KEYTAKEAWAYS

- Meteora’s MET TGE launches on October 23, marking Solana’s largest liquidity event and a new era for DeFi participation.

- The MET token release empowers Solana’s community, enabling fair liquidity, fee sharing, and high-yield opportunities for LPs.

- Meteora’s TGE introduces innovation in dynamic liquidity, driving Solana’s DeFi growth and reshaping decentralized trading efficiency.

CONTENT

In the crypto world, the Solana ecosystem stands out for high speed and low cost. Liquidity protocols are the core of DeFi infrastructure and are entering a major shift. On October 23, 2025, the long-awaited Meteora (MET) Token Generation Event (TGE) will begin.

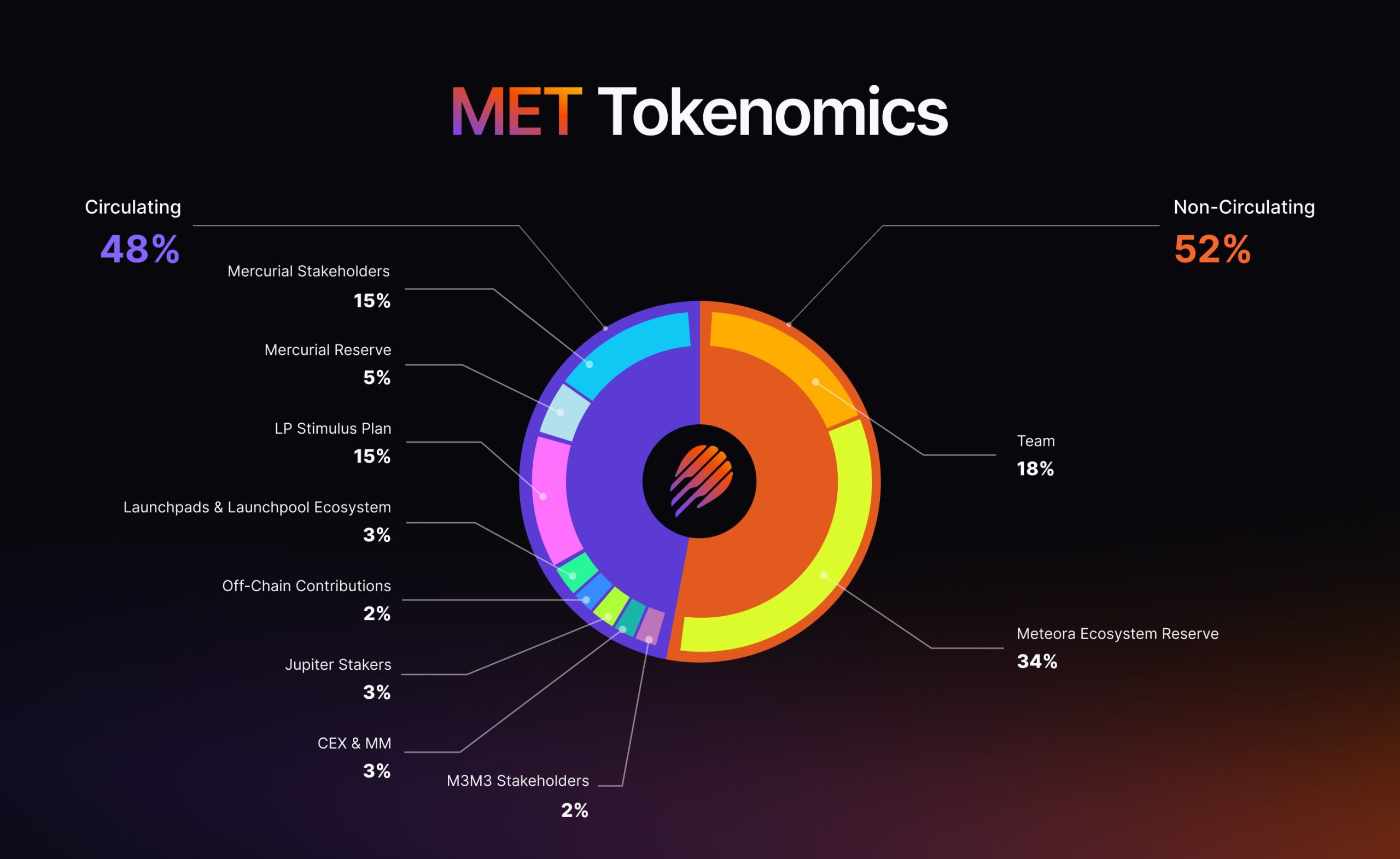

This is not only a token launch. It is the landmark “largest Liquidity Generation Event (LGE)” on Solana, called by the community “the most controversial token launch.” As a Solana liquidity leader, Meteora’s TGE will release 48% of circulating supply, about 480 million MET (total supply 1 billion). It may drive hundreds of millions of dollars in capital across the ecosystem and deliver strong returns for LPs (liquidity providers). This article explains the event and the logic and opportunities behind it.

I. METEORA OVERVIEW: SOLANA’S “LIQUIDITY ENGINE”

Meteora was founded in 2023 by veteran Solana developers. It aims to fix problems in traditional AMMs, such as high slippage, fragmented liquidity, and unfair fee distribution. Its core product is the Dynamic Liquidity Market Maker (DLMM). This is an innovative pool that adjusts the price curve with market volatility to execute trades more efficiently. Today, Meteora’s TVL exceeds $780 million.

It ranks among top Solana DeFi protocols and handles over 30% of DEX volume in the ecosystem. Imagine this: on Solana you are not only a trader but also part of the “LP Army.” With Meteora’s tools, users can create pools easily and earn dynamic fee shares. Since launch, Meteora has generated more than $1.3 billion in trading fees, of which $1.2 billion went back to users—an impressive feat in DeFi.

With deep integrations with Jupiter, Raydium, and other aggregators, Meteora’s Anti-Sniper Suite and Quote-Only Fee Collection help ensure fair launches and maximize returns. In short, Meteora is not “taking” fees. It shares the growth of the ecosystem so retail users can benefit from high-frequency trading.

II. ABC OF TGE AND LIQUIDITY PROTOCOLS

A TGE (Token Generation Event) is the start of a project’s native token issuance. It is like an ICO or IDO, but with more focus on community and fair distribution. Unlike VC-led early fundraising, a TGE often comes with airdrops and instant liquidity. The goal is for the token to trade freely on secondary markets from birth. For Meteora, this TGE uses a community-first design: 100% liquidity goes live at launch, with no lockups and no team pre-mine.

This is rare on Solana and has sparked “most controversial” debates because it breaks the usual “VC-friendly” model. MET is Meteora’s governance and utility token used for governance, incentives, and fee sharing. Holders can vote on upgrades, such as fee rules. Staking MET can unlock higher LP yields or access Liquidity Distributor NFTs, which auto-distribute fees to holders. MET holders share protocol fees, with an expected annual yield of 20%+.

Liquidity protocols like Meteora are the “highway” of DeFi. Traditional AMMs (like Uniswap) use the constant product formula (x*y=k), which causes large slippage on big trades. Meteora’s DLMM uses a binning model: liquidity is placed in price ranges, and users provide funds only in the active range, improving efficiency by 30%+. If you are new, start with Meteora’s “LP Bootcamp.” Learn to create a pool with a small amount (for example, 100 USDC) and earn a few dollars per day in passive income.

III. TGE KEY DETAILS: OCTOBER 23, ALL SET

The TGE will start on October 23 (UTC). It marks the birth of MET and the start of trading. The circulating supply will be 48%, and the rest will unlock gradually until 2026. The airdrop claim portal is live (met.meteora.ag). The claim period runs from TGE until April 23, 2026. Eligible users include LPs, traders, and community contributors. Listings are expected on Bitget, MEXC, and other exchanges, with instant spot trading support.

The opening price may be $0.5–$1, but volatility may be high. On the same day, DLMM v2 will launch to improve efficiency, along with Presale Vaults (tiered fundraising), Meteora Invent (one-click launch), and Dynamic Fee Sharing. Today (October 22) at 1 PM UTC, there is a community call hosted by core team members Zen, Soju, and Miir. They will explain MET details and announce major news before TGE. Find the link on the X account @MeteoraAG. More alpha is expected.

IV. IMPACT AND OUTLOOK

Meteora’s TGE is MET’s “graduation day” and a turning point for Solana DeFi. In a cooling market, this launch may revive liquidity and push TVL beyond $1 billion. The main debate is its “full float” design. On one hand, it empowers the community and avoids “VC dumping.” On the other hand, high float can create early price pressure. Price views differ. Some expect a short-term double. Others fear a pullback.

In the long run, MET’s “gud fee tek” should support value. Looking ahead, Meteora will keep expanding, adding more on-chain tools and cross-chain bridges, and may become Solana’s “liquidity monopolist.” For the LP Army, this is the upgrade of the money printer. Meteora TGE is a liquidity feast that will ignite Solana. If you checked eligibility, visit the site and claim the airdrop now. If you are new, start by joining the LP Army.

Risk note: volatility around TGE is high. Do not FOMO. Always DYOR. Follow @MeteoraAG for updates and beware of phishing. The team will never DM to ask for your wallet. In Web3, liquidity is power. Meteora shows that a great protocol does not take your money; it helps you earn more. See you on October 23.