KEYTAKEAWAYS

- MicroStrategy’s Bitcoin exposure is financed through long-dated, low-interest convertible debt, eliminating margin call risk and allowing time to absorb volatility.

- The strategy is fundamentally a macro bet on monetary debasement, using depreciating fiat liabilities to accumulate a fixed-supply digital asset.

- Rather than a ticking time bomb, MicroStrategy functions as a leveraged Bitcoin call option with asymmetric upside and controlled downside risk.

- KEY TAKEAWAYS

- MICROSTRATEGY BITCOIN LEVERAGE IS NOT TRADITIONAL DEBT FINANCING

- MICROSTRATEGY CASH FLOW SUPPORTS LONG-DATED BITCOIN EXPOSURE

- MICROSTRATEGY CONVERTIBLE DEBT CREATES ASYMMETRIC BITCOIN OPTIONALITY

- MICROSTRATEGY BITCOIN STRATEGY IS A MACRO MONETARY BET

- WHY RETAIL INVESTORS MISREAD MICROSTRATEGY BITCOIN LEVERAGE

- BITWISE, CRYPTO EQUITIES, AND LEVERAGED UPSIDE TO BITCOIN

- CONCLUSION: MICROSTRATEGY AS A BITCOIN CALL OPTION, NOT A TIME BOMB

- DISCLAIMER

- WRITER’S INTRO

CONTENT

An in-depth analysis of MicroStrategy’s Bitcoin leverage strategy, examining convertible debt, monetary debasement, and why MSTR functions as a long-term Bitcoin call option.

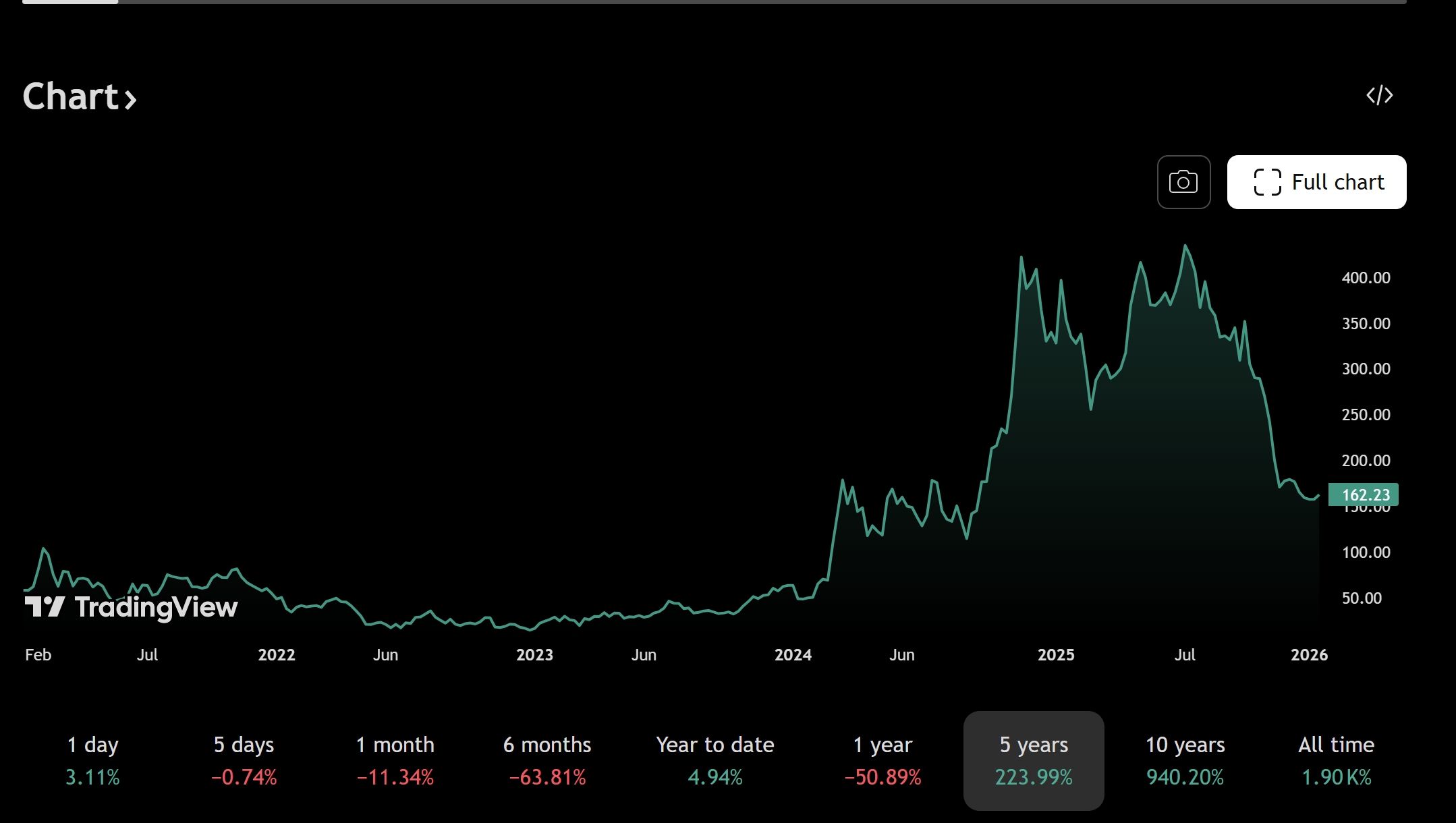

When Bitwise released its 2026 outlook, one conclusion immediately sparked debate: crypto-native equities such as Coinbase, MicroStrategy, and publicly listed mining companies could significantly outperform traditional Nasdaq technology stocks. The reasoning was straightforward but controversial. According to Bitwise, these firms possess a built-in form of leverage to the crypto cycle that conventional technology companies simply do not have.

Among them, MicroStrategy stands out as the most polarizing example. In private discussions, it is often described as a ticking time bomb—an overleveraged Bitcoin proxy destined to collapse once prices remain depressed for long enough. Yet this widespread skepticism is precisely what makes the case interesting. Historically, alpha rarely emerges from consensus. It tends to appear where narratives diverge most sharply.

Before judging whether MicroStrategy represents systemic fragility or financial sophistication, it is necessary to move beyond surface-level comparisons and examine how its strategy actually functions.

MICROSTRATEGY BITCOIN LEVERAGE IS NOT TRADITIONAL DEBT FINANCING

At first glance, the criticism appears intuitive. MicroStrategy borrowed money, bought Bitcoin, and now faces downside risk if prices fall below its average acquisition cost. From this perspective, failure seems inevitable in a prolonged bear market.

However, this framing implicitly assumes traditional leverage—short-term loans, high interest rates, and forced liquidations. MicroStrategy’s balance sheet does not resemble that structure at all.

The company has financed its Bitcoin purchases primarily through convertible and senior unsecured notes. Many of these instruments carry either zero or extremely low interest rates, and most mature between 2027 and 2032. Crucially, there are no margin calls or price-based liquidation triggers. As long as the company can service minimal interest obligations, it cannot be forced to sell its Bitcoin holdings at depressed prices.

This distinction is fundamental. Leverage with forced liquidation risk behaves very differently from leverage designed around time and optionality.

MICROSTRATEGY CASH FLOW SUPPORTS LONG-DATED BITCOIN EXPOSURE

Another common misconception is that MicroStrategy has abandoned its operating business and now depends entirely on Bitcoin appreciation. In reality, the company remains a profitable enterprise software provider.

Its core analytics and software operations generate roughly $120 million in quarterly revenue, producing stable cash flow that helps cover interest expenses. While this business represents only a small portion of the firm’s overall market capitalization, it plays a critical role from a credit perspective. It provides the liquidity needed to maintain the capital structure during extended periods of market stress.

Time is the second structural advantage. Because debt maturities are several years away, MicroStrategy does not require immediate price appreciation. The company only faces real stress if Bitcoin collapses far below its average cost and remains there for multiple years.

As of December 30, 2025, MicroStrategy held approximately 672,500 BTC at an average acquisition cost near $74,997. This number frequently anchors bearish arguments, but focusing on spot price alone ignores the asymmetric payoff embedded in the firm’s liabilities.

MICROSTRATEGY CONVERTIBLE DEBT CREATES ASYMMETRIC BITCOIN OPTIONALITY

Convertible debt introduces a payoff structure that is often misunderstood. If MicroStrategy’s share price rises substantially—typically as a result of Bitcoin appreciation—bondholders can choose to convert their debt into equity rather than demand repayment of principal.

Some of the 2030 maturity notes issued in 2025, for example, carry conversion prices around $433 per share, far above the current trading level near $155. At today’s price, conversion is irrational, so the company simply services minimal interest.

If Bitcoin rallies significantly, equity value expands and part of the debt can effectively disappear through conversion. If Bitcoin stagnates but does not collapse, MicroStrategy continues operating while paying very little in real terms. Only in a scenario where Bitcoin falls toward $30,000 and remains there into the late 2020s does forced deleveraging become a serious concern.

That scenario is possible, but it is far more extreme than many casual critiques imply.

MICROSTRATEGY BITCOIN STRATEGY IS A MACRO MONETARY BET

At a deeper level, MicroStrategy is not merely speculating on Bitcoin’s price. It is expressing a view on the future of the global monetary system, particularly the long-term purchasing power of the U.S. dollar.

By issuing long-dated, low-coupon debt denominated in dollars, the company is effectively short fiat currency. If monetary expansion continues and inflation remains structurally elevated, the real value of its liabilities erodes over time. Bitcoin, with a fixed supply capped at 21 million coins, serves as the opposing asset in this trade.

This is why comparing MicroStrategy to a reckless leveraged trader misses the point. The strategy resembles a long-duration macro position rather than a short-term speculative bet. Borrowing depreciating currency to acquire a scarce digital asset is a classic approach in environments where debt can be inflated away.

In simple terms, if future dollars are worth less than today’s dollars, repaying nominal debt becomes easier over time. The longer the maturity and the lower the interest rate, the stronger this effect becomes.

WHY RETAIL INVESTORS MISREAD MICROSTRATEGY BITCOIN LEVERAGE

Retail investors often evaluate leverage through the lens of personal finance. Loans must be repaid, losses are realized quickly, and leverage is inherently dangerous. Corporate finance at scale operates under a different set of rules.

MicroStrategy can refinance, roll debt forward, issue equity, or restructure obligations in ways unavailable to individuals. As long as capital markets remain accessible and the firm maintains credibility, time becomes an asset rather than a liability.

This gap in perspective explains why Michael Saylor’s strategy frequently appears reckless to outsiders. In reality, it is internally coherent—provided one accepts its core assumption: long-term monetary debasement and Bitcoin’s persistence as a global store of value.

BITWISE, CRYPTO EQUITIES, AND LEVERAGED UPSIDE TO BITCOIN

Viewed through this framework, Bitwise’s optimism toward crypto equities becomes easier to understand. Companies such as MicroStrategy and Coinbase are not merely participants in the crypto ecosystem; they are structurally leveraged to it.

When the crypto cycle turns positive, their earnings power, balance sheets, and equity valuations can expand faster than those of traditional technology companies. This leverage amplifies downside risk, but markets rarely reward linear exposure during speculative expansions. They reward convexity.

CONCLUSION: MICROSTRATEGY AS A BITCOIN CALL OPTION, NOT A TIME BOMB

MicroStrategy is neither a guaranteed success nor an imminent collapse. Framing it as a ticking time bomb oversimplifies both its capital structure and its strategic intent. In reality, it functions as a large, publicly traded call option on Bitcoin—funded with long-dated, low-cost debt and supported by a cash-generating operating business.

Whether this proves visionary or disastrous ultimately depends on Bitcoin’s long-term trajectory and the credibility of fiat monetary systems over the next decade. What is clear, however, is that this is not a naïve gamble. It is a deliberate macro bet executed with institutional tools.

And in financial markets, it is often these uncomfortable, widely doubted structures that produce the most asymmetric outcomes.

The above viewpoints are referenced from Ace

Read More: