KEYTAKEAWAYS

- Prediction markets such as Polymarket priced in de-escalation ahead of official announcements, reinforcing their growing role as early indicators of political risk for financial markets.

- While U.S. equities staged a sharp relief rally on reduced trade uncertainty, Bitcoin and broader crypto assets responded cautiously, reflecting structural sensitivity to liquidity and capital flows rather than headlines alone.

- Persistently fearful sentiment readings and continued spot ETF outflows suggest that macro relief has stabilized crypto markets, but has not yet provided the conditions for a sustained upside breakout.

CONTENT

The suspension of U.S. tariffs on Europe eased geopolitical risk and lifted global equities, but crypto markets remain constrained by weak sentiment, ETF outflows, and unresolved liquidity pressures despite early signals from prediction markets.

A SUDDEN DE-ESCALATION

Global risk sentiment shifted abruptly after Donald Trump confirmed that the United States would suspend its planned February 1 tariffs on European Union goods following preliminary coordination with NATO over Greenland and broader Arctic security arrangements, a reversal that removed one of the most acute geopolitical overhangs facing markets at the start of the year. According to reporting by Reuters and Bloomberg, Trump emphasized that the U.S. would not pursue coercive economic or military measures related to Greenland, framing the outcome instead as a strategic dialogue aimed at countering Russian and Chinese influence in the Arctic, a narrative that markets quickly interpreted as a meaningful reduction in near-term trade and security risk.

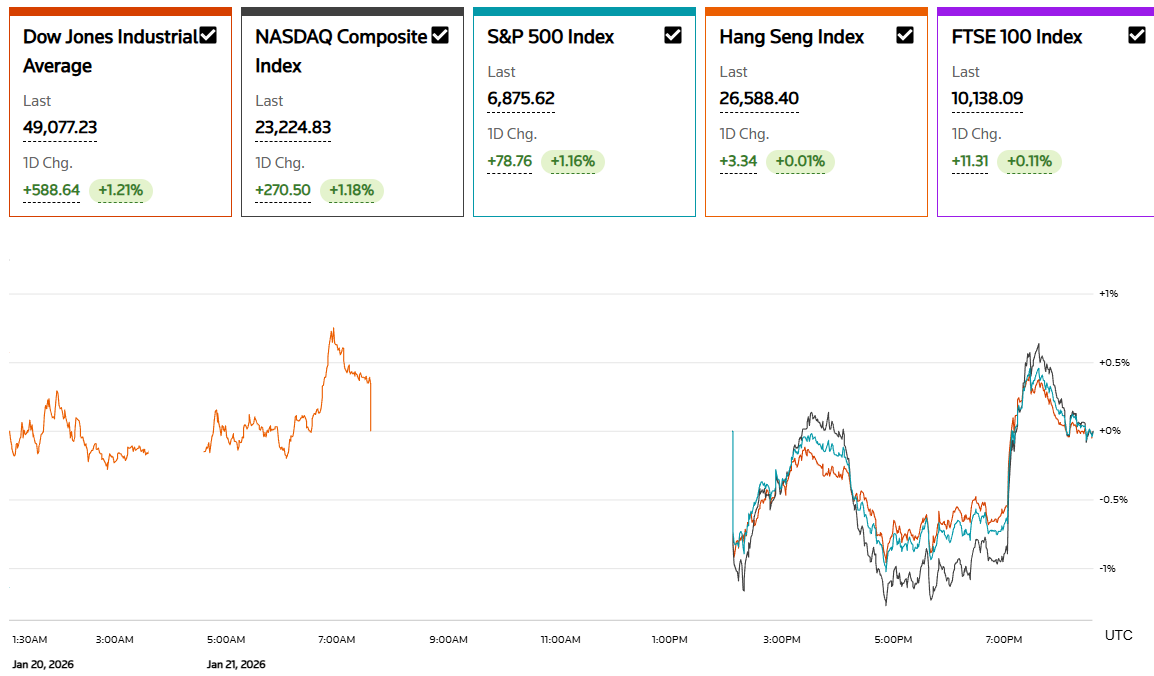

The relief was immediate across traditional markets. U.S. equities rallied sharply, with the Dow Jones Industrial Average rising roughly 1.2%, while the S&P 500 and Nasdaq Composite each gained about 1.1%, led by semiconductors where Advanced Micro Devices jumped more than 7% in a single session, as investors unwound defensive positioning built during the tariff standoff, according to exchange data and post-close market summaries.

PREDICTION MARKETS MOVED FIRST

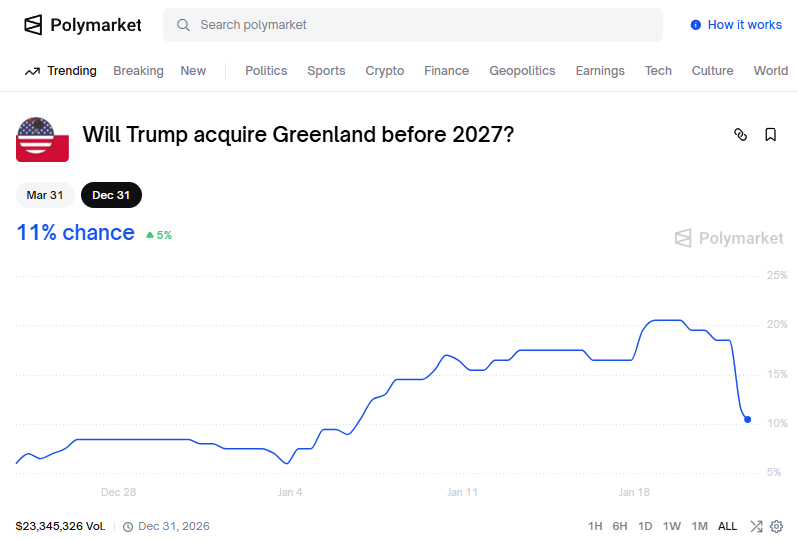

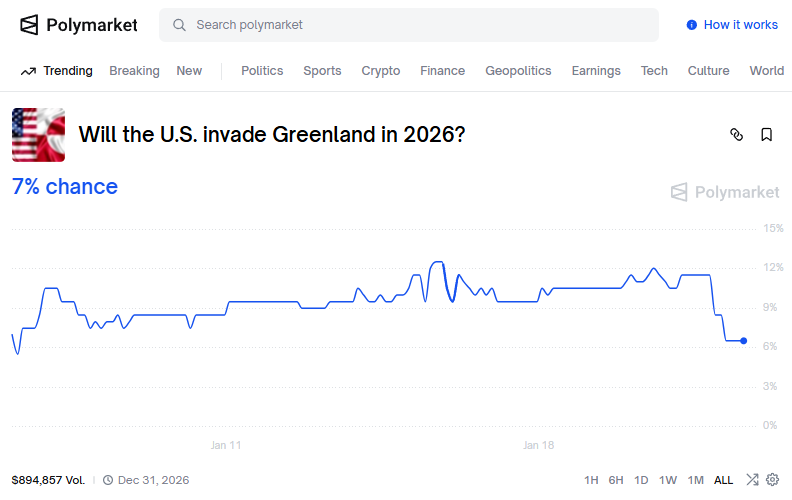

Notably, a significant portion of this repricing had already begun before the official announcement, driven by activity on Polymarket, where contracts tied to U.S.–EU tariff implementation and Greenland-related escalation saw a rapid collapse in “yes” probabilities in the hours leading up to Trump’s statement. Polymarket data showed implied probabilities for near-term U.S. tariffs on the EU falling sharply, signaling that speculative capital was increasingly betting on de-escalation rather than confrontation.

This shift in probabilistic pricing appears to have influenced broader market positioning, as traders across asset classes used prediction-market odds as an early signal of political intent, effectively front-running traditional news confirmation. The episode reinforces the growing role of crypto-native prediction markets as real-time aggregators of political risk, where expectations adjust faster than spot markets and, in some cases, guide short-term price action across equities, commodities, and digital assets.

CRYPTO REACTS, BUT WITH HESITATION

Despite the easing of geopolitical stress, crypto markets delivered a more muted response. Bitcoin, which had briefly slipped below $88,000 during the height of tariff fears, stabilized after the announcement but failed to reclaim the psychologically important $90,000 level with conviction, instead oscillating within a narrow range, according to aggregated exchange pricing data.

This divergence highlights a structural difference between equities and crypto. While equity markets quickly price in reduced trade friction and improved earnings visibility, crypto markets remain more sensitive to liquidity conditions and positioning. At the time of the rebound, Bitcoin was already facing persistent ETF outflows and reduced leverage appetite, limiting the upside impact of positive macro news even as downside risks eased.

SENTIMENT AND FLOWS REMAIN FRAGILE

Broader sentiment indicators support the view that the crypto market is stabilizing rather than reversing. The Crypto Fear & Greed Index published by Alternative.me fell to 32, firmly in fear territory, reflecting continued caution among traders. Meanwhile, weekly flow data compiled by CoinShares and ETF issuers showed ongoing net outflows from spot Bitcoin ETFs, extending a trend that has constrained price momentum throughout the month.

Additional signals from U.S.-focused metrics, including a consistently negative Coinbase Bitcoin Premium Index, suggest that American buying interest remains subdued, even as geopolitical tensions recede. Together, these indicators imply that macro relief alone is insufficient to trigger a sustained crypto rally without renewed capital inflows and improving risk appetite.

RELIEF IS NOT A RESET

The contrast between the equity rally and crypto’s hesitation underscores a broader reality: while the suspension of EU tariffs removes a significant tail risk, it does not automatically restore the liquidity and conviction required for a renewed crypto uptrend. Prediction markets correctly anticipated political de-escalation and helped shape short-term positioning, but translating improved probabilities into durable price appreciation still depends on structural factors such as monetary conditions, ETF demand, and regulatory clarity.

In this context, the current market environment resembles a fragile calm rather than a reset, with geopolitical uncertainty temporarily dialed down but crypto assets still caught between easing macro pressure and unresolved internal headwinds, leaving Bitcoin consolidating rather than decisively following traditional risk assets higher.

Read More: