KEYTAKEAWAYS

-

What is a prediction market is best understood as a mechanism that converts dispersed beliefs into real time probability through financial incentives, often producing more accurate forecasts than polls or expert consensus.

-

Crypto native platforms like Polymarket have transformed prediction markets from academic experiments into public information infrastructure by enabling global participation, transparent settlement, and continuous price discovery.

-

While prediction markets are powerful tools for aggregating knowledge, they introduce new challenges around regulation, ethical boundaries, oracle design, and feedback loops that must be carefully managed as adoption grows.

- KEY TAKEAWAYS

- WHAT IS A PREDICTION MARKET AND WHY IT EXISTS

- HOW PREDICTION MARKETS TURN BELIEF INTO PROBABILITY

- POLYMARKET AND THE RISE OF CRYPTO NATIVE PREDICTION MARKETS

- REAL WORLD USE CASES AND INFORMATIONAL POWER

- LIMITATIONS REGULATION AND STRUCTURAL RISKS

- A MARKET THAT PRICES UNCERTAINTY RATHER THAN AUTHORITY

- DISCLAIMER

- WRITER’S INTRO

CONTENT

What is a prediction market has become one of the most searched questions in crypto and financial circles over the past two years. Once treated as a niche concept discussed mainly by economists and political scientists, prediction markets have moved into the mainstream conversation. Traders reference them. Journalists cite them. Policymakers quietly monitor them. In moments of uncertainty, prediction markets are increasingly treated as a parallel source of truth.

At a surface level, a prediction market looks simple. People trade contracts tied to future events, and prices reflect perceived probabilities. But this simplicity is deceptive. Behind each price sits a complex system of incentives, information flows, and behavioral dynamics. Unlike polls or expert panels, prediction markets do not ask participants to explain their reasoning. They ask them to commit capital. That single requirement fundamentally changes how information is revealed.

The growing relevance of prediction markets is not accidental. Traditional forecasting tools are struggling. Opinion polls suffer from selection bias and declining response rates. Expert forecasts often lag reality and cluster around consensus views. Statistical models depend on assumptions that break down during regime shifts. Against this backdrop, the question of what is a prediction market matters because it points to a different way of producing knowledge. It replaces authority with accountability and opinion with probability.

Understanding prediction markets today requires more than a definition. It requires examining why they exist, how they function at a micro level, why crypto native platforms like Polymarket changed their trajectory, and what risks emerge when markets begin to shape the very realities they attempt to predict.

WHAT IS A PREDICTION MARKET AND WHY IT EXISTS

Markets as decentralized information processors

To understand what is a prediction market, it is necessary to start with a broader insight about markets themselves. Markets are not merely mechanisms for buying and selling goods. They are decentralized systems for processing information. Prices encode expectations about the future based on the collective actions of individuals responding to local signals.

This idea is most closely associated with Friedrich Hayek, who argued that no central planner can ever possess the full range of knowledge dispersed across society. Information about the world is fragmented, contextual, and often tacit. Markets solve this problem not by collecting information, but by allowing people to act on what they know. Prices emerge as summaries of these actions.

Prediction markets take this logic and apply it directly to uncertainty about future events. Instead of inferring expectations indirectly through asset prices or surveys, prediction markets explicitly ask participants to trade on outcomes. The market price becomes a probability estimate derived from economic behavior rather than verbal claims.

What is a prediction market in operational terms

Operationally, a prediction market consists of contracts tied to specific, verifiable outcomes. These outcomes may be binary, such as whether a candidate wins an election, or scalar, such as the level of inflation at a given date. Each contract pays out a fixed amount if the outcome occurs and nothing if it does not.

Participants buy and sell these contracts based on their beliefs and information. If they believe an outcome is underpriced, they buy. If they believe it is overpriced, they sell. The resulting price reflects the balance of informed conviction in the market.

This structure transforms belief into a measurable quantity. Asking what is a prediction market is therefore asking how belief becomes constrained by cost. The market does not reward confidence alone. It rewards accuracy over time.

HOW PREDICTION MARKETS TURN BELIEF INTO PROBABILITY

Incentives filter noise better than opinion

The defining feature of prediction markets is incentive alignment. In polls, respondents face no cost for being wrong. In expert panels, reputational incentives often encourage caution and conformity. Prediction markets are different. Participants must put money at risk.

This requirement filters noise aggressively. Traders with weak information or low confidence participate less. Those with strong signals and conviction trade more heavily. Over time, inaccurate traders lose capital and influence, while accurate ones gain it. The market evolves toward better calibration not through debate, but through selection.

This is why prediction markets often outperform traditional forecasting methods. They do not assume equal credibility. They allow credibility to be earned and lost through economic consequences.

What is a prediction market pricing mechanism

Modern prediction markets rely on mechanisms that ensure continuous pricing even when participation is limited. Early markets used traditional order books, matching buyers and sellers directly. However, many contemporary platforms employ automated market makers that adjust prices algorithmically based on order flow.

These systems ensure that traders can always transact, while making it increasingly expensive to push prices toward extremes. Small trades move prices slightly. Large moves require disproportionate capital. This structure discourages casual manipulation and forces conviction to be expressed through sustained risk taking.

Understanding what is a prediction market therefore involves understanding how cost curves, liquidity parameters, and market design shape probability formation.

POLYMARKET AND THE RISE OF CRYPTO NATIVE PREDICTION MARKETS

What Polymarket changed about scale and visibility

The emergence of Polymarket marked a decisive shift in the prediction market landscape. Earlier platforms existed, but they struggled with liquidity, user experience, and regulatory constraints. Polymarket combined crypto infrastructure with consumer grade design, dramatically lowering the barrier to participation.

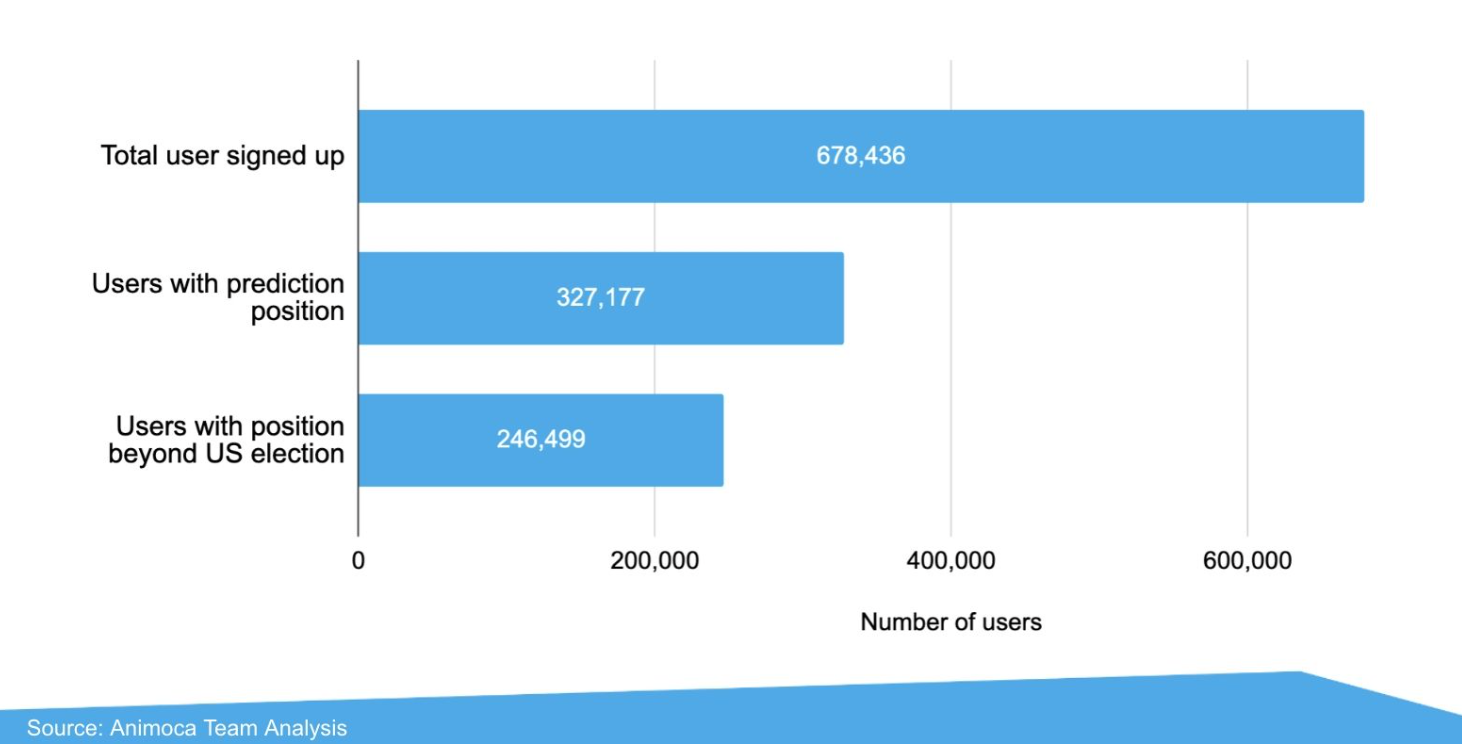

Built on blockchain settlement, Polymarket enabled global access, transparent resolution, and rapid market creation. Users did not need traditional brokerage accounts. They needed a wallet. This design unlocked massive participation during high interest events such as elections and geopolitical crises.

As trading volume grew, Polymarket prices began appearing in mainstream media. Journalists referenced them alongside polls. Analysts compared them to expert forecasts. Campaigns quietly monitored them for momentum signals. In practice, Polymarket turned prediction markets from niche tools into public indicators.

This shift redefined what is a prediction market in the public imagination. It was no longer an experiment. It was infrastructure.

Crypto infrastructure and the oracle problem

Crypto native prediction markets introduced new advantages, but also new risks. Settlement transparency reduced trust requirements, but outcome resolution became a central challenge. Markets are only useful if outcomes are resolved credibly.

This led to the development of oracle systems that combine economic incentives with dispute resolution. Instead of relying on a single authority, decentralized oracles rely on token based incentives to align truth telling. Incorrect resolutions can be challenged at a cost, while honest reporting becomes the equilibrium strategy.

Understanding what is a prediction market in the crypto era therefore requires recognizing that it is not just a trading venue. It is a system for producing truth under adversarial conditions.

REAL WORLD USE CASES AND INFORMATIONAL POWER

Elections macro data and real time sentiment

Elections brought prediction markets into the spotlight because outcomes are binary and publicly verifiable. But their utility extends far beyond politics. Markets now exist for inflation releases, interest rate decisions, court rulings, regulatory approvals, and even corporate actions.

Each market acts as a sensor. Individually, these signals may seem narrow. Collectively, they form a probabilistic map of expectations across domains. Analysts increasingly treat prediction market prices as alternative data inputs rather than curiosities.

What is a prediction market revealing that experts miss

Experts often face asymmetric incentives. Being wrong publicly carries reputational risk. As a result, forecasts tend to cluster around consensus views. Prediction markets do not punish dissent. They reward it when it is correct.

This allows markets to surface minority views early. When informed traders disagree with prevailing narratives, prices move before consensus shifts. This early warning function is one of the most underappreciated aspects of prediction markets.

Understanding what is a prediction market means recognizing that it captures disagreement quantitatively, not rhetorically.

LIMITATIONS REGULATION AND STRUCTURAL RISKS

Manipulation moral hazard and feedback loops

No prediction market is immune to risk. Short term manipulation is possible, particularly in thin markets. However, sustained manipulation is costly. Traders with better information profit by correcting mispricing, restoring prices toward reality.

More concerning are cases where participants can influence outcomes directly. When markets allow trading on events that participants can affect, moral hazard emerges. This is why careful market selection and restrictions are essential.

Another risk involves feedback loops. Market prices can influence behavior. High probability signals can shape decisions, making outcomes more likely. This self reinforcing dynamic requires careful interpretation.

What is a prediction market allowed to become

Regulatory frameworks remain fragmented. Some jurisdictions treat prediction markets as derivatives. Others classify them as gambling. Ethical concerns arise when markets involve harm, violence, or tragedy.

These debates are unresolved. They reflect broader questions about whether society is comfortable pricing all forms of uncertainty. Understanding what is a prediction market therefore includes understanding where society draws its boundaries.

A MARKET THAT PRICES UNCERTAINTY RATHER THAN AUTHORITY

What is a prediction market is ultimately a question about how societies choose to confront uncertainty. Prediction markets do not promise certainty or moral clarity. They offer something narrower and more powerful. A disciplined way to aggregate belief under risk.

By forcing opinions to bear economic consequences, prediction markets transform speculation into signal. They do not eliminate uncertainty. They measure it. In a world saturated with noise, that may be the most valuable function a market can perform.