KEYTAKEAWAYS

-

Traditional markets outperform crypto: gold surges over 50% and equities hit record highs, while Bitcoin rises only ~17%, challenging crypto’s role as a superior asset.

-

Liquidity gaps widen: global stock markets attract massive inflows, but crypto capital remains limited and fragmented, making the industry look increasingly small and fragile.

-

Innovation slows and narratives fade: unlike the booming AI sector, crypto narratives struggle to sustain momentum, leaving insiders as the main profit-takers in a stagnating market.

- KEY TAKEAWAYS

- External Crisis in the Crypto Market: Better-Performing Assets Speak for Themselves

- Internal Concerns in the Crypto Market: Time Becomes the Only Test for Projects

- In conclusion: Cherish the retail investors still in the market; they might just be the engine of the next bull market.

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Crypto markets face shrinking liquidity, weak innovation, and fading hype as traditional assets surge — raising doubts about whether the bull cycle has already passed.

Last night, the Federal Reserve finally cut interest rates by 25 basis points as expected. More importantly, it also announced that it will end its balance sheet reduction on December 1.

Following the news, the cryptocurrency market did not rise as expected; instead, it fluctuated slightly downwards. (See also: “ BTC Falls Below $110,000: Where Did Market Confidence Go? “)

In contrast, US stocks experienced a sharp rise, with Nvidia, which had just boosted investor confidence at the GTC fall conference, surpassing a market capitalization of $5 trillion , setting a new global record. Combined with the previous news that “the Shanghai Composite Index has returned to 4,000 points after 10 years,” it’s no wonder that some people exclaimed: “Brothers, we can’t hold on any longer. Let’s go play US stocks, Hong Kong stocks, and A-shares.”

Looking at the current market situation, our most direct feeling is: if things continue like this, very few people will trade cryptocurrencies anymore. It’s no exaggeration to say that the crypto market is facing a new round of “industry crisis.” The biggest difference between this crisis and previous ones is that it’s caught between internal and external troubles —the industry is lacking innovation, sector bubbles are rotating rapidly, large funds are taking over the pricing power of mainstream coins, the strategies and experience accumulated by ordinary people are becoming ineffective, veteran investors are losing interest, and a world where “only insiders make huge profits” has been achieved. Compared to external markets (gold, Japanese and Korean stock markets, Nasdaq, etc.) that are almost universally hitting new highs, cryptocurrencies, which have always touted their wealth effect and attracted newcomers, are completely ignoring it. Data shows that institutional net inflows have stagnated, and DAT and ETFs have lost their luster.

If the crypto market truly needs to weather the storms together, it needs massive amounts of capital, greater attention, and liquidity .

External Crisis in the Crypto Market: Better-Performing Assets Speak for Themselves

The first major disappointment in the crypto market is perhaps most directly reflected in its lagging asset price increases compared to gold.

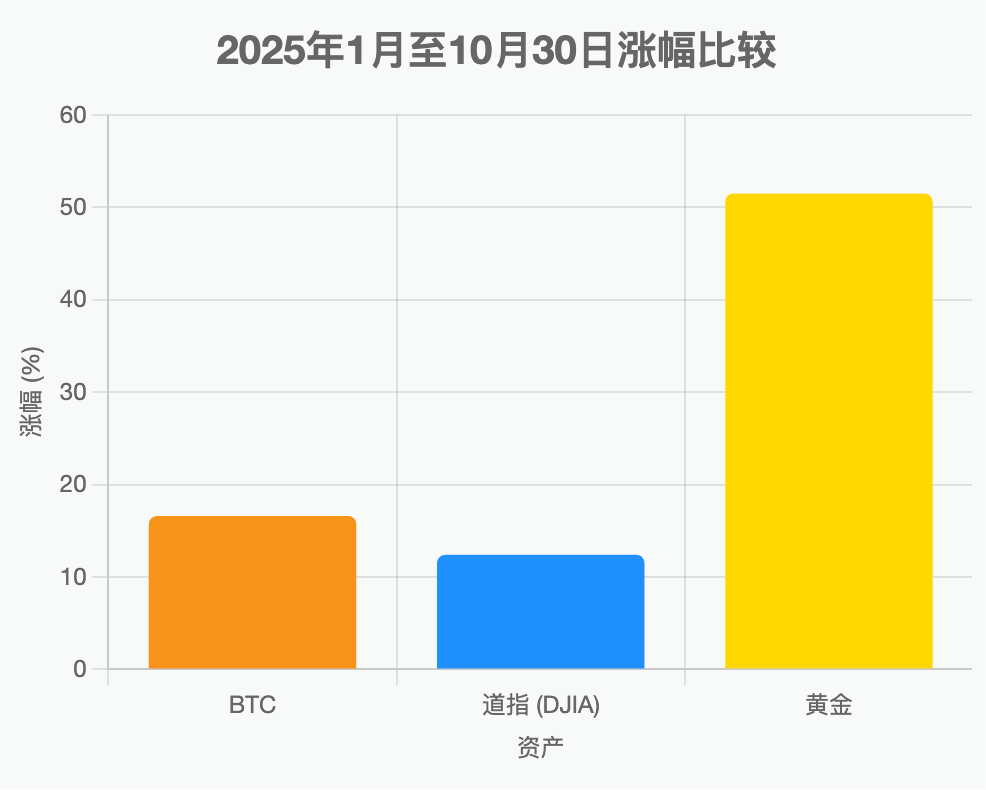

BTC’s annual gains slightly outperformed the Dow Jones Industrial Average, but were far behind gold’s performance.

As we can clearly see from the comparison chart below, gold’s over 50% increase is more impressive than BTC’s current increase of approximately 17%. In contrast, although the Dow Jones Industrial Average’s increase is less than BTC’s, it reached 48,000 points last night, setting a new record high. Compared to BTC’s decline from over $125,000 to its current price of around $111,000, gold has undoubtedly performed better.

Compared to the more widely accepted gold, BTC’s safe-haven properties, high risk, and high volatility have been questioned more. After all, whenever macroeconomic or global/regional crises occur, BTC has not seen a frenzy of buying; many people view it as an asset class in the US stock market that “will only follow the decline.”

Chart showing the annual gains of BTC, Dow Jones Industrial Average, and Gold (as of October 30)

A summary of the Dow Jones Industrial Average’s annual gains

Market size limitations and liquidity shortages

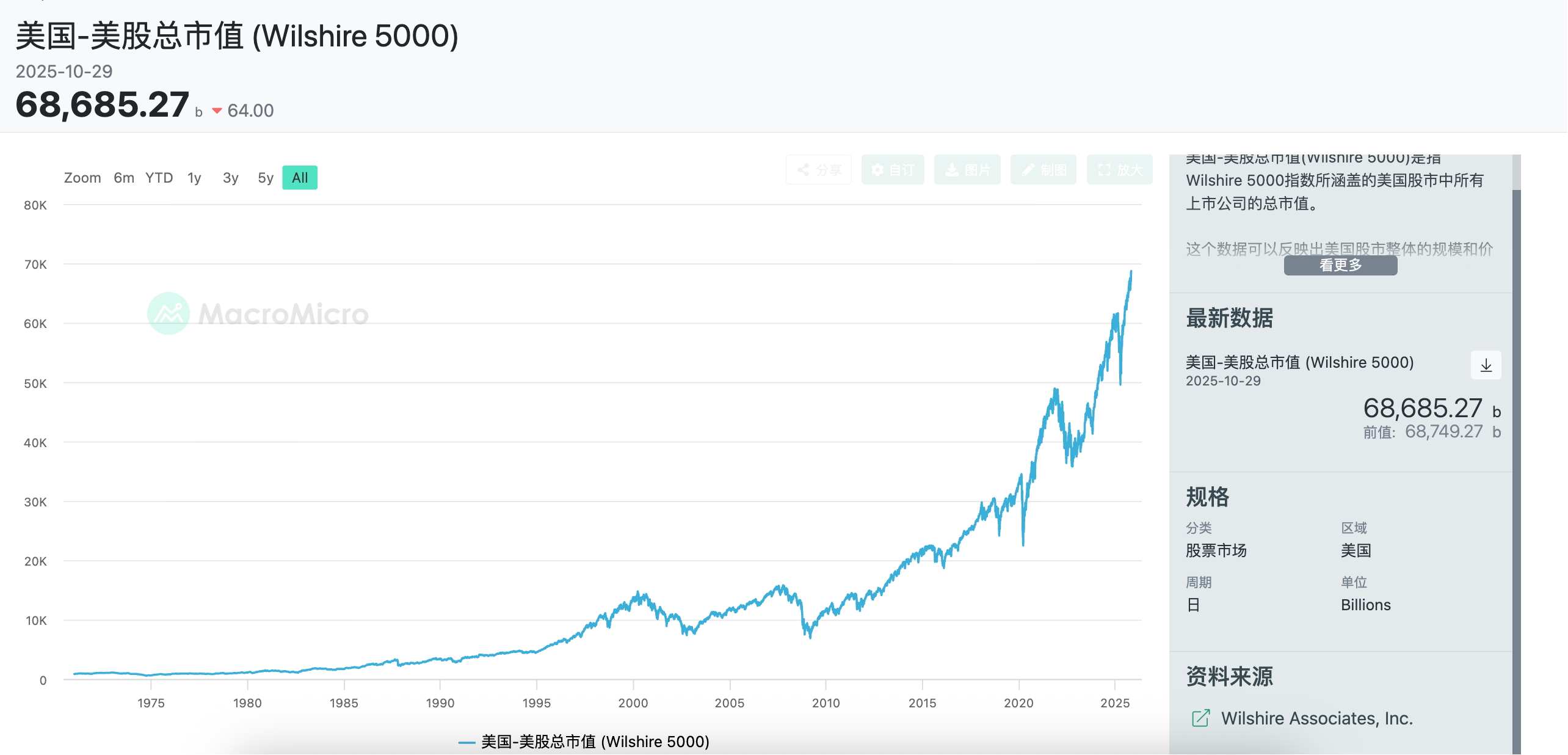

In addition, compared to the US stock market with a total market capitalization of nearly $70 trillion , the crypto market, with a total market capitalization of only $3 to $4 trillion, has become a rather lackluster “small cake”—after nearly 17 years of development, the total market capitalization of cryptocurrencies is still less than 10% of the US stock market; its share in the global economic system is even more pitiful.

The total market capitalization of US stocks is nearly $70 trillion.

If the above figures seem too macro-level, let’s use a more easily understood analogy: Take Nvidia’s revenue performance as an example. At the recently concluded Nvidia GTC conference, Jensen Huang stated that Blackwell and the Rubin chip, launching next year, are expected to generate a combined $500 billion in GPU sales over five quarters. This alone exceeds the current market capitalization of Ethereum (ETH). To put it simply, Nvidia’s annual revenue from this single business is equivalent to, and even surpasses, the market capitalization Ethereum accumulated over 10 years .

If we take retail investor data out of the box, in the first half of 2025 alone, Nasdaq individual investors traded a staggering $6.6 trillion ; in comparison, the liquidity of the cryptocurrency market is like a depression in the ocean.

Driven by mainstream market narratives, the crypto community has stagnated.

In addition to the data and market factors mentioned above, a lack of narrative is another problem facing the crypto market today.

Compared to the booming development of cutting-edge technologies, especially in the field of AI, many projects and their narratives in the crypto industry still lag behind.

Compared to AI companies that have launched numerous AI models this year, such as Claude Code, GPT5, Deepseek V3.1, and Qwen3 MAX, “crypto x AI projects” that are still in the paper or token stage are far less active than at this time last year. Market attention and investors are fragmented by DAT treasury, exchange mechanisms, and Meme coins, making it difficult to form a strong industry-level consensus.

Internal Concerns in the Crypto Market: Time Becomes the Only Test for Projects

Following the narrative, the various internal problems of the crypto market are also fully revealed.

The “October 11th crash” wiped out the last bit of liquidity from the cryptocurrency market.

The current cooling of cryptocurrency market trading and project development is most directly caused by the industry-wide crash on October 11.

Multiple sources have confirmed that the scale of liquidation in this industry-wide crash is at least in the range of 30-40 billion US dollars, which is equivalent to a reduction of about 1% in the overall size of the cryptocurrency market in one day; according to statistics from Coinglass alone, more than 1.6 million people have been liquidated; countless people have watched their accounts go to zero and bid farewell forever to the crypto market, a high-risk area that is prone to rapid decline and decay.

It can be said that the “October 11 crash” further exacerbated the already scarce liquidity in the crypto market.

As a result, it will be difficult for new funds to enter the crypto market in the short term.

Crypto market trends rotate, but usually last no more than a week.

The fragmentation of market hotspots is another major manifestation of internal problems.

Just a couple of days ago, the market was speculating about the “two saints’ intentions” and playing with Chinese memes; these past two days, x402 has already started to revive old ideas, attracting widespread attention online; and with the market fluctuating up and down, saving money and investing seems to have become the only option for many people.

Market trends are dazzling and tear attention apart like scraps of paper, making it impossible to piece together a complete picture of the market.

Trump’s series of TACO-related stunts have ruined the crypto market.

Another internal problem plaguing the crypto market is the various TACO (Trump-style backing down) dramas that have emerged since Trump took office.

From the tariff trade war that began in April to the subsequent postponement of high tariff policies by various countries; from the slightly tense Sino-US situation to the current meeting between the two heads of state, Trump always makes tough statements first, causing the market to tremble and fall across the board; then a dramatic turn of events occurs, pulling the financial market and the crypto market out of the abyss and ushering in a wave of inexplicable but real rise.

The ongoing volatility in the crypto market since BTC broke new highs is undoubtedly related to Trump and his family and faction, who are highly active in the crypto market and have a huge influence on it.

In short, if you’re not in the “insider” circle, you’re just a cash machine for the “insider” circle.

Image source: Odaily Planet Daily reader group – A10 Supercar Club

With investment projects booming, the crypto community has become a “piggy bank.”

On the one hand, the depletion of industry narratives has led many crypto projects into involutionary competition and severe homogenization; on the other hand, more and more projects are starting to operate in the form of “financial management projects,” backed by major well-known investment institutions or with a glamorous background and ecosystem support, becoming one of the few focal points in the market.

Previous events such as Circle’s nearly 10-fold increase upon listing, the stablecoin issuance boom, and Plasma’s (XPL) lucrative airdrops have led many to believe, with little other choice, that they can only exchange liquid funds for economic returns.

The cryptocurrency market is no longer the testing ground for technology and innovation it once was; instead, it increasingly resembles a giant “piggy bank.” This morning, news broke that MegaETH, a flagship project in the Ethereum ecosystem, has raised $1 billion in its public sale (actually limited to $50 million), representing an oversubscription of 20 times.

In such a market environment, even the initial deposit quota of a top-tier project like Stable was filled by insider trading (further reading: “ Stable’s first round of $825 million in pre-deposits sold out in seconds, releasing $700 million before tweeting? “) . It’s no wonder that many people are lamenting that “there’s not enough money” while painfully shouting that “this market is truly hellishly difficult.”

In conclusion: Cherish the retail investors still in the market; they might just be the engine of the next bull market.

Finally, from the perspective of a “crypto newbie,” I want to say to the many crypto projects and trading platforms: cherish the newbies who are still in the game. In the future, as the penetration rate of cryptocurrencies increases, we will be among the few liquidity providers who have survived multiple industry tests and remain at the table.

Of course, I would prefer that the next bull market be supported by projects that have been in business for many years and have real value. Now, I can still count on you guys, right?