KEYTAKEAWAYS

- Gold and silver are being repriced as primary geopolitical hedges amid credible military escalation risk and tariff-driven uncertainty, while Bitcoin remains constrained by leverage unwinds and liquidity sensitivity.

- The sharp divergence between precious metals and BTC underscores that, in crisis regimes, markets still favor assets with long-standing monetary credibility and central-bank demand.

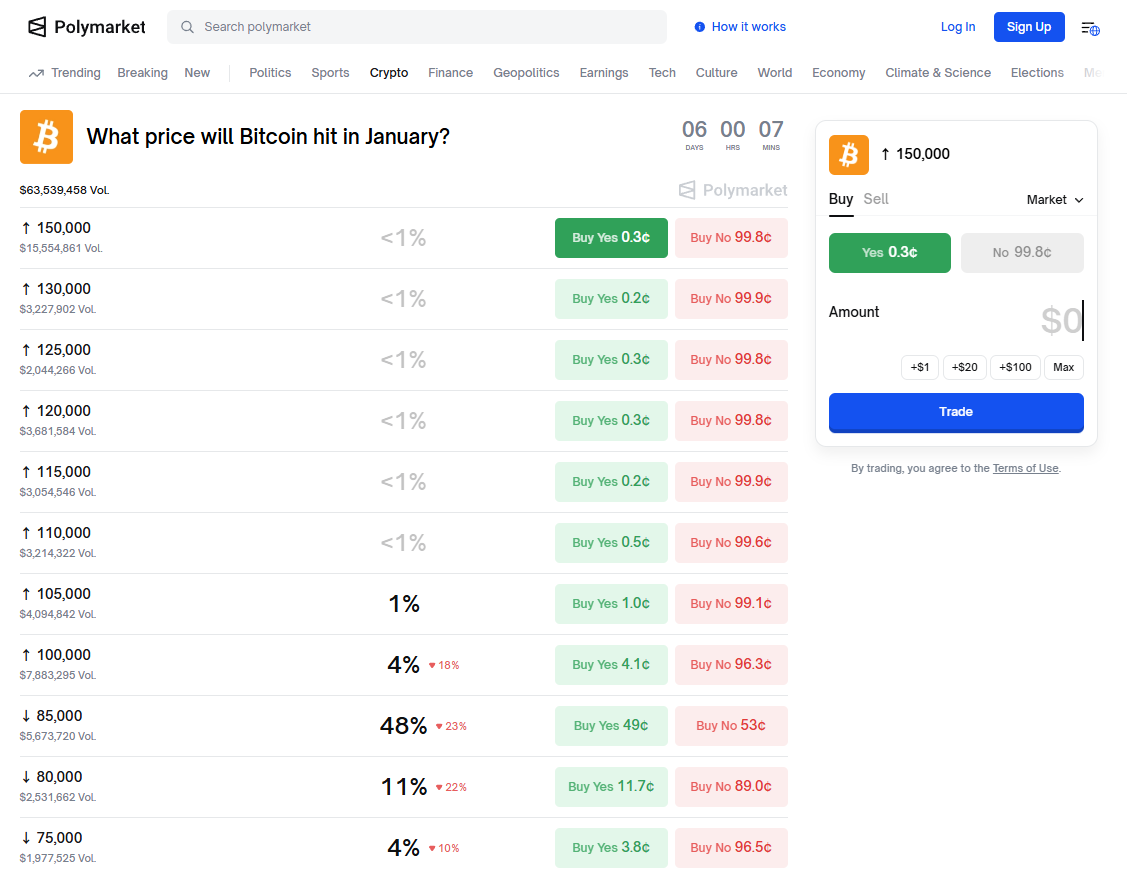

- Polymarket’s rising odds of Bitcoin revisiting $85,000 reflect a shift toward downside protection and macro-driven positioning rather than speculative upside, signaling a market bracing for prolonged uncertainty.

CONTENT

Escalating U.S.–Iran tensions, Trump’s renewed geopolitical brinkmanship, and tightening liquidity have pushed gold above $5,000 while exposing Bitcoin’s vulnerability as markets increasingly price conflict risk over “digital gold” narratives.

WHEN SAFE HAVENS ARE STRESS-TESTED

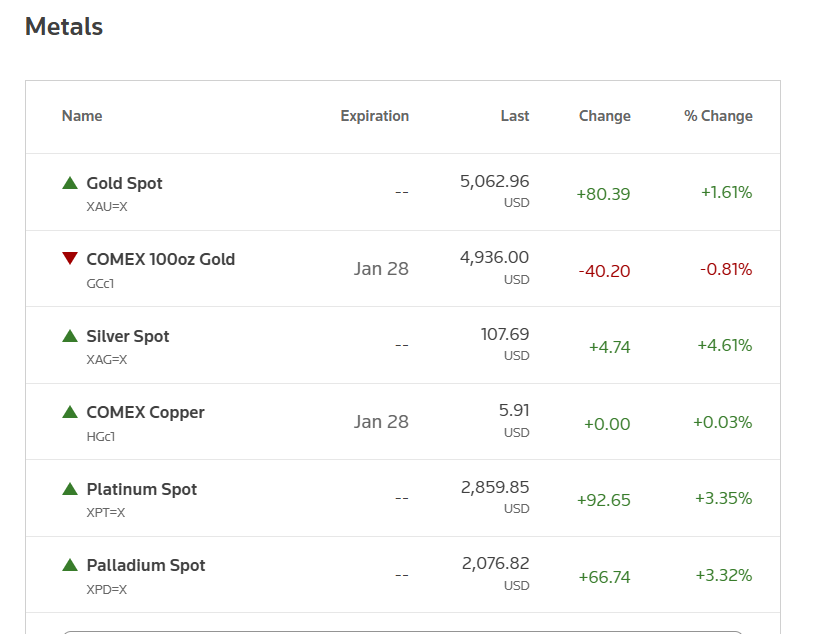

In late January 2026, markets were forced to price a risk mix that is unusually toxic for “growth-like” assets: a renewed escalation premium around Iran alongside a second, separate credibility premium tied to Washington’s tariff signaling and alliance bargaining, which together pushed investors toward assets that behave well under uncertainty rather than assets that merely benefit from liquidity. Reuters reported spot gold surging past $5,000/oz for the first time, printing an intraday record around $5,085.50, with analysts explicitly linking the move to safe-haven demand under geopolitical instability and policy unpredictability. The same burst of defensive positioning also lifted silver into historically rare territory, with Reuters coverage around the same window describing silver breaking above $100/oz amid a speculative frenzy and safe-haven demand. This context matters because it explains why the “gold bid” looked structural rather than headline-driven: central-bank buying, ETF flows, and the perception that policy risk is no longer a tail event but a baseline assumption all reinforce gold’s role as the asset of last resort when investors want duration-free insurance.

WHY GOLD AND SILVER SURGE

Gold’s 2026 breakout has not required a perfect macro setup; it has thrived precisely because the setup is messy, since the metal tends to benefit when confidence in policy coherence weakens and when geopolitical uncertainty increases the value of portability and neutrality. Reuters described gold’s move as being supported not only by geopolitics but also by expectations of U.S. monetary policy easing, ETF inflows, and central-bank purchases (with China highlighted in the reporting), which is the combination that turns a “fear trade” into a sustained trend rather than a one-day spike. Silver, meanwhile, has behaved less like a pure monetary hedge and more like a crowded momentum trade layered on top of a tightness narrative, which is why it can overshoot violently: Reuters noted silver’s rapid acceleration to/through the triple-digit threshold, a level that psychologically pulls in trend-followers and retail reflex bids. Even the equity “fear gauge” responded in a way that fits the same regime shift: the VIX jumped to around 20 in the Greenland-tariff tension window, signaling a broad repricing of uncertainty rather than a single-asset story. If that sounds like a classic “risk-off tape,” it is—except the twist is that the geopolitical premium was not only Middle East related; it was also entangled with tariff threats and alliance bargaining over Greenland, where Reuters reported Trump first threatening levies and later withdrawing them after outlining a framework with NATO.

BITCOIN UNDER LIQUIDITY PRESSURE

Bitcoin’s underperformance in this specific kind of stress does not automatically disprove the “digital gold” thesis, but it does clarify its conditionality: BTC can resemble an inflation hedge or a debasement narrative when liquidity is expanding and positioning is patient, yet it often behaves like a high-beta, 24/7 risk asset when the market needs instant liquidity and leverage must be cut first. CoinDesk documented bitcoin sliding back into the high-$80,000s in late January, with additional reporting framing the move as a give-back of earlier-year gains and a reflection of weakened risk appetite even as precious metals ripped higher. The mechanics are straightforward and brutally non-ideological: because BTC trades continuously and has deep derivatives venues, it becomes one of the fastest assets to de-risk when headlines shift the probability mass toward adverse outcomes, and once key levels break, liquidations accelerate the move in a way that gold’s largely unlevered spot market structure typically does not. CoinDesk’s Asia morning briefing earlier in the month described a separate but instructive flush where bitcoin’s drop below $93,000 triggered roughly $680 million in long liquidations, underscoring how quickly leverage can turn a pullback into a cascade. In other words, gold rallies because it is the destination of fear, while bitcoin often sells off because it is the funding source of fear—until the forced selling ends and long-horizon buyers step in.

GEOPOLITICS VS POLICY RISK

The market’s Iran pricing has been driven by a familiar channel—higher perceived probability of disruption, sanctions escalation, and second-order inflation risks via energy—but the more corrosive ingredient for risk assets is policy volatility, because it raises the discount rate investors apply to almost everything that depends on stable rules. Reuters reported Trump saying he and the U.S. military were weighing “strong options” on Iran, which naturally thickens the geopolitical tail and keeps safe-haven demand bid. At the same time, the Greenland tariff episode created a separate line of uncertainty about trade policy and alliance bargaining, first via the threat itself and then via the reversal, which can calm markets for a day while still reinforcing the belief that policy paths are discontinuous rather than gradual. This dual-premium environment is exactly where gold can look “clean” and bitcoin can look “messy”: gold does not require stable institutions to function, while bitcoin’s institutional bid—spot ETFs, corporate treasury narratives, prime-broker access—still depends on the smooth functioning of financial plumbing and risk tolerance, both of which tighten when volatility rises and macro catalysts cluster.

WHAT POLYMARKET IS PRICING IN

Prediction markets have become a shadow dashboard for how traders are translating headlines into probabilities, and the usefulness is not that they are always right, but that they quantify the distribution of expectations in real time in a way that social media cannot. On Polymarket’s crypto markets page, the contract referencing bitcoin dipping to $85,000 in January showed the probability rising to roughly 49% during the spike in macro uncertainty, which is effectively the market saying: “a deeper drawdown is no longer a fringe scenario; it is close to a coin flip.” The analytical value is that this probability can move faster than traditional research notes or daily closes, and it tends to react immediately to the same catalysts that drive liquidation clusters—geopolitical escalation headlines, tariff reversals, volatility spikes—so it often behaves like a high-frequency sentiment seismograph. In a regime where gold is breaking milestones and silver is sprinting through psychological levels, the signal from prediction markets is not simply bearishness on BTC; it is a reminder that bitcoin’s path is still governed by market microstructure—leverage, liquidity, and positioning—at least as much as by the long-run store-of-value narrative, which is why the “digital gold” story can be directionally true over cycles yet disappoint precisely when the tape turns into a forced-deleveraging event.

Read More:

Gold keeps breaking records while bitcoin stalls — why “digital gold” is lagging