KEYTAKEAWAYS

- BNB forms a closed-loop digital economy where chain, liquidity, social, storage, and wallet rails reinforce each other, creating structural demand and user retention.

BTC serves as digital gold, ETH as programmable infrastructure, while BNB emerges as the coordinated execution layer with the strongest ecosystem cohesion and growth flywheel.

BNB’s integrated architecture accelerates value compounding, yet also transmits shocks faster. High structural upside paired with high reflexivity defines its investment profile.

- KEY TAKEAWAYS

- BNB: SUPPLY STRUCTURE, DEMAND PATHWAYS, AND DEFENSIVE DESIGN

- BNB CHAIN: HIGH-ENGAGEMENT EXECUTION ENVIRONMENT

- THE LIQUIDITY TRIANGLE: CEX → WALLET → DEX

- LAYERED ADOPTION: FINANCE, SOCIAL, STORAGE, AND EDUCATION

- STRATEGIC CAPITAL & BUILDER INFRASTRUCTURE

- THE EMERGING PATTERN

- CLOSING FRAMEWORK: BTC, ETH AND BNB IN THE SAME MAP

- A REALITY WORTH NOTING: SYMMETRY OF STRENGTH AND RISK

- DISCLAIMER

- WRITER’S INTRO

CONTENT

A deep dive into BNB’s ecosystem flywheel, its synergy across chain, liquidity, and applications, and why BNB stands beside BTC and ETH in long-term growth potential.

When YZi Labs released its latest analytical report on BNB, the conversation around this asset—and more importantly, the ecosystem behind it—shifted significantly.

The report framed BNB not as a token tied to a single platform, but as an increasingly independent, deflationary, and multi-sector economic engine supporting one of the most active blockchain networks in the world.

According to the analysis, BNB’s model—full circulating supply, ongoing burn mechanics, broad utility, and deep ecosystem participation—positions it differently from assets whose value relies primarily on narrative momentum.

Instead, BNB’s trajectory appears anchored in measurable usage, liquidity depth, and expanding product pathways across both CeFi and DeFi.

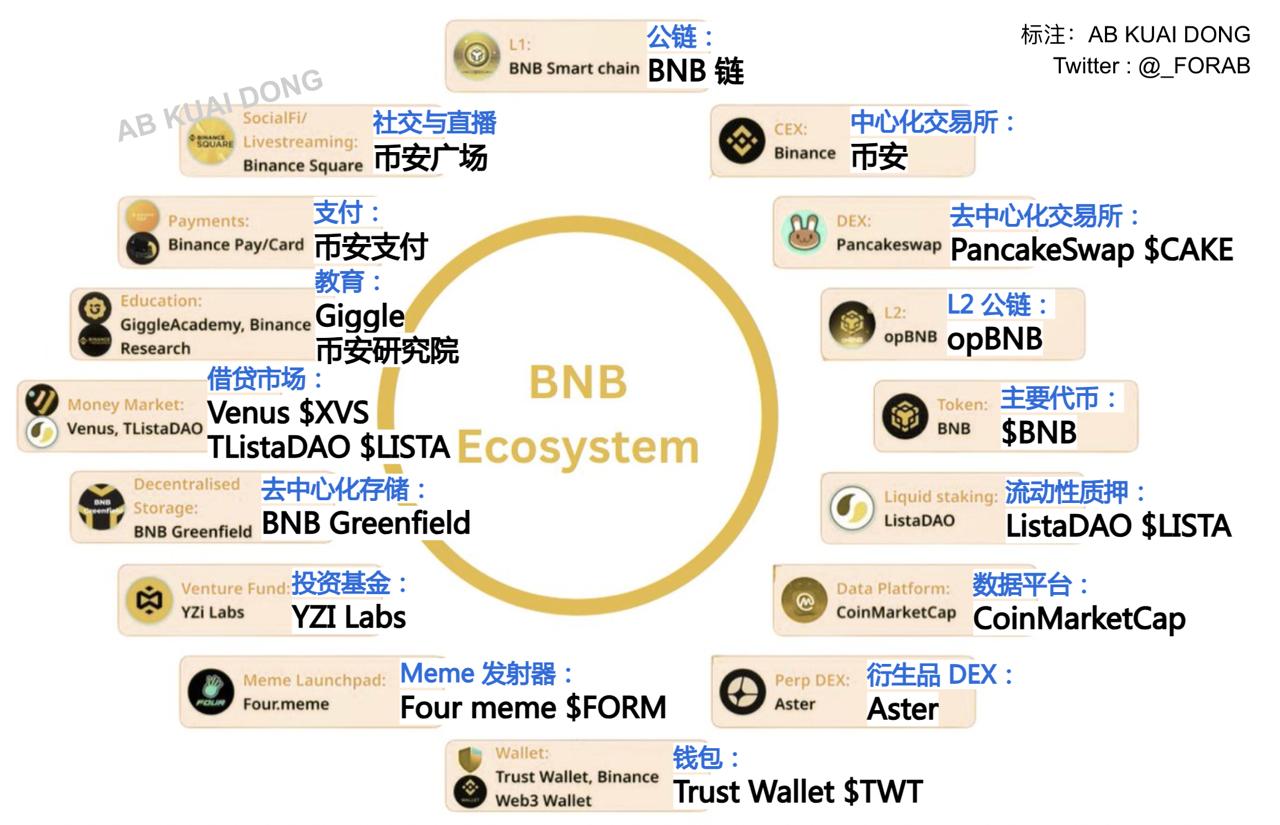

However, what deserves deeper attention—and what often remains under-examined—is the highly coordinated nature of the BNB ecosystem.

It is not simply a network of isolated applications; it is a linked economic system, where each component reinforces others and value circulates internally before exiting externally.

This is the part the market is only beginning to fully price in.

BNB: SUPPLY STRUCTURE, DEMAND PATHWAYS, AND DEFENSIVE DESIGN

BNB maintains a capped supply framework and follows a systematic burn schedule, progressively reducing the circulating quantity. Public reporting and chain data indicate that a substantial share of supply has already been removed over time, strengthening long-term scarcity dynamics.

More importantly, BNB’s supply is already fully in circulation—minimizing dilution fears that increasingly weigh on other ecosystems. This alone reshapes the asset’s risk profile, particularly for institutional allocators evaluating longevity, unlock mechanics, and monetary transparency.

Demand flows remain diversified—transaction fees, staking, governance, participation programs, and network utility across multiple product layers. Rather than relying on a single driver, BNB accumulates value through repeated on-chain interaction and recurring ecosystem loops.

BNB CHAIN: HIGH-ENGAGEMENT EXECUTION ENVIRONMENT

Public network data continues to show high transaction throughput and sustained active participation. Across BNB Smart Chain and opBNB, the network supports millions of weekly active addresses spanning trading, liquidity, gaming, NFT activity, and social engagement.

While exact volumes fluctuate with broader market conditions, BNB Chain remains consistently among the most actively used smart-contract networks globally, both in raw users and DeFi participation counts.

Beyond scale, the distinctive element is integration. Each on-chain rail feeds the next:

- BNB Chain executes activity

- opBNB provides throughput for cost-sensitive and social workloads

- BNB Greenfield introduces decentralized data rails for media & application storage

- Trust Wallet captures users entering from CeFi or self-custody

Instead of parallel silos, these layers function as a coordinated operating stack.

THE LIQUIDITY TRIANGLE: CEX → WALLET → DEX

A primary reason BNB retains network gravity is the fluid movement between platforms.

- Users enter through Binance

- Move to Trust Wallet for ownership

- Engage on PancakeSwap and other on-chain venues

- Recycle capital into staking, lending, or liquidity pools via Venus and ListaDAO

This forms a circular economy, where capital rarely leaves the BNB orbit once converted. Liquidity is not only sourced externally; it is retained, recycled, and re-leveraged.

This alignment reduces fragmentation and reinforces BNB’s role as the “base currency” of its network economy.

LAYERED ADOPTION: FINANCE, SOCIAL, STORAGE, AND EDUCATION

The BNB ecosystem is neither purely financial nor purely consumer-social—it blends infrastructure with culture and knowledge:

- PancakeSwap anchors on-chain markets

- Venus & ListaDAO extend credit and stablecoin participation

- Binance Square creates a social & content hub linked to commerce

- GiggleAcademy & research initiatives build long-term talent & awareness

- CoinMarketCap remains a global discovery funnel touching nearly every new crypto participant

- Four.meme and emerging creator rails demonstrate cultural velocity and memetic on-ramps

This cross-stack interaction produces a network where capital, culture, and infrastructure reinforce each other.

STRATEGIC CAPITAL & BUILDER INFRASTRUCTURE

Growth does not happen organically without financing channels.

YZi Labs and ecosystem-aligned venture initiatives play a strategic role — supporting builders, incubating products, and accelerating adoption.

Unlike networks where capital inflow depends heavily on external VC rotation, BNB increasingly shows signs of internal capital recycling, where what is built, funded, and launched stays within the network and enriches the base layer.

THE EMERGING PATTERN

There is a visible pattern—one seen in strong digital economies, not speculative clusters:

- The chain gains users

- Users need liquidity → DEX and lending gain activity

- Activity produces applications → wallets and social platforms amplify conversion

- Storage + L2 layers scale demand → education and culture onboard the next cycle

- All activity continually routes back to BNB as settlement value

This is not narrative-driven growth; this is economic flywheel behavior.

And crucially, it is measurable.

CLOSING FRAMEWORK: BTC, ETH AND BNB IN THE SAME MAP

In the broad architecture of crypto, each major asset has evolved into a distinct pillar with its own narrative, utility, and monetary logic.

Bitcoin remains digital gold — the purest monetary asset in the space, engineered for preservation of value and long-term certainty. Its strength lies in simplicity: a fixed supply, impeccable settlement finality, and unmatched credibility. BTC does not promise programmability; it offers monetary sovereignty.

Ethereum has become the fertile soil of smart-contract innovation — the most compatible, deeply integrated, and permissionless development substrate in Web3. It is not merely a chain, but a marketplace for computation and programmable trust. ETH captures value through settlement, security and fee markets, enabling an open-ended innovation frontier.

BNB now represents the third strategic archetype — not a passive monetary reserve like BTC, and not a primarily open-innovation soil like ETH, but a coordinated, operating-system-style ecosystem asset. Its value grows through self-reinforcing product flywheels, where trading, liquidity, storage, social, and education layers feed each other and compound demand.

It is the clearest example of a closed-loop crypto economy building inside the industry, where product synergy is a moat, user retention is structural, and capital circulates internally before exiting externally.

And because this system is now visibly functioning, BNB stands — increasingly credibly — as the asset with the largest incremental upside potential after BTC and ETH.

A REALITY WORTH NOTING: SYMMETRY OF STRENGTH AND RISK

Yet, strength and risk are symmetrical.

A tightly connected ecosystem can create powerful growth loops, but also faster transmission of stress when pressure arrives.

When value circulates efficiently, gains compound.

But when external shocks occur, the same interconnected rails can accelerate volatility.

BNB’s moat is ecosystem cohesion —and that same cohesion means the feedback cycle — good or bad — moves quickly.

This does not diminish the thesis. It simply clarifies the profile:

Higher structural momentum.

Higher structural reflexivity.

Investors, builders, and institutions evaluating BNB must therefore consider not just upside, but speed — in both directions.