KEYTAKEAWAYS

- Institutions evaluate on-chain financial solutions based on efficiency, risk control, auditability, and compliance, rather than technical labels or ideology.

- Debt capital markets and structured products are among the first to go on-chain, with real-world examples validating feasibility and efficiency improvements.

- Despite regulatory, technical, and institutional challenges, on-chain finance is poised to become the default infrastructure for capital markets, enabling efficient, transparent, and composable operations.

- KEY TAKEAWAYS

- WHY INSTITUTIONS ARE FOCUSING ON ON-CHAIN FINANCE

- WHY THE LINE BETWEEN DEFI AND TRADFI IS DISAPPEARING

- DEBT CAPITAL MARKETS LEADING ON-CHAIN

- ON-CHAIN FINANCE TRANSFORMING CORE OPERATIONS

- MAPLE PRACTICES AND INSTITUTIONAL PERSPECTIVE

- REAL-WORLD CHALLENGES

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

As on-chain financial infrastructure matures, institutions are increasingly blurring the line between DeFi and TradFi, with core capital market activities moving rapidly to blockchain.

WHY INSTITUTIONS ARE FOCUSING ON ON-CHAIN FINANCE

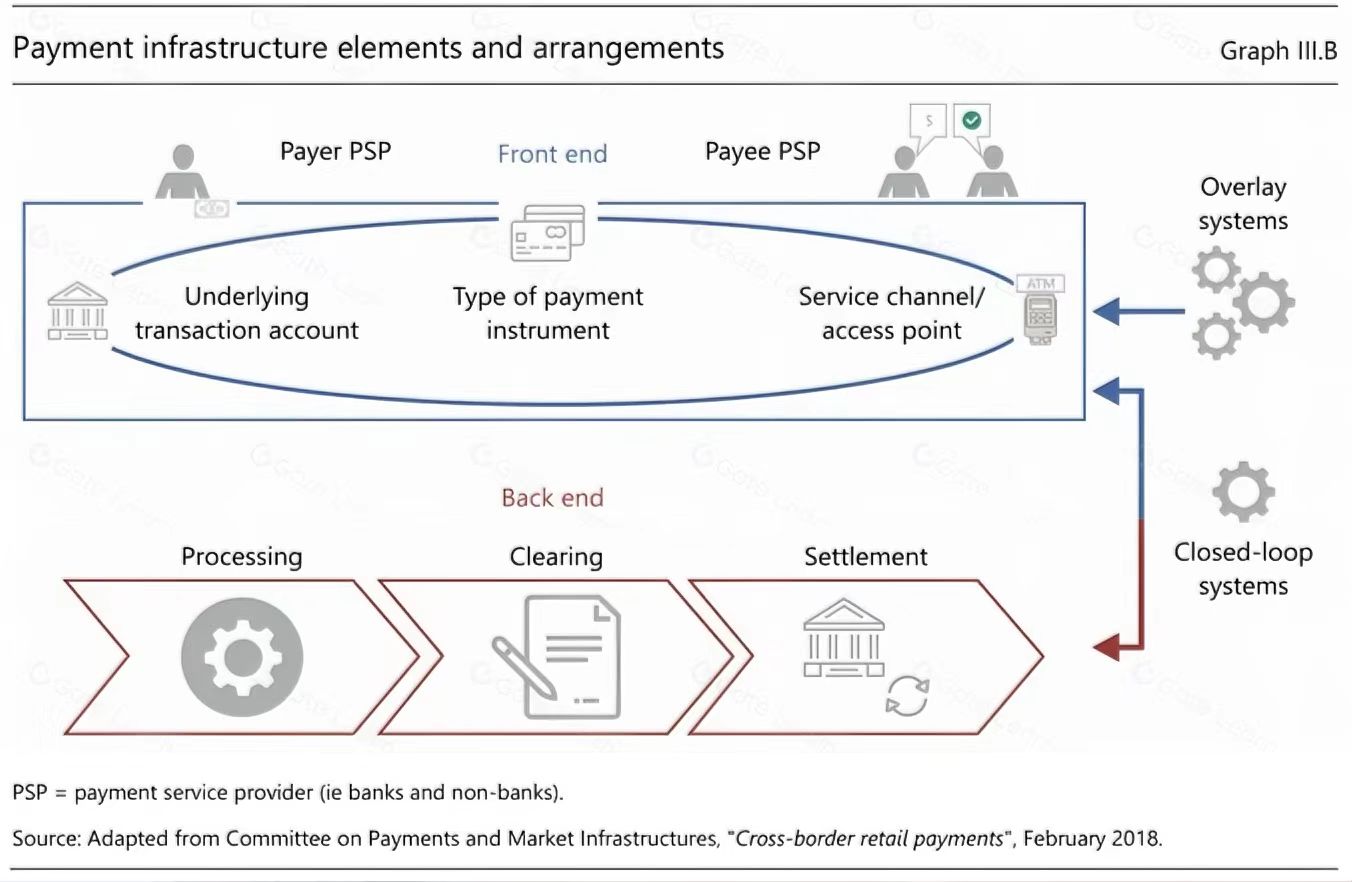

In recent years, traditional financial institutions have shown growing interest in on-chain finance, driven by three major factors. First, the regulatory environment has improved. Clearer frameworks for stablecoins and digital securities have reduced legal uncertainty for institutions. Second, technological maturity has increased. Stable public chains, Layer 2 scaling solutions, and improved smart contract security have transformed blockchain from an experimental tool to a quantifiable and controllable infrastructure. Third, traditional financial clearing is often slow, costly, and inefficient, prompting institutions to seek alternatives.

For example, the global on-chain Real World Asset (RWA) market exceeded $25.5 billion by mid-2025, with private credit accounting for 58.5%, U.S. Treasury bonds 29.6%, and commodities 6.4%. BlackRock and Securitize launched tokenized Treasury funds, reaching $2 billion in assets between 2024 and 2025, offering daily interest distribution and transparent holdings. Franklin Templeton’s BENJI tokenized money market fund in Europe manages approximately $700 million across Stellar and Arbitrum networks. These examples demonstrate that institutions are integrating on-chain finance into actual operations rather than treating it as a conceptual experiment.

When evaluating on-chain solutions, institutions also consider long-term sustainability and cross-market applicability. Different asset types, such as debt instruments, structured products, derivatives, and cross-border transactions, pose varying demands on system stability. Blockchain provides a unique value proposition by balancing efficiency, transparency, compliance, and risk control.

Figure 1: Hierarchical Architecture of Traditional Payment Infrastructure

WHY THE LINE BETWEEN DEFI AND TRADFI IS DISAPPEARING

Over the past few years, discussions often focused on differentiating DeFi from TradFi, but institutional practice shows this distinction is becoming less meaningful. Institutions are more concerned with whether a system provides actual efficiency gains, meets compliance standards, and integrates with existing operations. Technically, DeFi is not about decentralization per se but about ledger consistency, settlement speed, and controllable risk. Practically, institutions assess on-chain solutions based on cost reduction, improved clearing efficiency, and legal recognition.

Real-world examples support this trend. JPMorgan’s tokenized money market fund, initially funded with $100 million, optimizes efficiency through on-chain settlement and custody. Italy’s UniCredit issued tokenized structured notes, fully recorded on-chain for transparent issuance and real-time holdings. These cases indicate that institutions no longer view DeFi and TradFi as opposites but integrate on-chain solutions into core operations.

The maturation of on-chain finance promotes an “infrastructure-first” mindset rather than an “ideology-first” approach. Institutions prioritize actionable, operable, and quantifiable business value.

DEBT CAPITAL MARKETS LEADING ON-CHAIN

While payment systems are often highlighted as blockchain’s main use case, capital markets are more suitable for early on-chain adoption due to concentrated clearing bottlenecks, tokenizable standardized assets, and high transaction value. BlackRock and Securitize’s tokenized Treasury funds, as well as Fidelity and Franklin Templeton’s on-chain funds, demonstrate that debt and structured products are leading the on-chain trend.

On-chain debt markets not only improve clearing efficiency but also increase market liquidity. Real-time ledger updates enhance risk assessment and capital allocation. Compared to traditional systems, high-value assets benefit more from blockchain efficiency, explaining why institutions prioritize debt markets for on-chain adoption.

ON-CHAIN FINANCE TRANSFORMING CORE OPERATIONS

The value of on-chain finance lies in optimizing financial operations, not just the assets themselves. In traditional systems, clearing, custody, risk management, and issuance are divided among multiple parties. On-chain systems provide real-time verifiable ledgers, shifting risk management from after-the-fact reporting to continuous monitoring. Ledgers also offer modularity: clearing, custody, risk, and issuance modules can be flexibly combined, improving efficiency and transparency.

This capability enables innovative products. UniCredit’s tokenized notes, JPMorgan’s tokenized funds, and DAMAC Group’s tokenized real estate projects all implement debt asset splitting, accounts receivable securitization, and smart yield distribution on-chain. These initiatives enhance liquidity and provide institutions with diversified risk management and capital optimization tools, demonstrating the feasibility of on-chain finance in real-world asset management.

MAPLE PRACTICES AND INSTITUTIONAL PERSPECTIVE

Maple Finance, a crypto-native institution, focuses on on-chain debt and credit structures for institutional clients. Its experience shows that on-chain capital markets are not theoretical but based on quantifiable business logic and long-term sustainability. Institutions evaluate system stability, default management, and cross-market operability rather than short-term market sentiment. Practices by BlackRock, Fidelity, and JPMorgan further validate the operational feasibility and strategic value of on-chain finance.

REAL-WORLD CHALLENGES

Despite clear trends, on-chain capital markets face multiple challenges. First, regulatory fragmentation and cross-border complexity remain, as varying national laws complicate unified on-chain operations. Second, balancing privacy and transparency is unresolved; public ledgers must be auditable while protecting sensitive client data. Third, existing financial intermediaries may resist change due to entrenched interests.

Technical and governance risks persist, including smart contract vulnerabilities, settlement delays, and cross-chain interoperability issues. Different chains lack standardized assets and data protocols, limiting large-scale deployment. Overall, on-chain capital markets are likely to develop gradually, with institutions balancing efficiency improvements and risk management.

CONCLUSION

Looking ahead, on-chain finance will develop in layers. High-value institutional assets such as debt, structured products, and credit derivatives will move on-chain first, while retail and routine transactions gradually follow. As cross-chain technologies and regulatory frameworks mature, on-chain products will gain interoperability and global trading capability.

Institutional on-chain finance will also enable innovative products like global tokenized bonds, on-chain asset securitization markets, and real-time settlement systems. Pilot programs by BlackRock, Fidelity, and JPMorgan confirm market demand, and more institutional assets will migrate on-chain over time. Market demand for efficiency, transparency, and risk control will continue to grow, positioning on-chain finance as the default infrastructure for capital markets rather than an optional tool.

Ultimately, on-chain finance is not just a technological upgrade but a milestone in financial modernization, signaling a new phase of high-efficiency, transparent, and composable capital markets. Institutions are integrating blockchain into long-term strategy and systematic investment, laying the foundation for a sustainable financial ecosystem.

Read More:

Bitcoin ETF: From Institutional Trials to Long-Term Allocation