KEYTAKEAWAYS

- Easy to Compute – Market capitalization is calculated by multiplying an asset’s current price with its circulating supply.

- Useful Comparison Metric – Market cap provides a quick way to compare the size, ranking, and relative importance of different assets.

- Key factor amongst others – While important, market cap should be used alongside other factors like liquidity, adoption, and activity to understand true valuation of a certain cryptocurrency.

CONTENT

This article offers a simple understanding of an important crypto performance parameter – Crypto Market Cap.

But what exactly is the crypto market cap?

And more importantly, how to calculate crypto market cap accurately? In this guide, we’ll break down the concept, formula, examples, and common misconceptions so you can make smarter decisions in your crypto journey.

Introduction

The cryptocurrency world is fast-moving, volatile, and exciting. Whether you’re a casual investor, a trader, or simply curious about how cryptocurrencies are valued, one of the first metrics you’ll encounter is market capitalization.

It’s a widely used measure to compare cryptocurrencies, assess their relative size, and gauge their overall significance in the digital asset space. As an important crypto performance metric, an insight into the market cap enables a more accurate choice in crypto investment.

Let’s explore..

What Is Crypto Market Cap?

In fiat based financial systems, market capitalization refers to the total value of a company’s shares on the stock market. Similarly, in the crypto world, market cap represents the total value of a cryptocurrency in circulation.

It’s a snapshot of how big or small a particular cryptocurrency is compared to others. Market cap helps investors navigate queries like:

- How significant is a certain coin in comparison to Bitcoin or Ethereum?

- Is this token a small, risky project or a large, more stable one?

- Where does this cryptocurrency stand in the overall market hierarchy?

Why Market Cap Matters in Crypto

Understanding how to calculate crypto market cap provides critical insights into aspects like:

- Relative Ranking – Market cap allows you to compare one cryptocurrency against others. This is why CoinMarketCap, CoinGecko, and other platforms rank cryptocurrencies by market cap.

- Risk Assessment – Smaller market cap coins tend to be more volatile, while larger market cap cryptocurrencies are usually more established and stable.

- Portfolio Strategy – Market cap allows investors to diversify across large-cap, mid-cap, and small-cap coins. This helps balance risks and rewards.

- Market Sentiment – A rising or falling overall crypto market cap often indicates global investor confidence or fear.

Market cap metrics help aggregate cryptocurrency market data and assess the overall health and growth potential of the industry.

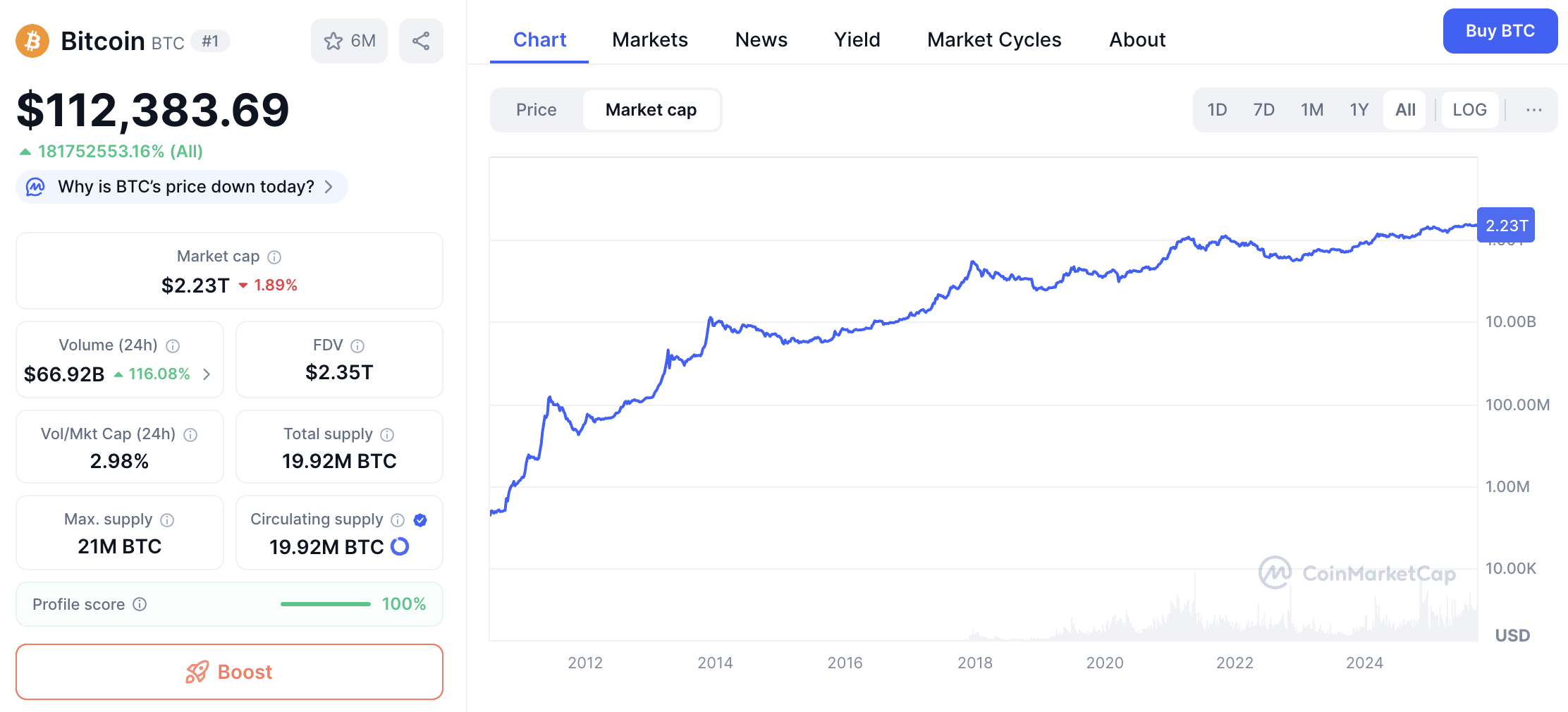

Here’s a view of Bitcoin’s market cap performance through 2025.

Source: https://coinmarketcap.com/currencies/bitcoin/

The Formula: How to Calculate Crypto Market Cap

Crypto Market Cap Formula:

Market Cap = Current Price of Coin × Circulating Supply

- Current Price – The latest market price of the cryptocurrency, usually averaged across exchanges.

- Circulating Supply – The number of coins currently available and circulating in the market (not locked, burned, or reserved).

Here’s how the formula works in practise:

Example 1: Bitcoin

- Current Price: $112,946

- Circulating Supply: 19.92 million BTC

- Market Cap = 112,946 × 19,920,000 = $1.19 trillion

Example 2: Ethereum

- Current Price: $4,359

- Circulating Supply: 120.7 million ETH

- Market Cap = 4,359 × 120,700,000 = $526 billion

By learning how to calculate crypto market cap this way, one can instantly deduce how different cryptocurrencies compare in scale.

Types of Market Cap in Crypto

When learning how to calculate crypto market cap, it’s also important to understand the different variations of supply and valuation:

- Circulating Market Cap – The most commonly used metric, based on the current circulating supply.

- Fully Diluted Market Cap (FDMC) – Considers the maximum supply of a coin. For example, Bitcoin’s FDMC uses 21 million coins (its algorithmically assigned max cap), not the current 19 million circulating.

FDMC=Current Price×Max SupplyFDMC

- Realized Market Cap – Values coins based on the price they last moved, not current price. This is a more realistic picture of invested capital and a useful metric.

How to Calculate Total Crypto Market Cap

Investors also look at the overall crypto market cap, which represents the value of all cryptocurrencies combined.

Formula:

Total Market Cap = ∑(Price of Each Coin×Circulating Supply of Each Coin)

Platforms like CoinMarketCap and CoinGecko update this number in real time, giving a sense of the entire industry’s size.

As of 2025, the total crypto market cap fluctuates between $2–3 trillion, depending on market cycles.

Market Cap Categories in Crypto Finance

Depending on the scale and financial criticality of projects, investors often classify cryptocurrencies by market cap size:

- Large-Cap Cryptocurrencies – Market cap above $10 billion (e.g., Bitcoin, Ethereum). Considered relatively stable.

- Mid-Cap Cryptocurrencies – Market cap between $1–10 billion. Higher growth potential but riskier.

- Small-Cap Cryptocurrencies – Market cap under $1 billion. High risk, high reward, often speculative.

Knowing how to calculate crypto market cap helps investors categorise and optimise investment portfolios accordingly.

Limitations of Market Cap in Crypto Valuation

While market cap is a useful metric, it’s not perfect. Here are some downsides:

- Price Manipulation – Thinly traded coins can have inflated prices, giving a misleadingly high market cap.

- Circulating Supply Disputes – Different sources may report different supply figures.

- Ignored Factors – Market cap doesn’t account for liquidity, trading volume, or real-world adoption.

- Future Token Unlocks – FDMC may reveal hidden risks if many tokens are locked and due for release.

So while learning how to calculate crypto market cap is essential, investors should also consider other metrics like trading volume, on-chain activity, and developer ecosystem.

Step-by-Step Guide: How to Calculate Crypto Market Cap Yourself

If you want to calculate manually:

- Find the Current Price – Check a trusted exchange or aggregator like Binance, Coinbase, or CoinGecko.

- Check Circulating Supply – Look at project websites, blockchain explorers, or reliable aggregators.

- Apply the Formula – Multiply the two numbers.

- Compare Across Coins – Repeat for multiple cryptocurrencies to see where they stand.

- Cross-Check with Data Sites – Compare your calculation with CoinMarketCap or CoinGecko for accuracy.

Other Complementary Metrics

To get a holistic view, combine market cap with:

- Trading Volume – Shows liquidity and real activity.

- TVL (Total Value Locked) – Popular in DeFi to gauge adoption.

- Active Addresses – Reflects network usage.

- Developer Activity – A measure of ecosystem strength.

By using a combination of all the above metrics in addition to market cap, one can negate investment risks and build a diverse portfolio of leading tokens.

Conclusion

Learning how to calculate crypto market cap is a fundamental skill for anyone entering the cryptocurrency investment space.

Although the formula is simple — Price × Circulating Supply — its implications are important. Market cap helps assess the scale of a project, helps assess risk levels, and provides a common yardstick to compare coins.

However, one cannot rely on market cap as the only measure of value. It’s advisable to combine market cap with liquidity, adoption, and utility metrics for a more well-rounded analysis.

As crypto continues to evolve, knowing how to calculate crypto market cap will help you cut through the noise and focus on what matters: making informed, data-driven investment decisions.