KEYTAKEAWAYS

- River’s surge reflects a structural re-rating tied to its role as a chain-agnostic stablecoin liquidity layer, reinforced by integration with TRON’s dominant USDT settlement ecosystem.

- Derivatives positioning amplified the rally, with exceptionally high funding rates signaling short-squeeze dynamics rather than purely organic spot demand.

- Whether River can sustain its valuation will depend less on short-term price momentum and more on adoption, token supply dynamics, and execution of its cross-chain infrastructure vision.

CONTENT

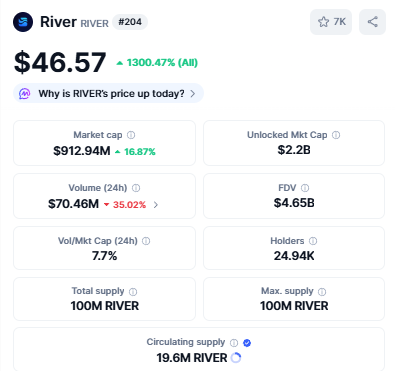

Justin Sun’s $8 million strategic backing pushed River’s valuation to a $2 billion high, highlighting growing market conviction in chain-abstracted stablecoin infrastructure amid extreme leverage-driven momentum.

A SINGLE ANNOUNCEMENT, A SHARP REPRICING

River, a decentralized chain-abstraction stablecoin infrastructure project, entered a new phase of market attention after Justin Sun publicly confirmed an $8 million strategic investment, an announcement that immediately altered how the market priced both River’s growth prospects and its integration path within the TRON ecosystem. Following the disclosure, River’s fully diluted valuation surged toward $2 billion, marking a new all-time high, while spot prices climbed above $46, according to aggregated exchange data, reflecting a rapid reassessment by traders who interpreted the investment not as passive capital but as an endorsement of River’s role in cross-chain stablecoin settlement.

Unlike typical headline-driven pumps, the repricing coincided with tangible protocol expansion. River’s core product, satUSD, is designed to enable 1:1 minting against USDT, USDD, and other multi-chain stablecoin assets, positioning the protocol as a chain-agnostic liquidity layer rather than a single-network token. Public documentation and on-chain dashboards indicate that this abstraction model allows River to route stablecoin liquidity across ecosystems while maintaining parity, a design that has drawn comparisons to earlier cross-chain settlement experiments but with a stronger emphasis on composability and capital efficiency.

INFRASTRUCTURE, NOT JUST SPECULATION

The strategic logic behind Sun’s investment becomes clearer when viewed through TRON’s existing dominance in stablecoin settlement. According to data published by TRONSCAN and cited by multiple industry reports, TRON consistently processes the majority of global USDT transfer volume, making it one of the most heavily used settlement layers for dollar-denominated crypto transactions. By supporting River’s infrastructure, Sun effectively extends TRON’s stablecoin reach into a broader, chain-abstracted framework, where liquidity can move seamlessly between networks without fragmenting user experience.

This positioning is reinforced by River’s recent collaboration with Sui, which signals an intent to operate as neutral infrastructure rather than a TRON-exclusive tool. Official announcements from both teams describe the partnership as a step toward expanding stablecoin functionality across heterogeneous execution environments, a narrative that aligns with broader industry trends favoring abstraction layers over siloed chains. In this context, River’s rally reflects not only speculative enthusiasm but also a market attempt to price in infrastructure optionality.

DERIVATIVES HEAT AND CROWD BEHAVIOR

While fundamentals provided the narrative backbone, market mechanics amplified the move. Over the past two weeks, River’s token price increased by more than eightfold, a pace that drew aggressive participation in derivatives markets. Exchange data shows that perpetual futures funding rates for River briefly spiked to levels exceeding 4,000% annualized, an extreme reading that indicates a heavily crowded short side and intense squeeze dynamics rather than balanced directional conviction.

Such conditions often create feedback loops, as forced liquidations on short positions add fuel to spot buying, pushing prices higher even in the absence of proportional new capital. The surge in both spot and futures volume, which placed River among the most actively traded assets globally during peak sessions, underscores how leverage and sentiment can temporarily dominate price discovery, especially when a compelling narrative attracts retail and momentum traders simultaneously.

LIQUIDITY, UNLOCKS, AND SUSTAINABILITY

Despite the strength of the rally, questions around sustainability are already shaping market discourse. Community discussions and analyst notes increasingly focus on token unlock schedules and circulating supply dynamics, recognizing that infrastructure narratives do not eliminate the mechanical impact of supply entering the market. Publicly available tokenomics data suggests that upcoming unlocks could introduce additional liquidity, a factor that long-term participants are watching closely as a potential inflection point for volatility.

At the same time, River’s rising exchange coverage, including expanded spot and derivatives listings on major venues, has improved liquidity depth, which may mitigate abrupt drawdowns compared with thinner, earlier phases of trading. The balance between new supply and growing market access will likely determine whether River’s valuation consolidates at higher levels or retraces as speculative pressure fades.

A BET ON STABLECOIN ABSTRACTION

Ultimately, River’s ascent to a $2 billion valuation reflects a broader bet on stablecoin abstraction as a critical layer in crypto’s next infrastructure cycle. As capital and users spread across multiple blockchains, protocols that can unify liquidity and settlement without imposing friction are increasingly viewed as strategic assets rather than peripheral tools. Sun’s investment has accelerated this narrative by anchoring River within a proven stablecoin ecosystem while preserving its cross-chain ambition.

Whether the current rally can be chased safely is less a question of short-term momentum and more a question of execution, adoption, and how quickly infrastructure usage can justify market expectations. In the near term, River’s price action will likely remain volatile, shaped by derivatives positioning and unlock events, but over a longer horizon, its success will hinge on whether chain abstraction moves from a compelling thesis to a widely adopted standard in stablecoin finance.

Read More:

Justin Sun: A Controversial Figure in the Cryptocurrency Space