KEYTAKEAWAYS

- Galaxy’s forecasts excel at macro trend accuracy but overestimate prices, offering valuable directional insight while reminding investors to discount headline targets and focus on structural shifts.

- A major 2026 theme is the transition from narrative-driven crypto to real business capitalization, with applications and stablecoins capturing more value than underlying networks.

- Solana is positioned as the core on-chain capital market, where meme speculation fades, institutional participation rises, and revenue-backed projects become the preferred risk-adjusted opportunities.

CONTENT

A deep dive into Galaxy Research’s 2026 Bold Predictions, examining consensus trends, conflicting views, and what macro shifts, Solana, and real revenue mean for crypto investors.

Over the past month, I’ve reviewed Messari and Bitwise, and conducted investment research on gold. Now I’m starting to write my third research report on Galaxy, breaking it down.

By now, I have a general understanding of several macro trends and hot sectors in the crypto market for next year.

The more research reports you read, the more you’ll find that the conclusions of each report largely corroborate each other, with some overlap.

Therefore, areas repeatedly mentioned in multiple research reports represent future consensus directions, and it’s advisable to invest in those with high credibility.

For areas that only appear in a few research reports, they are considered Alpha-level investments with less competition, but require more time for research and investment.

Now, I’ve also come across some opposing viewpoints in research reports, which is quite interesting. These are all professional institutions offering different judgments on the same issue, leading to controversy. If used correctly, this can be a chaotic ladder; if used incorrectly, it can be a cognitive trap.

This is also a key point I’m breaking down in this research report today.

This is the third installment in my series analyzing annual research reports over the past 26 years. I invite you to read Galaxy Research’s “Galaxy Research: 2026 Bold Predictions”.

Let’s get straight to the point and talk about some interesting places, one by one.

1. ACCURACY BACKTESTING

Unlike Messar, which focuses on the overall picture of the cryptocurrency market, and Bitwise, which focuses on institutional fund flows, Galaxy’s report has a more “structurally pragmatic” tone.

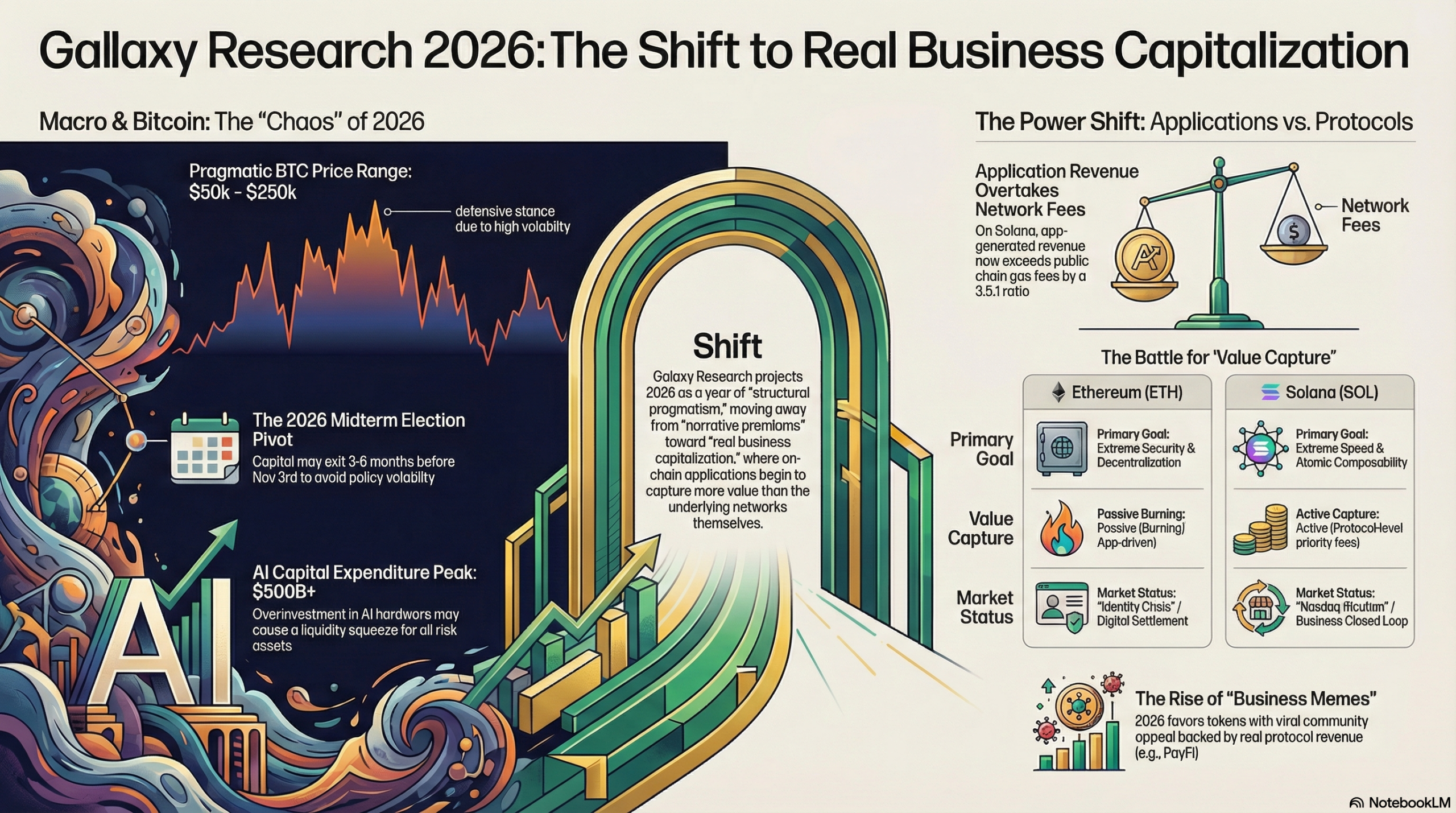

“2026 is too chaotic to predict”—G has shown extreme caution (even defensiveness) in predicting prices, but has been unusually aggressive in its transformation of infrastructure and business logic.

Remember when I mentioned Bitwise? One problem with their research reports was that they read too much like a sales pitch. The whole thing was basically saying that crypto is great this year, and you should buy now.

However, Galaxy was quite shameless, setting the tone that “2026 is too chaotic to predict” regarding pricing, and offering a price prediction of $50k to $250k for BTC—a range that was essentially meaningless.

The reason is that their 25-year BTC prediction was $150k-$185k, but the actual highest price was only $120k in October.

So the 25-year-old’s proven mistakes have resulted in such a wide price range this year, which is also why I chose to look at his research report.

Previous research reports have been too optimistic; I need some different perspectives to balance out the predominantly optimistic conclusions.

The following is a backtesting of Galaxy Research Report’s annual predictions over the past three years, and we can discover an interesting pattern:“Extremely accurate market trend judgment, overly high price target, and leading-edge technical details.”

|

years |

Core forecast themes |

Accuracy Review |

Expert Commentary (Skeptical Review) |

|

2023 |

Survivorship |

✅ High |

Accurately predicted the deleveraging and consolidation of leading institutions in the FTX post-market. |

|

2024 |

The Year of Institutionalization |

✅ Extremely high |

The prediction perfectly captured the dominance of Bitcoin ETFs and the resulting influx of institutional funds. |

|

2025 |

Bitcoin’s $150,000 Promise |

❌ Deviation |

Mistake: Predicting BTC would reach $150k-$185k, but the actual high in 2025 was only around $126k, and it fell back to around $90k by the end of the year. |

|

2025 |

Mining companies are transforming towards AI computing power. |

✅ Full marks |

This was Galaxy’s most successful prediction last year, with many Bitcoin mining companies (such as IREN and Core Scientific) successfully transitioning to AI hosting. |

2. CORE VIEWPOINTS OF THE RESEARCH REPORT

A complete transformation from “narrative-driven” to “real business capitalization”

Galaxy believes that 2026 will be the year the crypto market moves away from its “narrative premium,” which aligns with Messari’s report that L1 valuations are too high and 2026 will be a period of deflating the bubble, as well as Bitwise’s report that the market prefers projects with real business revenue.

See, this is the first point, based on the consensus of multiple research reports.

If I had to summarize the core argument of this research report in one sentence, it would be:

——For the first time, on-chain applications will surpass the underlying network in value capture, and stablecoins will officially evolve from “transaction tools” to “the ultimate solution for global payment settlement.”

Remember the “ETH identity crisis” mentioned in Messari? This was a divergence with Galaxy.

The former focuses on how ETH can seize value capture, that is, L1 reclaiming revenue rights, while the latter focuses on how application revenue on L1 will ultimately exceed that of the underlying network.

We’ll discuss this later, but remember this is a key point of contention.

The latter’s section on stablecoins is a consensus mentioned in all three research reports, with Bitwise’s report even offering a more explicit stance.

—In 2026, in some emerging countries, stablecoins were accused by companies of disrupting their domestic financial systems, and I listed the opportunities that lay within that situation at the time.

Unlike previous research reports, Galaxy’s report consists of 26 independent predictions, which can be summarized into the following five core sections:

|

Chapter Theme |

Prediction point number |

Expected length proportion |

Focus |

|

I. Bitcoin and Macroeconomic Game Theory |

1 – 5 |

20% |

Volatility reduction and the post-ETF era’s investment logic of dollar-cost averaging |

|

II. Solana and On-Chain Capital Markets |

6 – 10 |

25% |

Core focus: The meme craze is fading, and real revenue is rising. |

|

III. Power Transfer in the L1/L2 Value Chain |

11 – 16 |

20% |

The battle for “profit sharing rights” between the application layer and the protocol layer |

|

IV. Integration of Stablecoins with Traditional Finance |

17 – 21 |

20% |

Settlement volume surpasses ACH, traditional giants enter the market. |

|

V. AI and On-Chain Infrastructure |

22 – 26 |

15% |

AI Agents: On-Chain Payments and New Regulatory Frontiers |

2.1 BTC and Macroeconomic Game

The section on BTC and macroeconomic game theory overlaps with Bitwise’s opening points about the end of the four-year cycle theory and the shift in pricing power. Both argue that as crypto assets become increasingly integrated with the real-world market and the overall crypto market grows, mainstream cryptocurrencies will experience less volatility and behave more like the Nasdaq, leading to a healthier market in the future.

My prediction for BTC’s price movement is consistent with my previous research on gold, leaning towards a pattern of initial decline followed by a rise.

More specifically, G believes that the short-term risk for BTC (early 2026) is skewed to the downside unless BTC can stabilize above $100k-$105k; otherwise, the market will remain in the shadow of a “post-halving correction year.”

In addition to the macroeconomic factors I mentioned earlier, such as the low real interest rates in the US, I also mentioned the US midterm elections and the peak in AI capital expenditures.

The US midterm elections will be held on November 3, 2026.

Previously, in 2025, with Republicans controlling both houses of Congress, the crypto industry enjoyed a policy “honeymoon period” (such as the passage of the GENIUS Act and a major reshuffle of SEC personnel).

G believes that if Democrats regain control of either the House or the Senate, radical pro-crypto legislation like that enacted in 2025 will stall.

Basically, institutions will start recouping funds 3-6 months before the mid-term election (i.e., mid-2026) to avoid policy fluctuations caused by the election. This is the political incentive that Galaxy believes will make the market “dull and volatile” in 2026.

The reason for the peak in AI capital expenditure is that institutions such as Goldman Sachs and Bank of America predict that global capital expenditure on AI supercomputing centers will peak in 2026 (estimated to exceed $500 billion).

Over the past two years, venture capital that should have flowed into the crypto market has been frantically siphoned off by AI, with the stock price growth of Nvidia and Microsoft built on the expectation that “as long as you buy chips, you can make a lot of money in the future.”

Spending peaks in 2026, signifying the end of the “buying shovels (infrastructure)” phase. If these giants cannot prove by then that “selling gold mines (AI software/business)” can generate hundreds of billions in profits, the entire AI valuation bubble will collapse instantly.

Furthermore, the tens of billions invested in hardware in 2024-2025 will face huge depreciation provisions in 2026. If revenue does not keep up, the profit statement will look very bad.

This will lead to a liquidity crunch, and the withdrawal of funds will drag down all risky assets, with cash and government bonds flowing back first.

The logic of flowing to assets with real revenue is the same as the path I previously explored in my discussion of traditional asset rotation.

The above two points are G’s differing views on the 2026 trend of BTC, and I believe they are two very valuable points.

Whether these two events will actually occur requires further research, but at least we’ve seen a different perspective compared to the previous one that only talked a lot.

I feel so much more at ease, hahaha

2.2 Solana and On-Chain Capital Markets

Have you noticed that SOL is repeatedly mentioned in Messari, Bitwise, and now Galaxy?

This makes me seriously doubt how much of this is driven by self-interest, and how much is genuinely from a genuinely nice SOL, the Alpha opportunity I’ve always dreamed of.

G’s viewpoint isThe on-chain economy will shift from meme-driven to “real revenue-driven,” and the Solana on-chain capital market size is predicted to surge from $750 million to $2 billion.

Leaving aside the SOL price forecast, this part overlaps with M’s views on the L1 valuation trap and DePin’s revenue year.

Let’s start with the backside. I had AI calculate the cost basis of these three SOLs for me, and the approximate ranges are as follows:

|

mechanism |

Where is the “buttock”? |

Estimated cost (for reference only) |

|

Galaxy Digital |

He issued the Invesco Galaxy SOL ETF; he is also Solana’s top validator and the initiator of DAT (Digital Asset Treasury). |

I entered the market in multiple stages: I acquired a significant amount of low-priced tokens (approximately $20-$40) during FTX’s bankruptcy liquidation in 2023; and purchased more tokens through an ETF in 2025 at a cost of approximately $100-$120. |

|

Bitwise |

They just launched BSOL (Staking ETF), and currently manage over $500 million in assets. |

Recent buying has been primarily driven by ETF subscribers, with an average cost of around $120+. |

|

Messer |

It is a long-term partner of the Solana Foundation, and many of its analysts were early evangelists of SOL. |

The cost of its core members and affiliated VCs’ private funding rounds in 2020-2021 was likely below $10. |

As of January 12, 2026, the price of SOL is $139.

Next, let’s look at the head part, and combine it with some data to see why G’s viewpoint is—The on-chain economy will shift from meme-driven to “real revenue-driven,” and the price of SOL will surge.

Strictly speaking, I think the research report means that hype-driven memes are about to decline, while business-oriented memes will become the new favorites in 2026.

In other words, hype-driven memes won’t disappear, but the original, unregulated funds driven solely by FUD/FOMO will see their overall capital diluted due to the exponentially increased difficulty in making profits.

The reasons are as follows:

Extremely low success rate: According to tracking data from 2024-2025 for platforms like Pump.fun, less than 2% of tokens successfully listed on mainstream DEXs, and 99% of those tokens went to zero within three months of listing.

This extremely high failure rate can lead to severe investor fatigue and financial exhaustion after multiple failed attempts, causing retail investors to “go back to zero” repeatedly.

The exhaustion of the existing market share: Data from the end of 2025 shows that the total transaction volume in the Meme sector decreased by approximately 65% compared to the beginning of the year.

Excluding the main factors of the overall market correction, this means that the number of new “buyers” entering the market is no longer keeping up with the pace of coin issuance.

When the market enters a phase of zero-sum game, funds will naturally seek out more certain destinations.

Institutional entry: This is the biggest logic. With the implementation of relevant policies and the entry of institutions in 2026, institutional analysts could no longer write a report saying, “Because this cat picture is cute, we’re going to invest $100 million.”

But they could write: “The project has acquired 1 million active users through MEME (promotional means), generating $50 million in annual fee revenue, and currently has a low price-to-sales ratio (P/S).”

If we follow G’s logic, future memes will fall into the following three categories:

|

type |

Representative characteristics |

Key Indicators |

Investment Logic |

|

Pure Emotion MEME (P Junior Battlefield) |

Pure Stray Dog, Flash Mob, PVP |

Twitter popularity, whale holdings, 15-minute trading volume |

Making quick money: the instantaneous burst of attention in the game |

|

Culture/Community MEME (Evergreen Blue Chip) |

Such as DOGE, PEPE, WIF |

Growth in cryptocurrency holding addresses, secondary market depth, cultural symbols |

Earn consensus money: Bet on it becoming the chain’s “totem”. |

|

Business/Revenue MEME (Institutional Favorite) |

Behind it are AI, PayFi, or hardware businesses. |

Agreement Revenue (REV), Buyback Ratio, Business Growth Rate |

Earning money with certainty: Enjoying the narrative premium while having fundamentals as a safety net. |

Purely sentiment-driven MEME logic is Value = Attention; once no one talks about it anymore, liquidity instantly dries up, and the price goes to zero.

Many of my friends are also on-chain P-skill traders. By constantly sensing on-chain sentiment, monitoring the popularity of social media content, and managing their positions, they are able to achieve stable profits in the “fool’s denial” (a term referring to speculative trading on cryptocurrencies).

However, this kind of chain scanning requires most of my time and energy, which isn’t suitable for a lazy person like me. That’s why many recent Chinese cryptocurrency posts use phrases like “I’m here!”, “I love you, Mom!”, and “Mom!”

Although we’re all in the same circle, and I saw it early on, I won’t rush in because I know my limitations; that kind of life isn’t for me.

With the involvement of institutions, the logic of business-oriented MEMEs becomes: Value = Attention + Floor Value (Revenue)

Suppose an AI computing power project issues its own token via MEME. When the token price drops to a certain level, the computing power rental income (cash flow) earned by the project will trigger a buyback and burn.

This type of coin experiences explosive growth in bull markets, similar to MEME (driven by narrative), and exhibits resilience in bear markets, resembling blue-chip stocks (through buybacks), somewhat like a “leveraged convertible bond.”

The projects I’m looking for in the future are those with real underlying business operations, launched on the SOL platform, leveraging SOL’s high-frequency settlements and the viral spread of memes, gradually becoming favorites of both institutional and retail investors.

However, the above assumptions are all based on G’s perspective, which presents at least two risks:

First, if Firedancer experiences a major bug or delay, Solana’s “financial-grade application” narrative will be rendered meaningless.

Secondly, it underestimated retail investors’ reliance on sentiment and misjudged speculative memes. While the logic wasn’t necessarily flawed, the speed of this shift was more problematic.

Of the new memes on SOL, how many are hype-driven and how many are genuinely business-driven? At least in my opinion, retail investors who entered the market under the influence of sentimental FOMCs are unlikely to change their minds in a short period of time, and they will never disappear.

Similarly, following this logic, I identified some key projects worth paying attention to.

Key projects that have already been implemented:

- PayFi (Payments as Finance): Representative projects include Helius and Solana Pay. They leverage Solana’s low latency to reduce the cost of settling fiat currencies in cross-border trade to one ten-thousandth.

- RWA (Real Asset Tokenization): Ondo Finance: Bringing US Treasury yields on-chain.

- LST and Liquid Staking: Jito (JTO): By controlling the weighting of MEV allocations, Jito effectively plays a dual role as a “central bank” and “clearinghouse” on Solana.

- Decentralized computing power trading: Render (RNDR): With AI spending reaching its peak, enterprises need cheaper distributed computing power, and Render’s settlement efficiency on Solana is its core competitive advantage.

In addition, you can also check out BONK, JUP, ai16z, and aixbt.

The above viewpoints are referenced from Ace

Research Report Series:

Messari 2026 Crypto Theses: Why Speculation Is No Longer Enough (Part 1)