KEYTAKEAWAYS

-

Smart Asset Tags could turn X from a pure information platform into a financial entry point where attention, data, and potential liquidity converge in one place.

-

By embedding real time asset data directly into social content, X creates a structural advantage over crypto native apps that still struggle with distribution and user scale.

-

The move signals a broader ambition to build a super app, but execution risks remain high given X’s past delays in payments, wallets, and spam control.

- KEY TAKEAWAYS

- WHEN X BECOMES A “SMART ASSET WINDOW”: A WEB2 DOWNWARD DISRUPTION OF CRYPTO PRODUCTS

- MARKET REACTIONS: PRAISE, DOUBT, AND EVERYTHING IN BETWEEN

- WEB2 PRODUCTS VS CRYPTO APPS: NETWORK EFFECTS AS A STRUCTURAL ADVANTAGE

- X VS WECHAT: PUBLIC SOCIAL MEDIA VS SEMI PRIVATE SOCIAL PLATFORMS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

A shockwave that could affect 600 million crypto users and a 3 trillion dollar market may be coming.

Just yesterday, X product lead and Solana advisor Nikita Bier posted that X is the best place to get financial news and that the platform is developing Smart Asset Tags. This feature will allow users to tag specific assets or smart contracts when posting market related content. Users will be able to click these tags in their timeline to see real time prices and all related mentions. The feature is expected to be publicly released next month, with ongoing iteration and feedback collection before launch.

As soon as the news broke, the market reacted strongly. Some believe this move shows X is executing Elon Musk’s long stated vision of a super app. Others argue that, with its massive user base and strong crypto community, X could become a direct competitor to centralized exchanges. Some also noticed hints that X could funnel huge amounts of attention and liquidity into ecosystems like Solana.

When a major Web2 platform turns its attention to crypto, is this a new shift in internet finance, or just another unfulfilled promise like past payment features?

WHEN X BECOMES A “SMART ASSET WINDOW”: A WEB2 DOWNWARD DISRUPTION OF CRYPTO PRODUCTS

Based on what is known so far, let us first look at the details of this new feature.

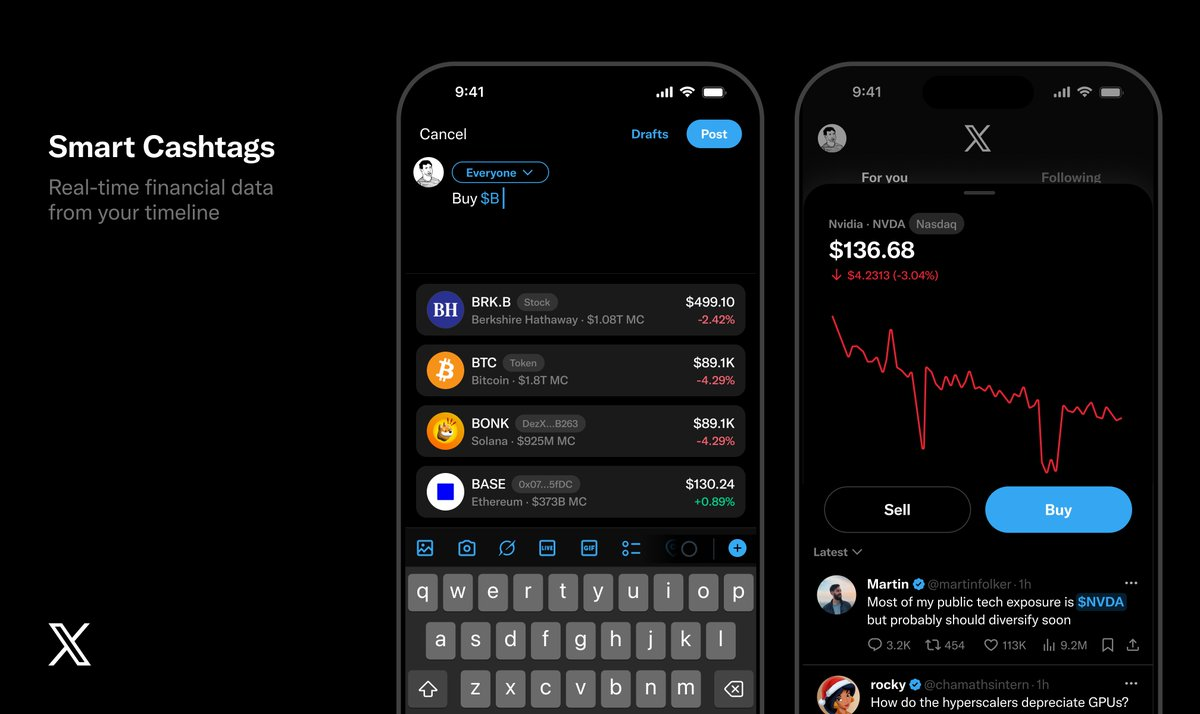

According to images shared by Nikita Bier, Smart Asset Tags aim to provide real time financial data directly within the user timeline. Asset related information will be aggregated and displayed in one place. When posting, users can tag assets by ticker, including stocks, BTC, or meme tokens. Clicking a ticker shows the real time price and may even lead to a future Buy or Sell interface.

What sparked even more speculation is the list of example assets shown. In addition to major assets like BRKB and BTC, the image also included BONK from the Solana ecosystem and BASE, a Base ecosystem token that has not yet launched. This led many to believe that early support may focus on Solana and Base.

In the comments, Nikita Bier also responded to several hot questions. When asked whether this means users could one day trade directly on X using self custody wallets or exchange widgets, he replied with a simple “eyes” emoji. When asked about data sources, he said the APIs are almost real time and based on onchain minted assets.

MARKET REACTIONS: PRAISE, DOUBT, AND EVERYTHING IN BETWEEN

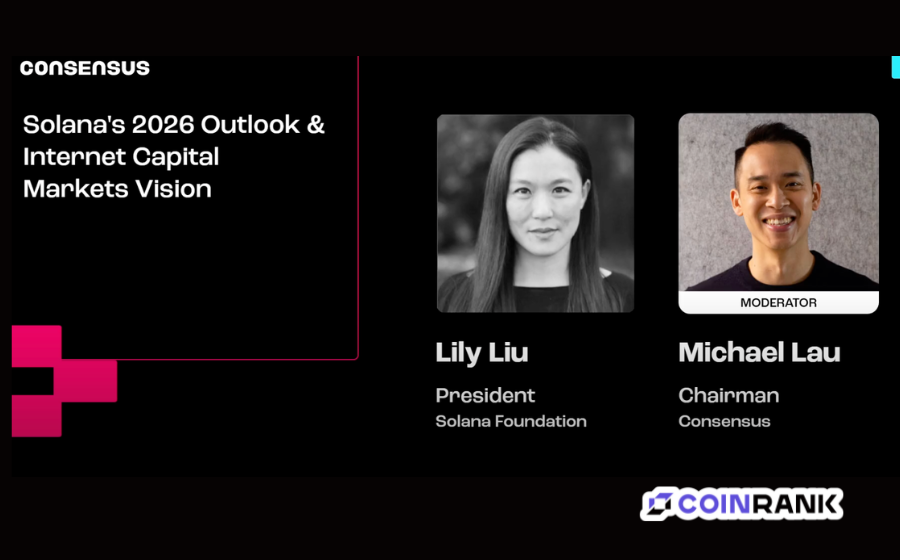

The announcement quickly drew attention from Solana, BNB Chain, Base ecosystem teams, and the broader Crypto Twitter community. The reactions were enthusiastic, but not unanimous.

Solana’s official account openly reacted by pointing out that BONK appeared in the image, implying that X will allow users to post about Solana tokens and view charts and news. After Nikita Bier later tweeted that his own investments were listed in his bio, Solana replied that they felt the same, clearly taking advantage of the exposure.

BNB Chain did not stay quiet either. When users discussed whether BNB Chain would be supported, Binance founder CZ replied jokingly that he was a small shareholder and that they would see. When others suggested this could spark a competition for chain liquidity, CZ said there was no need for exclusivity and that multiple chains could coexist. Later, BNB Chain growth lead Nina Rong stated that she had reached out to Nikita Bier to offer support for the Smart Asset Tags initiative.

Helius CEO mert commented that if Solana centered infrastructure was needed, people could reach out to him. Base ecosystem projects and accounts also appeared in the comments, asking about the BASE token and expressing interest. Bitget’s official account said they were curious, while Binance.US said the idea sounded useful. Crypto journalist Laura Shin asked whether this was another step toward X becoming an all in one app.

Opinions within the crypto community were even more divided. Anita from Sentient Asia argued that X could become a killer of exchanges like Binance. Crypto influencer Jia Mi Wei Tuo claimed X was simply copying Binance and later said he did not trust X to build wallets or trading products given its poor group chat experience. Others said X has already damaged crypto discussions, or that crypto related posts are quickly overwhelmed by spam.

CryptoQuant founder Ki Young Ju shared similar concerns. He argued that X suppresses legitimate crypto content while failing to control automated spam. According to data, posts containing the keyword crypto can reach over 7.7 million automated messages per day. He said X cannot effectively distinguish bots from real users and that paid verification has become a tool for spam accounts.

X now stands in a difficult position, trying to promote crypto adoption while controlling spam and content quality at the same time.

WEB2 PRODUCTS VS CRYPTO APPS: NETWORK EFFECTS AS A STRUCTURAL ADVANTAGE

Regardless of opinions, this move represents a form of structural disruption to existing crypto applications. This can be seen in three key ways.

First, X has an enormous network effect. With roughly 400 to 600 million monthly active users, its scale is already close to the total number of crypto users worldwide. In traditional internet terms, users bring views and engagement. In crypto terms, users also represent capital and liquidity. Turning content tags into financial entry points directly addresses a long standing weakness of crypto native apps.

Second, this is a meaningful step toward a super app. In Western markets, products usually focus on narrow verticals. In contrast, platforms like WeChat and Alipay showed that an all in one model can work. Elon Musk has repeatedly said he wants X to become a WeChat like app. With plans around payments, Visa integration, and creator incentives, starting with assets like crypto and stocks may be a strategic move. Many users would welcome the ability to read news and trade assets in the same place.

Third, this could mark the start of a new financial model in Western internet platforms. Many Western users rely on credit cards and offline retail. They have not experienced waves of internet finance or strong incentives to use crypto payments or stablecoins. Smart Asset Tags could help close this gap by introducing investment, payments, and yield concepts directly into a familiar social platform.

Before dismissing this idea, it is worth noting how WeChat evolved from messaging into a full economic system. X may not be as far away from such a transformation as it seems.

X VS WECHAT: PUBLIC SOCIAL MEDIA VS SEMI PRIVATE SOCIAL PLATFORMS

WeChat today can be divided into three main layers.

The first is social connections, including friends, groups, and moments. The second is content creation and distribution, such as official accounts and video channels. The third is finance and life services, including payments, wallets, shopping, and utilities.

X, as a public social platform, currently focuses on two main areas.

The first is public timelines built around follows and topics, used by individuals, institutions, and even governments as a primary communication channel. The second is community and group features, which have long been criticized for poor user experience.

In this context, Smart Asset Tags could play a role similar to WeChat Wallet and Red Packets. On one side, they integrate tightly with content creation and discussion. On the other, they help build the missing layer of capital flow, investment, and commerce inside the platform.

Of course, real world results will depend on execution and user experience.

It is also important that this move comes shortly after Elon Musk mentioned opening the X algorithm. Changes in crypto content visibility and spam control could have broader and longer lasting effects than many expect.

Skeptics point out that asset display features are not new. Tools like Solana Blinks, wallet price widgets, and browser plugins already exist but never achieved mass adoption. Whether X can change this dynamic remains unclear.

And it is worth remembering that the promised X Money payment feature, announced in early 2025, still has not arrived. Musk first hinted at payments back in 2023, more than two years ago.

In terms of product iteration speed, Western platforms still lag far behind their Asian counterparts.

Whether Smart Asset Tags become a true turning point or just another unfinished promise will soon be tested by the market.