KEYTAKEAWAYS

-

Ostium shifts the RWA narrative from tokenization to onchain perpetual exposure creating a transparent alternative to the multi trillion dollar CFD industry.

-

Its dual oracle system and shared liquidity architecture introduce institutional level risk controls enabling accurate pricing and sustainable liquidity across global macro assets.

-

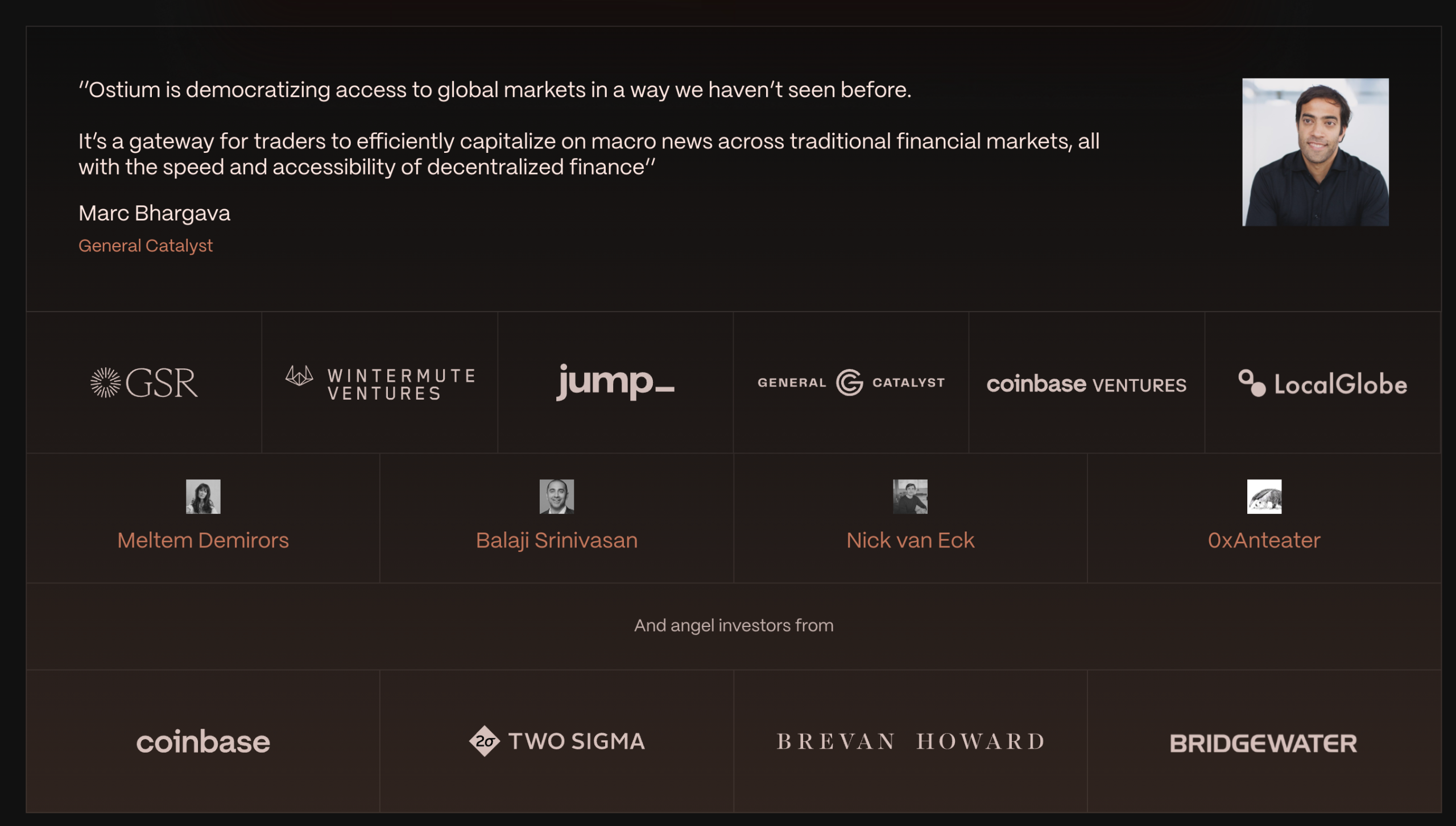

Backed by Jump Crypto General Catalyst and top market makers Ostium positions itself as the first serious infrastructure for onchain global markets and a potential challenger to traditional brokers.

CONTENT

THE SHIFT FROM TOKENIZATION TO PERPETUAL EXPOSURE

For years most of the attention in the RWA narrative focused on tokenization. Industry builders spent their time turning treasury bills credit portfolios or real estate into onchain assets. This brought value to settlement and yield but did not unlock the deeper demand that drives global trading activity. Tokenized assets are slow and often restricted by compliance checks. They are useful for capital storage not speculation. The largest markets in the world run on leverage and short term exposure not on ownership.

This is the gap that Ostium tries to fill. The team starts with a simple idea. The next phase of RWA will not be about wrapping assets. It will be about offering direct price exposure for global macro markets through onchain perpetual contracts. The traditional CFD industry processes trillions of dollars every month. Yet it is known for opaque pricing wide spreads and dealers who profit from client losses. Retail traders continue to use these platforms because they want leverage on gold crude foreign exchange and index movements. They do not care about asset custody. They care about execution.

Ostium enters this environment with a proposal that feels inevitable in hindsight. A transparent non custodial and auditable system that lets users trade global markets with the reliability of smart contracts. No dealer book. No silent price widening. No arbitrary liquidations. The protocol positions itself not as a DeFi experiment but as a structural upgrade to a giant yet fragile industry. This is why its early supporters come from both crypto native firms and traditional market makers. They see a model that mirrors real world trading behaviour while avoiding the flaws that created decades of conflict between brokers and clients.

The more one looks at the current state of global finance the clearer this transition becomes. High inflation broken correlations and unstable foreign exchange cycles push investors to search for tools that hedge risk without reentering the banking system. DeFi has never been able to serve these needs. Ostium breaks that limitation by giving traders a direct path to major global markets. Its products become a bridge between two financial realities. One is twenty four hours open and permissionless. The other is regulated slow and filled with friction. The protocol sits in the middle and gives each side what they lack.

A NEW ARCHITECTURE FOR RWA MARKETS

The most distinctive part of Ostium is not its asset list or its interface. It is the structure beneath the surface. Most perpetual DEXs try to mimic the behaviour of centralized exchanges. Ostium does not follow that path. It builds a system that respects how traditional markets move and how risk flows through a portfolio. This is visible in every design choice.

The shared liquidity layer is the foundation. It separates short term market noise from long term liquidity. A liquidity buffer absorbs daily profit and loss. Behind it sits the OLP vault which carries deeper risk and receives a meaningful share of protocol revenue. This structure aligns interests instead of putting traders and liquidity providers against each other. It fixes a weakness that hurt many early DeFi derivatives projects. Liquidity providers no longer fear profitable traders because the system distributes shock in a controlled way. The result is a healthier market and a more stable liquidity base.

The second breakthrough is the dual oracle design. RWA assets do not trade nonstop. They close on weekends and holidays. They gap when news breaks. A normal crypto oracle cannot handle these conditions. Ostium solves this by building a custom pull based oracle for RWA assets while using Chainlink Data Streams for crypto markets. The RWA oracle respects trading hour logic. It pauses when markets close and handles price gaps at open. It avoids the dangerous scenario where traders can attack stale prices on weekends. This gives the protocol a realistic microstructure that mirrors traditional exchanges without copying their custodial model.

Then comes the imbalance score. This is a mathematical engine that calculates how much risk the system takes with every new position. It looks at volatility correlation and long short imbalance. If an order increases risk it pays a higher fee. If it reduces risk it pays less. This dynamic pricing mechanism creates a portfolio that moves toward balance instead of drifting into dangerous concentration. Few DEXs attempt this level of risk modelling. Ostium does it because its asset list requires it. Someone trading gold is not the same as someone trading a memecoin. Someone trading USDJPY needs different fee logic than someone trading Ethereum. The imbalance score ties these differences into one unified risk framework.

The combination of these elements turns Ostium into an engineered system rather than a simple trading venue. It reflects the founders backgrounds in macro trading and quantitative research. They understand what breaks in volatile markets. They understand why risk must be measured not assumed. Their architecture shows this awareness. It is built to survive conditions that have destroyed many onchain trading platforms in the past.

THE RISE OF A NEW COMPETITOR IN DERIVATIVES

The global derivatives landscape has never been more crowded yet never more open to disruption. Hyperliquid dominates crypto native perpetuals. Centralized exchanges remain strong but face pressure from compliance and rising operational requirements. Gains Network captures retail interest with its synthetic trading model. None of them focus deeply on the RWA exposure that traders actively demand. Ostium enters that empty space with a clear target. It aims to become the onchain platform for global macro trading and it is not subtle about this goal.

Its market strategy reflects this ambition. It does not list hundreds of volatile assets. It focuses on gold oil silver copper foreign exchange majors and global equity indices. These are the instruments traders use to express views on inflation growth policy and geopolitical tension. These are the instruments that move when real world events unfold. In traditional finance trading them requires account approval leverage restrictions and custody risk. On Ostium a trader only needs a Web3 wallet and a few dollars. This level of access did not exist before.

The capital behind the protocol also tells its own story. Jump Crypto General Catalyst SIG GSR and Wintermute are not casual investors. They select systems that can scale into institutional infrastructure. Their involvement signals confidence in both the market design and the long term demand for onchain global trading rails. It also signals something deeper. These firms believe the future of derivatives will not be fully centralized. They expect some part of the market to migrate to transparent non custodial execution where algorithms can verify every part of the process. Ostium is one of the few architectures built with this assumption in mind.

The competitive edge becomes clearer when comparing models. Hyperliquid offers unmatched speed but focuses on crypto assets. Gains offers synthetic exposure but lacks a granular risk engine. Traditional CFD brokers offer wide market access but operate in a black box. Ostium blends the strengths of these systems while avoiding their weaknesses. It brings transparency where brokers lack it. It brings risk measurement where synthetic models ignore it. It brings a focus on global assets where crypto exchanges hesitate to expand. As a result the protocol occupies a category that did not exist before.

This is also why the protocol has momentum behind its points program. Traders see it as a major future airdrop. Liquidity providers see it as a long term yield strategy. Users who missed early Hyperliquid activity do not want to miss the next potential breakout. The program is simple. It rewards volume and liquidity. It is integrated into both trading behaviour and social referral behaviour. It sets the stage for a future token that will likely play a role in governance and collateral design. In the context of the 2026 cycle this adds another layer of interest to the protocol.

THE FUTURE OF GLOBAL MARKETS ONCHAIN

The story of Ostium is not only about a protocol. It is about how financial markets evolve when technology removes the need for permission or trust. For a decade DeFi tried to expand by building better venues for crypto assets. Ostium turns the direction outward. It looks at the largest markets in the world and asks why they cannot exist onchain. It answers that question with design not narrative. Its architecture shows how to support global macro exposure inside an environment that has no central authority and no closing bell.

The future path of the project is shaped by several forces. Macroeconomic conditions remain unstable. This increases the demand for liquid hedging tools. RWA adoption continues to grow as more users move part of their portfolios into blockchain based systems. Developers push toward account abstraction and simpler interfaces that reduce the friction of onchain trading. Each of these forces supports the growth of a platform like Ostium. As the user experience becomes smoother the protocol becomes a realistic alternative to offshore brokers. As trust in centralized intermediaries declines transparent execution becomes a competitive advantage.

Regulation sits as the main uncertainty. Offering exposure to equities and commodities to global retail users has always raised questions. Ostium reduces this risk by avoiding custody and using a synthetic model. It limits access where needed but still operates in a permissionless environment. It will need to navigate this space carefully as adoption grows. Yet history shows that markets tend to embrace systems that offer clear rules and transparent execution. If the protocol maintains a strong security record and avoids critical failures it will earn the credibility needed to operate at scale.

The broader implication is that DeFi is no longer a niche inside crypto. It is becoming the infrastructure that absorbs parts of traditional finance. The shift will not happen all at once. It will begin with traders who want cheaper and more reliable execution. It will spread to liquidity providers who see predictable yield inside a transparent system. It will reach institutions when the technical foundation becomes stable enough for regulated flows. Ostium positions itself at the front of this transition. It aims to become the reference point for onchain global markets.

In the end the protocol represents a simple idea with major consequences. Markets are more efficient when rules are visible. Traders take more rational risk when liquidation logic is transparent. Liquidity grows when incentives are aligned. Ostium tries to apply these principles to assets that have never lived onchain in a serious way. If it succeeds it will not just compete with other DEXs. It will compete with the entire CFD industry and with the fragmented infrastructure that surrounds global macro trading today.

The project is a bet on a world where blockchains become the default execution layer for every asset class. This world will take time to arrive. It will require technical strength regulatory awareness and consistent delivery. But the direction is clear. The next frontier of DeFi is not inside crypto. It is the transformation of global markets themselves. Ostium stands as one of the first systems designed for that world. It reflects ambition discipline and a willingness to challenge the largest structures in traditional finance. Whether it becomes the leading platform or a catalyst for a broader shift its impact is already visible. It shows that the era of onchain global markets has begun.