KEYTAKEAWAYS

- Uniswap’s adoption of Continuous Clearing Auctions signals a move away from exchange-controlled listings toward protocol-native liquidity distribution, positioning decentralized auctions as a credible alternative to centralized launch mechanisms.

- By embedding CCA functionality directly into its main interface, Uniswap is transforming token launches from isolated events into a composable market process that unifies auctions, swaps, and secondary trading within a single liquidity layer.

- The rollout highlights both the promise and the limits of Uniswap v4, where modular innovations such as hooks and auctions expand institutional and financial use cases, even as adoption, liquidity concentration, and regulatory clarity remain unresolved constraints.

CONTENT

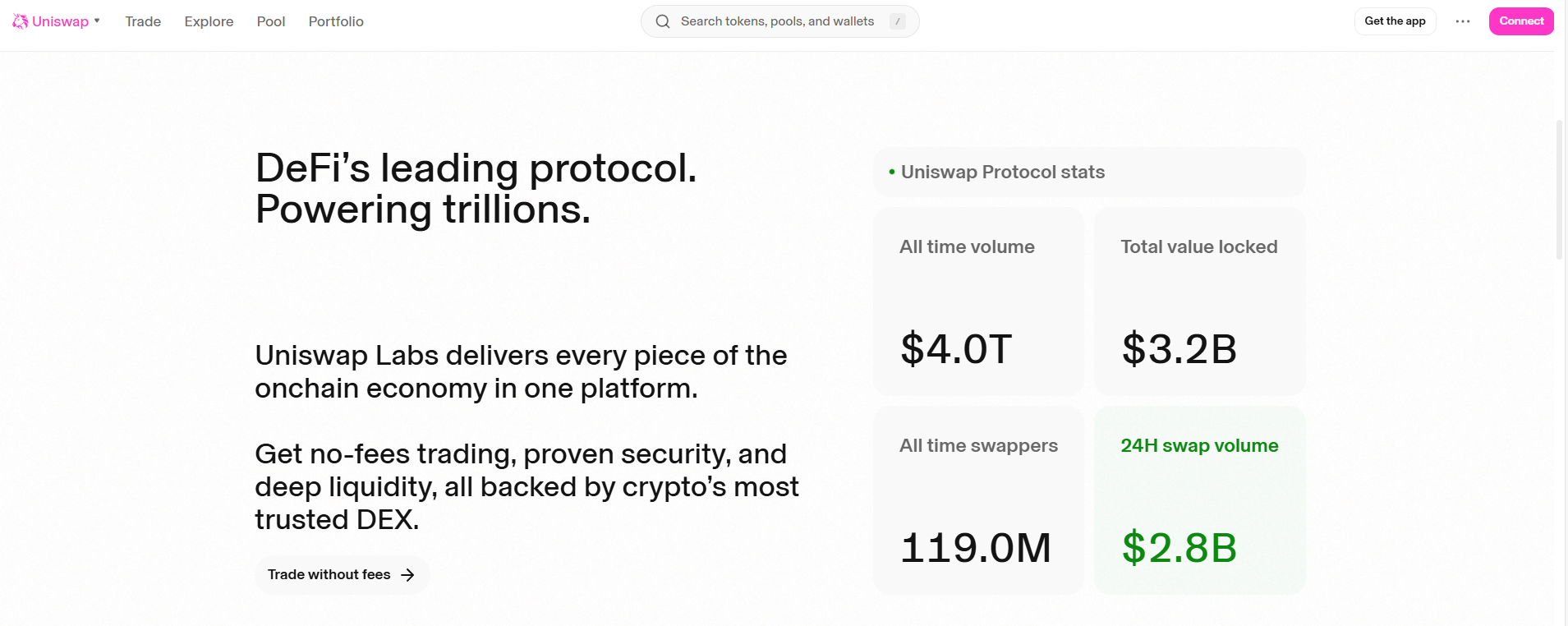

Uniswap’s integration of Continuous Clearing Auctions marks a structural shift in how tokens are launched on-chain, challenging centralized exchange dominance by embedding price discovery and liquidity formation directly into decentralized market infrastructure.

A NEW KIND OF LAUNCH

When Uniswap confirms that its mainnet interface will support Continuous Clearing Auctions on February 2, it is not simply adding another launch mechanic to an already crowded DeFi toolkit, but rather making an unusually explicit statement about who should control token distribution in a post–centralized-exchange world. The CCA model, which allows price discovery through a time-extended, demand-weighted clearing process rather than a single block or privileged allocation window, represents a structural break from both the ICO era of 2017 and the exchange-curated launchpads that dominated the 2020–2023 cycle, and the fact that Uniswap is integrating this functionality directly into its web interface suggests that decentralized liquidity formation is being treated as core infrastructure rather than an experimental add-on. According to protocol disclosures shared with early participants, the first wave of CCA-based launches, including Rainbow’s RNBW token, is expected to introduce roughly $150 million in fresh liquidity, a scale that places this experiment closer to a mid-tier centralized exchange listing than to the boutique launches that have traditionally characterized on-chain auctions.

FROM THEORY TO PRACTICE

While Continuous Clearing Auctions may sound novel to many DeFi users, the mechanism itself draws on older financial-market ideas, combining elements of call auctions used in traditional equities markets with the continuous settlement logic native to blockchains, and its recent on-chain validation owes much to earlier pilots conducted within the Aztec ecosystem. In those trials, documented publicly by Aztec, CCAs demonstrated an ability to concentrate large amounts of committed capital without the reflexive volatility that typically accompanies first-minute token trading, largely because participants submit bids across a defined price curve rather than racing for execution priority. What makes the Uniswap implementation more consequential is not merely that the model worked in isolation, but that it is now being embedded into the deepest pool of decentralized spot liquidity in crypto, where auctions, swaps, and post-launch trading can occur within a single, composable environment, collapsing what used to be a fragmented process involving launchpads, OTC desks, and secondary exchanges into a unified flow.

THE END OF LISTING MONOPOLIES

For much of crypto’s short history, the power to determine how new tokens enter the market has oscillated between two imperfect extremes: permissionless but chaotic launches on-chain, and highly controlled, often opaque listings on centralized exchanges. The rise of exchange launchpads in the last cycle was a response to genuine problems—front-running, bot dominance, and insider allocation—but it also re-introduced gatekeeping dynamics that many assumed DeFi had permanently discarded. CCA-based auctions, especially when hosted by a protocol with Uniswap’s reach, offer a credible third path by allowing projects to access deep liquidity without surrendering pricing authority to intermediaries, while giving participants a transparent, rules-based mechanism to express demand. It is therefore not surprising that developer commentary and DeFi-focused social channels have framed this launch as an attempt to reclaim token distribution as a public good, nor that institutional observers have begun to take notice, as evidenced by Bitwise filing a Uniswap ETF trust registration in Delaware, a move publicly visible through state corporate records and widely interpreted as a signal that Uniswap’s role is increasingly being evaluated through a traditional asset-management lens rather than as a purely retail-driven protocol.

UNISWAP V4 IN CONTEXT

Any assessment of the CCA rollout inevitably feeds into a broader debate about Uniswap v4 itself, which since its 2024 introduction has been positioned as a modular evolution of the protocol rather than a wholesale replacement of v3. On-chain data aggregated by Dune Analytics dashboards maintained by independent analysts shows that v4 has already generated well over $150 million in cumulative swap fees since launch, and while liquidity remains concentrated on Ethereum mainnet, Base, and Unichain, its share of total Uniswap trading volume has steadily increased as developers experiment with hook-based customization. At the same time, adoption metrics reveal a more nuanced picture, with hook utilization still representing a small fraction of total pools, reinforcing the view that v4’s true impact may lie less in immediate volume displacement and more in enabling specialized financial behaviors—such as auctions, conditional liquidity, and institution-friendly execution logic—that previous versions could not support cleanly.

RISKS BENEATH THE OPTIMISM

None of this, however, eliminates the structural uncertainties that accompany any attempt to redefine how assets are issued and traded, particularly in a regulatory environment that has yet to articulate clear boundaries around decentralized auctions and token distributions. From a technical standpoint, CCA logic introduces additional layers of complexity that must be robust under adversarial conditions, while from a market perspective, the concentration of early liquidity around a small number of chains raises familiar concerns about fragmentation and migration friction. Even Uniswap’s own token economics remain a variable, with UNI burn dynamics fluctuating daily based on protocol activity, a pattern visible in on-chain supply data and one that ties long-term value capture to sustained usage rather than to headline-driven launches. In that sense, the February 2 rollout should be understood less as a definitive solution and more as a historically significant experiment, one that tests whether decentralized markets can finally internalize the full lifecycle of asset creation, pricing, and trading without reverting to the centralized shortcuts that DeFi originally set out to escape.

Read More: