KEYTAKEAWAYS

- The UNIfication proposal passed governance votes, enabling the v2/v3 protocol fee switch and triggering UNI token burn, marking a significant adjustment in the protocol's economic structure.

- The fee switch and discount auction mechanism reflect a balanced design for protocol sustainability and LP returns, changing the economic position of UNI.

- The market has priced in this structural change, but the real impact will unfold in the long-term effects on liquidity, trading behavior, and protocol revenue.

CONTENT

Uniswap has passed the governance proposal to activate the protocol fee switch and UNI token burn mechanism, laying the foundation for protocol value capture and economic structure reshaping.

UNISWAP IS AT A PIVOTAL YET OVERDUE MOMENT

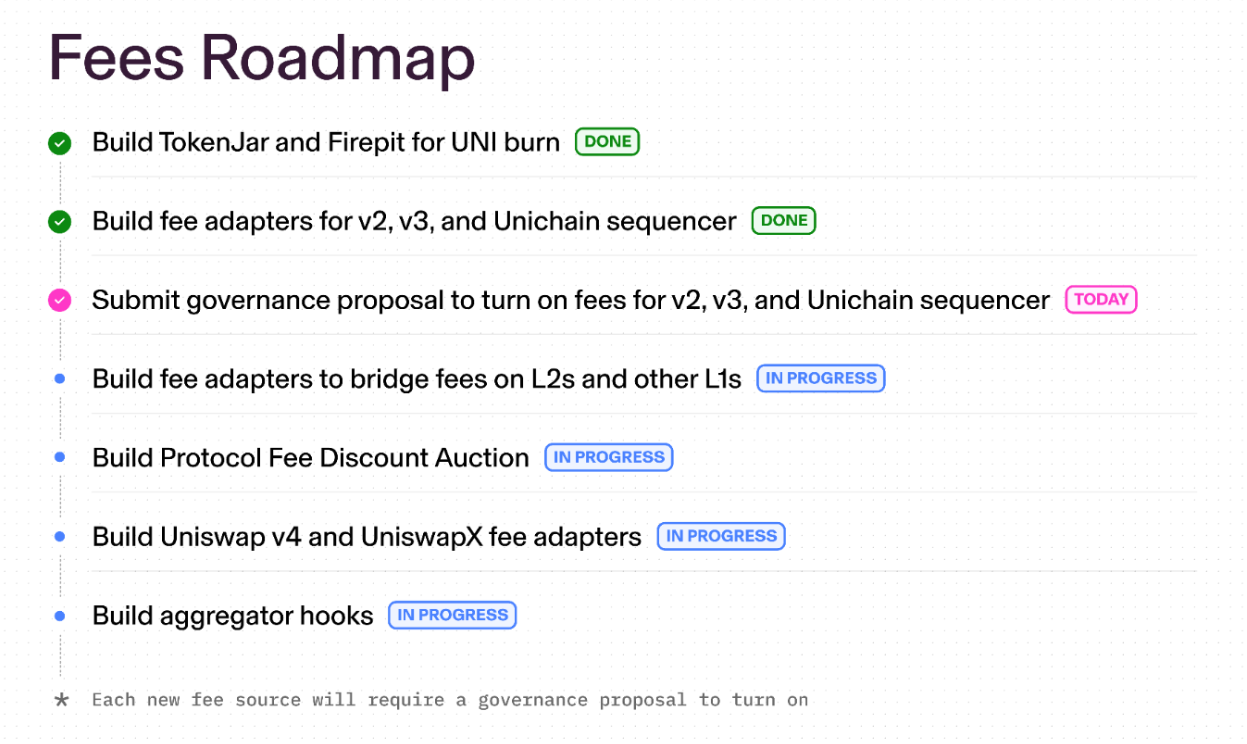

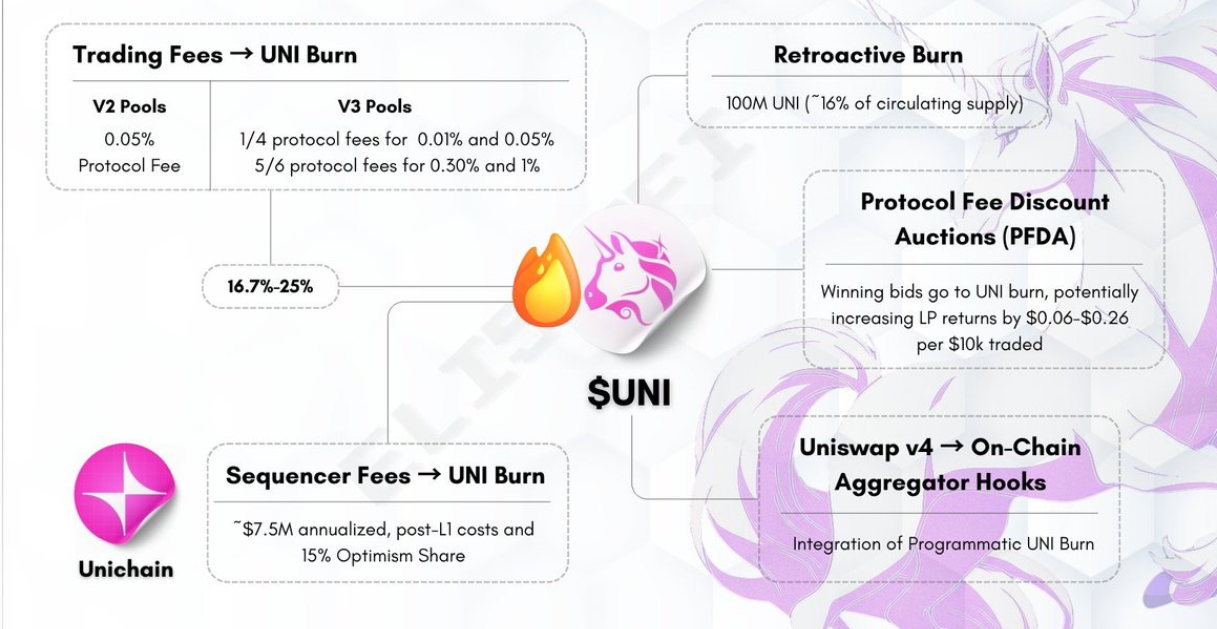

With the UNIfication governance proposal surpassing the 40 million UNI approval threshold, the activation of the protocol fee switch has become a certainty. The current approval votes are approaching 62 million, with voting ending on December 25. According to Uniswap Labs CEO Hayden Adams, after voting concludes, a two-day time lock period will begin. Following that, Uniswap is expected to officially activate the v2 and v3 protocol fee switches on the Unichain mainnet later this week and simultaneously trigger the UNI token burn mechanism.

Process-wise, this is a controlled and highly predictable governance implementation; in significance, it represents Uniswap confronting its long-term economic structure. This decision is not sudden, but it is particularly necessary at this moment.

Figure 1: Structure of the Protocol Fee Switch

A DECISION DELAYED FOR YEARS

The fee switch is not a new topic.

In fact, since the design of Uniswap v2, the protocol layer had already reserved the technical interface to extract a portion of trading fees for the protocol. In other words, Uniswap has always had the potential to become a value-capturing protocol but chose not to exercise this capability for years.

This choice was deliberate, not a mistake.

In the early days of DeFi, Uniswap faced a highly uncertain market: liquidity was scarce, user education costs were high, and protocol competition was intense. In this context, giving almost all fees to LPs maximized liquidity attraction and market share while aligning with the narrative of a public infrastructure.

This strategy proved successful. Uniswap became the de facto standard for decentralized trading, with top-tier trading volume, user base, and brand influence.

However, problems accumulated over time.

As trading volume continued to grow, Uniswap effectively became one of DeFi’s most significant cash flow generators but lacked mechanisms to capture this value sustainably for the protocol itself. UNI, as a governance token, remained largely a tool for voting rather than an economic feedback instrument.

As the industry matured, this structural gap became increasingly apparent.

THE PROPOSAL IS MORE THAN “COLLECTING FEES”

The UNIfication proposal gained broad consensus not simply because of whether to collect fees, but because of how fees are collected and redistributed.

First, activating the protocol fee switch signals Uniswap’s shift from a purely neutral matching layer to a participant in value distribution. This is not a negation of LP roles but a confirmation of the protocol’s long-term sustainability.

Second, the proposal specifies a one-time burn of 100 million UNI from the Uniswap Foundation treasury. This action is clear in both symbolism and practical effect: the protocol begins actively reducing token supply rather than relying solely on market forces.

More importantly, a portion of future protocol fees will be continuously used for token burns, linking UNI supply changes with protocol operation in a long-term, traceable manner. While this does not equate to direct dividends, it provides a decentralized and resilient feedback mechanism.

At the same time, the protocol fee discount auction mechanism (PFDA) is not a simple patch. Its core purpose is to balance value capture for the protocol with LP returns, avoiding structural disruptions to liquidity depth caused by fee adjustments.

Overall, the design leans toward prudence rather than radical reform.

Figure 2: Fee Switch and Token Burning Flow

THE CHANGE IS NOT ISOLATED

When observed over a longer timeframe, the activation of the fee switch is not an isolated event.

On one hand, Uniswap is gradually building a more complete execution and settlement system around Unichain, strengthening control over trade paths, ordering, and infrastructure. On the other hand, the competitive focus of the DeFi industry is shifting.

Previously, protocols competed on trading volume, TVL, and user growth; today, the market increasingly cares about whether protocols have sustainable cash flow and whether governance tokens can reasonably bear this value.

In this context, continuing to forgo protocol-level revenue becomes a passive choice.

As more protocols explore different forms of value recapture, Uniswap remaining in the early distribution model would only exacerbate tension between governance and economic reality.

This explains why the recent governance vote did not trigger major contention but instead showed overwhelming support.

UNI’S POSITION IS CHANGING

It is important to distinguish that activating the fee switch does not give UNI attributes similar to traditional equity, nor does it equate to a direct share of protocol profits.

However, the economic position of UNI within the protocol has changed materially.

Under the new mechanism, protocol activity, trading volume, and token supply are no longer completely disconnected. The burn mechanism ensures UNI is no longer an abstract governance token but begins to reflect the long-term cumulative effect of protocol operations.

At the same time, this serves as a practical test of decentralized governance effectiveness.

This vote is not symbolic; it directly alters the protocol’s economic foundation, and its impact will persist over time.

CONCLUSION

The price increase of UNI following the vote is often attributed to “positive sentiment,” but a more accurate interpretation is that the market is pricing a forthcoming structural change with a clear timeline.

Unlike many governance proposals that remain at the conceptual or discussion stage, this process—from vote conclusion to time lock to official activation—occurs over a short, predictable period. The market is concerned not with distant speculation but with a change that is happening.

The real variable lies not in the price itself, but in how the fee switch will affect liquidity structure, trading behavior, and the long-term distribution of protocol revenue.

Activating the fee switch will not instantly transform Uniswap or automatically create new valuation narratives for UNI.

Yet it accomplishes a long-avoided task:

allowing Uniswap to confront the question of ownership and capture of value it generates.

For a protocol that has become DeFi infrastructure-level essential, this is not an endpoint but an overdue and necessary beginning.

The most significant changes will unfold after the vote concludes.

Read More:

Uniswap: The Past, Present, and Future of Decentralized Trading

The Rising Concentration of DEX Fees: Uniswap and Hyperliquid Lead the Market