KEYTAKEAWAYS

-

Polymarket is not a betting platform but a probability market where information is priced through capital at risk, creating real time signals that often outperform polls and expert forecasts.

-

By enforcing full collateralization and market driven pricing, Polymarket transforms opinions into accountable financial positions, making accuracy more valuable than narrative.

-

As regulation, institutional capital, and AI driven trading converge, Polymarket represents the early structure of Information Finance, where uncertainty itself becomes a measurable asset.

CONTENT

INTRODUCTION WHAT IS POLYMARKET AND WHY PEOPLE CARE

What is Polymarket and why has it suddenly become one of the most discussed platforms in global finance and crypto markets.

This question is no longer only asked by Web3 users. It is now being discussed by hedge funds journalists regulators and policy analysts.

Image source: https://www.theblock.co/

At its surface Polymarket looks simple. Users trade on the outcome of real world events. Elections interest rate decisions wars technology launches and even scientific milestones. If an event happens one side pays out. If it does not the other side wins.

But this description misses the point.

What is Polymarket really about is not betting. It is about turning judgment into a financial position. Every trade is a statement of belief backed by capital. Unlike opinions on social media or forecasts on television Polymarket forces participants to accept consequences.

This is why Polymarket matters in a world defined by uncertainty. Traditional information systems are slow biased and fragmented. Polls lag reality. Experts face no cost for being wrong. Media incentives reward attention not accuracy.

Polymarket flips this structure. It creates a market where information competes openly. Prices move as new data appears. Bad information is punished. Good information is rewarded. Over time the market converges toward the most defensible probability.

This mechanism explains why Polymarket surged in 2025 and 2026. As geopolitical risk monetary policy uncertainty and technological disruption accelerated people searched for tools that could aggregate dispersed knowledge faster than institutions.

Polymarket did not predict the future perfectly. But it created something more powerful. A real time probability engine driven by incentives not narratives.

WHAT IS POLYMARKET AND HOW THE CORE MECHANISM WORKS

HOW PROBABILITY IS TURNED INTO A PRICE

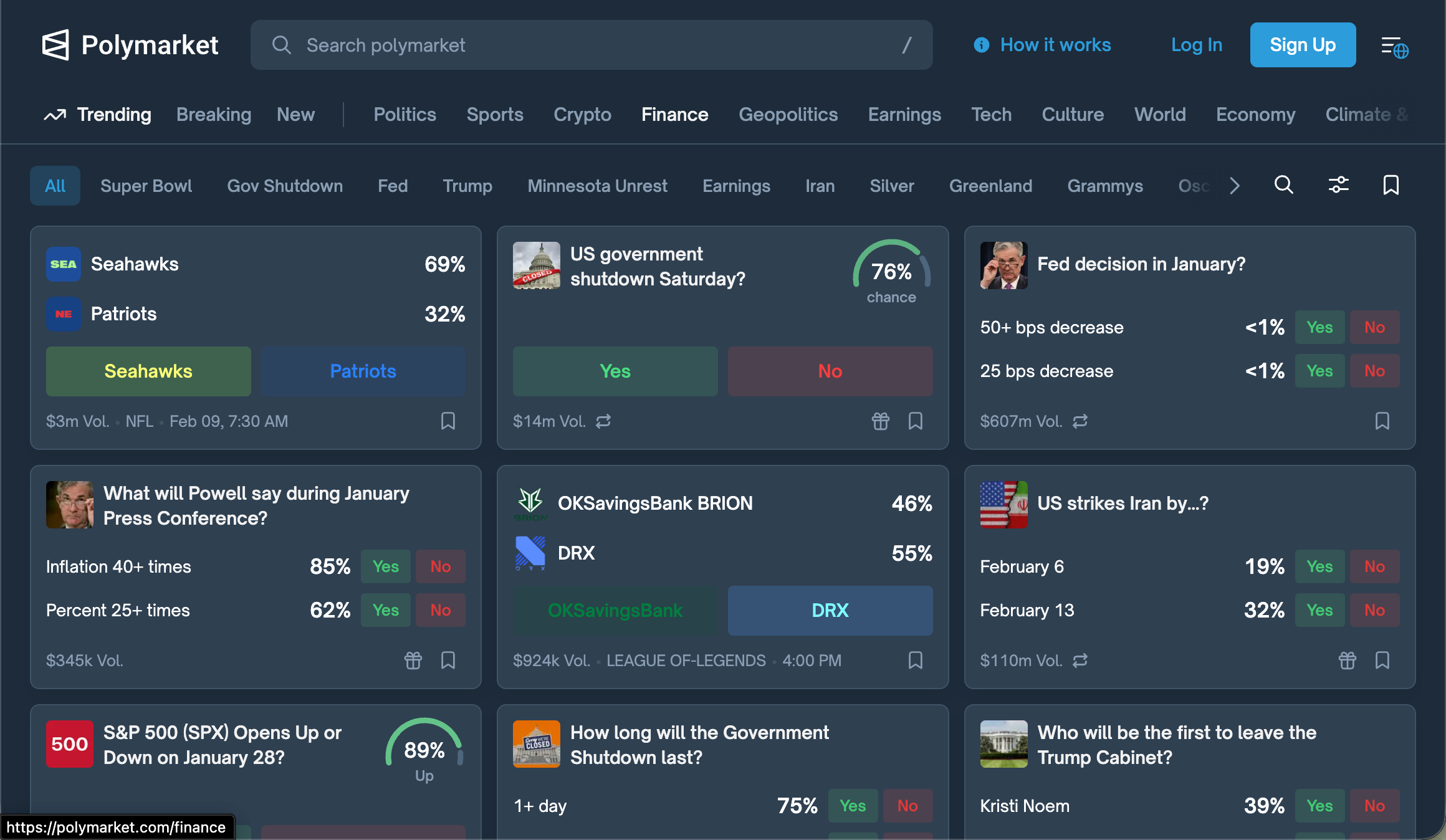

At the heart of Polymarket is a simple rule. All possible outcomes of a market must always sum to one dollar.

If an event has two outcomes Yes and No each side represents a share of one dollar. When the Yes token trades at sixty cents the market is saying there is roughly a sixty percent probability the event will occur. This is not an opinion. It is a price formed by capital at risk.

Image source: https://polymarket.com/

Every trade updates this probability. When new information enters the market traders react immediately. There is no waiting for surveys reports or commentary. Price is the signal.

This structure is enforced by smart contracts. When users enter a market their collateral is split into conditional tokens representing each outcome. Only one outcome can be redeemed at settlement. The other becomes worthless.

This design ensures full collateralization. There is no leverage hidden in the system. No fractional backing. No discretionary settlement. The math guarantees conservation of value.

Because of this traders can enter and exit positions at any time. If prices diverge from rational probabilities arbitrage participants step in. Over time inefficiencies shrink.

This is why Polymarket prices are often more accurate than forecasts produced by experts. Experts are not penalized for error. Traders are.

WHY THIS IS NOT GAMBLING IN THE TRADITIONAL SENSE

Many critics describe Polymarket as gambling. This label is convenient but misleading.

Gambling relies on fixed odds set by an operator. Polymarket has no house setting prices. Odds are created by participants themselves. There is no guaranteed edge for the platform.

More importantly gambling outcomes are isolated. Prediction market outcomes generate information. When prices move they communicate collective belief.

In this sense Polymarket is closer to a financial derivative than a casino game. It is an event based contract whose price reflects expectations.

This distinction is critical for regulation adoption and institutional interest. Once prediction markets are recognized as information instruments not entertainment products they become legitimate tools for risk management.

WHY WHAT IS POLYMARKET BECAME A GLOBAL QUESTION IN 2025

FROM NICHE CRYPTO TOOL TO MACRO SIGNAL

For several years Polymarket existed quietly within crypto circles. It was used to predict elections token prices and protocol upgrades. Volumes were modest. Attention was limited.

That changed as global uncertainty increased.

Interest rate policy became harder to forecast. Elections grew more polarized. Geopolitical conflict returned as a dominant risk factor. Traditional forecasting models struggled.

During this period Polymarket prices often adjusted before mainstream narratives shifted. Traders reacted to leaks local data and subtle signals faster than institutions could.

As a result journalists and analysts began to monitor Polymarket markets not for profit but for insight. The platform became a real time sentiment dashboard.

This is when the question what is Polymarket moved beyond crypto media. It entered mainstream finance.

REGULATION AND THE RETURN TO THE UNITED STATES

Another major turning point was regulation.

After being restricted in the United States Polymarket chose a long path back. Instead of fighting regulators it acquired licensed infrastructure and rebuilt itself within the system.

This decision transformed perception. Institutional capital does not engage with gray market tools. Once regulatory clarity improved participation followed.

The result was a feedback loop. Higher quality participants improved price accuracy. Better prices attracted more observers. Visibility increased legitimacy.

Polymarket did not become important because it was decentralized. It became important because it produced useful information.

THE FUTURE OF POLYMARKET AND INFORMATION FINANCE

AI TRADERS AND THE ACCELERATION OF PRICE DISCOVERY

One of the most underappreciated shifts happening on Polymarket is the rise of automated participants.

AI agents now scan news social data research papers and economic releases in real time. They execute trades instantly when probabilities change.

This has two effects. First markets react faster. Second human bias is reduced.

As more machine driven capital enters prediction markets prices may converge more quickly toward true probabilities. This challenges the role of human intuition but strengthens the informational value of the market.

Prediction markets could become the most efficient aggregation layer for global knowledge.

THE ETHICAL LIMITS OF TRADING ON TRUTH

However this power introduces tension.

If markets predict sensitive political or military outcomes too accurately they may reveal information that should not be public. They may also create incentives for insiders to trade on privileged data.

These concerns are real and unresolved. Regulation will likely impose boundaries on who can trade what.

The long term success of Polymarket depends on balance. It must preserve openness while preventing abuse.

If it succeeds prediction markets may become a core layer of the global information system. Not replacing journalism science or policy but complementing them with a price based signal.

In that future asking what is Polymarket will feel outdated. It will simply be understood as where uncertainty goes to be measured.