KEYTAKEAWAYS

- Major news events create layered opportunities across speed, association, and awareness—each with different timing and risk profiles.

- Traders can profit beyond initial moves by identifying correlated tokens or sentiment-driven assets linked to the same headline.

- Prediction markets offer early insights into event credibility and capital flow, helping traders anticipate and validate real-time sentiment shifts.

CONTENT

Trump’s pardon of CZ triggered three layers of crypto market opportunity—from direct BNB trades to narrative-linked tokens and emerging prediction markets.

When Donald Trump announced the full pardon of Binance founder CZ (Changpeng Zhao), the crypto world instantly went into overdrive.

What appeared to be a political headline quickly turned into a case study of how fast capital moves when sentiment flips.

Within minutes, traders, whales, and retail investors were reacting — some with conviction, others chasing momentum.

Yet beneath the chaos, there was structure.

In fact, the market presented three distinct layers of opportunity that can serve as a reference for the next major breaking news event — whether bullish or bearish. These layers represent different risk levels, timing windows, and decision-making frameworks that traders can apply depending on how quickly they act and how well they interpret the news cycle.

Let’s break them down and see how they unfolded in real time.

1. THE FIRST LAYER: LONG BNB DIRECTLY

The most straightforward move was to go long on BNB.

When the news first appeared around 23:00 local time, early mentions surfaced on X (Twitter). Within just five minutes, the information had spread across the crypto community. However, CZ’s first personal post came later at 12:58, followed by official confirmations from Binance’s account and co-founder Yi He.

In that early window — before the confirmation — the news came primarily from Reuters and other Western outlets. That meant traders were operating under uncertainty, weighing the credibility of the report. But uncertainty also created opportunity.

The BNB chart showed a sharp move: the token rose from roughly $10.30 to $11.20 within an hour. Those who entered right after the Reuters headlines captured significant gains. The risk, however, was in the truth of the story — if it had proven false, a swift correction would have followed.

The first layer of opportunity is always the simplest and riskiest. Acting early often pays best, but it also tests one’s conviction and ability to manage uncertainty.

2. THE SECOND LAYER: IDENTIFY RELATED TOKENS

After the direct BNB move, the next play was to find correlated tokens — assets that might benefit from the same narrative.

This second layer requires more analysis and patience but often offers a wider time window.

The first group of related assets was meme coins tied to the Binance ecosystem or CZ’s persona. Four (Four Meme), for instance, reacted with a noticeable delay. Its chart shows a move from around 10:30 to 1:30, giving roughly a three-hour trading window — longer than BNB’s.

Next came project tokens with indirect links, such as Aster and WLFI, which is associated with Trump’s own brand and political momentum.

These tokens responded later but still reflected the broader sentiment. Aster’s reaction window lasted about an hour, while WLFI moved over two hours.

The takeaway here is that meme tokens tend to react faster and more violently, while project tokens tied to the same ecosystem or theme provide longer and more stable opportunities.

Traders who missed BNB’s first move could still profit by rotating into these secondary plays — provided they correctly identified the link and avoided over-leveraged entries.

3. THE THIRD LAYER: PREDICTION MARKETS

The final and often overlooked layer lies in prediction markets — platforms where users can bet on real-world outcomes. This is a relatively new but rapidly growing frontier in crypto.

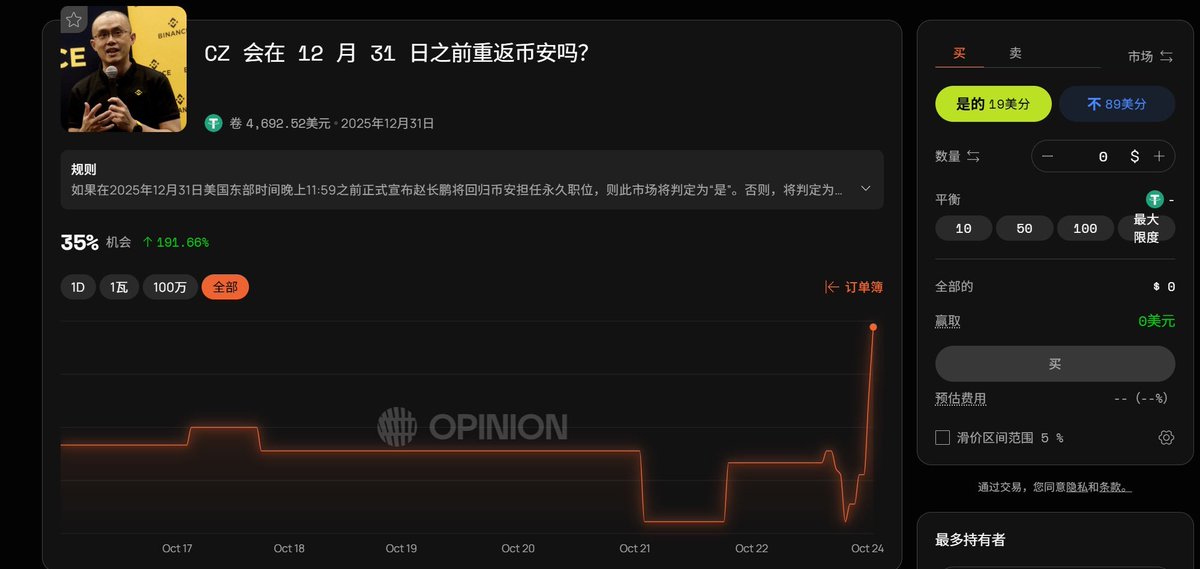

Shortly after the pardon news spread, traders noticed activity on Polymarket, a leading platform for political and event-based predictions.

As @EnHeng456 noted, this space can act both as an early indicator and as a trading opportunity in itself.

Before the pardon was confirmed, data from analysts such as @ai_9684xtpa revealed that a well-known whale, Garrett, had been accumulating positions predicting that Trump would pardon CZ — starting as early as September 28, weeks before the news broke. That’s not luck; it’s positioning based on conviction and insight.

This doesn’t mean everyone should start betting on political outcomes, but prediction markets can validate or challenge narratives in real time. When a rumor surfaces, checking Polymarket can serve as a quick sentiment barometer — if liquidity spikes on one side of a bet, informed capital may already be moving.

Beyond verification, participating in such markets can be profitable. After the CZ case, for example, markets predicting whether Sam Bankman-Fried (SBF) would be released this year also surged, reflecting how sentiment can ripple through narratives.

STRUCTURE IN CHAOS

News-driven trades may look chaotic — a mix of algorithms, influencers, and retail traders reacting simultaneously — but there is structure beneath the noise.

The first layer rewards speed and courage: trading directly on the headline before confirmation.

The second rewards reasoning and association: identifying related assets likely to benefit from the narrative spillover.

The third rewards awareness: understanding how prediction markets can reveal or amplify sentiment early.

Each layer carries its own balance of risk and reward. The earlier you act, the greater your potential return — but also the higher the uncertainty. Later layers offer more confirmation but smaller moves.

In this case, BNB’s initial spike ended before most traders noticed. Yet related tokens and prediction markets continued to move for hours, offering entry points for those who understood the structure.

FINAL THOUGHTS

Trump’s pardon of CZ was more than a political act; it was a vivid demonstration of how modern crypto markets digest and react to information. The speed of data transmission, the interplay between on-chain and off-chain activity, and the reflexive behavior of sentiment all prove that opportunity in crypto is multi-layered.

The next time breaking news hits — whether it’s an arrest, a regulatory move, or a surprise partnership — think in layers.

Ask yourself: What’s the direct exposure? What’s the narrative spillover? What’s the meta opportunity?

Because by the time a story reaches the headlines, smart money has already moved. But for those who see the rhythm beneath the noise, opportunity remains — not by guessing, but by structuring chaos into strategy.