KEYTAKEAWAYS

-

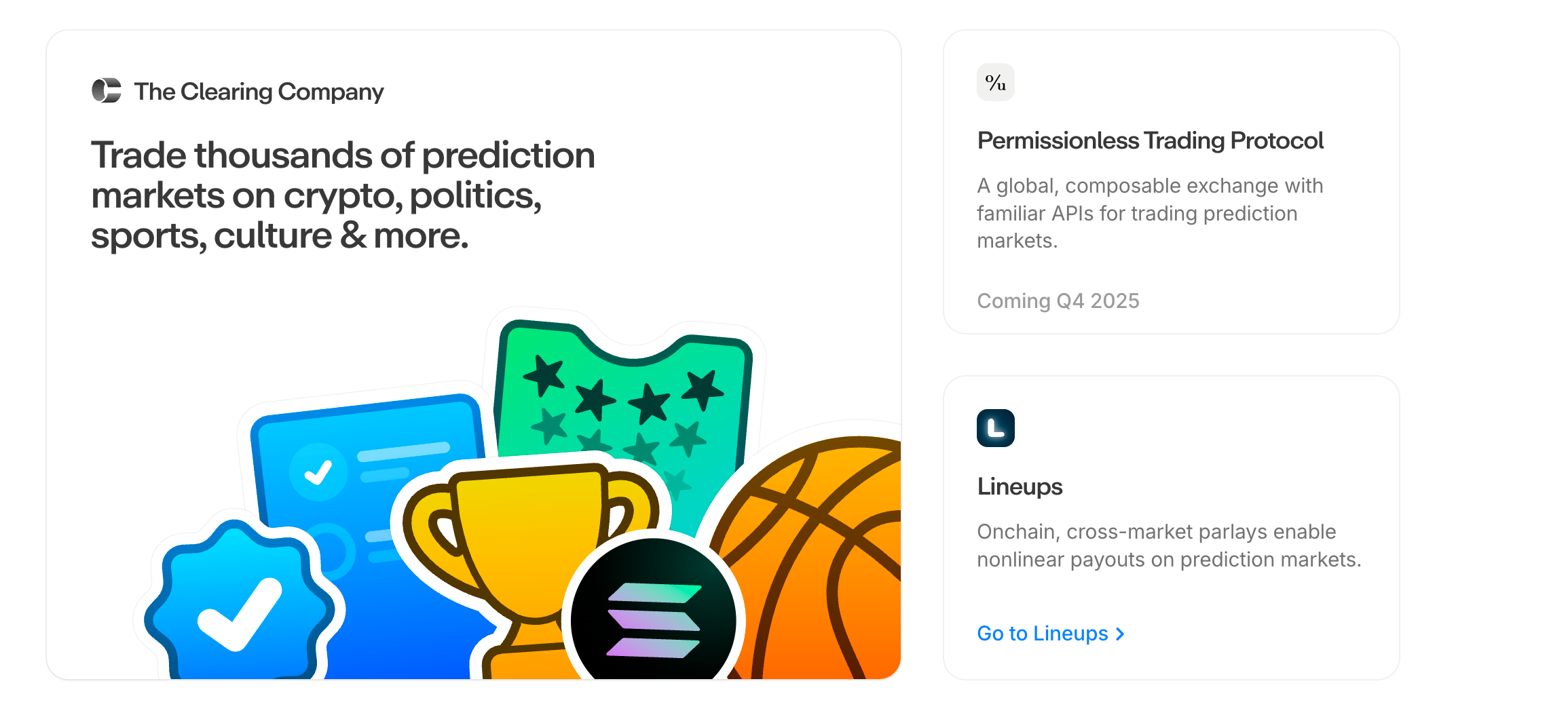

Coinbase’s acquisition of The Clearing Company is not about prediction markets as a product, but about owning the verification layer where real world outcomes are resolved and enforced.

The deal targets the structural bottleneck of prediction markets: who has the authority to declare truth at scale.

-

By institutionalizing resolution through a regulated clearing model, prediction markets shift from experimental crypto applications to infrastructure that institutional capital can actually use.

Resolution risk becomes regulatory risk, replacing social consensus with legal accountability.

-

Base and USDC enable prediction markets to operate as continuous financial rails, where real world events are priced, settled, and enforced in real time rather than debated after the fact.

This architecture turns information itself into a tradable, capital weighted asset class.

CONTENT

FROM EXPANSION NARRATIVE TO VERIFICATION CONTROL

When Coinbase confirmed its acquisition of The Clearing Company, much of the early commentary framed the move as a routine expansion into prediction markets. That interpretation is convenient, but incomplete. This deal is not about adding another trading vertical or chasing a new source of transaction fees. It is about control over verification.

Prediction markets have always promised more than speculation. They offer a mechanism to price the future through capital rather than opinion. Prices aggregate belief, information, and conviction into a single probability signal. Yet despite growing participation and cultural relevance, prediction markets have never crossed into true financial infrastructure. The reason is not demand. It is resolution.

No market can scale if the question of what actually happened remains unstable.

FROM MARKET PARTICIPATION TO VERIFICATION AUTHORITY

Every prediction market eventually reaches the same moment. An election concludes. A court ruling is issued. A data release becomes official. At that point, the system must decide which outcome is final.

Blockchains cannot observe reality. They rely on external inputs. In prediction markets, this dependency becomes existential. The mechanism that injects real world outcomes into the system determines whether the market is credible or fragile.

Decentralized oracle designs attempted to solve this through social consensus and token based disputes. In theory, anyone could challenge an incorrect outcome. In practice, resolution slows as stakes increase. Disputes become costly. Attack surfaces expand. Markets designed for efficiency become uncertain precisely when certainty matters most. Institutional capital does not tolerate that ambiguity.

Centralized approaches resolve outcomes faster, but collapse into trust assumptions. Users must believe the operator will act honestly. Regulators see opaque discretion rather than enforceable process. Legal exposure accumulates. Prediction markets did not stall because people stopped caring. They stalled because no one truly owned the outcome.

WHY CLEARING MATTERS MORE THAN MARKET DESIGN

The Clearing Company approached this problem from a different direction. Instead of focusing on interfaces or market creation, it focused on the clearing layer. Its insight was structural. Verification, not trading, was the bottleneck.

By positioning itself as a stablecoin native clearing entity and seeking recognition as a regulated derivatives clearing organization, TCC reframes resolution as an institutional responsibility. Outcomes are not decided by token votes or platform preference. They are signed by an entity that carries explicit legal accountability.

Execution and settlement still occur on chain. Capital moves automatically through smart contracts using stablecoins. What changes is the source of authority at the moment of resolution. Code does not attempt to judge reality. Code enforces the consequences of a legally recognized outcome.

This shift is subtle but decisive. Resolution risk becomes regulatory risk. And regulatory risk, unlike social consensus, can be audited, modeled, and priced. That is the threshold institutions require before engaging at scale.

WHEN CODE STOPS ARGUING AND STARTS ENFORCING

Prediction markets are operationally demanding. They involve frequent trades, small position sizes, and a long tail of niche events. High transaction costs destroy the economics. Without cheap execution, the model collapses.

Coinbase’s Base network provides an environment where micro markets can exist without friction. Low fees allow continuous trading. Settlement becomes constant rather than periodic. Markets can follow real world events as they unfold instead of lagging behind them.

Stablecoin native clearing plays an equally important role. USDC is not merely a settlement asset in this architecture. It is the accounting unit that aligns on chain execution with compliance and risk frameworks. Funds settle instantly while remaining legible to auditors and regulators. Capital efficiency improves without sacrificing clarity.

This architecture reflects a broader shift in crypto thinking. For years, the industry argued that code itself could replace institutions. Prediction markets expose the limits of that belief. In the real world, truth is established through formal processes. Elections are certified. Courts rule. Authorities publish data.

Coinbase’s acquisition of The Clearing Company signals a different thesis. Instead of challenging legal authority, it integrates with it. Verification becomes institutional. Blockchain infrastructure becomes the execution layer that enforces those decisions transparently and in real time.

If this model succeeds, prediction markets will no longer sit at the margins of finance. They will evolve into probabilistic risk instruments embedded across the economy. Information itself becomes a tradable asset class, priced not by narrative, but by capital weighted probability.