KEYTAKEAWAYS

- JuCoin’s 70% crash revealed liquidity fragility, speculative hype, and weak fundamentals behind its rapid growth story.

- Investors face red flags including lack of transparency, thin markets, and looming regulatory scrutiny.

- Confidence in JU depends on real adoption and stronger foundations, not just marketing promises.

CONTENT

JuCoin’s token collapsed over 70% in hours, exposing liquidity gaps, weak fundamentals, and investor concerns. Explore what triggered the crash and its implications for JU’s future.

INTRODUCTION

The cryptocurrency market is no stranger to sharp price swings, but the recent collapse of JuCoin (JU) token has raised serious questions about liquidity, investor confidence, and the project’s future.

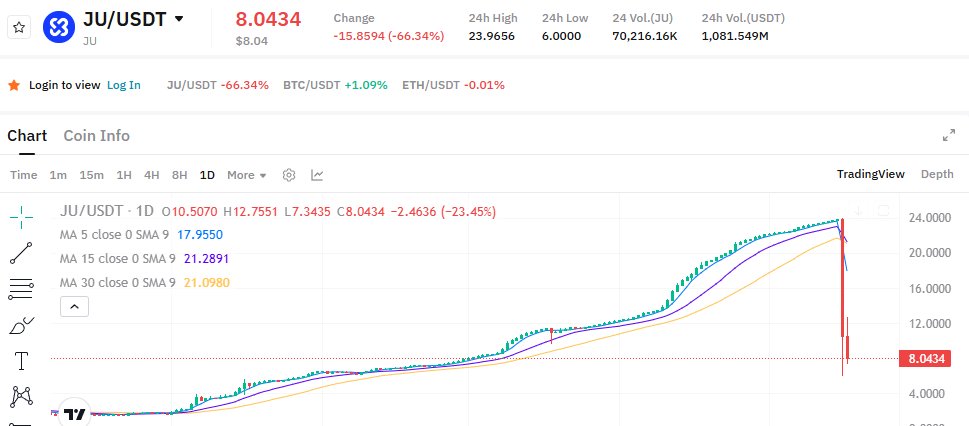

Once trading at nearly $24, JU’s price tumbled to the $6–$7 range within hours, erasing almost three-quarters of its market value. This sudden decline shocked traders and analysts alike, especially given the token’s rapid growth earlier in the year.

THE CRASH: PRICE DROP AND MARKET REACTION

In mid-September, JU suffered a dramatic 70–75% price drop. The decline was accompanied by an explosion in trading volume, with over $1.3 billion in JU changing hands in a single day. Such a spike in activity usually indicates panic selling, forced liquidations, or coordinated market exits.

The speed of the fall drew comparisons to other exchange tokens that faced liquidity shocks in the past. Within hours, JU’s market capitalization shrank significantly, eroding confidence in the token’s short-term stability.

Ju.com, the company behind the token, issued a statement attributing the crash to “market conditions and external liquidity factors.” The team reassured users that the platform was functioning normally and that funds remained safe. While this may calm some fears, investors were left demanding more transparency on what actually triggered the massive sell-off.

SIGNS OF WEAK FOUNDATIONS

While JuCoin has been marketed as a fast-growing ecosystem with ambitious goals, the crash highlighted structural weaknesses that had been overlooked:

- Overhyped Expansion: Ju.com frequently promoted its Layer-1 blockchain, “On-Chain trading” features, and stock market integration. However, many of these offerings remain in early stages, with little evidence of widespread adoption.

- Lack of Transparency: Information about token issuance, treasury management, and liquidity support is sparse compared to more established exchange tokens such as BNB or OKB. Investors are left guessing about circulating supply and real backing.

- Market Depth Concerns: The crash showed that JU lacked the liquidity needed to withstand large sell-offs. A token tied to a global platform should not collapse 70% in hours if the order books were truly strong.

- Speculative Growth: Much of JU’s price surge earlier this year may have been driven more by aggressive marketing and speculation than genuine demand for utility.

These signs suggest that JU’s rise may have been less about strong fundamentals and more about a momentum-driven rally vulnerable to sudden reversals.

LIQUIDITY AND LEVERAGE ISSUES

One of the most likely explanations for JU’s crash lies in liquidity and leverage. Despite Ju.com’s reported user base of over 50 million accounts and daily trading volumes near $5 billion across its platform, JU itself may not have had deep enough liquidity on open markets.

Large sell orders, combined with thin buy support, can cause rapid downward spirals. This effect is magnified when traders use leverage. If JU holders had taken on margin positions, even a modest price decline could have triggered cascading liquidations, forcing further sell pressure. This “domino effect” has been seen across the industry, from exchange tokens to high-profile DeFi assets.

RISKS AND RED FLAGS

The JU token crash brings several risks to the forefront:

- Liquidity Fragility: Exchange tokens should represent stability for their platforms. JU’s sudden collapse suggests structural weaknesses that investors should not ignore.

- Credibility Gap: Marketing narratives around JuCoin may have run ahead of reality. Until tangible adoption and use cases materialize, confidence will remain shaky.

- Competitive Pressure: In a market dominated by established exchange tokens, JU’s fundamentals appear weak. Rivals such as BNB and OKB maintain stronger liquidity, more robust ecosystems, and clearer regulatory positioning.

- Regulatory Scrutiny: By blending exchange services with stock trading and tokenized real-world assets, Ju.com risks drawing regulatory fire. This could further undermine JU’s growth prospects.

MARKET IMPACT AND INVESTOR OUTLOOK

The JU token crash not only damaged investor portfolios but also tested market confidence in emerging exchange tokens. Historically, tokens tied to centralized platforms can act as both a growth engine and a risk factor. If confidence wanes, the token price can become a liability rather than a strength.

In the short term, JU faces an uphill battle to rebuild trust. Transparent communication, stronger liquidity support, and delivery on promised ecosystem features will be essential. Without these, investors may hesitate to re-enter, keeping the price suppressed.

In the longer term, if Ju.com proves its technology, expands adoption of its blockchain, and successfully integrates real-world assets into its ecosystem, JU could recover. But credibility is difficult to restore once shaken, and the road ahead will likely be volatile.

CONCLUSION

The collapse of the JuCoin token is a stark reminder of the fragility of emerging digital assets. Even projects with bold visions can falter when liquidity dries up and investor trust evaporates.

For traders and investors, the lesson is clear: marketing hype and ambitious roadmaps do not substitute for strong fundamentals, deep liquidity, and transparent governance. Until Ju.com addresses these weaknesses, JU will remain a highly speculative asset with uncertain prospects.