KEYTAKEAWAYS

- The long-term rate-cut path signals a multi-year shift toward looser liquidity, creating a supportive macro environment for Bitcoin and risk assets beyond short-term FOMC volatility.

- Real interest rates peaked in late 2023 and have since trended lower, with each decline aligning closely with Bitcoin’s major upward legs throughout 2024.

- Despite short-term consolidation in 2025, the broader macro structure still favors risk assets, though ideal entry points depend on upcoming short-term data and market reactions.

- KEY TAKEAWAYS

- THE LIMITS OF REACTING TO A SINGLE RATE DECISION

- WHY THE RATE-CUT PATH IS FAR MORE IMPORTANT

- LOOKING BACK: THE MARKET ENTERED A NEW LOW-RATE ERA IN 2024

- WHY THE REAL INTEREST RATE MATTERS MORE THAN THE NOMINAL RATE

- WHAT RECENT REAL INTEREST RATE DATA REVEALS

- COMBINING LONG-TERM AND MID-TERM MACRO SIGNALS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

The real rate trend and long-term rate-cut path reveal why Bitcoin remains in a bull-market correction phase despite short-term volatility around the upcoming FOMC decision.

The next FOMC meeting is only a few days away, and as usual, all eyes are on whether the Federal Reserve will cut rates. Yet focusing solely on the meeting itself often leads investors to overlook the real driver of long-term market trends: the rate-cut path, not the decision of a single night.

While the upcoming meeting may influence short-term volatility—especially as markets have already priced in expectations—the far more important signal for crypto investors lies in the trajectory of interest rates over the coming years. Understanding this difference is essential for navigating where Bitcoin, risk assets, and macro liquidity could be heading next.

THE LIMITS OF REACTING TO A SINGLE RATE DECISION

Market participants love reacting to FOMC nights. Headlines are dramatic, narratives are easy to amplify, and price movements are visibly immediate. But the policy rate announced during a meeting reflects only the current stance—what the Fed is prepared to implement right now. This is a short-term indicator, and its impact fades quickly once the initial volatility passes.

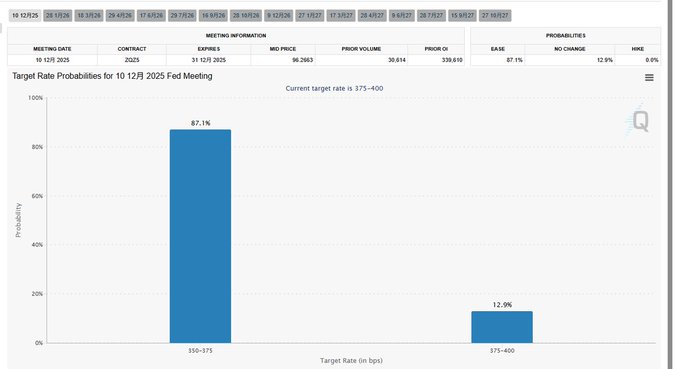

Yes, expectations for the upcoming meeting have shifted. As of now, markets are pricing an 87.11% probability that the target range will be lowered to 350–375 basis points, and a 12.9% probability of a smaller cut to 375–400. Such expectations likely contributed to Bitcoin’s pullback around November 25, when markets adjusted their pricing ahead of the announcement.

However, traders often confuse this short-term repricing with a durable trend. When the meeting arrives, positive news may already be fully priced in, while a disappointment can trigger outsized downside reactions. This is why the market sometimes rallies before the meeting and stalls—or even corrects—after it.

But none of this defines the long-term environment in which risk assets truly thrive or struggle.

WHY THE RATE-CUT PATH IS FAR MORE IMPORTANT

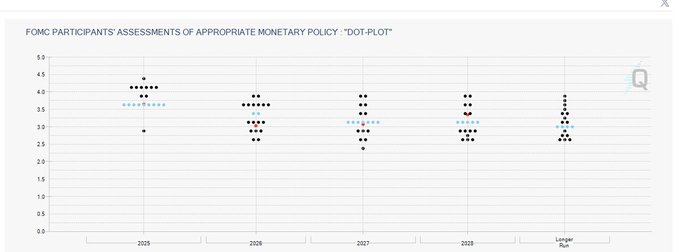

While the FOMC meeting tells us where rates are this month, the rate-cut path tells us where policy is likely to move over multiple years. That trajectory—visible through the Fed’s dot plot and evolving market expectations—is what shapes liquidity conditions, risk appetite, capital allocation, and ultimately Bitcoin’s multi-year trend.

As of now, the current effective rate sits at 3.88%. The dot plot shows a consistent downward path over the next several years, with expectations falling toward the low-3% range by 2028. This downward slope is not about short-term relief but about the structural environment in which global capital will operate.

To understand the significance of this, one only needs to look backward.

LOOKING BACK: THE MARKET ENTERED A NEW LOW-RATE ERA IN 2024

When we examine the rate-cut path of the past few years, the pattern becomes unmistakable. Beginning in 2024, the market entered what can be described as the start of a new long-term low-rate era. This shift helped unlock substantial liquidity and is one of the biggest reasons Bitcoin performed so strongly throughout 2024.

Risk assets respond not to a single cut, but to the expectation that rates will remain lower—or continue falling—over a long horizon. When the path bends downward, markets can discount future cash flows more aggressively, capital becomes less constrained, and investors grow more willing to assume risk.

Consequently, the rate-cut path alone already suggests that markets broadly expect favorable conditions for risk assets over the next several years.

Yet relying solely on the rate path is dangerous because expectations can be fragile. A geopolitical surprise, an inflation resurgence, or a sudden shock could redraw the map entirely. Markets price in probability, not certainty. And so no investor should take aggressive bets only because the dot plot looks supportive.

To refine our view, we need a metric that reflects how policy interacts with real economic conditions—not just nominal announcements.

WHY THE REAL INTEREST RATE MATTERS MORE THAN THE NOMINAL RATE

Most people focus on the nominal rate—the one the Fed announces—but this number alone is often misleading. It tells us what the Fed says, not what the market experiences.

A better way to understand the difference is to imagine middle-school homework. The teacher assigns three math test papers and instructs you to time yourself, complete the work carefully, and submit the results. That’s the nominal requirement.

But in reality, many students simply glance at the answer sheet, copy the solutions, deliberately create a few “mistakes” for realism, and write a reflection about needing to “be more careful next time.”

That is the actual execution—far removed from the nominal instruction.

Interest rates work the same way. The Fed sets the nominal rate, but markets react through expectations, inflation, risk premiums, and liquidity flows. The true lived experience of financial conditions is the real interest rate, which adjusts the nominal rate for inflation and reflects actual market pressure.

This is what matters most for long-term macro trends—and especially for Bitcoin.

WHAT RECENT REAL INTEREST RATE DATA REVEALS

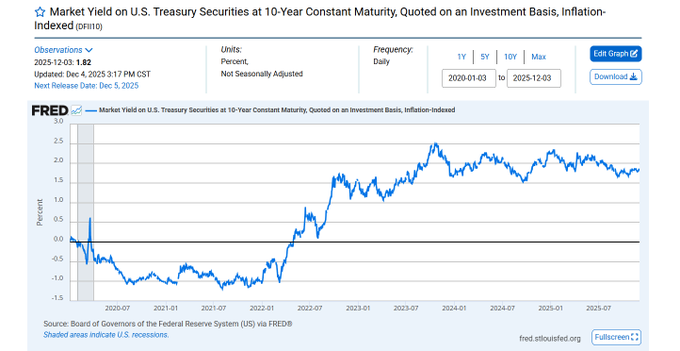

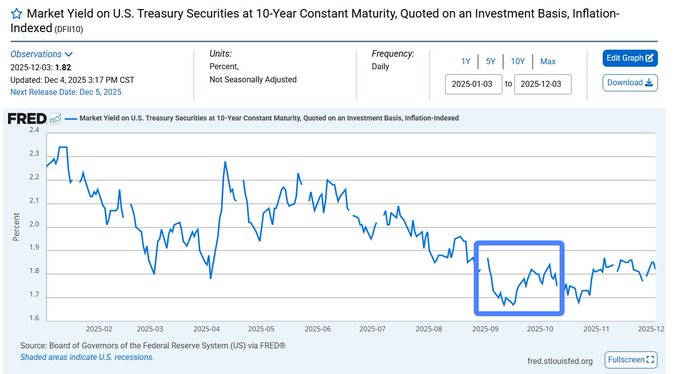

Focusing on the 5-year real interest rate offers an especially clear picture. During 2022 and 2023, real rates surged aggressively. That period also corresponded to one of crypto’s harshest bear markets. When real rates rise, liquidity tightens, leverage unwinds, and risk assets suffer.

But something critical happened in late 2023.

In October 2023, the 5-year real rate peaked. From that point forward, a gradual downward trend began to form. And importantly, each local high in 2024 was followed by a pullback—each of which lined up neatly with Bitcoin’s three major upward legs during the year.

By contrast, the pattern changed in 2025. After months of steady decline, real rates flattened in October 2025 and have since moved into a period of sideways consolidation. This signals neither a tightening environment nor an aggressively easing one—just a pause, a plateau.

Such plateaus often precede major macro decisions or inflection points. They can accompany short-term corrections in risk assets even if the long-term outlook remains positive.

COMBINING LONG-TERM AND MID-TERM MACRO SIGNALS

When we combine the long-term rate-cut path with mid-term real-rate trends, the conclusion becomes clearer.

The market remains in a bull-market correction phase—a temporary cooling period within an overall optimistic macro backdrop. Liquidity is not tightening aggressively, structural downward pressure on rates persists, and historical patterns align with the idea that Bitcoin’s broader uptrend has not been invalidated.

However, determining whether now is the right time to re-enter the market requires more than long-term optimism. It depends on how short-term indicators behave, how real rates break out from their current consolidation, and how the market digests the upcoming FOMC meeting.

The long-term thesis remains strong. But entries are made on short-term signals.

And those short-term signals will unfold next week.

Read More:

Bitcoin Faces ETF Selling Pressure, But It’s Not a Bear Market