KEYTAKEAWAYS

- Aster surpasses Hyperliquid in 24-hour perpetual volume, reaching $12B, thanks to CZ's endorsement, high-leverage innovations, and Genesis Stage 2 rewards.

- On BNB Chain, Aster's explosive growth hits 40% market share via token surge, multi-chain features, and incentive programs, outpacing DeFi rivals.

- Aster's rise in 2025 DeFi boom: Binance backing, 50x leverage tools, and ASTER airdrops drive it past Hyperliquid to lead perpetual contracts.

- KEY TAKEAWAYS

- BINANCE’S “TURBO ACCELERATION”: HOW CZ’S ENDORSEMENT IGNITES ASTER’S ROCKET ENGINE

- THE EDGE OF PRODUCT INNOVATION: HIGH LEVERAGE AND MULTI-CHAIN SETUP REMAKE TRADING

- THE MULTIPLIER EFFECT OF TOKEN LAUNCH: HOW ASTER LIGHTS THE LIQUIDITY SPARK

- THE MAGIC OF GENESIS STAGE 2 REWARDS: TRADE-AND-MINE’S SUSTAINABLE LOOP

- CHALLENGES AHEAD: ASTER’S PATH TO LAST AND DEFI’S FUTURE MIRROR

- DISCLAIMER

- WRITER’S INTRO

CONTENT

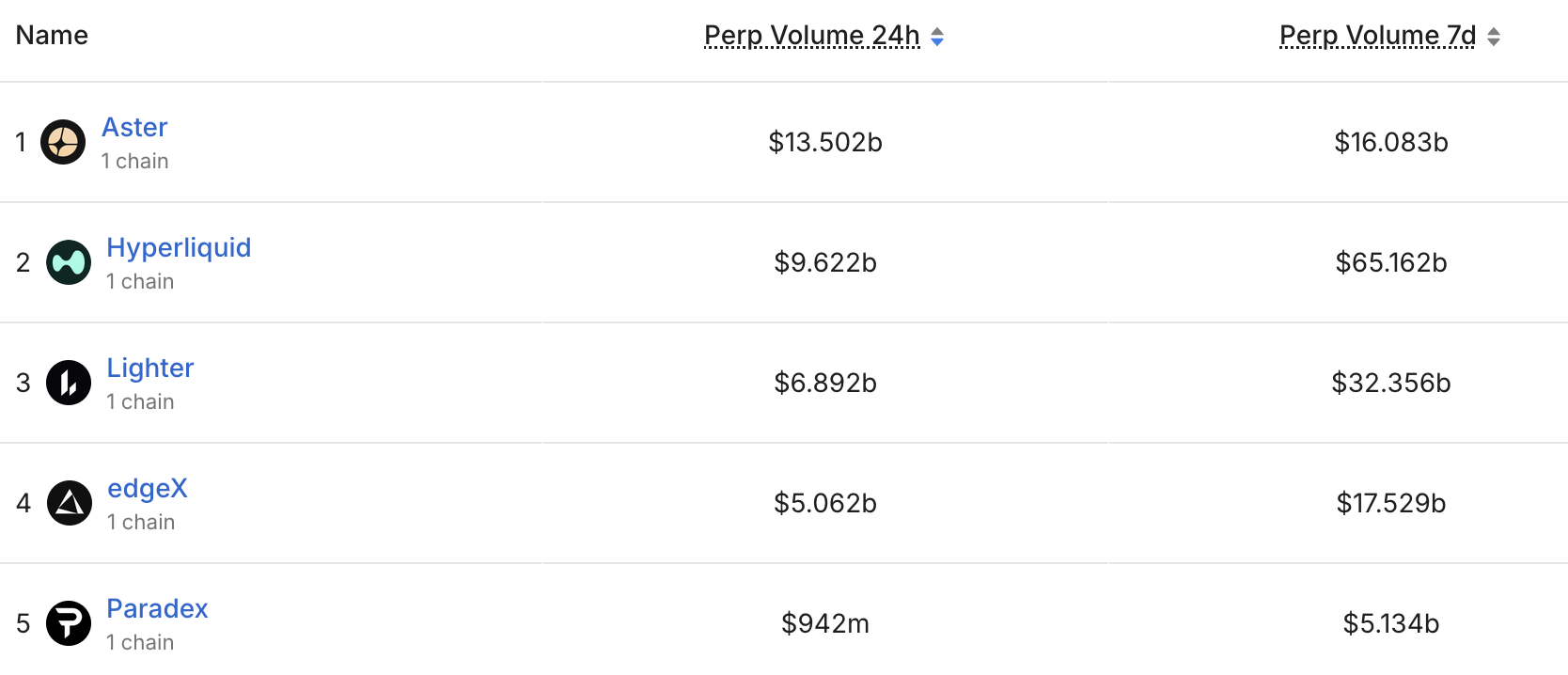

In the fast-changing world of crypto derivatives, September 23, 2025, marks a big milestone. Aster, a new decentralized perpetual contracts exchange (Perp DEX) on BNB Chain, saw its 24-hour trading volume break past 12 billion dollars for the first time. It overtook Hyperliquid, which had held the top spot for a long time.

This is not just a number shift. It is a quiet revolution in the DeFi world. Just months ago, Aster was a young project. Its TVL was only in the hundreds of millions. Now, it has handled over 500 billion dollars in trades. It serves more than 2 million users. Its market share nears 40%. In this bull market wave, Aster’s rise is no accident. It comes from a mix of Binance ecosystem support, product changes, token launch, and reward plans. Aster shines like a new star. It lights up the future of the Perp DEX field. At the same time, it warns old players.

Aster’s success story starts with its quiet launch in March 2025. At that time, the DeFi market was speeding up. Trading volume went from 647.6 billion dollars in 2024 to 1.5 trillion dollars. Perpetual contracts, as high-risk high-reward tools, drew many traders to on-chain platforms. Hyperliquid held the top seat with its fast order book and low delay. Its monthly trading volume hit 2.7 trillion dollars. But Aster came like a fresh wind.

It brought modular design and dual-mode trading (spot + contracts). It did not just copy old ways. It fit BNB Chain’s low fees and high speed. Fees are as low as 0.02%. It supports 1-50x leverage. This lets small traders join leverage games at low cost. Big players like its hidden orders and grid trading. In just six months, Aster’s TVL jumped from zero to over 1.1 billion dollars. In September, monthly trading volume grew 76% from last month. It reached 20 billion dollars. This growth comes from market boom. But it also fits DeFi users’ need for “fast + easy.” In a world full of hard protocols, Aster’s simple screen and smooth bridges let new users start quick. This drove user growth.

BINANCE’S “TURBO ACCELERATION”: HOW CZ’S ENDORSEMENT IGNITES ASTER’S ROCKET ENGINE

If Aster’s growth has one key spark, it is the public nod from Binance founder Changpeng Zhao (CZ). On September 18, 2025, CZ posted on X to praise Aster’s new ideas. This post hit like a bomb. It blew up the market right away. News spread, and ASTER token price rose 1650% in 24 hours. In one week, it climbed 400% more. Market cap went from low to 1.55 billion dollars. This is not just fame effect. It is full input from Binance resources. Aster, as a native project on BNB Chain, gets direct help from Binance’s HODLer Airdrop, Megadrop rewards, and liquidity pools. BNB Chain has over 5 million daily active users. CZ’s nod opens the door to this huge group for Aster. In days, Aster got over 200,000 new users. Funds flowed in over 1.1 billion dollars. TVL broke past 2 billion dollars.

CZ’s move is not random. As Binance’s old leader, he knows DeFi trends well. In 2025, Binance speeds up multi-chain plans. It stresses privacy and derivatives changes. Aster’s modular build fits this plan. It supports cross-chain bridges. Users move assets easy from Ethereum, Solana, or Arbitrum. This stands out from Hyperliquid’s single-chain way. More key, Binance listed ASTER/USDT perpetual contracts on September 19.

It supports 50x leverage. This boosted trading volume more. Data shows Binance’s list added over 30% of Aster’s first liquidity. Whale funds moved from Hyperliquid to Aster at billions scale. In X talks, many traders call it “CZ’s turbo acceleration.” It gives not just funds, but trust. In DeFi’s trust issues, CZ’s okay is like a gold sign. It lifts Aster from side player to center. Hyperliquid’s founder Jeff did not reply public. But its share fell from near 50% at year start to 38%. It feels the storm. Aster’s comeback shows Binance power in 2025 DeFi bull. It reminds us, on-chain projects need giant help to fly high.

THE EDGE OF PRODUCT INNOVATION: HIGH LEVERAGE AND MULTI-CHAIN SETUP REMAKE TRADING

Aster’s draw goes beyond nods. Its main strength is in product design. High-leverage perpetual contracts are always Perp DEX killers. Aster offers 1-50x and test 3x leverage products. It hits traders’ needs spot on. In 2025’s shaky market, leverage tools grow gains and risks. But Aster’s special part is risk control: built-in dynamic margin changes and AI stop-loss tips. Users keep high capital use in high leverage. Next to Hyperliquid’s pure order book, Aster’s dual-mode lets users switch spot and contracts smooth. It cuts cross-platform hassle. This shone in September’s market drop. Overall Perp DEX volume shook, but Aster drew funds from CEX with low fees and fast runs.

Multi-chain plan is Aster’s other strong card. It stays not on BNB Chain only. It uses bridge protocols to reach Ethereum and Solana. It supports 24/7 stock perpetuals and hidden orders. This makes Aster a true “all-chain DEX.” Users skip chain liquidity splits. Data shows September cross-chain trades at 35%.

Far above Hyperliquid’s 15%. Grid trading add-in hooks algo traders: set auto buy-sell ranges to catch small moves, no need all-day watch. On X, pro traders praise Aster’s “smooth feel,” better than Hyperliquid’s delays. These changes are real. They turn to numbers: Aster’s yearly income over 60 million dollars. Leverage trades give 70% fees. In Perp DEX shift from 647.6 billion in 2024 to 1.5 trillion, Aster’s plan cuts like a sword. It breaks rivals’ lines. It shows change is not add features, but fix real pains. It makes trades smarter and open to all.

THE MULTIPLIER EFFECT OF TOKEN LAUNCH: HOW ASTER LIGHTS THE LIQUIDITY SPARK

Token economy is often DeFi project’s soul. Aster’s ASTER launch is its growth “multiplier.” After TGE on September 17, 2025, ASTER price ran wild. First day up 1650%, 24-hour volume at 345 million dollars. Total supply 800 million. Over 50% goes to community rewards. This lets holders feel rule and gain from start. ASTER cuts fees (hold for 5% back). It acts as collateral for leverage trades. It ties user loyalty.

This launch’s smart part is tie to Binance. Binance list and CZ nod push ASTER to global exchanges. Liquidity swells from millions to billions. On X, traders talk “multiplier effect”: each ASTER trade stirs on-chain action. Whales buy drive price find. Small users rush for airdrop hope. In September week, ASTER cap times four to 1.55 billion dollars.

This hot money turns quick to perpetual volume. Vs Hyperliquid’s HYPE, ASTER’s FDV is one-fifth. But daily volume already beats. This uneven growth from ASTER’s use design: not just bet tool, but eco fuel. It pushes asBNB and USDF passive gain products. asBNB stakes BNB to catch eco rewards. Adds 20-50% points. USDF anchors 1:1 to USDT stable. Gives weekly auto share to holders. Result is clear: ASTER launch makes short hype and builds long liquidity wall. It lets Aster stand out in fight.

THE MAGIC OF GENESIS STAGE 2 REWARDS: TRADE-AND-MINE’S SUSTAINABLE LOOP

In Aster’s growth puzzle, Genesis Stage 2 reward plan is the “glue.” Started in September, this stage’s total pool is 4% of ASTER supply (about 400 million, worth over 700 million dollars). It rewards active traders via Rh points. Users trade perpetuals on Aster Pro. Points build auto from volume, leverage, hold time. New users trade 50,000 dollars in 7 days to unlock. Referral gives endless level back, up to 10%. Plan ends October 5. Snapshot then airdrop by October 17. Stage 3 adds spot points.

This plan’s magic is “trade-and-mine” lasting way. It skips short brush risks. Passive tools like asBNB and USDF raise capital use: hold over 1 USDF and weekly trade over 2,000 dollars for auto rewards. In September, it drew 330,000 new accounts. User base to 1.848 million. Tie to Binance eco adds more: HODLer Airdrop puts right to asBNB holders. Pushes point spread like virus. On X, traders share point stories. Community heat matches Hyperliquid. Genesis Stage 2 not just boosts short volume. It builds user keep loop. It turns Aster from flow site to eco hub.

CHALLENGES AHEAD: ASTER’S PATH TO LAST AND DEFI’S FUTURE MIRROR

Aster’s shine is bright, but tests come close. High-leverage 3x products draw eyes, but like double blade: in September shakes, some users lost big from bursts. Also, token hold focus and pump doubts from TGE rise stir X fights. Hyperliquid share down, but monthly volume still over Aster 13 times. Yearly income 1.08 billion dollars. Aster needs to show multi-chain work in Stage 3. Skip liquidity splits.

Look ahead, Aster’s way may be Perp DEX model. In 2025 DeFi total volume seen at 2 trillion dollars, its fight with Hyperliquid will push field changes. For traders, more chances. For eco, it hints golden time for on-chain derivatives. Aster’s comeback is not just number win. It is DeFi spirit reborn—change, open, never stop.