KEYTAKEAWAYS

- Stablecoins have entered a global regulatory expansion phase driven by the U.S. GENIUS Act and rapid adoption in Asia and Europe.

- Ethereum captures over half of all stablecoin supply and dominates on chain liquidity inflows, becoming the core beneficiary of the new stablecoin cycle.

- DeFi on Ethereum is accelerating again with rising TVL and stable yields, making stablecoins a mainstream yield instrument for global investors.

CONTENT

THE GLOBAL STABLECOIN WAVE HAS ALREADY STARTED

As the United States passes the GENIUS Act, the path forward for regulated stablecoins becomes clearer. Traditional and crypto native capital now have a compliant instrument for payments, settlement and liquidity provisioning.

The United States sets the tone with the GENIUS Act

On July 18, President Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act). The law recognizes stablecoins backed 1:1 by cash, bank deposits or U.S. Treasury bills. Issuers must operate under banking oversight or federal approval and publish monthly reserve reports with third party audits.

The U.S. has clearly chosen to advance regulated private stablecoins instead of a centralized CBDC. Key benefits include:

• Strengthening the dollar’s global currency position • Increasing demand for U.S. Treasuries • Accelerating cross border settlement and economic efficiency

Global regions move quickly on stablecoin regulation

Hong Kong enacted its stablecoin bill on August 1 The European Union began enforcing MiCA in 2024 Japan approved USDC as the only legally compliant dollar stablecoin South Korea is preparing a domestic won stablecoin through a consortium of eight banks

These developments indicate one direction: stablecoins are becoming a standardized global instrument for payments and financial infrastructure.

STABLECOIN MARKET SIZE AND DISTRIBUTION

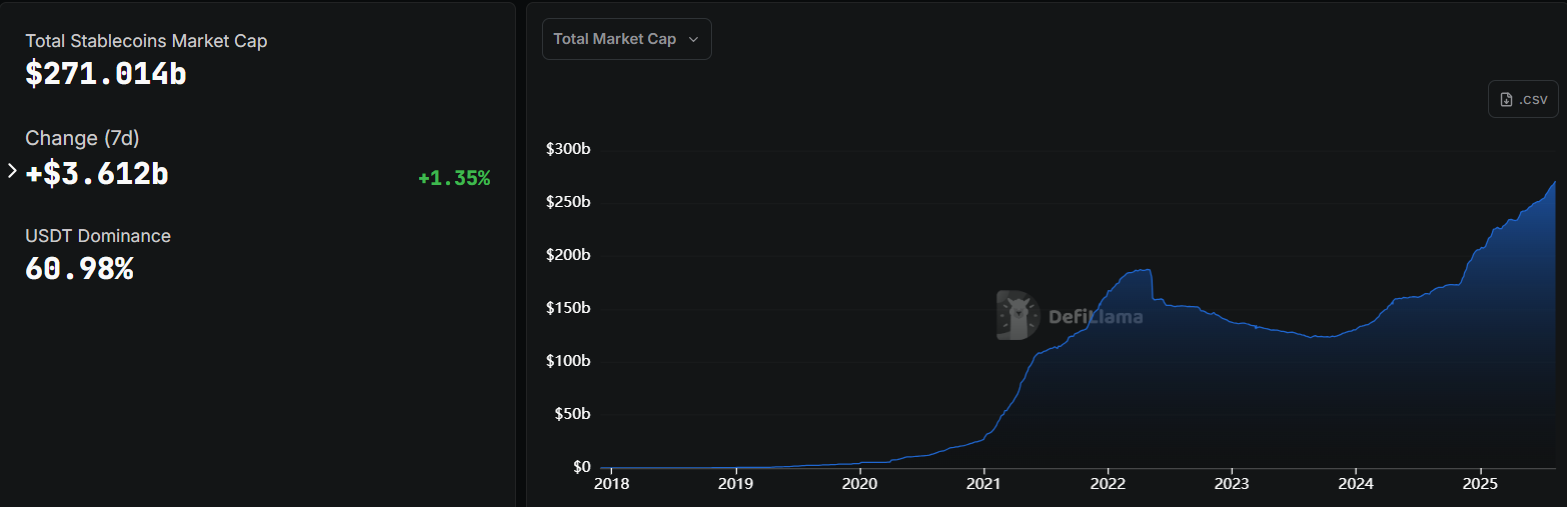

The total stablecoin market cap has reached 270 billion dollars, doubling the 2021 peak. USDT leads with 164.5 billion dollars (60 percent market share). USDC follows at 65.2 billion dollars. New generation stablecoins like USDe and USDS contribute additional momentum.

Across ecosystems, USDT and USDC capture over 85 percent market share. On Ethereum, USDT accounts for 49 percent and USDC for 29 percent.

ETHEREUM BECOMES THE BIGGEST BENEFICIARY

Ethereum hosts over half of all stablecoins in circulation, giving it unmatched DeFi liquidity depth.

On chain capital flows confirm Ethereum’s dominance

Artemis data shows strong liquidity concentration:

• Inflows: 21.2 billion dollars • Outflows: 12.8 billion dollars • Net inflow: 8.4 billion dollars

Other chains remain largely unchanged, highlighting Ethereum’s clear advantage in capturing stablecoin driven liquidity.

Ethereum DeFi enters a new growth phase

As inflows accelerate, TVL across major Ethereum DeFi protocols grows by roughly 50 percent month over month. Institutional and traditional finance participants increasingly allocate to lower risk and yield stable on chain products.

Ethereum’s DeFi ecosystem is becoming the preferred environment for stable yield strategies.

HOW USERS CAN EARN YIELD WITH STABLECOINS

Holding stablecoins is no longer only about trading convenience. Users can earn yield through:

Centralized exchange products

Platforms like Binance, Bybit and OKX offer stablecoin earn programs and structured products.

Decentralized DeFi protocols

Users can earn through DEX LP positions, perps DEX liquidity, lending protocols like AAVE or ecosystems like Hyperliquid.

Typical yields range from 4 to 10 percent annually, with higher returns available in DeFi for users comfortable with protocol risk.

CONCLUSION

The global stablecoin wave is fully underway. Ethereum stands as the earliest and biggest winner. ETH returned above four thousand dollars and major protocols continue expanding. For institutional and traditional investors seeking low risk and stable yield, Ethereum remains the preferred on chain destination.

As more jurisdictions finalize stablecoin regulation, holding regulated fiat stablecoins will become a global habit. Payments and on chain financial applications will accelerate. Stablecoins are evolving into a universal digital money layer with Ethereum at the center of this transformation.