KEYTAKEAWAYS

- Most new tokens launched in 2025 suffered severe losses, with median prices down about 71% from initial FDV.

- Capital rotated away from high-valuation narratives toward mature crypto infrastructure with clearer cash-flow potential.

- The few winning new tokens shared low initial valuations, later launch timing, and higher product maturity.

CONTENT

2025 became a brutal year for new crypto tokens as liquidity tightened and valuations collapsed, marking the end of speculative launches and a shift toward fundamentals-driven capital allocation.

When the tide goes out, you discover who’s been swimming naked. By the end of the year, the true structure of the market has finally been laid bare. For most crypto investors, 2025 is shaping up to be a painful “year of new-token deaths” best left forgotten. As liquidity tightens and risk appetite cools rapidly, newly issued tokens have faced across-the-board valuation compression. Among them, infrastructure and gaming—once the most heavily hyped sectors—have suffered the most severe damage.

Capital is no longer willing to pay for distant growth narratives or lofty fully diluted valuations. Instead, it is clearly rotating back toward more mature crypto core infrastructure with clearer paths to cash flow and stronger network effects. This shift not only signals the end of a speculative cycle, but also reflects the crypto market’s transition into a more pragmatic, fundamentals-driven phase. Based on on-chain data from an OX Research report, this article reviews the true flow of capital toward year-end from two perspectives: index performance and the actual returns of newly launched tokens.

>>> More to read: Stablecoin Regulation: Institutional Logic, Regulatory Paths, and Structural Impact on Global Finance

CRYPTO ASSETS UNDER PRESSURE AS RISK AVERSION RISES

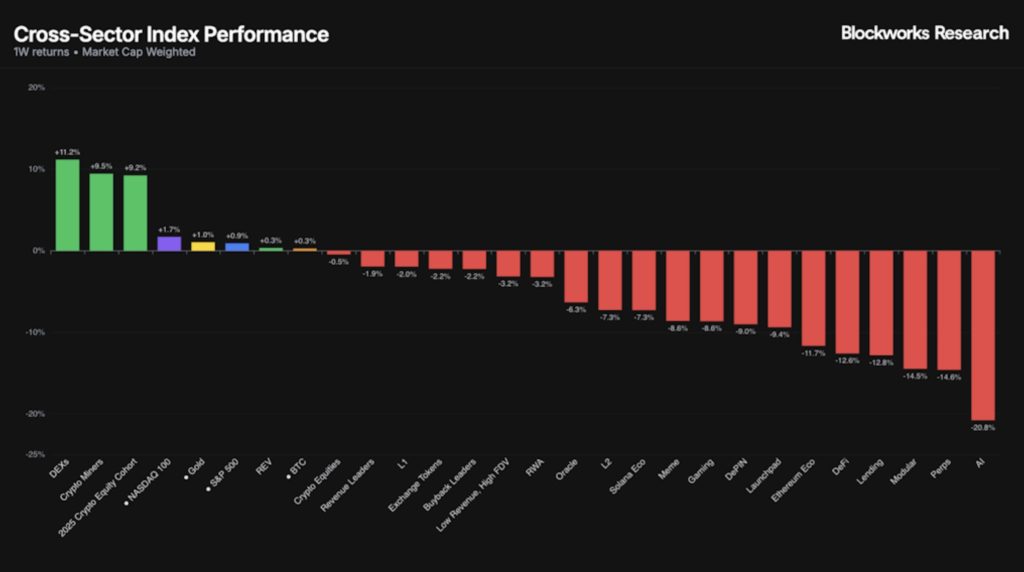

From a market-wide perspective, Bitcoin (BTC) was nearly flat last week, clearly underperforming the Nasdaq, the S&P 500, and gold. This divergence became even more pronounced around December 18: while most crypto sectors declined in tandem, U.S. equities remained relatively stable. This pattern suggests a rise in risk aversion specifically toward crypto assets, rather than a simple deterioration in the broader macroeconomic environment.

Among sector indices, decentralized exchanges (DEXs) delivered the strongest performance, followed by crypto miners and 2025 crypto equity funds. The rally in DEXs was largely driven by UNI, which surged 15.4% over the week. Earlier, a key Uniswap governance proposal passed its on-chain vote, with roughly 69 million UNI participating. Of these, 40 million tokens met the quorum and voted in favor, acting as a short-term bullish catalyst.

In contrast, Layer 1 blockchains (L1s) and exchange platform tokens edged lower. The artificial intelligence (AI) sector ranked last, mainly due to weakness in TAO. Market participants generally attribute this to Bittensor’s first halving in mid-December. Although the halving cut daily issuance by half, it failed to generate immediate incremental demand. Instead, it triggered a classic “sell-the-news” reaction, compounded by broader risk-off positioning across AI tokens, further amplifying downside pressure.

>>> More to read: Messari’s 2026 Crypto Theses: Power Struggles, Stablecoins, and Skepticism (Part 2)

THE BRUTAL REALITY OF NEW TOKENS: NEGATIVE RETURNS AS THE NEW NORMAL

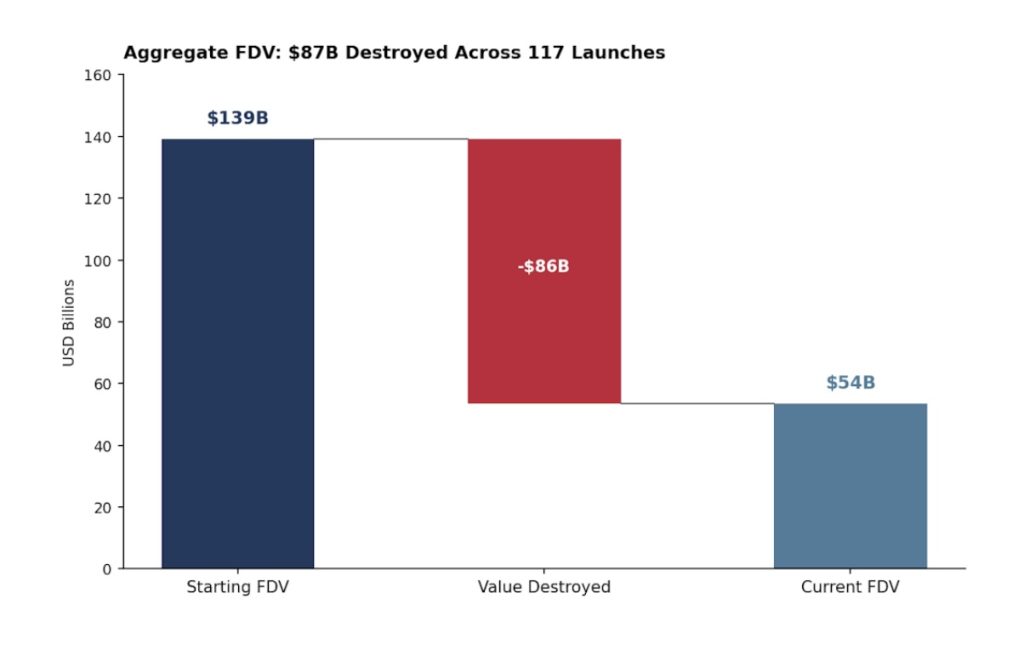

If sector rotation already hinted at where capital is flowing, the return data of newly launched tokens delivers an even harsher verdict on 2025. According to research, 117 new tokens were launched during the year, and the vast majority have posted negative returns since listing. The median token price is down roughly 71% from its initial fully diluted valuation (FDV), with only 17 tokens—about 15%—still trading above their launch valuation.

The declines are not only widespread but severe. Around 40% of tokens have fallen by more than 80%, and overall, 85% are now trading below their issuance value. Losses are most heavily concentrated in the 50% to 90% drawdown range, indicating that most projects did not collapse overnight but instead bled slowly, becoming increasingly marginalized by the market over time.

Extreme cases are equally striking. Fifteen tokens have dropped by more than 90%, including several once highly anticipated “star” projects such as Berachain (-93%), Animecoin (-94%), and Bio Protocol (-93%). In aggregate terms, the total FDV of this cohort has shrunk from USD 139 billion at launch to roughly USD 54 billion. This implies that around USD 87 billion—nearly 60% of headline, paper valuations—has been wiped out by the market, even before accounting for projects that have effectively gone to zero.

>>> More to read: Blockchain Is the Foundation, Web3 Is the City

COMMON TRAITS AMONG THE FEW WINNING NEW TOKENS

Despite the bleak overall performance, right-tail dispersion still exists—but it is highly concentrated. The worst performers are largely clustered around infrastructure and gaming narratives, with projects like Syndicate and Animecoin posting drawdowns of more than 93%. By contrast, the small group of standout winners share several clear characteristics: later launch timing, lower initial valuations, and higher product maturity. Examples such as Aster (+745%), Yooldo Games (+538%), and Humanity (+323%) all launched in the second half of the year, successfully avoiding the structural trap of high-FDV issuances.

In summary, 2025 does not mark the end of crypto, but rather the end of the easy gains from new token launches. Capital has made its stance clear: it prefers mature, verifiable infrastructure over blind bets on high-valuation projects. For investors, the most important lesson of the year may be that in an environment where liquidity is no longer abundant, valuation, timing, and fundamentals ultimately matter far more than a compelling story well told.