KEYTAKEAWAYS

- The USD1 airdrop on Binance appears less attractive than headline figures suggest, with rapid supply growth and token price risk likely pushing effective yields toward the high single digits.

- Onchain strategies currently offer higher nominal returns, led by OpenEden’s PRISM pre-deposit incentives and ListaDAO’s U/USDT LP program, though a significant portion of yield is driven by token rewards rather than base yield.

- Across all options, investors must weigh headline APY against dilution, liquidity constraints, and incentive sustainability, as elevated yields largely reflect short-term promotional dynamics rather than structural carry.

CONTENT

A comparative snapshot of current passive yield opportunities across exchanges and onchain strategies, assessing USD1 airdrop returns alongside higher-APY DeFi options from ListaDAO, OpenEden, and Buidlpad.

EXCHANGE-BASED YIELD

At the moment, the most talked-about yield opportunity is undoubtedly Binance’s newly renewed USD1 holding subsidy program.

On January 23, Binance announced an airdrop campaign for eligible users holding USD1 on the platform. The campaign runs from January 23 to February 20, with a total reward pool equivalent to USD 40 million in WLFI. Eligible users must hold a USD1 balance in any Binance account category, including spot accounts, funding accounts, margin accounts, and USD-M futures accounts, with margin and futures balances receiving a 1.2× reward multiplier. During the campaign period, WLFI rewards will be distributed weekly to USD1 holders. The first airdrop will take place on February 2, covering rewards accrued from January 23 at 08:00 to January 30 at 08:00, with subsequent distributions occurring every Friday.

A simple yield calculation suggests that the results may not fully align with general market expectations. Overall, there are two key variables: the total value of the WLFI reward pool, and the total amount of USD1 held on Binance.

Starting with the first variable, the WLFI reward pool was initially expected to be a fixed USD 40 million. However, earlier today, World Liberty Financial transferred 235 million USD1—worth approximately USD 40 million—from its treasury address to Binance. This transfer is likely to constitute the total reward pool for this airdrop campaign. As a result, over the coming one-month period, the actual value of the reward pool will fluctuate with WLFI’s market price. Given the current downward market trend and the natural sell pressure associated with airdropped tokens, it is reasonable to expect some degree of value erosion in the pool.

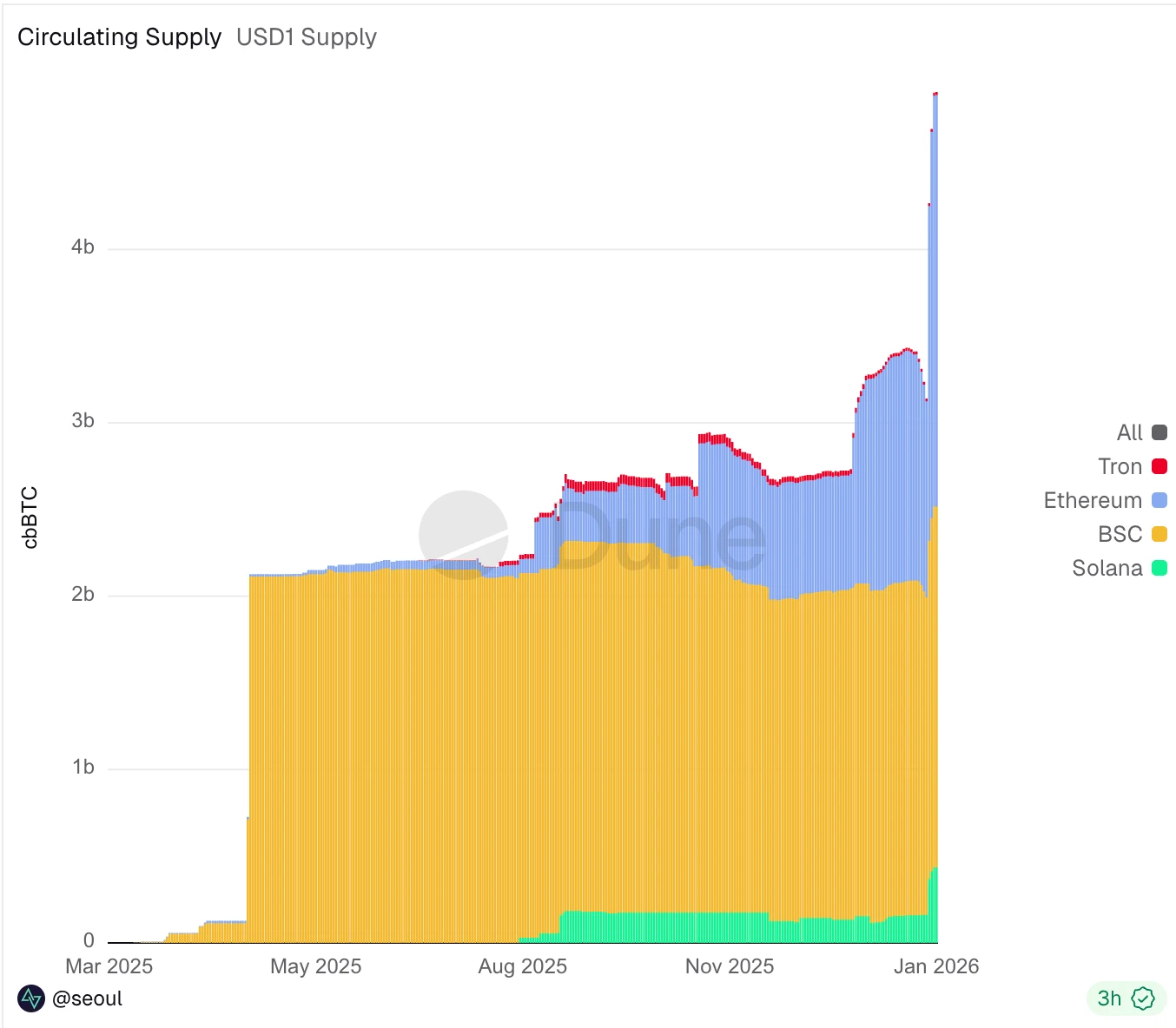

As for the total amount of USD1 on Binance, current total issuance has reached 4.9 billion USD1, with approximately 4.22 billion held on the Binance platform. Based on this static snapshot, the average annualized yield of the campaign would be around 12%. However, since Binance announced the campaign, USD1 supply growth has been unusually rapid—nearly 700 million new USD1 have been issued since January 23, with most of the new supply flowing directly into Binance. This dynamic will inevitably accelerate yield dilution.

Taking both variables into account, it is reasonable to expect the average yield of this campaign to fall below 10% relatively quickly, with a final level around 8% being a more realistic outcome. Under this assumption, unless one already holds USD1 (or other stablecoins with higher premiums than USDT, such as USDC), entering the position at a premium—such as converting USDT into USD1 at current market premiums—no longer appears particularly attractive from a cost-performance perspective.

ON-CHAIN STRATEGY ONE: LISTADAO U/USDT LP INCENTIVES (21.29% APY)

Earlier today, the leading BSC lending protocol ListaDAO announced a U-denominated LP deposit incentive program in collaboration with Binance Wallet.

Users must participate through Binance Wallet, with the campaign running from January 26 at 08:00 to February 9 at 08:00 (Beijing time). Participation involves depositing U/USDT LP into ListaDAO via smart lending, meaning users deposit both U and USDT simultaneously. ListaDAO is allocating 240,000 LISTA tokens as incentives, corresponding to a current annualized yield of approximately 21.29%.

ON-CHAIN STRATEGY TWO: OPENEDEN PRISM PRE-DEPOSIT (26.4% APY)

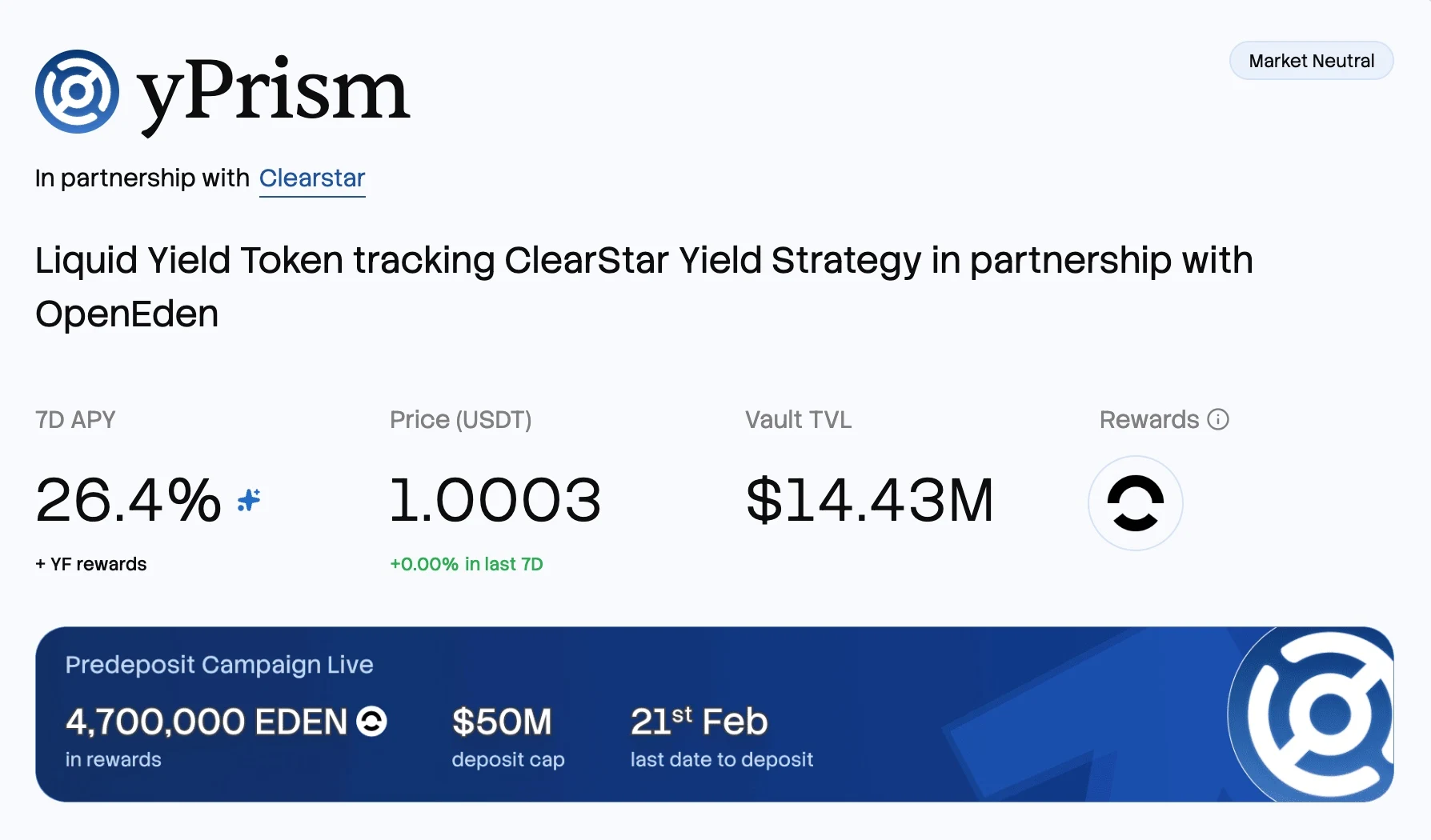

On January 23, OpenEden announced on X that it is partnering with FalconX and Monarq to launch a tokenized yield investment portfolio called PRISM. The product aims to deliver stable returns across market cycles through a multi-strategy quantitative model actively managed by Monarq, while maintaining low correlation with broader crypto price movements.

PRISM is scheduled to officially launch in February, but pre-deposits are already open. The pre-deposit cap is USD 50 million, with USD 14.43 million currently deposited, leaving ample remaining capacity. OpenEden is offering 4.7 million EDEN tokens as incentives for pre-deposit participants, resulting in a current real-time annualized yield of approximately 26.4%, primarily driven by additional token rewards.

ON-CHAIN STRATEGY THREE: BUIDLPAD VAULT PHASE TWO (8% APY)

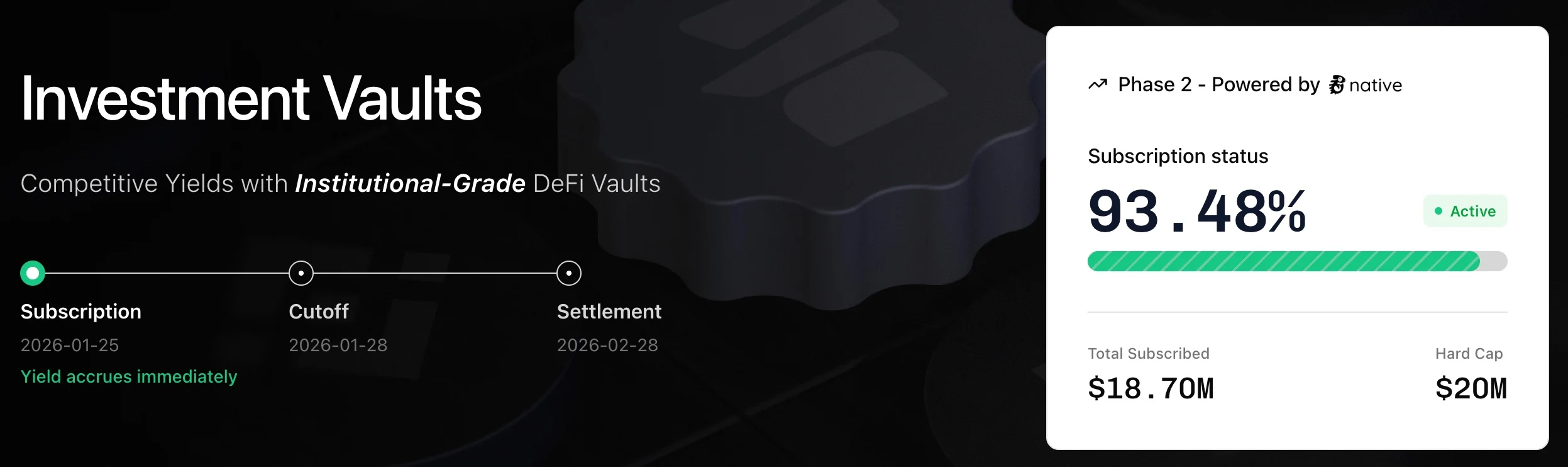

On January 24, Buidlpad announced the launch of Phase Two of its DeFi fixed-term deposit product, Buidlpad Vault, offering a fixed yield of 8%. Deposits opened at 08:00 UTC on January 25, with a total cap of USD 20 million. Supported assets include ETH and USDT on Ethereum, as well as BNB and USDT on BSC.

As of the time of writing, approximately USD 18.7 million has already been deposited, leaving a limited remaining allocation available for participation.