KEYTAKEAWAYS

- Bitcoin exposure has driven MSTR’s derivatives open interest to extreme levels, signaling heavy leverage speculation around MicroStrategy stock.

- Despite the hype, MSTR shares are down about 50% in 2025, far underperforming Bitcoin, with mNAV compressing toward parity.

- Rising STRC dividends and potential MSCI index exclusion add financial and structural risks for MicroStrategy investors.

CONTENT

Michael Saylor says Bitcoin made MicroStrategy (MSTR) interesting as derivatives open interest soars, mNAV compresses, dividends rise, and MSCI index risks loom.

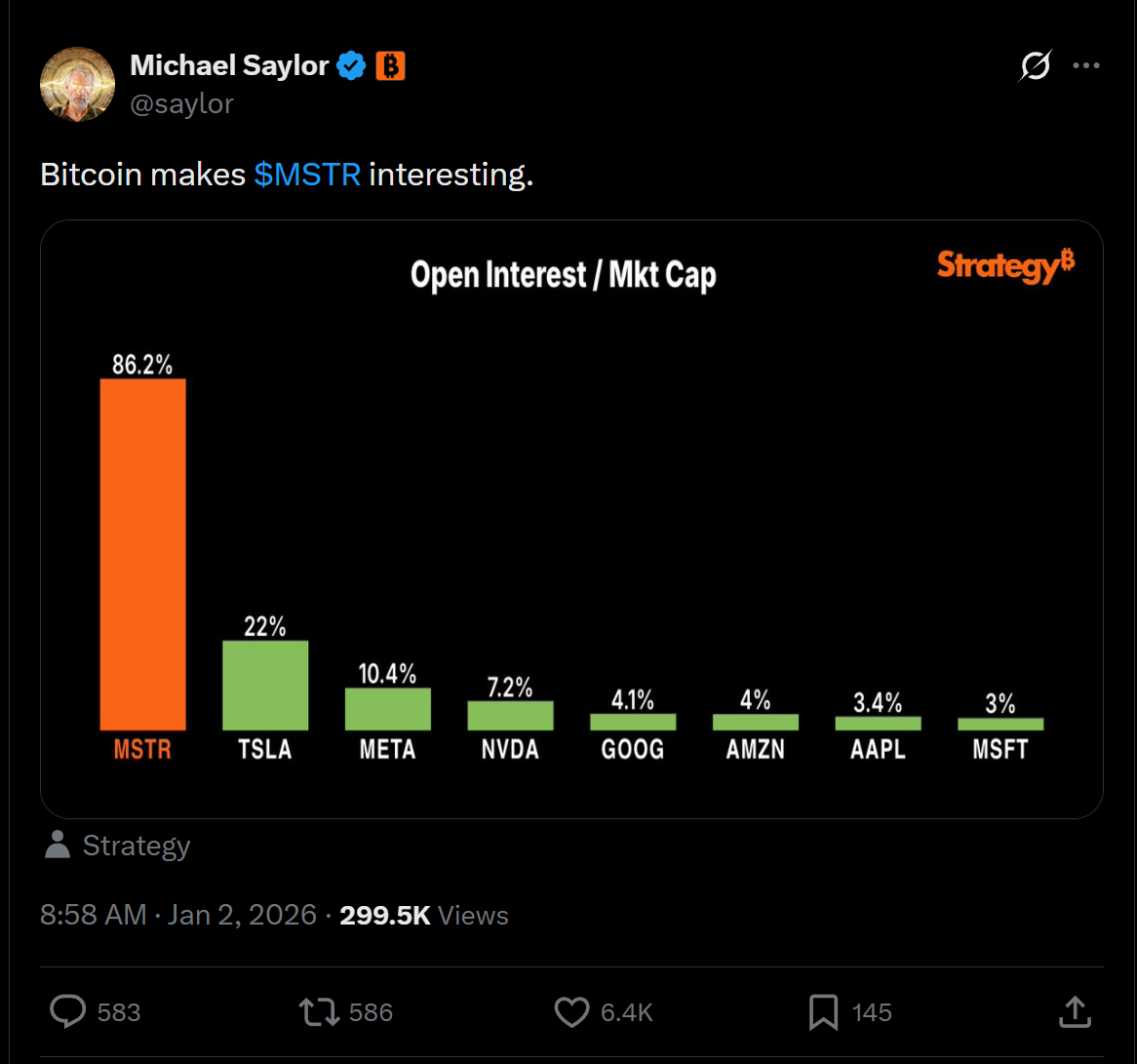

MicroStrategy founder Michael Saylor, a pioneer of the Bitcoin treasury strategy, recently pointed out that MSTR’s open interest notional value far exceeds that of other tech giants, arguing that Bitcoin is what made MSTR “interesting.”

However, MSTR shares have fallen about 50% so far in 2025—significantly underperforming Bitcoin’s roughly 6% decline—prompting some observers to question whether the stock’s weakness is largely the result of heavy short selling.

OPEN INTEREST SURGES: HAS BITCOIN-DRIVEN LEVERAGE SPECULATION MADE MSTR “INTERESTING”?

Michael Saylor compared MSTR’s open interest notional value with that of other major tech stocks, arguing that Bitcoin is what made MSTR interesting. According to the chart, MSTR’s ratio of derivatives open interest to market capitalization stands at 86%—far above Tesla’s 22% and Microsoft’s 3%. In Saylor’s view, Bitcoin integration has significantly increased the stock’s appeal to traders seeking leveraged exposure to Bitcoin.

In equity markets, a stock’s “open interest” (OI) typically refers to the total number of outstanding derivatives contracts—such as options or futures—linked to that stock. Comparing the notional value of these derivatives’ open interest with the company’s market capitalization serves as a proxy for the degree of leverage speculation and the influence of the derivatives market on the stock’s price. When this ratio becomes excessively high, it suggests that a large amount of speculative capital is actively betting on the stock.

WEAK SHARE PRICE PROMPTS ANOTHER DIVIDEND HIKE ON STRC TO 11%

MicroStrategy also announced that it has raised the dividend rate on its perpetual preferred stock STRC to 11%. Because the company originally targeted a trading range of 99–101 for STRC, increasing the dividend yield has become the primary tool to support the stock price. This marks the second dividend increase since STRC was issued in July last year.

>>> More to read: Who is Michael Saylor? Founder of MicroStrategy

MNAV PREMIUM COMPRESSION AND POTENTIAL MSCI INDEX ADJUSTMENT RISKS

MSTR has fallen about 50% so far in 2025, significantly underperforming Bitcoin’s roughly 6% decline. As a result, its mNAV—the ratio between the current share price and the value of the Bitcoin it holds—has compressed toward parity, approaching a level of 1.

The market is now awaiting a decision from global index provider MSCI on January 15 regarding whether Strategy and other DAT companies could be removed from its indices, a move that could introduce additional downside risk.

>>> More to read: What is MicroStrategy (MSTR)? From Data to Digital Gold