KEYTAKEAWAYS

- The Solana Shenzhen event’s sudden halt stemmed from overcrowding, not regulatory tightening, reflecting public enthusiasm far beyond expectations.

- Solana’s strong rally—up 15% with over $11B TVL—shows confidence and resilience despite mainland uncertainty and global regulatory scrutiny.

- The incident reveals China’s paradox: strict control on tokens but unstoppable curiosity for blockchain innovation and decentralized technology.

CONTENT

The Solana Shenzhen event’s shutdown revealed China’s deep crypto paradox—strict regulation meets rising public demand—while SOL’s strong market rally shows unstoppable global momentum.

A SCENE THAT SHOCKED THE COMMUNITY

Yesterday, the Solana Accelerate APAC Shenzhen event—part of a broader Asia tour following Shanghai and Hangzhou—came to an unexpected halt midway through its schedule.

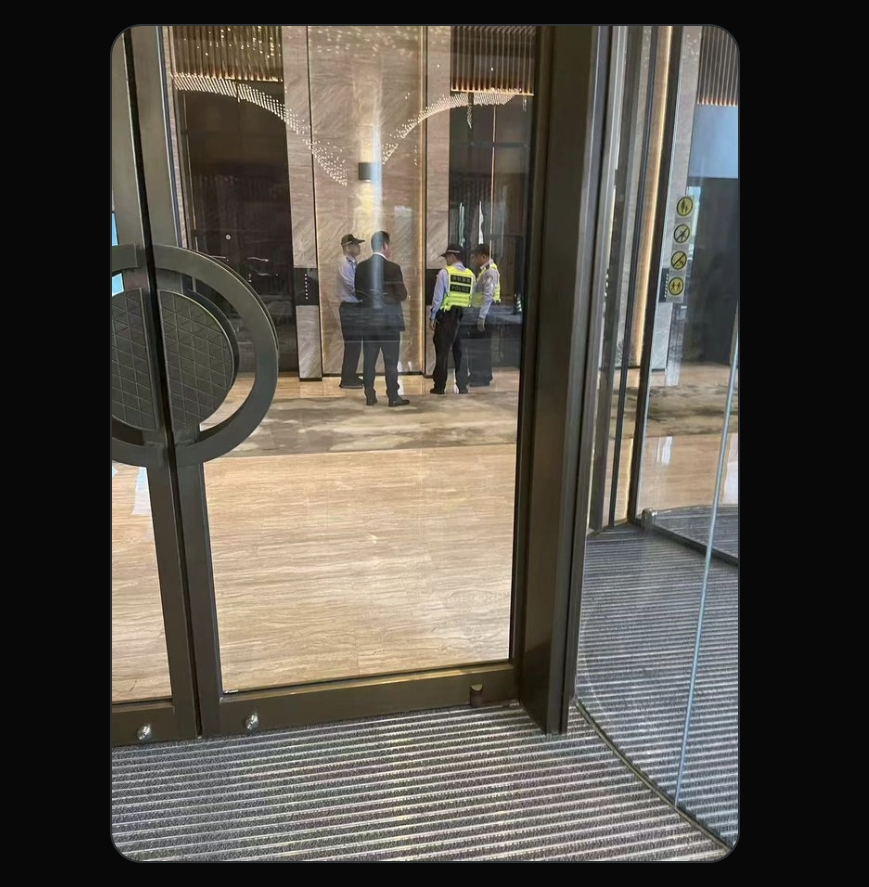

Police entered the venue and asked organizers to suspend the remaining sessions, including the hackathon demo.

Almost instantly, the news spread across crypto WeChat groups and X.

Many feared the worst: “Is this a signal that mainland China is tightening control again?” or “If even Solana can’t hold an event, who else dares to try?” The initial interpretation was predictable—linking the incident to Beijing’s long-standing skepticism toward crypto assets.

But as more details surfaced, the reality turned out to be much simpler—and perhaps more revealing.

NOT REGULATION—JUST OVERCAPACITY

Multiple attendees later confirmed that the shutdown had little to do with a new regulatory campaign.

Instead, the venue was overwhelmed by attendance far beyond capacity. People who couldn’t get in reportedly grew frustrated and filed complaints, prompting local authorities to assess safety risks.

As lawyer Honglin Liu, who attended Solana’s earlier Shanghai event, later explained, the Solana Foundation had followed unusually strict compliance protocols: no token discussions, no price speculation, and no policy comparisons. The focus was purely on technology, infrastructure, and open finance—hardly the kind of content that would trigger official scrutiny.

From that perspective, the Shenzhen suspension wasn’t a story of repression; it was a story of enthusiasm surpassing expectations. And that’s precisely what makes it remarkable.

WHAT THE CROWD REALLY SHOWED

The fact that so many people showed up, in a city where crypto remains technically off-limits, reveals something regulators can’t easily measure: demand.

No matter how strict the policy lines are drawn, interest in digital assets and decentralized technology hasn’t faded. Developers, investors, and curious newcomers are still eager to learn, build, and connect. The packed venue wasn’t a sign of defiance—it was a sign of curiosity and commitment.

In China, where blockchain is promoted as a strategic technology but tokens are treated as taboo, this contradiction defines the industry’s daily reality. The Shenzhen incident simply made that contradiction visible in real time.

MEANWHILE, SOLANA IS SURGING

Ironically, while the offline event was being cleared, Solana (SOL) was performing extraordinarily well online.

Over the past week, SOL climbed from around $158 to $182, posting a robust 15% gain—one of the strongest among major layer-1 tokens. Trading volume surged past $25 billion on centralized exchanges, while Solana’s total value locked exceeded $11 billion, its highest level since 2022.

On-chain data paints an even clearer picture: daily active wallets surpassed 1.2 million, and the memecoin ecosystem—led by BONK, WIF, and POPCAT—kept transaction counts near record highs. Despite mainland uncertainty, Solana’s network activity and developer momentum continue to accelerate globally.

This decoupling between regulatory noise and market performance underscores an essential truth: innovation and demand don’t move in sync with policy cycles.

A REFLECTION ON CHINA’S POLICY PARADOX

China’s stance toward blockchain has always been paradoxical: enthusiastic about the technology, cautious about the tokens that drive it. On paper, the government supports blockchain innovation and digital economy initiatives. Yet in practice, any event touching digital assets operates under unwritten constraints.

The Shenzhen episode, therefore, isn’t a setback—it’s a mirror. It reflects both the vitality of China’s developer community and the fragility of its regulatory comfort zone. The enthusiasm that filled the Solana hall suggests that curiosity has already outgrown control.

Strict regulation may protect against short-term risks, but it also limits long-term potential. The country that once led in fintech adoption now faces the challenge of reconciling innovation with supervision. That requires not tighter walls, but smarter frameworks.

WHERE LUI’S VIEW FITS IN

As Honglin Liu noted in his post-event reflection, this wasn’t a ban, but a lesson in execution. He praised Solana’s organizers for their strong compliance practices—focusing on technology, avoiding speculation, and respecting diverse regulations.

His takeaway—that blockchain events in China can still thrive if they navigate boundaries with professionalism—aligns with what many insiders quietly believe. The goal isn’t to avoid attention, but to understand the limits and work intelligently within them.

THE BIGGER PICTURE

While some view the Shenzhen suspension as a warning, I see it as proof of something deeper: the crypto conversation in China is alive and unstoppable. The energy that filled that venue won’t disappear because of one police visit. It will resurface online, in developer circles, in cross-border collaborations—and eventually, when the time is right, back on stage.

Solana’s surge over the past week embodies this spirit perfectly. The market isn’t just reacting to hype; it’s responding to real ecosystem progress—from Jupiter’s decentralized trading growth to rising liquid staking and AI integrations. Every on-chain metric tells the same story: while some doors close, new ones open elsewhere.

CONCLUSION

The Solana Shenzhen incident began as a rumor of repression but ended as a reminder of resilience.

It showed that even under tight supervision, people’s interest in crypto and decentralized technology remains unwavering.

Yes, China’s policy framework is still cautious. But the overflowing crowd in Shenzhen proved that demand cannot be legislated away. Regulation may shape behavior, but it cannot extinguish curiosity—and curiosity is what fuels innovation.

In the end, this wasn’t a story about Solana being stopped; it was a story about Solana being unstoppable. The chain’s price, performance, and community all point to the same conclusion: crypto in China isn’t dying—it’s waiting for permission to breathe again.