KEYTAKEAWAYS

-

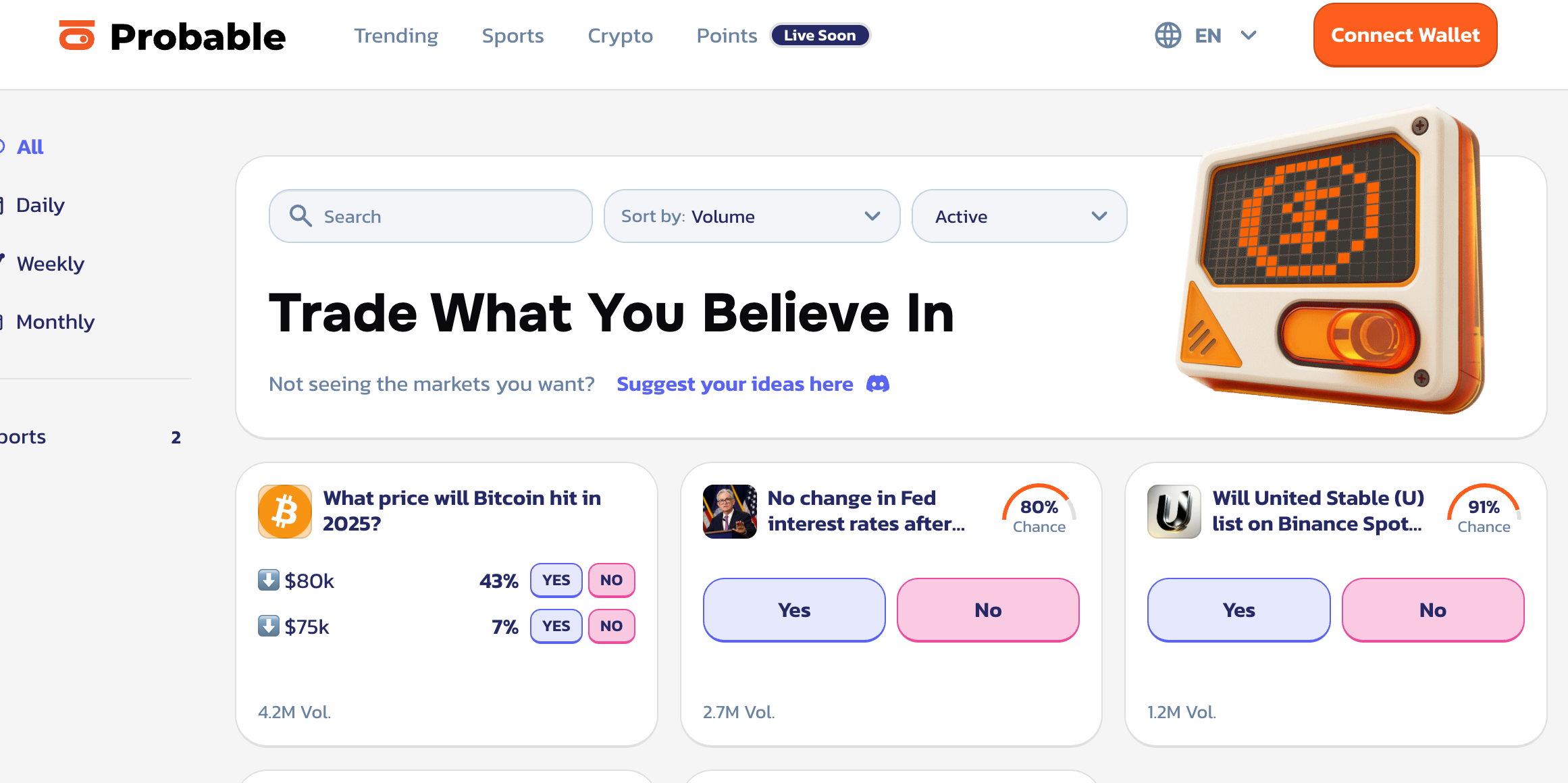

Prediction markets in 2025 are no longer niche betting products. They are becoming real time probability engines that price uncertainty faster than traditional research, polls, or media narratives.

-

Probable Markets is not trying to replace Polymarket. It is filling a structural gap inside BNB Chain by keeping event driven trading, regional markets, and crypto native predictions within its own ecosystem.

-

Zero fees and flexible oracle design help Probable accelerate price discovery early on, but its long term success will depend on whether it can build deep, resilient liquidity that supports institutional and large scale participation.

CONTENT

For most of crypto’s history, prediction markets sat in an awkward middle ground. They were intellectually interesting, occasionally insightful, but rarely treated as essential parts of the financial stack. To many users, they felt closer to betting products than to serious market tools. Even within Web3, they were often viewed as side experiments rather than core infrastructure.

That perception has started to break down.

By 2025, financial markets are operating in an environment defined by continuous uncertainty. Elections shift asset prices overnight. Policy signals trigger volatility before official announcements. Social sentiment moves faster than research desks can respond. In this context, traditional information channels struggle to keep pace, and probability itself begins to function as a scarce and valuable resource.

It is within this broader shift that Probable Markets emerges, not as a novelty product, but as part of a deeper rethinking of how information is priced inside crypto markets.

FROM BETTING MECHANISM TO INFORMATION PRICING LAYER

Prediction markets did not suddenly gain relevance because traders became more interested in speculation. They gained relevance because existing systems for processing information started to fail under pressure. Research reports take time to publish. Polling data arrives late and often incomplete. Commentary reacts after prices have already moved.

Markets, by contrast, respond instantly when capital is forced to express conviction.

Platforms such as Polymarket demonstrated this dynamic clearly during major political and macroeconomic events. In several cases, probability curves adjusted well before expert commentary caught up, reflecting shifts in collective belief as soon as new information surfaced.

This does not mean prediction markets are inherently smarter than analysts. It means they are less forgiving. Incorrect assumptions are punished immediately, while accurate insights are rewarded in real time. Over repeated cycles, this dynamic transforms prediction markets from entertainment venues into functional information engines.

As a result, prediction markets begin to act as a pricing layer for uncertainty itself. Instead of asking what might happen, participants observe where capital is positioning right now. Once that behavior becomes normalized, prediction markets stop being optional tools and start resembling financial infrastructure.

WHY BNB CHAIN COULD NOT AFFORD TO STAY OUT

BNB Chain has long been one of the most active ecosystems in crypto, particularly among retail users. Transaction volume has never been the issue, nor has participation. What BNB Chain lacked was a native venue for expressing views on real world outcomes in a decentralized, permissionless way.

Before Probable, users who wanted to trade event driven outcomes were often forced to bridge assets to other ecosystems or rely on centralized platforms. That friction mattered more than it appeared. Prediction markets generate repeated engagement, frequent decision making, and constant capital movement. Losing that activity means losing attention, data, and behavioral liquidity.

This is why the involvement of PancakeSwap and YZi Labs should be read as a strategic response rather than a simple product launch. Probable is designed to fill a structural gap inside the BNB Chain ecosystem, capturing a category of activity that had previously flowed elsewhere.

Rather than competing directly for the most crowded US focused narratives, Probable leans into regional events, crypto native outcomes, and high frequency sports markets. This positioning aligns closely with the geographic distribution and behavioral patterns of BNB Chain users, making it less a deviation from the ecosystem and more a reflection of it.

WHY UMA MATTERS MORE THAN IT LOOKS

At the center of every prediction market lies a single critical question: who determines the outcome. The answer defines not only technical architecture, but also the range of markets a platform can realistically support.

Probable’s decision to build on UMA reflects this reality. Traditional oracle systems excel at delivering objective, structured data such as asset prices, but they struggle with subjective or irregular real world events. Elections, regulatory outcomes, or disputed sports results do not fit neatly into pre defined data feeds.

UMA approaches this problem differently by assuming outcomes are correct unless challenged, introducing dispute resolution only when economic incentives justify it. This design accepts occasional delays in exchange for flexibility, allowing a broader range of markets to exist without requiring heavy upfront infrastructure.

For Probable, this choice expands what is possible. It enables markets that are region specific, politically nuanced, or difficult to standardize, which would be impractical under more rigid oracle frameworks. The result is not just technical versatility, but editorial freedom in deciding what kinds of questions can be priced by the market.

ZERO FEES ARE NOT THE ENDGAME

Probable’s launch with zero trading fees attracted early attention, but the strategy runs deeper than user acquisition. Prediction markets rely on continuous adjustment, where small informational advantages drive incremental trades. High fees introduce friction that discourages correction and weakens price accuracy.

Lower costs improve signal quality, making prices more responsive to new information. In this sense, zero fees function as an investment in probability precision rather than a short term promotion.

That said, fees are not the defining challenge ahead. Liquidity is.

Without sufficient depth, markets become unstable. Large trades distort prices, professional participants stay away, and the platform risks becoming noisy rather than informative. The long term viability of Probable depends on whether it can aggregate liquidity across markets and attract participants capable of sustaining efficient pricing.

This is where many prediction platforms falter. For now, Probable occupies a promising position at an early stage, supported by the right ecosystem and timing. Whether it matures into infrastructure will depend less on narrative and more on execution.

What is already clear is that prediction markets are no longer peripheral. And BNB Chain is no longer content to observe their rise from a distance.