KEYTAKEAWAYS

- Uniswap’s CCA mechanism replaces speed-driven token launches with continuous, auction-based price discovery, aiming to improve fairness and reduce MEV advantages.

- Arbitrum-native platforms such as HuddlePad are adopting CCA as a default launch primitive, signaling a shift toward standardized, infrastructure-level issuance models.

- The success of CCA will depend on post-launch liquidity depth and repeat adoption across projects, determining whether it becomes a lasting market standard or a one-off experiment.

- KEY TAKEAWAYS

- WHAT HAPPENED: CCA-STYLE LAUNCHES ARE MOVING FROM THEORY TO ARBITRUM EXECUTION

- WHAT CCA ACTUALLY CHANGES: FROM SPEED GAMES TO MECHANISM DESIGN

- WHY ARBITRUM IS A NATURAL HOST FOR THIS MODEL

- HUDDLEPAD AS THE “ARBITRUM-NATIVE” WRAPPER AROUND CCA

- THE DATA SIGNAL: EIGEN FLOW INTO UNISWAP V3 SHOWS MECHANISM-ADJACENT ATTENTION

- WHAT TO WATCH NEXT: THREE CHECKS THAT SEPARATE A REAL SHIFT FROM A ONE-OFF TREND

- BOTTOM LINE: CCA IS A BID TO “STANDARDIZE FAIRNESS” IN TOKEN ISSUANCE

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Uniswap’s Continuous Clearing Auction (CCA) introduces a new standard for Arbitrum-native token launches by combining transparent price discovery with automatic liquidity formation onchain.

WHAT HAPPENED: CCA-STYLE LAUNCHES ARE MOVING FROM THEORY TO ARBITRUM EXECUTION

Uniswap has been rolling out Continuous Clearing Auctions (CCA) as part of its broader Liquidity Launchpad framework—an onchain mechanism designed to run fair price discovery auctions and then automatically seed a Uniswap v4 pool at the discovered clearing price.

In parallel, Arbitrum-native teams have begun positioning CCA as a “default” launch primitive for the ecosystem, with Huddle01 announcing HuddlePad as an Arbitrum-native launchpad built on Uniswap’s CCA engine, and Arbitrum’s official account publicly amplifying the same direction.

The significance is not that another launchpad exists, but that Arbitrum is converging on a mechanism design standard: instead of “first block wins” token launches, the market is experimenting with continuous auction clearing + liquidity bootstrapping as the baseline.

WHAT CCA ACTUALLY CHANGES: FROM SPEED GAMES TO MECHANISM DESIGN

Traditional token launches have a familiar failure mode: whoever has the best latency, MEV access, or execution tooling captures the best price, while everyone else buys into instant volatility and thin liquidity. CCA is explicitly trying to make that failure mode structurally harder.

In Uniswap’s own write-up and whitepaper framing, CCA combines uniform clearing logic with early participation incentives to smooth price discovery, and then converts auction outcomes into immediate onchain liquidity rather than leaving “day-one liquidity” to ad-hoc market making.

That design targets three pain points simultaneously:

- PRICE DISCOVERY becomes a process (clearing over time), not a single chaotic moment.

- LIQUIDITY FORMATION is built into the mechanism, rather than depending on incentives or discretionary market makers.

- MANIPULATION SURFACE AREA is reduced because the “edge” shifts away from speed and toward transparent bidding.

If it works as intended, CCA pushes token launches closer to how mature markets are supposed to behave: a transparent price formation process followed by liquidity at the price that actually cleared.

WHY ARBITRUM IS A NATURAL HOST FOR THIS MODEL

Arbitrum’s core advantage is not just lower fees; it is that the ecosystem has accumulated deep DeFi-native liquidity and active trading behavior, which makes it viable to run auctions that need sustained participation rather than one-time hype.

In practice, a mechanism like CCA benefits from environments where (1) traders are already comfortable executing onchain, and (2) protocols can compose liquidity and settlement in the same venue. That is precisely what Uniswap is building toward with Liquidity Launchpad as a v4-native framework.

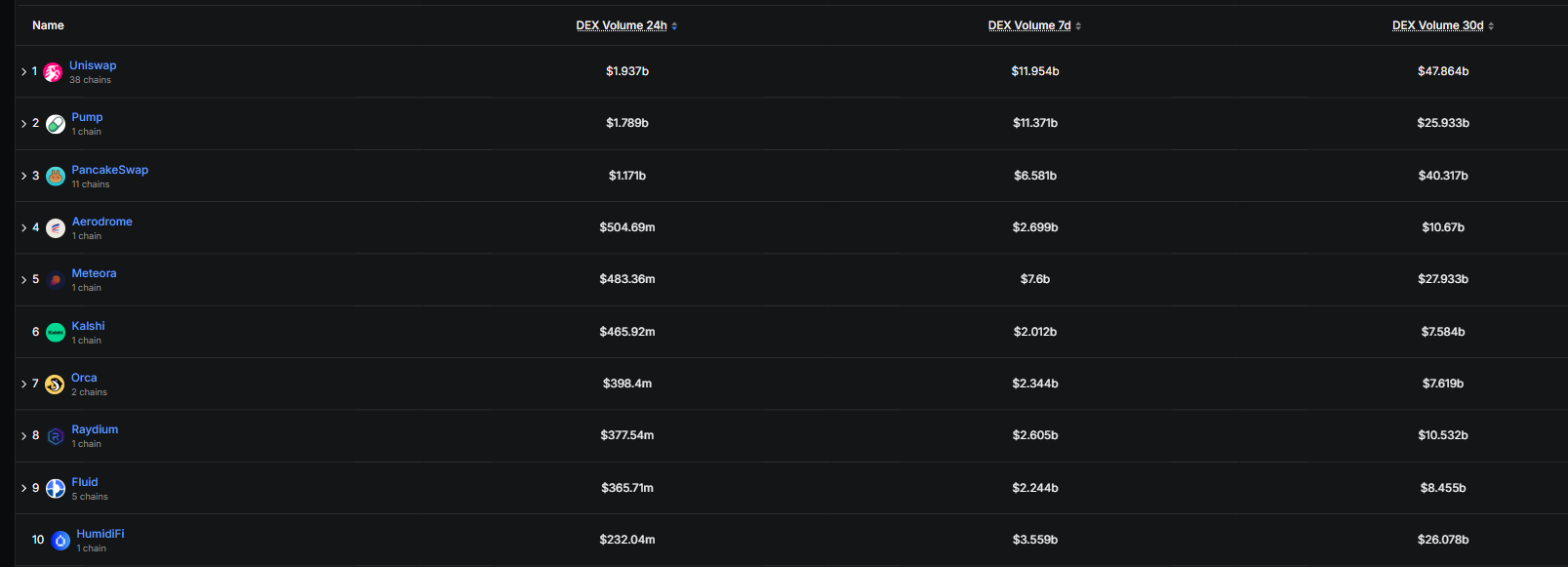

And the market context supports why Uniswap is the “default venue” for this experiment: DefiLlama’s live DEX leaderboard regularly places Uniswap among the top DEXs by 24h volume, and historical reporting has shown Uniswap leading monthly DEX volume in prior peaks.

HUDDLEPAD AS THE “ARBITRUM-NATIVE” WRAPPER AROUND CCA

HuddlePad’s positioning is straightforward: it is not presenting itself as a new launch mechanism invented from scratch; it is presenting itself as an Arbitrum-native distribution and UX layer around CCA—meaning the “innovation” is partly productization: making auctions easier for projects and community participants to run and join, while keeping the clearing logic onchain.

The key point for readers is: if Arbitrum-native projects begin launching with CCA by default, the ecosystem could see a structural change in what “a good launch” looks like—less about immediate price spikes, more about credible price discovery and robust initial liquidity.

THE DATA SIGNAL: EIGEN FLOW INTO UNISWAP V3 SHOWS MECHANISM-ADJACENT ATTENTION

Alongside the narrative, onchain monitors flagged a notable liquidity movement: 4,952,647.21 EIGEN transferred into a Uniswap v3 pool, reported via Arkham-tagged monitoring and relayed by Binance’s official news account.

Even if this flow is not directly “CCA capital,” it is consistent with a broader behavioral pattern: when new issuance and auction mechanisms gain mindshare, attention often shows up first as liquidity positioning in the most liquid onchain venues, especially Uniswap pools.

The important analytic caution is that a single flow is not proof of sustained adoption; it is a high-frequency attention proxy that often accompanies shifts in launch/issuance narratives.

WHAT TO WATCH NEXT: THREE CHECKS THAT SEPARATE A REAL SHIFT FROM A ONE-OFF TREND

- AUCTION OUTCOMES VS. POST-LAUNCH VOLATILITY

If CCA clears smoothly but liquidity still collapses post-launch, then the “fair launch” claim is only partially solved. Uniswap’s framework is explicitly designed to tie auctions to durable liquidity, so post-launch depth is the real test.

- PARTICIPATION QUALITY

CCA’s edge is supposed to be fairness through mechanism design; that only holds if participation is broad and not dominated by a small cluster of sophisticated bidders.

- REPEATABILITY ON ARBITRUM

The decisive signal will be whether multiple Arbitrum-native projects adopt CCA-style launches, turning it into a norm rather than a novelty—exactly the shift Arbitrum’s own messaging implies it wants to enable.

BOTTOM LINE: CCA IS A BID TO “STANDARDIZE FAIRNESS” IN TOKEN ISSUANCE

Uniswap’s CCA is best understood as an attempt to turn token launches from a social event into market infrastructure: a process where price discovery and liquidity provisioning are mechanically linked, minimizing the speed-and-bot advantages that defined earlier generations of launches.

If Arbitrum-native platforms like HuddlePad can make this usable at scale, Arbitrum could become the first major L2 where “fair launch” is not a slogan but a default mechanism choice.

Read More:

Uniswap’s Continuous Clearing Auctions Are Reshaping Arbitrum-Native Token Launches