KEYTAKEAWAYS

- U.S. Bitcoin spot ETFs logged approximately $19.29 million in net outflows in a single day, extending their net-outflow streak to seven consecutive sessions, with only Fidelity’s FBTC posting inflows and Invesco’s BTCO leading outflows.

- U.S. Ethereum spot ETFs recorded $9.63 million in net outflows, driven mainly by BlackRock’s ETHA, while Fidelity’s FETH was the sole product to attract new capital.

- In contrast to BTC and ETH ETFs, several altcoin spot ETFs—including Solana, XRP, and LINK—registered net inflows, while DOGE, LTC, and HBAR products saw flat fund flows.

CONTENT

U.S. crypto ETFs continued to face sustained selling pressure, with Bitcoin spot ETFs recording seven consecutive days of net outflows while Ethereum ETFs also posted net withdrawals, even as selective altcoin products saw modest inflows.

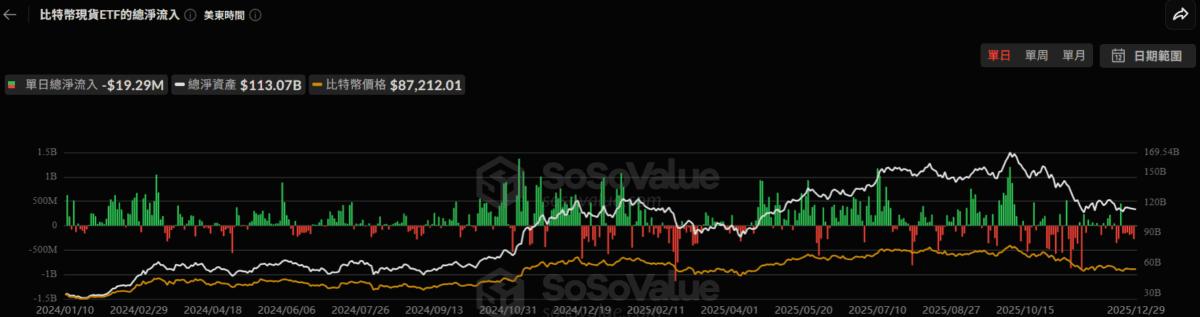

According to data from SoSoValue, U.S. Bitcoin spot exchange-traded funds (ETFs) recorded approximately $19.29 million in net outflows on Monday, marking the seventh consecutive day of net outflows. Over the past ten trading days, these ETFs posted net inflows on only one day.

Among the 12 Bitcoin spot ETFs, only Fidelity’s FBTC recorded net inflows yesterday, totaling approximately $5.7 million. The largest net outflow came from Invesco’s BTCO, which saw outflows of $10.41 million.

Daily fund flows of U.S. Bitcoin spot ETFs

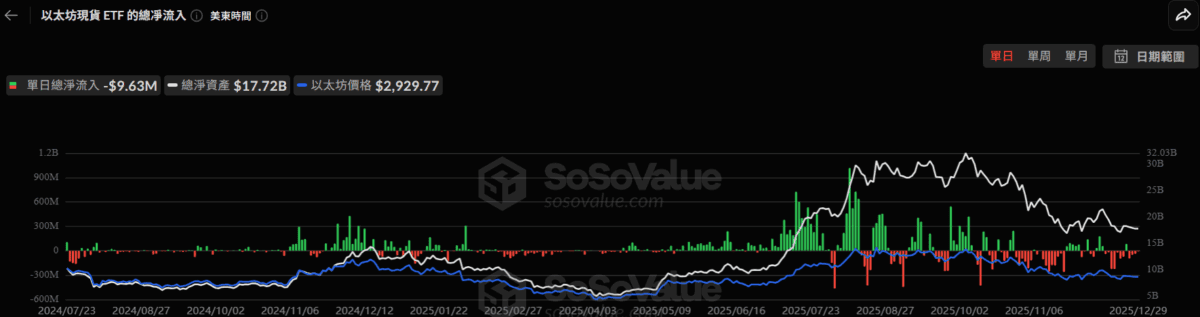

U.S. Ethereum spot ETFs recorded net outflows of $9.63 million yesterday, primarily driven by BlackRock’s ETHA, which saw outflows of $13.28 million. The only ETF with net inflows was Fidelity’s FETH, totaling $3.65 million. The remaining seven ETFs recorded zero net flows.

Daily fund flows of U.S. Ethereum spot ETFs

In other altcoin fund products, eight Solana spot ETFs recorded combined net inflows of $2.93 million; five XRP spot ETFs posted total net inflows of $8.44 million; and Grayscale’s LINK spot ETF recorded approximately $544,000 in net inflows. Two Dogecoin (DOGE) spot ETFs, as well as Canary’s Litecoin (LTC) ETF and HBAR ETF, all recorded zero net flows.

Read More:

Bitcoin ETF: From Institutional Trials to Long-Term Allocation

Bitcoin ETFs Look Less Powerful — Because the Market Is Changing