KEYTAKEAWAYS

- Kraken has formally launched its IPO process through a confidential S 1 filing, positioning itself to become the next major US crypto exchange to enter public markets, potentially as early as mid 2026.

- With strong profitability, accelerating revenue growth, and a $20 billion valuation backed by top tier financial institutions, Kraken stands out as one of the few crypto native companies that can meet traditional capital market expectations.

- Kraken’s expansion beyond spot trading into derivatives, tokenized equities, payments, institutional services, and self custody signals a strategic shift toward building a full stack crypto financial ecosystem rather than a single product exchange.

CONTENT

In 2025, the United States has effectively become the center of the crypto industry. Another major milestone has now arrived. Kraken, one of the oldest US based cryptocurrency exchanges, has formally submitted a confidential S 1 filing to the US Securities and Exchange Commission, marking the start of its IPO process.

Founded in 2011, Kraken is one of the few early era crypto exchanges that has survived and scaled into the current cycle. After Coinbase paved the way years ago, the US market has seen limited native crypto exchange listings. Kraken’s move signals a new phase in the convergence between crypto markets and traditional finance.

In November 2025, Kraken completed a two stage financing round totaling $800 million, bringing its latest valuation to $20 billion. This figure already exceeds the market capitalization of Circle at the time of writing, which stands near $18 billion. As a result, expectations around Kraken’s IPO have intensified.

Market consensus suggests Kraken could complete its listing around mid 2026, positioning it as one of the most significant crypto finance crossover events of the year.

KRaken IPO PROCESS

In November 2025, Kraken submitted a draft S 1 registration statement to the US Securities and Exchange Commission through a confidential filing. This officially initiated the IPO process, while keeping detailed disclosures private until a later stage.

As a result, key information remains undisclosed. This includes whether Kraken will list on the New York Stock Exchange or Nasdaq, as well as its ticker symbol, offering size, and pricing range.

Based on recent fundraising momentum and regulatory timing, market observers believe Kraken could reach the public markets in the first half or middle of 2026 if approvals proceed smoothly.

The latest funding round included participation from major financial and quantitative firms. A $600 million primary round was backed by Jane Street, DRW, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital. An additional $200 million strategic investment came from Citadel Securities. The combined round set Kraken’s valuation at $20 billion.

Kraken’s IPO is closely watched not only because of its long operating history, but because it has demonstrated sustained profitability while actively expanding its business scope. The listing is widely seen as another key intersection between crypto markets and traditional financial systems.

MARKET EXPECTATIONS AROUND KRAKEN

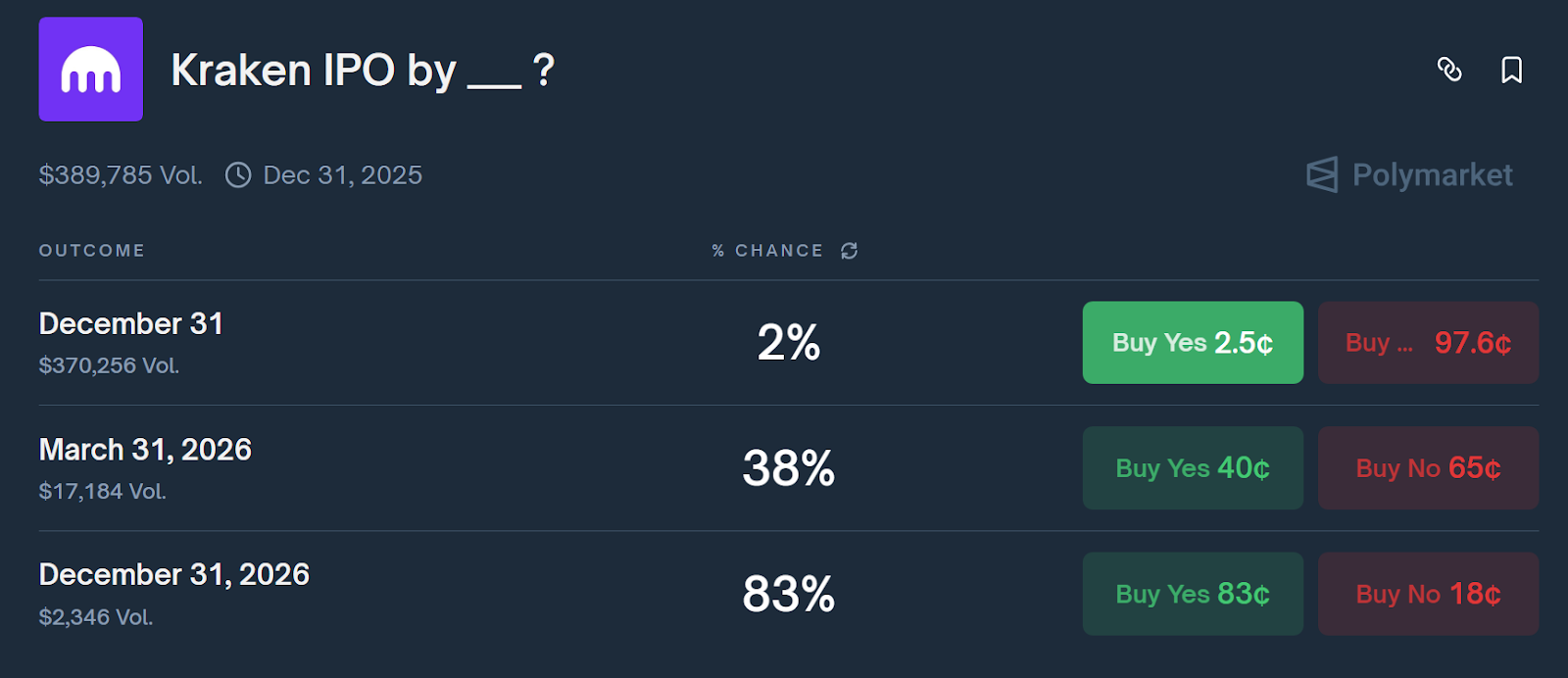

Prediction markets and investor estimates have converged around a relatively narrow range for Kraken’s potential IPO valuation. Most expectations fall between $16 billion and $22 billion.

In terms of timing, forecasts lean toward a listing after the second quarter of 2026. These projections reflect growing confidence in Kraken’s fundamentals and the maturing valuation framework applied to crypto native companies in public markets.

KRAKEN FINANCIAL PERFORMANCE

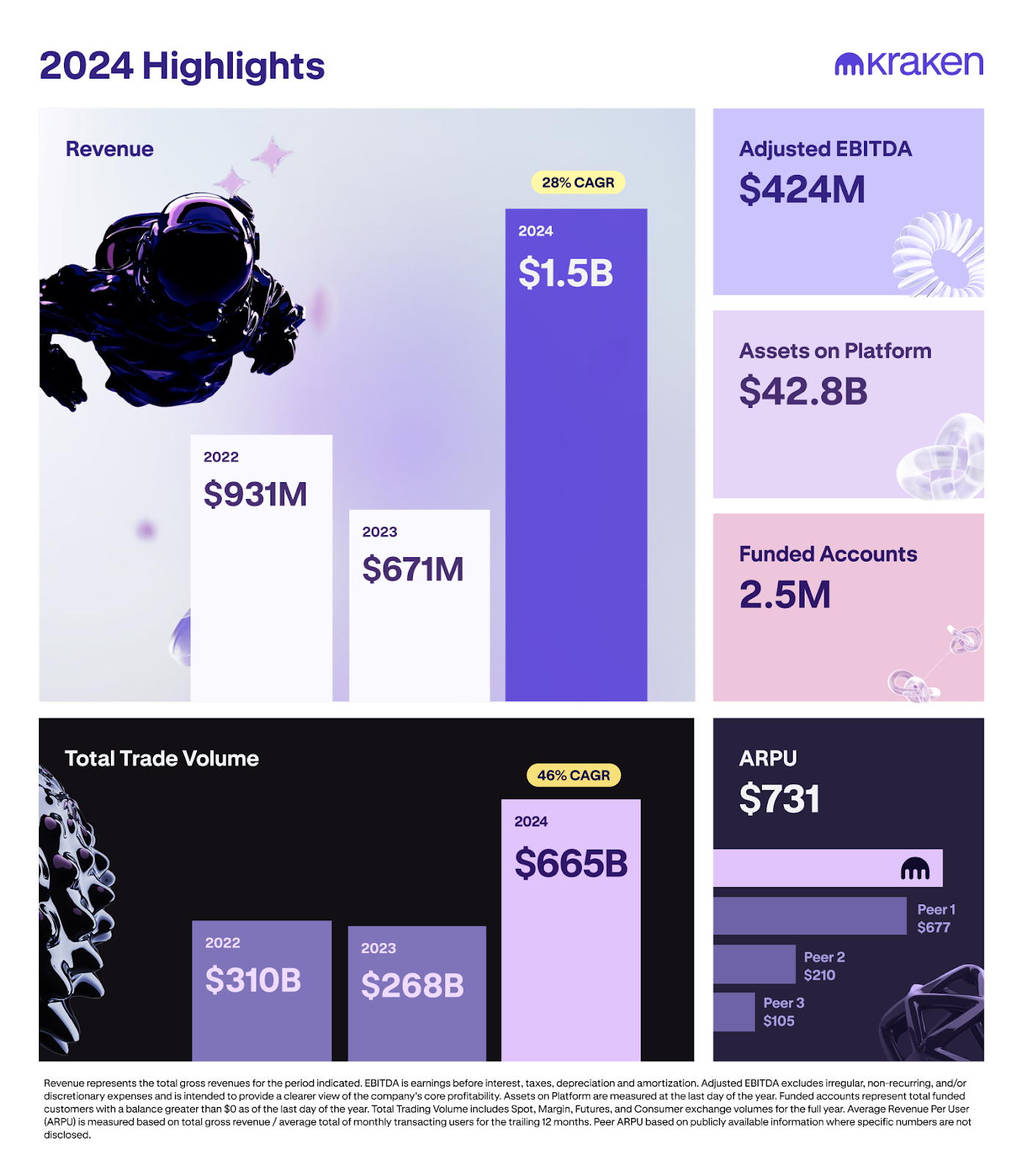

Kraken stands out among exchanges for its demonstrated ability to generate consistent operating profits.

In 2024, Kraken reported approximately $1.5 billion in annual revenue, more than doubling year over year. Adjusted EBITDA reached $424 million. The platform managed roughly $42.8 billion in assets, served about 2.5 million funded active accounts, and processed $665 billion in annual trading volume. On average, each funded account generated more than $700 in revenue.

While full year 2025 figures have not yet been released, revenue from the first three quarters alone has already exceeded total revenue from 2024. This suggests continued expansion across core business metrics.

For crypto exchanges, which operate as asset light platforms, EBITDA is a key indicator of operational health. Kraken’s EBITDA performance highlights a strong and scalable core business model.

KRAKEN ECOSYSTEM EXPANSION

Although Kraken built its foundation on spot trading, it has evolved far beyond a single product exchange. The company is now developing a multi line financial ecosystem.

Spot trading remains the core revenue engine and liquidity base. At the same time, Kraken has aggressively expanded into derivatives. The acquisition of NinjaTrader enabled entry into retail focused futures and options trading. The purchase of Small Exchange provided access to US regulated futures exchange infrastructure, laying the groundwork for compliant derivatives operations in the United States.

In the tokenized assets sector, Kraken began offering tokenized US equities to non US users in 2025. These products allow stocks to trade on chain around the clock, and are viewed as a key bridge between traditional financial assets and blockchain infrastructure.

Kraken has also extended into payments and peer to peer transfers, aiming to build a closed loop experience that connects trading, asset management, and everyday transactions. For institutional clients, the platform offers OTC trading, block execution, API based trading, clearing services, and prime style solutions.

Launched in 2024, Kraken Wallet represents the company’s move into self custody and Web3 access. The wallet emphasizes simplicity and lowers the barrier for users entering decentralized applications and on chain ecosystems.

Taken together, Kraken is building an integrated structure spanning spot trading, derivatives, tokenized assets, payments, institutional services, and self custody wallets.

PUBLICLY LISTED CRYPTO COMPANIES IN THE US

Before Kraken, several crypto related companies have already entered US public markets.

Coinbase remains the most prominent example. It listed on Nasdaq in 2021 as the first publicly traded crypto exchange in the United States, and continues to serve as a benchmark for market valuation of the sector.

Bullish completed its IPO on the New York Stock Exchange in August 2025, with a focus on institutional trading infrastructure. Gemini also went public on Nasdaq in 2025, becoming another US based crypto exchange brand to reach public markets.

While not an exchange, stablecoin issuer Circle listed on the New York Stock Exchange in 2025. Its IPO raised more than $1 billion, and the company’s market value rose rapidly after listing. Circle’s debut is widely viewed as a milestone in crypto’s integration into mainstream financial markets.

CONCLUSION

The boundary between crypto and traditional finance is disappearing at an accelerating pace.

Following the launch of Bitcoin and Ethereum spot ETFs in 2024, and a wave of crypto related IPOs in 2025, digital asset companies are being absorbed into mainstream capital markets at visible speed.

Within this broader trend, Kraken’s IPO represents more than a single corporate milestone. It reflects a structural shift toward financialization, regulatory integration, and mass adoption. Crypto is steadily becoming part of everyday financial infrastructure, and Kraken’s public listing marks another step toward that outcome.