KEYTAKEAWAYS

-

Plasma’s XPL raised massive demand, with its public sale oversubscribed more than 7x and whales staking tens of millions of USDC within minutes.

-

Strong institutional backing from Tether and Peter Thiel gives Plasma credibility, while its design as a stablecoin-native blockchain positions it as an on-chain Visa network.

-

XPL price surged over 12x from public sale, and with circulating market cap already nearing $1.4B, the token could break $1 if momentum continues.

CONTENT

WHY IS PLASMA GAINING TRACTION?

As the broader market cools with Bitcoin and Ethereum facing corrections and mainstream altcoin discussions fading, a few “blockbuster” projects continue to dominate attention. Following WLFI’s headline launch, Plasma has emerged as a new focal point.

Plasma’s rise stems from two core drivers: institutional credibility and a clear product vision. Backed by Tether and Peter Thiel, the project quickly raised $24 million across seed and Series A rounds, followed by a $500 million valuation led by Founders Fund. Bitfinex later contributed $3.5 million to push USDT adoption within the Bitcoin ecosystem. This heavy funding positioned Plasma as a “star project” from day one.

Technically, Plasma is not a general-purpose blockchain but a native stablecoin infrastructure. It settles on Bitcoin’s mainnet for security while maintaining EVM compatibility. Transactions can be paid directly with USDT, and standard USDT transfers are free. Combined with selective privacy, BTC bridging, and a deep liquidity pool, Plasma aims to create a Visa-like on-chain network, making stablecoin payments a mainstream reality.

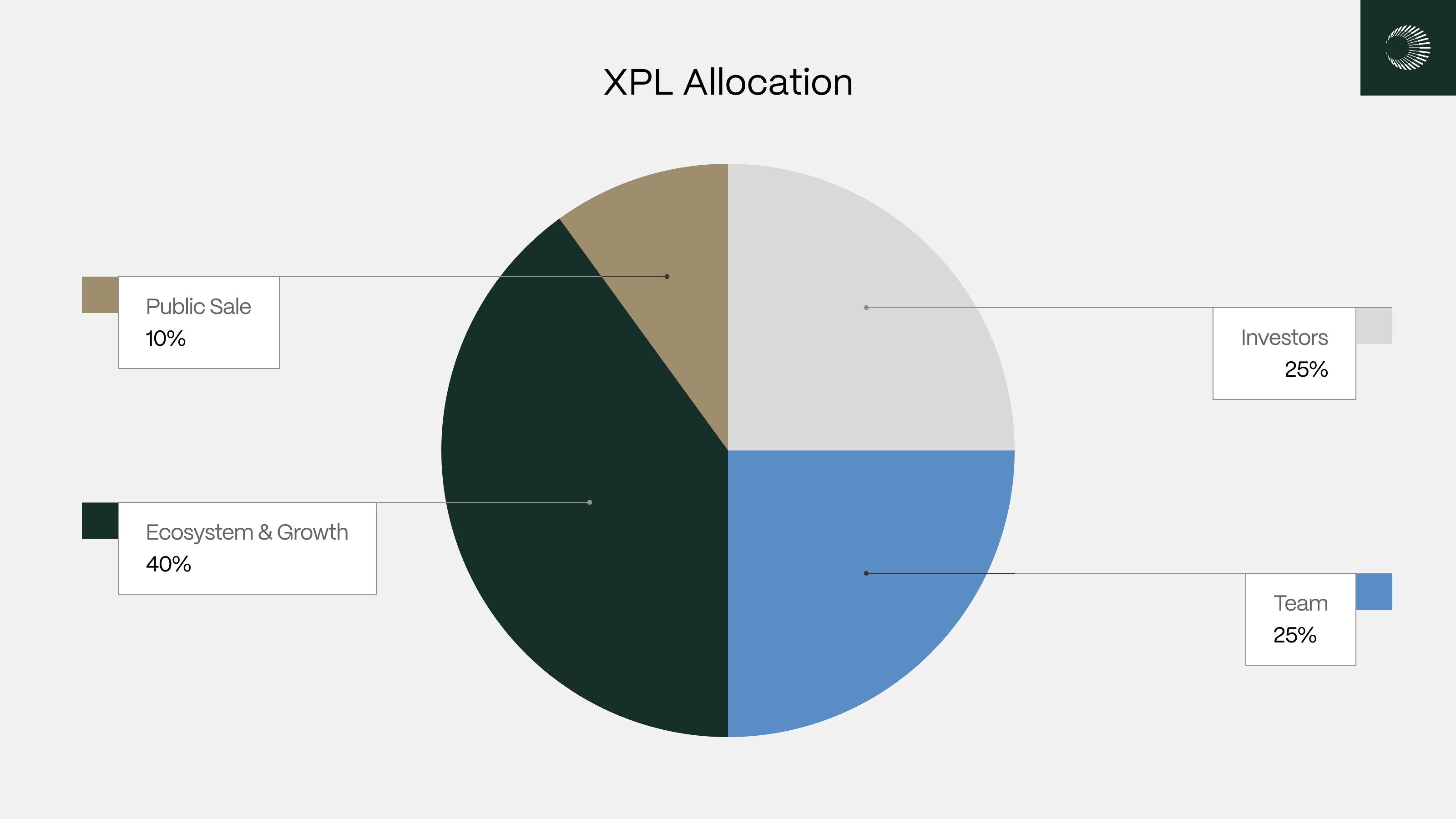

HOW IS THE PLASMA TOKEN (XPL) DISTRIBUTED?

Plasma’s XPL tokenomics define a total supply of 10 billion tokens: • Public Sale (10%): 1 billion tokens at $0.05 each. Non-U.S. buyers receive full unlock at mainnet beta launch; U.S. buyers unlock after 12 months. • Ecosystem & Growth (40%): 4 billion tokens, with 8% for immediate DeFi incentives and 32% vesting monthly over three years. • Team (25%): 2.5 billion tokens, unlocking one year post-launch and vesting over two additional years. • Investors (25%): 2.5 billion tokens, following the same schedule as team allocations.

This design delays team unlocks, signaling reduced near-term selling pressure. Key focus centers on the 1 billion public sale tokens and 800 million allocated to strategic partners.

PUBLIC SALE ALLOCATION AND BINANCE EARN IMPACT

The public sale offered XPL at $0.05. At today’s contract price of $0.62, that’s already a 12x gain.

The subscription process required users to deposit stablecoins into the Plasma Vault on Ethereum. Deposits hit capacity within two minutes, with one whale committing 50 million USDC (20% of total allocation). Another whale burned $100,000 in gas to deposit over 10 million USDC. Plasma later raised the cap to 1 billion USDT after overwhelming demand, with firms like Amber Group and Spartan Group joining in.

By July 17, Plasma’s official public sale was oversubscribed more than 7x, raising over $373 million.

Binance further amplified the frenzy, partnering with Plasma to allocate 100 million XPL (1% of supply) via its Earn program. Subscriptions maxed out multiple times, forcing adjustments to per-account caps. In total, 1 billion USDT flowed through Binance’s program.

The payoff: users depositing 10,000 USDT typically received 1000 XPL plus yield on their USDT deposits. At the current token price of $0.62, that’s worth ~$600, with a peak value of ~$840 when XPL hit $0.84. Including a $33 guaranteed yield, the two-month ROI hit 6.3%, or nearly 40% annualized.

The allocation of the remaining 700 million ecosystem tokens has yet to be announced, leaving room for speculation about future incentives.

MARKET OUTLOOK: CAN XPL BREAK $1?

With XPL’s contract price fluctuating between $0.50 and $0.80, Plasma’s total market cap sits between $5 billion and $8 billion. Its launch-day circulating supply was roughly 18%, giving it a circulating market cap of $900 million to $1.44 billion.

For comparison, INJ, ranked around 100th on CoinGecko, has a circulating market cap near $1.24 billion. If Plasma sustains momentum, a breakout to $1 per token — representing a $1.8 billion circulating cap — is possible, especially with backing from Tether, Thiel, and the stablecoin narrative.

Following WLFI’s explosive debut, Plasma now carries the community’s expectations as the next big play. Whether it breaks $1 soon will depend on sustained demand, market conditions, and how the team deploys its ecosystem incentives.