KEYTAKEAWAYS

- Shanggou Holdings launched a USD 40 million tokenized bond on HashKey Chain, backed by AI computing and renewable energy, the first such deal by a Chinese SOE.

- The issuance used Hong Kong’s regulatory framework, underwritten by GF Securities and advised by KWM, leveraging Ethereum-compatible infrastructure while ensuring compliance and market credibility.

- This landmark transaction highlights Hong Kong’s role in digital asset finance, advances RWA tokenization, and signals future Chinese SOE participation in blockchain-based debt markets.

CONTENT

Shanggou Holdings issues China’s first state-owned enterprise tokenized bond on HashKey Chain, anchored in AI computing and renewable energy, showcasing Hong Kong’s digital finance leadership.

INTRODUCTION

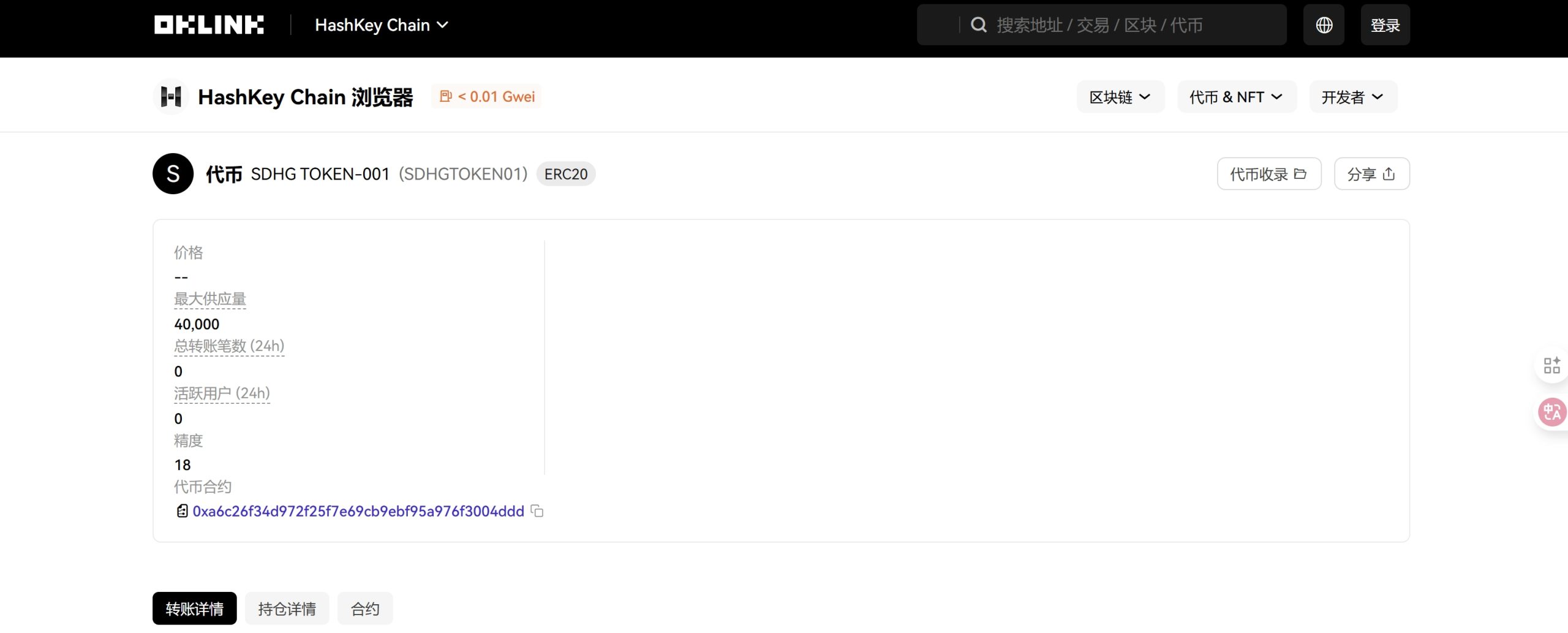

In September 2025, Shanggou Holdings Group Co., Ltd., a Chinese state-owned enterprise, completed the issuance of its first tokenized corporate bond on HashKey Chain, a licensed Ethereum-compatible blockchain operated in Hong Kong. This milestone marked the first tokenized bond issuance by a Chinese SOE through a compliant, regulated digital asset infrastructure.

Backed by tangible industrial assets such as computing power and renewable energy, the deal highlights both the growing adoption of real-world asset (RWA) tokenization and Hong Kong’s role as a global hub for regulated digital finance.

The issuance, valued at USD 40 million, was arranged by GF Securities (Hong Kong) Brokerage Limited and supported by King & Wood Mallesons (KWM) as legal counsel. It demonstrates how traditional financing can merge with blockchain technology in a way that satisfies compliance and unlocks new opportunities.

THE TOKENIZED BOND STRUCTURE

The transaction was structured as a digital bond issued by an indirect wholly-owned subsidiary of Shanggou Holdings. Instead of existing in paper-based or centralized digital form, the bond was recorded as tokens on HashKey Chain. This provided a secure, transparent, and immutable record of ownership and lifecycle events, including issuance, coupon distribution, and redemption.

Key details include:

- Issuance amount: USD 40 million

- Issuing entity: Shanggou Holdings subsidiary

- Underwriter and blockchain agent: GF Securities (Hong Kong)

- Legal counsel: King & Wood Mallesons

- Platform: HashKey Chain, an Ethereum-compatible blockchain operated in Hong Kong

By selecting HashKey Chain, the project balanced technical interoperability with Ethereum’s ecosystem and the regulatory oversight necessary for Hong Kong’s financial market.

UNDERLYING INDUSTRIAL ASSETS

Unlike tokenized financial derivatives, the Shanggou Holdings bond is anchored in industrial standard assets rather than financial securities. The core resources include:

- AI computing power – Shanggou’s stake in 21Vianet provides access to 573 MW of data-center capacity, more than 50,000 urban cabinets, and gigawatt-scale AI-focused facilities in Ulanqab. These resources are critical for China’s artificial intelligence and cloud services infrastructure.

- Renewable energy and carbon credits – Through Shanggou New Energy, the group operates 4.7 GW of installed renewable energy capacity, producing over 6.5 billion kWh annually. It also manages substantial green power certificates and carbon credit assets, increasingly traded in digital marketplaces.

By anchoring the bond to computing and renewable energy, Shanggou avoided regulatory sensitivities tied to financial securities in mainland China, while demonstrating how physical, measurable resources can be converted into tokenized financial instruments.

REGULATORY AND COMPLIANCE PATHWAY

The bond was structured to take advantage of Hong Kong’s newly established digital asset framework:

- Policy foundation – In August 2025, Hong Kong introduced the Stablecoin Ordinance, establishing the world’s first comprehensive legal framework for stablecoins and tokenized assets. Shortly after, the Web3 Standardization Association launched a global RWA registration platform, laying infrastructure for asset-backed digital products.

- Hong Kong as gateway – By conducting the issuance through GF Securities (Hong Kong) and legal counsel from KWM, Shanggou leveraged Hong Kong’s role as a bridge between China and global capital markets.

- Blockchain choice – HashKey Chain, an Ethereum-compatible blockchain run by a licensed Hong Kong financial group, ensured regulatory alignment while retaining compatibility with global decentralized infrastructure.

This layered design shows how Chinese SOEs can enter blockchain finance indirectly: by using Hong Kong as the jurisdiction, anchoring bonds in industrial assets, and relying on Ethereum-compatible but regulated platforms.

COMPARISON WITH DOMESTIC ASSET TOKENIZATION

Within mainland China, blockchain experiments for financial assets remain limited to alliance chains and regulatory platforms, rather than public or open networks. Key examples include:

- The PBoC’s Trade Finance Blockchain Platform, which has handled trillions of RMB in receivables financing.

- Bond registration pilots at the Shanghai and Shenzhen stock exchanges, which record issuance and lifecycle events on blockchain.

- Fund share registration projects by AntChain and WeBank, focusing on investor rights and transferability within controlled networks.

These initiatives focus on efficiency and compliance but avoid creating openly tradable tokenized securities. By contrast, Shanggou’s bond on HashKey Chain demonstrates a model where Chinese SOEs can integrate industrial assets into tokenized products within a globally credible yet regulated environment.

STRATEGIC SIGNIFICANCE

The transaction carries long-term implications for both China and the global RWA market:

- Proof of concept – As the first SOE to issue tokenized debt offshore, Shanggou sets a precedent for other large Chinese enterprises.

- Industrial synergy – Linking AI infrastructure with renewable energy reflects China’s dual strategy of digital transformation and green development.

- Hong Kong’s leadership – Hosting such transactions cements Hong Kong’s reputation as Asia’s hub for regulated Web3 innovation.

- Global RWA expansion – The deal highlights how tokenization is spreading from government bonds and stablecoins to industrial and resource-backed assets.

CONCLUSION

The Shanggou Holdings tokenized bond on HashKey Chain marks a landmark in blockchain finance. By anchoring the bond to computing and renewable energy assets, and issuing under Hong Kong’s regulatory framework, Shanggou established a viable model for Chinese SOEs to enter digital finance without breaching mainland restrictions.

For global markets, this issuance demonstrates how real-world asset tokenization can extend beyond financial instruments to include industrial and environmental resources. As regulatory frameworks mature, more enterprises are likely to replicate this blueprint, bridging traditional finance, blockchain infrastructure, and industrial economies.