KEYTAKEAWAYS

- Crypto treasuries emerged in 2020 with MicroStrategy’s Bitcoin purchases, evolving into digital asset treasuries (DATs) that now attract billions in institutional and retail investor capital.

- The rise is driven by inflation hedging, market storytelling, and capital market tools, as companies finance large crypto holdings through bonds, equity offerings, and structured instruments.

- Risks include volatility, regulatory scrutiny, and valuation bubbles, yet over 150 public firms now disclose crypto holdings, signaling growing integration between digital assets and traditional finance.

CONTENT

Crypto treasuries have grown from MicroStrategy’s bold Bitcoin bet to a global corporate trend. Discover their evolution, drivers, challenges, and future outlook shaping finance.

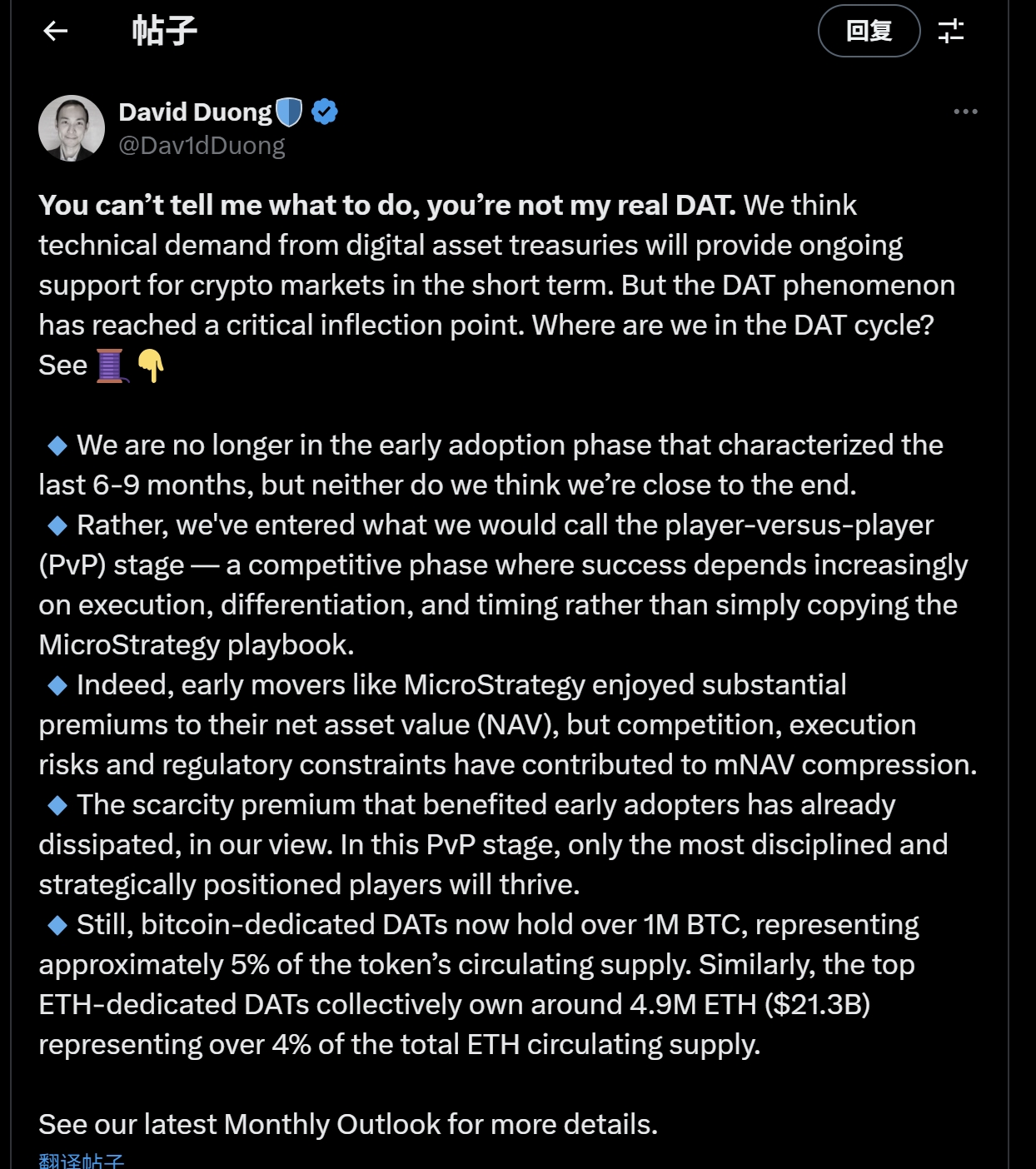

Recently, David Duong, head of research at Coinbase, tweeted, “We believe that the technological needs of crypto treasuries will provide continued support to the crypto market in the short term, but the DAT (Digital Asset Treasury) phenomenon has reached a critical inflection point. We are no longer in the early adoption phase of the past 6-9 months, but we also don’t think it’s nearing its end. Instead, we have entered the so-called PvP phase. This is a competitive phase where success increasingly depends on execution, differentiation, and timing, rather than simply copying the strategy playbook.

This wave of announcements has reignited debates over valuation premiums, corporate governance, and the role of digital assets in traditional finance.

Yet to understand why crypto treasuries have become such a powerful narrative, it is essential to trace their evolution—from a bold gamble by a single company to today’s global phenomenon.

FROM MICROSTRATEGY TO MARKET NARRATIVE

The story begins in 2020, when MicroStrategy shocked Wall Street by converting its excess cash into Bitcoin. At a time when corporate cash piles were languishing in low-yield accounts, CEO Michael Saylor argued that Bitcoin offered better protection against inflation. Critics labeled it reckless, but the decision turned MicroStrategy into the first publicly traded “crypto treasury.”

In the years that followed, other companies experimented with similar strategies. Tesla briefly added Bitcoin to its reserves in 2021, and Square (now Block) also purchased the asset. These moves coincided with a broader surge in crypto adoption, yet the practice remained scattered. Between 2021 and 2023, volatility and regulatory uncertainty discouraged most firms from following through, keeping the trend more symbolic than systemic.

2024–2025: THE AGE OF DIGITAL ASSET TREASURIES

By 2024, a noticeable shift occurred. Companies no longer spoke of “dabbling” in crypto—they branded themselves explicitly as digital asset treasuries (DATs). These firms tapped capital markets through convertible bonds, PIPE financings, and at-the-market offerings to raise funds dedicated to building crypto balance sheets. Unlike earlier adopters, they diversified beyond Bitcoin, incorporating Ethereum, Solana, and other highly liquid tokens.

This shift also reflected a change in investor perception. Shares of DATs began to trade not only on their business fundamentals but also on the scale of their token holdings. Much like gold mining companies serve as leveraged plays on bullion, DATs became equity proxies for crypto exposure. As Foresight News observed, the promise of a rising tide in digital assets was enough to draw billions of fresh capital into these firms.

WHY THE TREND TOOK HOLD

The rise of crypto treasuries has been driven by a combination of macroeconomic conditions, financial engineering, and market storytelling. Inflationary fears and concerns about fiat debasement gave digital assets an appeal as corporate hedges. At the same time, improvements in custody and compliance infrastructure made it safer for institutions to hold tokens at scale.

Perhaps most importantly, capital markets rewarded the story. Investors searching for exposure to crypto often preferred buying equity in listed treasuries rather than navigating token exchanges directly. As a result, companies could finance their acquisitions through traditional instruments while enjoying valuation uplifts tied to their crypto reserves.

CHALLENGES AND CRITICISMS

Yet the model is far from risk-free. Valuation bubbles remain a persistent concern, with equity premiums often assuming perpetual appreciation in volatile markets. Heavy reliance on debt financing exposes DATs to liquidity pressures if token prices correct sharply. Regulators are also beginning to scrutinize whether such holdings are reported transparently and valued fairly on balance sheets.

Beyond technical issues lies a deeper paradox: many treasuries rely on narrative momentum rather than diversified revenue streams. Critics warn that if the hype fades, firms positioned primarily as crypto vaults could face severe re-rating.

LOOKING AHEAD

Still, the momentum is undeniable. More than 150 listed companies worldwide now disclose crypto holdings, collectively amounting to tens of billions of dollars. The sector has already outgrown its experimental roots, evolving into a recognized narrative within both crypto markets and traditional finance.

The future trajectory will hinge on three interwoven forces: clearer regulatory standards, the cyclical tides of crypto prices, and the ability of treasuries to evolve into more than balance-sheet plays. Whether they become long-term pillars of corporate finance or remain speculative vehicles will depend on how they balance risk, disclosure, and strategic purpose.

For now, as the headlines show, digital asset treasuries represent one of the boldest attempts to merge the decentralized promise of crypto with the centralized machinery of capital markets. From MicroStrategy’s pioneering bet to today’s billion-dollar announcements, the story of crypto treasuries is still being written—one balance sheet at a time.