KEYTAKEAWAYS

-

Crypto market makers are no longer simple liquidity providers but structural operators

They actively manage inventory risk, route liquidity across fragmented venues, and increasingly shape how prices are discovered rather than merely reacting to market flow.

-

Liquidity has shifted from being subsidized to being selectively priced

After the collapse of leverage driven models, crypto market makers now deploy capital only where risk can be quantified and compensated, leaving weaker assets structurally thinner.

-

Intent based execution is turning crypto market makers into execution gatekeepers

As trading moves away from public order books toward solver driven systems, crypto market makers gain greater control over execution quality, efficiency, and access to liquidity.

- KEY TAKEAWAYS

- HOW CRYPTO MARKET MAKERS EVOLVED FROM PRICING TOOLS TO SYSTEM OPERATORS

- LIQUIDITY AFTER THE COLLAPSE OF LEVERAGE DRIVEN MODELS

- ON CHAIN LIQUIDITY AND THE HIDDEN COSTS OF DECENTRALIZATION

- FROM MARKET MAKING TO INTENT SOLVING

- WHY CRYPTO MARKET MAKERS NOW DEFINE MARKET STABILITY

- DISCLAIMER

- WRITER’S INTRO

CONTENT

For most of the crypto industry’s short history, liquidity functioned as a background condition rather than a strategic resource. As long as trading pairs appeared active and spreads remained narrow, few participants questioned how prices actually held together. That illusion collapsed after 2022. What followed was not simply a market downturn, but a structural reset in how the industry produces, prices, and controls liquidity. At the center of this transformation stand crypto market makers. Their role has expanded far beyond posting bids and asks. Today, they operate as liquidity engineers, risk distributors, and, increasingly, as hidden architects of market structure itself.

HOW CRYPTO MARKET MAKERS EVOLVED FROM PRICING TOOLS TO SYSTEM OPERATORS

Crypto market makers as inventory risk managers

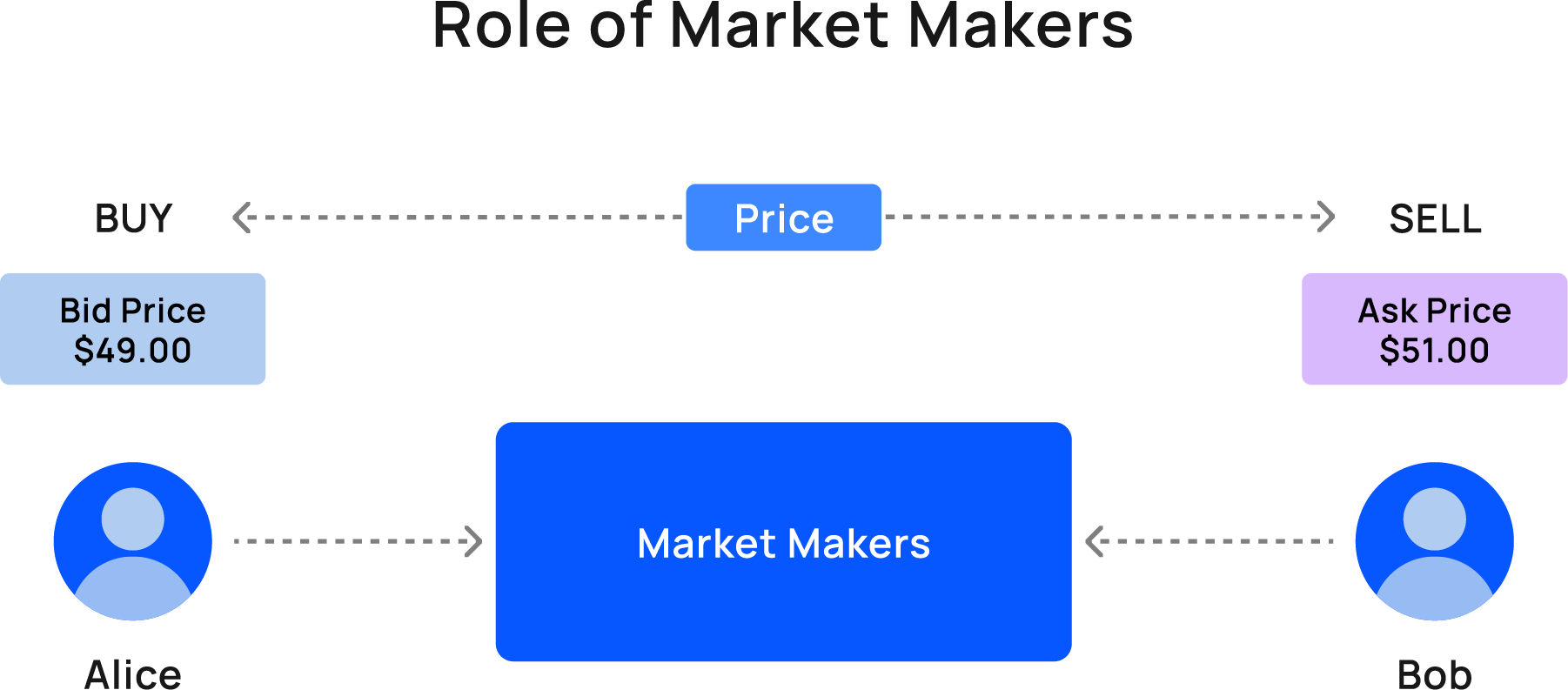

At their core, crypto market makers absorb imbalance. They quote both sides of a market and hold inventory so buyers and sellers do not need to arrive at the same moment. In early crypto markets, this function appeared deceptively simple. Volumes stayed low, correlations remained loose, and most trading activity followed directional speculation rather than systematic flow.

That environment no longer exists. Today, crypto market makers operate across dozens of venues at once. Inventory fragments across centralized exchanges, decentralized protocols, and off chain execution systems. At the same time, price movements propagate globally within milliseconds. Under these conditions, inventory no longer behaves like a passive stockpile of tokens. Instead, it acts as a constantly shifting risk surface.

Modern crypto market makers actively manage this exposure through dynamic pricing models. They adjust quote widths and skew in real time based on volatility, correlation, and current positioning. When inventory drifts out of balance, pricing tilts deliberately to attract opposing flow. The objective is not prediction. Instead, the goal is neutrality. Profit emerges from maintaining stability under stress rather than betting on market direction.

As a result, this shift has turned crypto market makers into continuous risk processors. Their success depends less on market opinion and more on execution speed, capital efficiency, and the ability to survive adverse flows without losing inventory control.

Crypto market makers inside fragmented execution environments

Fragmentation now defines crypto markets. Liquidity no longer resides in a single order book or even on a single chain. Instead, it spreads across centralized exchanges, automated market makers, concentrated liquidity pools, and intent based systems that never expose trades to public mempools.

Crypto market makers remain uniquely positioned to operate across all of these layers at once. They route inventory between venues, arbitrage price discrepancies, and internalize order flow whenever possible. This process requires deep technical integration, not only with exchanges, but also with blockchains themselves.

Firms such as Wintermute and GSR exemplify this transition. Their operations extend far beyond quoting markets. They manage cross venue exposure, deploy liquidity on chain, and design execution strategies that minimize both slippage and information leakage.

In practice, crypto market makers increasingly function as infrastructure providers. Markets operate smoothly not because liquidity exists everywhere, but because a small number of highly capable actors actively synchronize it.

LIQUIDITY AFTER THE COLLAPSE OF LEVERAGE DRIVEN MODELS

Crypto market makers and the end of implicit guarantees

The collapse of FTX and its affiliated trading arm exposed a dangerous assumption that had quietly underpinned crypto liquidity for years. Leverage, opacity, and commingled risk subsidized market depth. Liquidity appeared abundant because losses had not yet materialized.

However, when that structure failed, the industry confronted an overlooked reality. Liquidity that ignores risk does not represent liquidity at all. Instead, it represents deferred volatility.

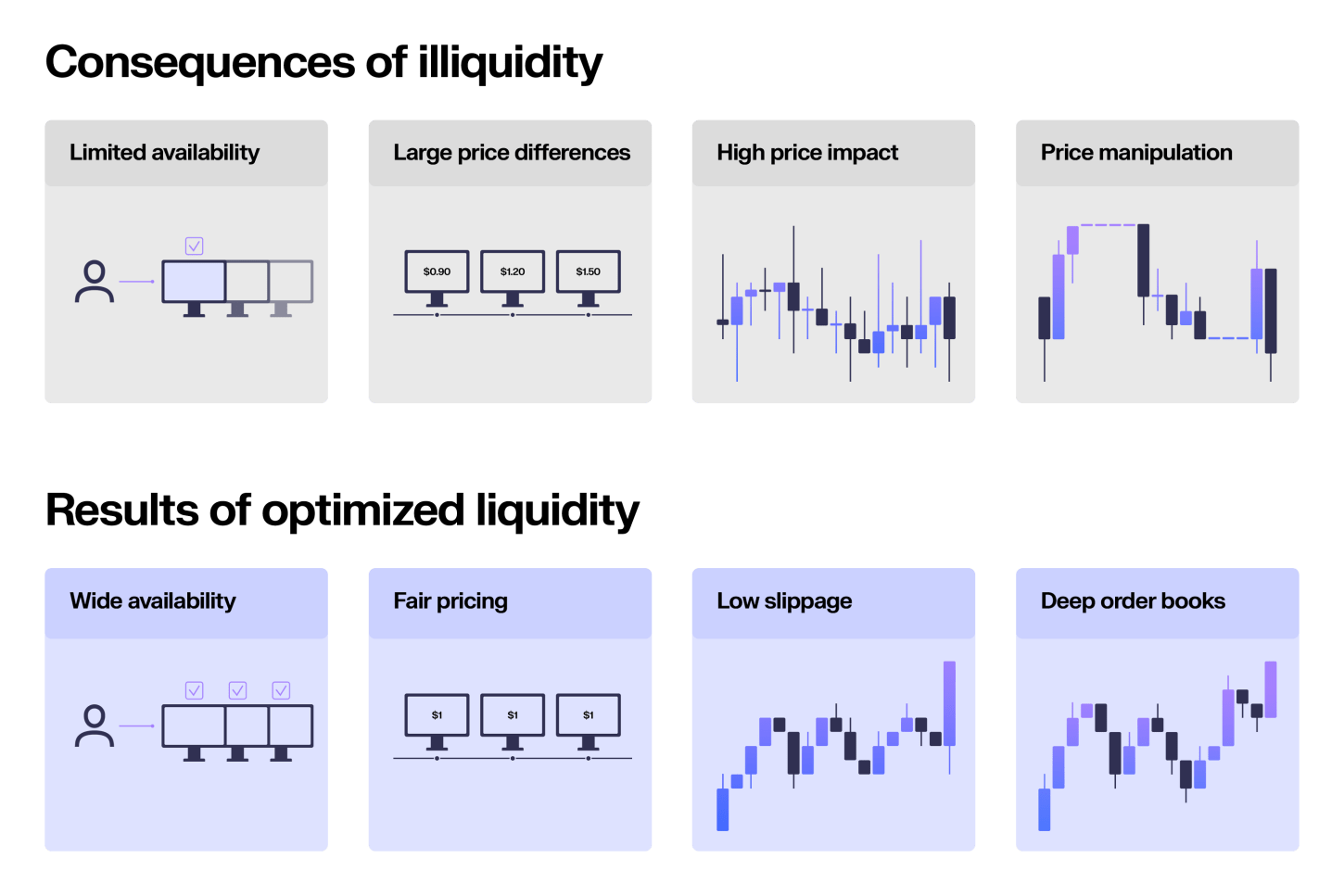

In the aftermath, crypto market makers adapted quickly. Balance sheets shrank. Inventory limits tightened. Risk controls became non negotiable. As a result, market depth visibly declined, especially outside major assets. This change did not represent regression. Rather, it marked a necessary correction.

Liquidity returned only where markets could price risk correctly. Assets lacking organic flow or transparent risk profiles remained thin. Crypto market makers stopped acting as backstops for speculative excess. Instead, they demanded compensation for uncertainty or withdrew entirely.

Crypto market makers and institutional capital realignment

One of the most significant post crisis shifts involved the arrival of traditional financial participants through regulated vehicles. The approval of spot Bitcoin exchange traded products connected crypto liquidity with legacy capital markets.

Authorized participants such as Jane Street and Virtu Financial now play a critical role in maintaining price alignment between Bitcoin spot markets and ETF shares. Their mandate remains narrow. Nevertheless, their impact has proven profound.

As a result, liquidity strengthened at the top of the market while pressure increased on smaller assets. Crypto market makers operating outside Bitcoin and Ethereum now face a harsher environment. Capital selection tightened. Risk tolerance declined. Liquidity provision became conditional rather than assumed.

Overall, the market did not become less liquid. Instead, it became more discriminating. That distinction matters.

ON CHAIN LIQUIDITY AND THE HIDDEN COSTS OF DECENTRALIZATION

Crypto market makers versus passive liquidity providers

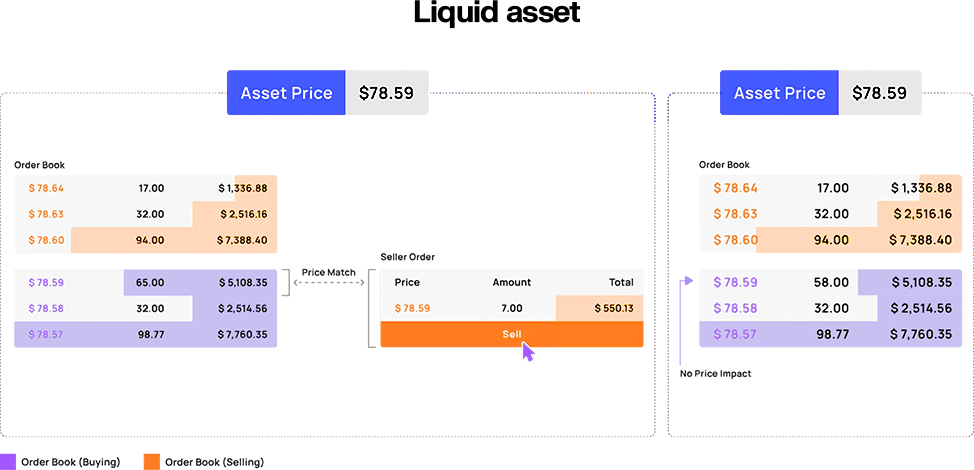

Decentralized exchanges once promised to democratize market making. Anyone could provide liquidity and earn fees. Over time, however, structural inefficiencies became increasingly difficult to ignore.

Automated market makers update prices only when trades occur. This delay allows arbitrageurs to extract value whenever external prices move first. Liquidity providers absorb the cost of this extraction through rebalancing losses.

For passive participants, providing liquidity can underperform simply holding the asset. Fees may offset losses in calm conditions. However, during periods of volatility, losses compound quickly. Crypto market makers understand this dynamic and design strategies that avoid acting as the passive counterparty.

Instead, they deploy liquidity tactically. They concentrate capital near active price ranges, withdraw during instability, and increasingly rely on just in time liquidity techniques that capture fees while minimizing exposure. As a result, execution improves for traders, but the distribution of rewards shifts.

Crypto market makers and the quiet recentralization of DEXs

A paradox has emerged. As decentralized exchanges grow more sophisticated, participation becomes more exclusive. Just in time liquidity, private transaction routing, and solver based execution favor actors with capital, infrastructure, and informational advantage.

Crypto market makers thrive in this environment. They commit large inventories for brief periods, capture fees with precision, and exit before risk materializes. Smaller participants cannot compete on these terms.

The outcome does not eliminate decentralization. Instead, it transforms it. Liquidity becomes modular, professionalized, and increasingly invisible to end users. What appears open on the surface often relies on a narrow set of dominant liquidity providers beneath.

FROM MARKET MAKING TO INTENT SOLVING

Crypto market makers inside intent based execution systems

Intent based trading represents the next stage of execution abstraction. Users no longer submit explicit trades. Instead, they express outcomes. Solvers compete to deliver the best execution.

Crypto market makers occupy a privileged position in this system. They hold inventory, understand price dynamics, and internalize trades without touching public liquidity pools. As a result, slippage declines, front running risk diminishes, and execution certainty improves.

However, this structure also concentrates power. Only participants with sufficient balance sheets and execution capabilities can compete effectively. As intent based systems scale, crypto market makers shift from liquidity providers to execution gatekeepers.

This evolution mirrors developments in traditional finance, where specialized firms internalize retail order flow. Crypto markets do not reject this model. They reconstruct it under different technical assumptions.

Crypto market makers and the future cost of liquidity

The long term implication remains clear. Markets will no longer treat liquidity as a public good. Instead, participants will price, optimize, and selectively deploy it. Crypto market makers will determine where liquidity concentrates and where it remains scarce.

This shift does not necessarily harm users. In many cases, execution quality improves. However, it reshapes the political economy of markets. Power moves from protocols to operators. It shifts from visible pools to invisible balance sheets.

Understanding this transition matters for anyone building, trading, or allocating capital in crypto. Markets do not fail when liquidity disappears. They fail when participants misunderstand liquidity.

WHY CRYPTO MARKET MAKERS NOW DEFINE MARKET STABILITY

Crypto market makers no longer sit at the periphery of the ecosystem. They form the connective tissue that holds fragmented markets together. They absorb volatility, manage risk, and determine how liquidity behaves under pressure. As the industry matures, their influence will continue to expand. Any serious analysis of crypto market structure must begin with crypto market makers, because they no longer merely participate in the market. They enable the market to function at all.