from deep liquidity pools, trusted infrastructures, and strong user adoption, further reinforcing their dominance in fee generation.

WHY UNISWAP CONTINUES TO DOMINATE FEE GENERATION

Uniswap stands as the flagship of decentralized spot trading. Over the past week alone, it collected approximately **$45.8 million** in trading fees. On an annualized scale, its fee generation reaches well into the **billion-dollar** mark.:contentReference.

Several factors underpin Uniswap’s dominance:

– Its **multi-chain deployment**, including Ethereum, Polygon, Arbitrum, and Base, ensures widespread accessibility.

– It remains a go-to choice for liquidity providers thanks to robust incentives and well-known token mechanics.

– Its reputation for stability and ease of integration attracts high-volume market makers and retail traders.

Collectively, these strengths make Uniswap a powerhouse in the DEX space.

HYPERLIQUID’S EXPONENTIAL GROWTH AMID FEE CONCENTRATION

Meanwhile, Hyperliquid has emerged as a formidable competitor. Over the past week, it gathered nearly **$28.3 million** in fees and is on track for **billion-dollar annualized revenue.

Even more impressively, another source highlights that Hyperliquid generated over **$19 million** in fees in just the past seven days.

Hyperliquid’s explosive growth may be attributed to:

– Its **perpetual-based trading model**, which attracts high-frequency traders and derivatives users.

– An aggressive liquidity and user acquisition strategy, including token buybacks and innovative revenue-sharing mechanisms.

– Its appeal as a differentiated DEX offering that complements, rather than directly competes with, traditional spot venues like Uniswap.

IMPLICATIONS FOR THE DEFI ECOSYSTEM

USERS AND TRADERS

For traders, the concentration of fees in top protocols simplifies choice — they naturally gravitate toward platforms offering tight spreads and high liquidity. However, overreliance on a few venues carries systemic risks, such as congestion, frontrunning, or smart-contract vulnerabilities.

LIQUIDITY PROVIDERS

LPs benefit from lower slippage and higher reward opportunities on dominant platforms, but also face centralization risks. Should these protocols suffer outages or governance issues, LPs across the ecosystem may be affected.

PROTOCOL DEVELOPERS

Emerging DEX developers must recognize that breaking into the top-tier fee bracket isn’t just about tokenomics — scalability, security, multi-chain presence, and user experience are equally pivotal.

BROADER MARKET IMPACT

Fee concentration underscores the importance of decentralization in theory vs. centralization in practice. While DeFi aims to distribute power, real-world usage often gravitates toward trusted, well-known platforms.

CONCLUSION

DefiLlama’s data paints a clear picture: a handful of DEX protocols — led by Uniswap and Hyperliquid — account for the lion’s share of trading fees. With Uniswap generating tens of millions in weekly fees and Hyperliquid rapidly catching up through its derivatives-centric offering, the DEX market continues to centralize its fee dynamics.

As the DeFi space advances, stakeholders should remain mindful of both the efficiency gains and the systemic risks of such concentration. Protocol innovation, ecosystem diversity, and transparency in governance will be key to safeguarding DeFi’s long-term vision of truly decentralized finance.