KEYTAKEAWAYS

- Data cited by CoinTelegraph, CertiK, and other independent analysts shows that total crypto losses exceeded $3.3 billion, even as the overall number of security incidents declined.

- A small number of supply chain and infrastructure-level attacks accounted for a disproportionate share of losses, with just two incidents responsible for nearly half of the annual total.

- The shift toward low-frequency, high-impact attacks highlights the growing importance of holistic security and operational resilience as institutional participation in crypto expands.

- KEY TAKEAWAYS

- MULTIPLE REPORTS CONFIRM A SHARP RISE IN TOTAL LOSSES

- FEWER INCIDENTS, BUT A MUCH HIGHER AVERAGE LOSS

- SUPPLY CHAIN ATTACKS ACCOUNT FOR A DISPROPORTIONATE SHARE OF LOSSES

- THE BYBIT INCIDENT AS A CASE STUDY IN SYSTEMIC RISK

- A SHIFT IN THE NATURE OF CRYPTO SECURITY RISK

- SECURITY AS A GATEWAY TO INSTITUTIONAL ADOPTION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Despite fewer reported incidents, crypto security losses surged to over $3.3 billion as high-impact supply chain and infrastructure attacks reshaped the industry’s risk landscape, according to multiple authoritative reports.

MULTIPLE REPORTS CONFIRM A SHARP RISE IN TOTAL LOSSES

According to consolidated reporting by CoinTelegraph, CertiK, and independent coverage by Business Insider, total losses from cryptocurrency hacks, exploits, and scams reached approximately USD 3.3–3.35 billion over the year, despite a noticeable decline in the total number of security incidents.

This divergence highlights a structural change in the crypto threat landscape: while basic vulnerabilities and opportunistic attacks are becoming less frequent, the financial impact of successful breaches has increased sharply, driven by highly targeted and sophisticated attack vectors.

FEWER INCIDENTS, BUT A MUCH HIGHER AVERAGE LOSS

Data cited by CoinTelegraph from CertiK’s annual security review shows that the number of recorded crypto security incidents fell year over year, yet the average loss per incident increased by more than 60%, reaching roughly USD 5.3 million per event.

This trend is corroborated by analysis from Chainalysis, which has repeatedly noted that attackers are increasingly prioritizing high-value infrastructure targets over smaller, retail-focused exploits, amplifying the economic consequences of each successful attack.

SUPPLY CHAIN ATTACKS ACCOUNT FOR A DISPROPORTIONATE SHARE OF LOSSES

One of the most significant findings emphasized across multiple reports is the role of supply chain vulnerabilities. CertiK data, cited by both CoinTelegraph and Business Insider, indicates that only two major supply chain incidents accounted for approximately USD 1.45 billion in losses, representing nearly half of total crypto-related losses during the year.

Unlike traditional smart contract exploits, supply chain attacks typically target third-party dependencies, developer environments, or infrastructure providers, allowing attackers to bypass conventional audit processes and inflict significantly larger damage.

THE BYBIT INCIDENT AS A CASE STUDY IN SYSTEMIC RISK

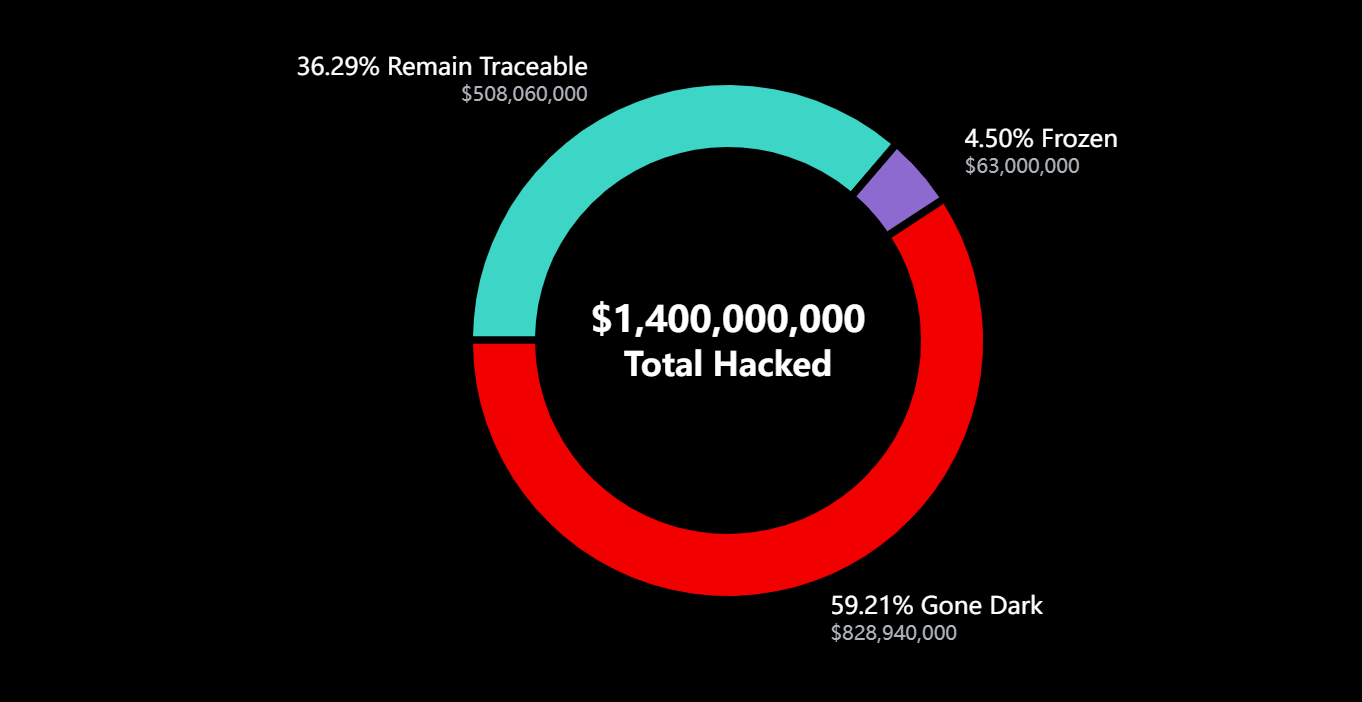

Among all reported incidents, the February Bybit security breach stands out as the most severe single event. According to CoinTelegraph and Business Insider, approximately USD 1.4 billion in digital assets were compromised, making it one of the largest crypto hacks ever recorded.

Post-incident reporting from CoinTelegraph confirmed that Bybit conducted extensive security remediation, including multiple external audits and operational upgrades, and subsequently restored platform liquidity within roughly 30 days, underscoring both the scale of the breach and the resilience required to recover from such systemic shocks.

A SHIFT IN THE NATURE OF CRYPTO SECURITY RISK

Taken together, insights from CoinTelegraph, CertiK, and Chainalysis point to a clear evolution in crypto security risk. While improvements in baseline smart contract security may be reducing the frequency of smaller exploits, infrastructure-level and dependency-driven attacks are becoming the dominant source of financial loss.

This shift has important implications for exchanges, protocols, and institutional participants, as traditional code audits alone are increasingly insufficient to address the most damaging threat vectors.

SECURITY AS A GATEWAY TO INSTITUTIONAL ADOPTION

As regulatory clarity improves and institutional participation in digital assets expands, security performance is emerging as a decisive factor in market trust. Analysis across multiple reports suggests that future adoption will depend not only on compliance and licensing, but also on demonstrable resilience against low-frequency, high-impact attacks.

In this context, the latest loss figures reflect more than isolated incidents; they represent a stress test for the industry’s operational maturity and its ability to function as part of a broader financial system.

Read More:

Binance Co-CEO Yi He’s Account Hack Exposes Critical Security Risks Behind Meme-Coin Manipulation