KEYTAKEAWAYS

-

River shifts cross chain stablecoins from asset transfer to yield generation by allowing collateral to stay on the source chain while stablecoins are minted and used natively elsewhere.

-

Omni CDP and satUSD form a cross chain debt engine that upgrades stablecoins from simple payment tools into revenue generating infrastructure.

-

TRON expansion and the Vault product line will determine whether River can move from a sound mechanism to real world scale adoption.

CONTENT

WHY COLLATERAL BEING STUCK ON ONE CHAIN IS NO LONGER ACCEPTABLE

For years, cross chain stablecoins looked like a solution. In reality, they only solved transport. Assets were moved from Chain A to Chain B through bridges, wrapped tokens, and message layers. Each extra step added cost, delay, and risk.

The deeper problem never disappeared. Collateral often lives on chains that are secure and liquid, such as Bitcoin related assets or major LSTs. But stablecoin demand lives elsewhere. Trading, liquidity pools, yield strategies, and new applications are spread across many chains.

This separation creates structural inefficiency. The same capital must be rebuilt again and again in different ecosystems. Liquidity becomes fragmented. Yield opportunities stay isolated. Capital efficiency stays low.

River targets this exact problem. It separates collateral from usage. Users lock assets on the source chain and mint satUSD natively on the destination chain. Collateral does not move. Stablecoin utility does.

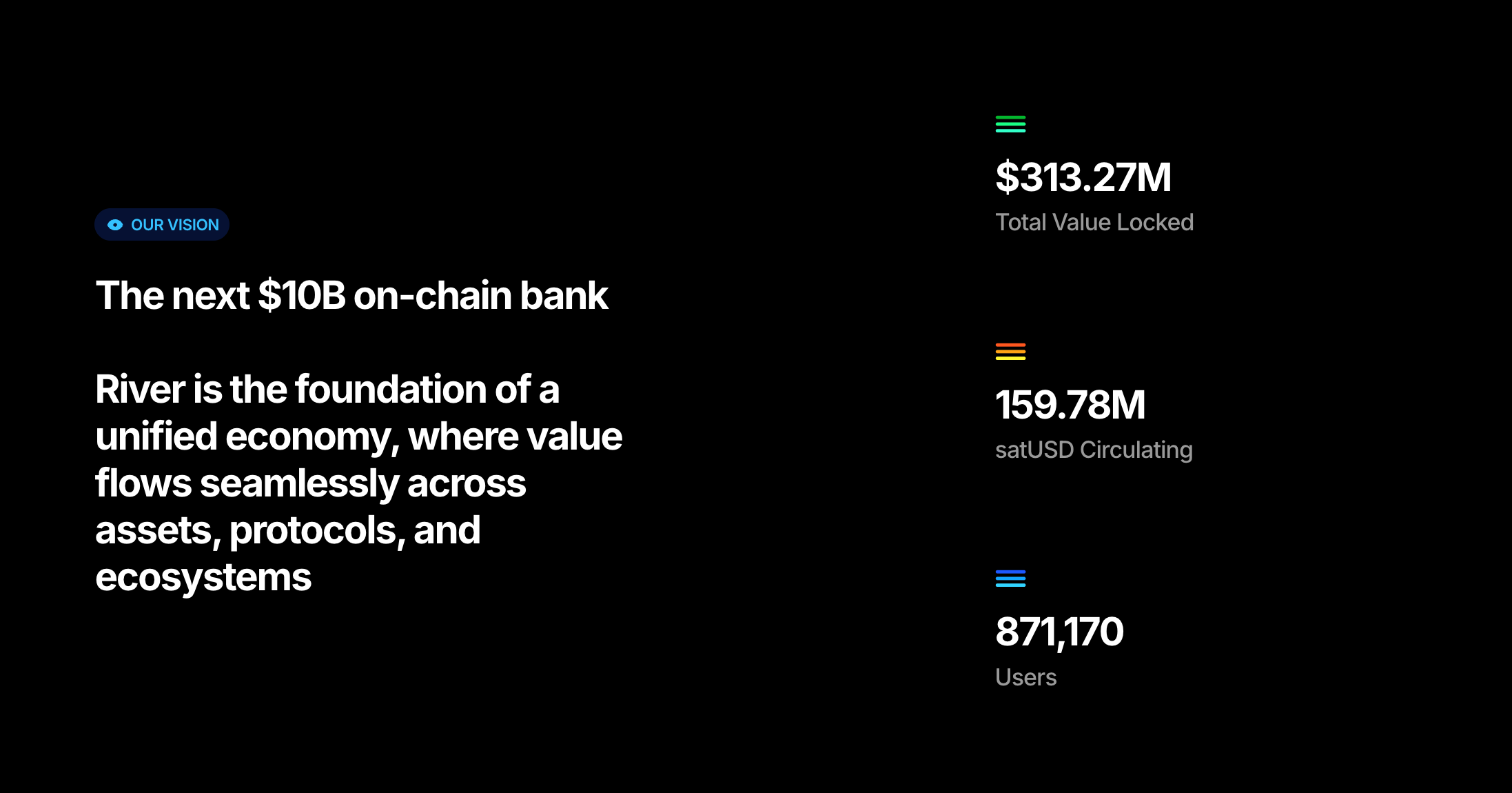

Instead of asking how to move assets more safely, River asks a different question. How can one unit of collateral generate value across multiple chains at the same time.

OMNI CDP AND SATUSD AS A CROSS CHAIN DEBT ENGINE

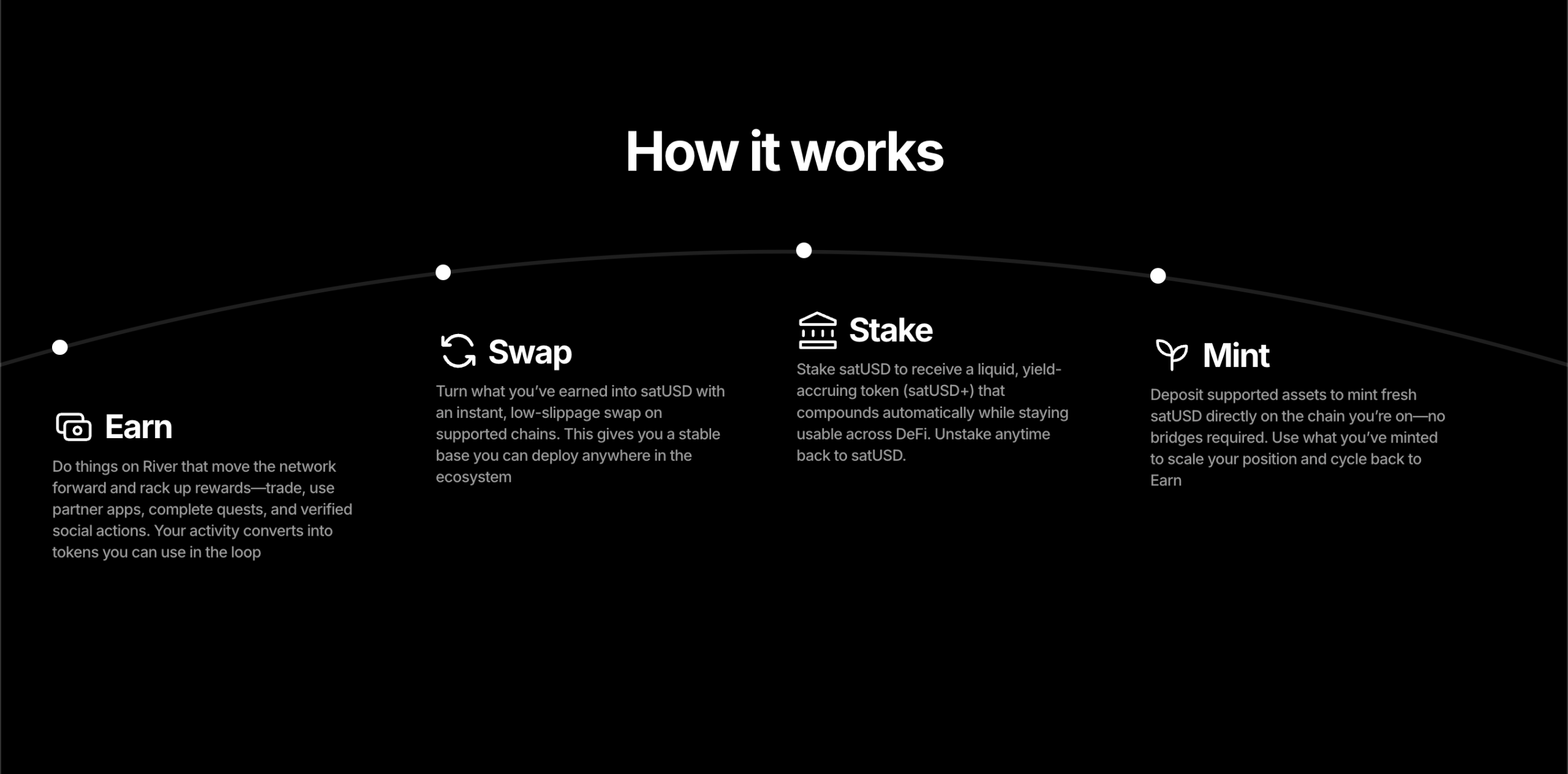

River’s core system is Omni CDP. Collateral is deposited on one chain. satUSD is minted on another chain as a native asset. This is not a bridge plus swap flow. It is a single debt position expressed across chains.

The system uses LayerZero OFT standards to support native multi chain issuance. satUSD exists directly on each supported chain without wrapping. This reduces friction and shortens the user path.

River also lowers the entry barrier. satUSD can be swapped one to one with USDT USDC and USD1. Users can start using satUSD without learning CDP mechanics first. The system handles complexity in the background.

satUSD is an over collateralized stablecoin. Collateral includes BTC ETH BNB and LST assets. Peg stability relies on liquidation and arbitrage mechanisms. The key difference is that the debt layer itself is cross chain by design.

Traditional CDP protocols face high expansion costs. Each new chain needs its own pools, liquidation liquidity, and demand side integration. River treats debt as a global layer first. Application growth then feeds back into collateral demand.

Around satUSD, River introduces staking. Users stake satUSD to receive satUSD plus. Rewards come from protocol revenue such as minting redemption and liquidation fees. satUSD is not just a medium of exchange. It becomes a yield bearing asset.

This turns stablecoin growth into a value loop. More usage creates more protocol revenue. Revenue flows back to long term participants. Growth relies less on external subsidies.

SMART VAULT AND PRIME VAULT AS RISK LAYERS

Omni CDP is the engine. Vaults are the consumer interface.

Smart Vault targets users who want yield without managing debt. Users deposit BTC ETH USDT or USDC. The protocol mints and stakes satUSD internally. satUSD never enters the user wallet. Users face no liquidation risk.

From the user side, this feels like a single step yield product. From the protocol side, it still feeds the satUSD debt engine. Complexity is absorbed by the system instead of the user.

Prime Vault targets institutions. Assets stay in custodial wallets. satUSD is minted and used internally by the protocol. Users do not directly hold debt. The design focuses on custody control and perceived compliance.

This is a CeDeFi style structure. Its success depends on details. Custodian quality. Asset segregation. Transparency of yield sources. Settlement behavior in extreme markets.

If these are unclear, Prime Vault becomes marketing. If they are solid, River may attract non native capital that DeFi protocols usually cannot reach.

Swap modules support one to one conversion between satUSD and major stablecoins. This supports peg stability and usability. River4FUN handles growth. On chain actions and social contributions generate River Points. Points later convert into governance aligned incentives.

TRON EXPANSION AND TOKEN FLYWHEEL AS THE REAL TEST

River’s recent expansion into the TRON ecosystem is a major signal. Reports show strategic investment from TRON DAO Ventures and plans to integrate satUSD into core TRON protocols.

TRON is one of the most active stablecoin ecosystems. If satUSD gains real liquidity and usage there, River moves from concept validation to market validation.

Funding reports also mention a larger strategic round involving multiple major crypto funds. Expansion plans include Ethereum BNB Chain Base Arbitrum Tron and Sui.

These signals matter because River positions itself as a debt layer that can scale across ecosystems. But they also concentrate risk.

Cross chain messaging risk is the first concern. If state synchronization fails, collateral and debt can diverge. This is a tail risk that affects system credibility.

Oracle risk is second. Different chains rely on different price feeds. Delays or failures are common causes of CDP incidents.

Liquidation and stability pool performance must be tested under congestion and MEV pressure. Recovery Mode logic must work across chains, not just locally.

Governance incentives are another sensitive area. Community discussions already show concerns about unlock order and staking dynamics. For a stablecoin system, trust is not optional.

Vault yield sources also require scrutiny. DeFi CeDeFi and RWA strategies need clear disclosure. Without transparency, the market will price them conservatively.

Stablecoin competition is no longer about who issues more tokens. It is about who uses collateral more efficiently.

River proposes a clear answer. One unit of collateral should work across chains at the same time. Omni CDP provides the mechanism. TRON expansion tests distribution. Vaults and token design test sustainability.

The next phase depends on execution. Are cross chain mint paths truly shorter and safer. Can satUSD liquidity hold one to one under stress. Does protocol revenue support long term incentives.

If any of these fail, chain abstraction becomes added risk. If they succeed, River may represent a new class of stablecoin infrastructure that turns fragmented liquidity into a unified system.