KEYTAKEAWAYS

- The January 22 service interruption at Four.meme reflects not just a suspected security incident, but the structural pressure faced by meme launch platforms operating at the center of high-frequency issuance, airdrops, and attention-driven participation.

- In airdrop-heavy market phases, the primary attack surface increasingly shifts away from smart contracts toward front-end interfaces, wallet authorization flows, and social amplification, where urgency and information asymmetry weaken user defenses.

- As BNB Chain’s meme economy scales, security capability and transparent incident disclosure are becoming limiting factors for platform credibility, turning information quality itself into a form of market infrastructure rather than a secondary concern.

CONTENT

Four.meme’s latest service disruption highlights how airdrop-driven meme cycles turn launch platforms into high-risk infrastructure, where security incidents, information gaps, and user behavior interact to amplify market volatility.

WHAT HAPPENED

On January 22, 2026 (UTC+8), multiple market trackers and exchange news feeds reported that Four.meme—a BNB Chain memecoin launch platform—experienced a brief service disruption around 20:30 (UTC+8), affecting core functions such as user login and token issuance, before services were later restored.

Because public disclosures around the incident remain limited—largely framed as a “suspected hack” followed by an “interrupted then restored” status update rather than a full technical post-mortem—the episode is best understood not as a confirmed exploit, but as a stress test of incident response at the center of a high-velocity meme economy. In environments where attention is fragmented by NFT airdrops, campaign-driven incentives, and the familiar “get in early” reflex, market reaction often becomes as informative as the unresolved technical root cause itself.

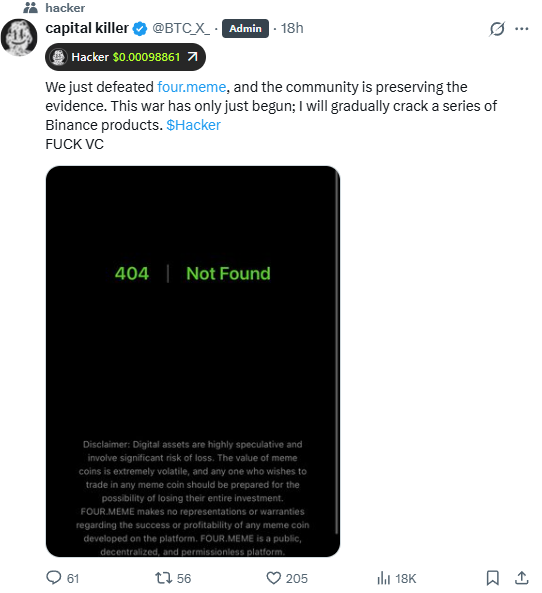

The situation was further amplified by a separate social signal. An X account posted a message claiming: “Today I will launch an attack on four.meme. I will use my newly developed virus injection attack …”

Such pre-announcements do not, by themselves, demonstrate technical capability. However, they do reflect how the meme market has evolved into a public theater of adversarial attention, where attackers—or would-be attackers—understand that virality can be weaponized to amplify fear, lure users into phishing, or obscure real intrusions within a louder spectacle.

WHY THIS PLATFORM KEEPS SHOWING UP IN INCIDENT REPORTS

If Four.meme appears repeatedly in exploit headlines, it is largely because launchpads combine three characteristics that attackers favor: fresh liquidity, repeatable user flows, and intense time pressure.

Historically, the platform has already faced confirmed exploits. A technical write-up by Verichains describes a February 11, 2025 incident with estimated losses of around $183,000, attributed to platform mechanics being abused to enable fund extraction. Later, on March 18, 2025, multiple outlets reported that Four.meme suspended and subsequently reinstated launch services following another exploit described as a sandwich or market-manipulation-style attack, with losses cited between $120,000 and $130,000 depending on the report.

What links these incidents is not a single persistent bug, but the structural reality that launchpads are adversarial environments by design. They sit at the point where liquidity is bootstrapped, transfer rules and pool-initialization logic are complex, and users are conditioned to approve transactions quickly because “the window is now.” Even when core protocol code is sound, the surrounding system—front-ends, routing layers, signing prompts, third-party dependencies, and user behavior—creates an attack surface that increasingly resembles an exchange rather than a simple dApp.

AIRDROPS + MEME VELOCITY = A SECURITY REGIME SHIFT

The recurring pattern—an NFT airdrop drawing attention followed by a security incident—is not coincidence, but a recognizable feature of crypto market microstructure.

Airdrops and reward programs produce short-lived but intense bursts of activity: large numbers of users repeatedly connecting wallets, signing messages, approving permissions, and navigating unfamiliar interfaces, often across cloned or hastily deployed sites. This is why the highest-risk periods for a community are frequently not quiet months, but peak incentive windows. Even outside crypto, mainstream security research consistently shows that threat actors exploit urgency because it weakens verification habits; social-engineering attacks are most effective when users are pushed to act quickly rather than carefully.

Within meme-coin launchpad ecosystems, the “airdrop mindset” also reshapes attacker incentives. High-volume onboarding creates opportunities that go beyond draining a single liquidity pool. The payoff may come from approval phishing, malicious script injection, DNS or front-end compromise, or large-scale impersonation campaigns designed to harvest signatures. This is why phrases like “virus injection” spread quickly: they map directly onto an existing fear that the front end—not the chain itself—is the weakest link.

Even if Four.meme’s January 22, 2026 incident is ultimately classified as a contained operational disruption rather than a confirmed fund loss, it still carries significance. It signals that the market is entering a phase where security posture becomes a constraint on growth. Airdrops and rapid token launches can attract users, but each additional user also increases the probability mass of mistakes, rushed approvals, and compromised devices.

WHAT THIS MEANS FOR BNB CHAIN’S MEME ECONOMY

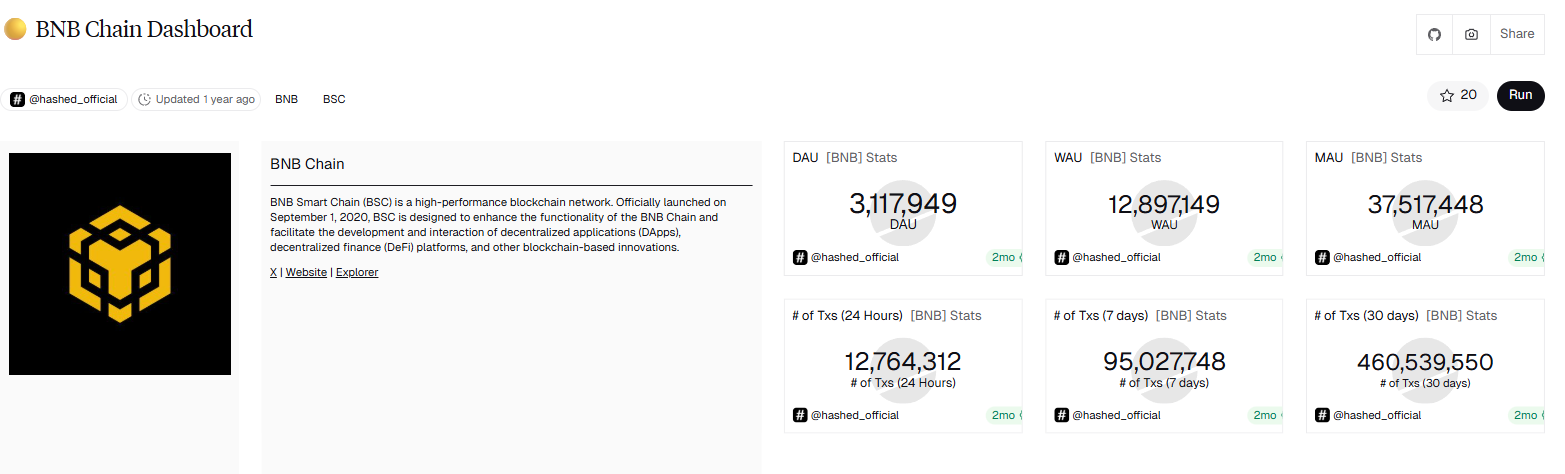

BNB Chain’s meme cycle is driven less by ideology than by throughput and distribution. When a launchpad gains momentum, it can generate measurable surges in token creation and trading activity. One market report noted that more than 15,000 tokens were created on January 11, 2026—the highest level since mid-October in that dataset—linking the spike directly to renewed meme-token attention.

Such acceleration is bullish for network activity and fee narratives, but it introduces a paradox. The faster the issuance factory runs, the more costly downtime becomes, and the more attractive the factory appears to adversaries. In traditional finance terms, a memecoin launchpad becomes systemically important to its niche once it concentrates enough issuance flow and liquidity formation for the market to treat it as implicit infrastructure.

This is where the macro layer emerges. The 2025–2026 period has seen regulators and institutions globally push digital-asset markets toward more robust infrastructure standards, whether through clearer rulemaking or institutional-grade operational controls. At the same time, retail-driven crypto activity has moved in the opposite direction—toward faster launches and higher volatility. When these forces collide, the platforms that endure tend to be those that demonstrate incident transparency, repeatable remediation, and credible third-party verification, rather than relying on assurances that issues have simply been “fixed.”

For Four.meme, two lessons from its historical record are already being priced in by the market. First, repeated incidents compound reputational risk even when each episode is resolved, as sophisticated participants apply a discount to future uptime and safety, raising the cost of liquidity formation. Second, post-incident recoveries are real but not free. Coverage following the March 2025 incident noted compensation and security-reinforcement messaging after services were reinstated. In crypto, compensation functions not only as user support, but as a balance-sheet and trust signal that shapes whether the next launch is met with enthusiasm or hesitation.

FROM “WAS IT A HACK?” TO “WHAT KIND OF MARKET IS THIS BECOMING?”

The more useful analytical shift is to move beyond binary framing—“hacked” versus “not hacked”—and view these episodes as part of a broader transition. Meme issuance is maturing into a high-frequency market structure, and high-frequency structures inevitably generate security arms races.

In earlier cycles, risk was concentrated primarily in token contracts themselves. In the current cycle, risk increasingly resides in the issuance pipeline: launch mechanisms, liquidity initialization logic, UI and signing surfaces, and the social layer that directs users where to click. This is why advance warnings, whether genuine or performative, can move markets even without confirmed exploits—they draw attention to the pipeline rather than the asset.

If Four.meme ultimately publishes a detailed post-incident report for the January 22 disruption—clarifying root cause, whether funds were affected, whether user approvals were compromised, and what changes were implemented—the market can treat the event as a contained operational setback. If not, the information vacuum will be filled in the familiar way memecoin cycles tend to operate: rumors, screenshots, impersonation links, and volatility.

That dynamic underscores the core insight of this episode. In the meme economy, information quality itself has become an asset, and every security incident is also an information crisis.

Read More:

Binance Co-CEO Yi He’s Account Hack Exposes Critical Security Risks Behind Meme-Coin Manipulation