KEYTAKEAWAYS

- USDY’s deployment on Sei marks a shift from static stablecoins toward programmable, yield-generating dollars that can function as active collateral and liquidity across DeFi markets.

- The move reflects the broader maturation of tokenized U.S. Treasuries into a multi-billion-dollar market, where infrastructure choices such as latency, finality, and composability increasingly shape capital flows.

- By pairing Ondo’s compliance-oriented RWA structure with Sei’s high-performance execution layer, the launch illustrates how institutional finance and onchain systems are beginning to converge at the level of cash management and settlement.

CONTENT

Ondo’s USDY going live on Sei highlights how yield-bearing, Treasury-backed dollars are evolving into core onchain financial primitives, combining institutional compliance, real-world yield, and high-performance blockchain settlement.

A NEW RWA ON-RAMP

Ondo’s USDY—short for Ondo U.S. Dollar Yield—has always been less about inventing yet another “stablecoin” and more about normalizing a familiar TradFi behavior on-chain: parking idle dollars in short-duration, Treasury-linked yield without giving up transferability, composability, or 24/7 settlement, and that is exactly why its Sei deployment is a meaningful headline rather than a routine multi-chain expansion. In Sei’s own announcement, USDY arrives with day-one utility across swaps, lending, and bridging—tradable on Saphyre, usable as collateral on Takara Lend and Yei Finance, and movable via LayerZero—which makes the launch closer to “plugging a yield-bearing dollar into an operating DeFi economy” than “adding a new token contract.”

WHAT USDY REALLY IS

A crucial detail often blurred in social-media shorthand is that Ondo does not frame USDY as a plain-vanilla stablecoin; in its own documentation, USDY is described as a tokenized note designed for qualifying non-U.S. individuals and institutions, with yield mechanics expressed either through an accumulating token price (USDY) or a rebasing wrapper (rUSDY), and the docs are explicit that the instrument is not registered under the U.S. Securities Act and is not offered in the U.S. or to U.S. persons, with additional investor-category restrictions across jurisdictions. That legal and product architecture is not incidental; it is a direct descendant of the post-ICO era’s harsh lesson that distribution and disclosure rules, not smart contracts, ultimately decide whether “on-chain dollars” can be distributed at scale, and it also explains why USDY’s story has increasingly converged with the broader institutional tokenization wave rather than the retail stablecoin arms race.

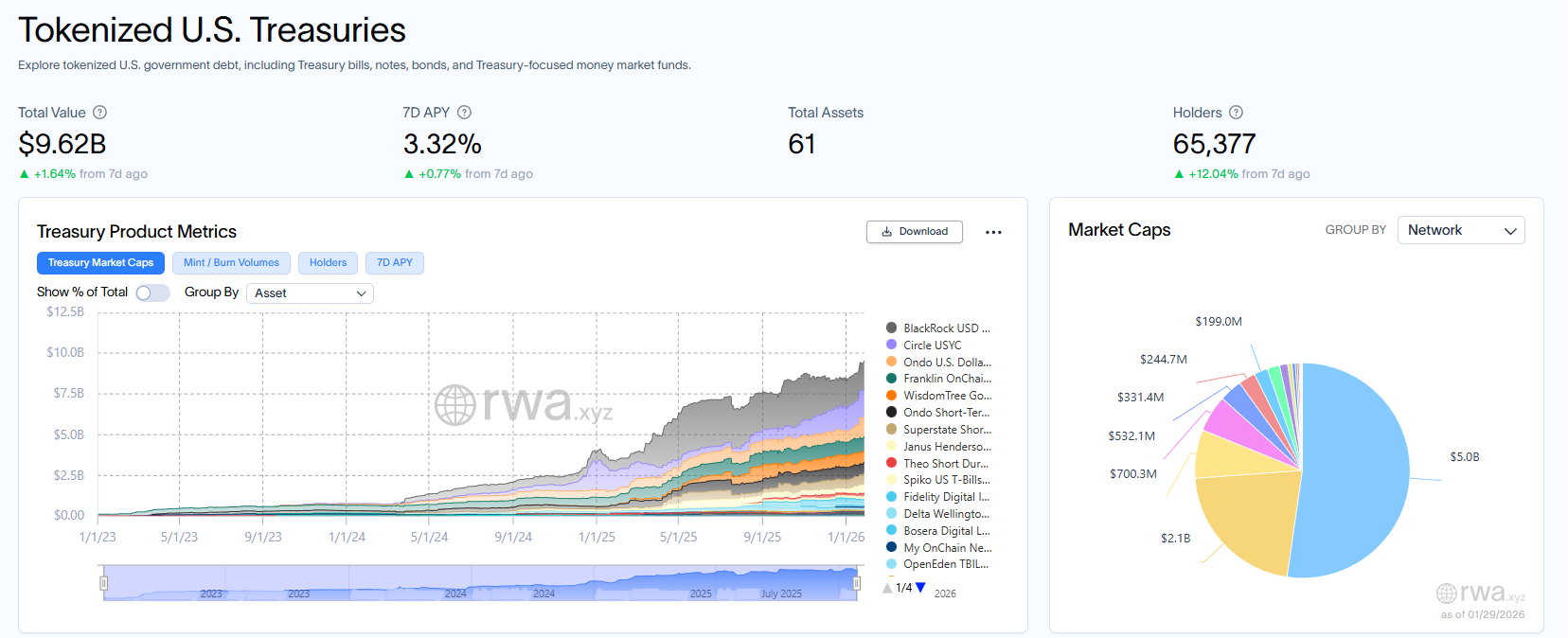

THE SCALE SHIFT: TOKENIZED TREASURIES ARE NO LONGER A NICHE

To understand why the Sei listing is arriving at exactly this moment, it helps to zoom out: tokenized U.S. Treasuries have crossed into a market measured in tens of billions, with RWA.xyz showing $10.00B in total value for tokenized Treasuries as of 01/28/2026, alongside tens of thousands of holders and dozens of products, which is a stark contrast to the early experiments of 2020–2022 when “tokenized Treasuries” mostly meant boutique structures with limited distribution. Within that market, RWA.xyz lists Ondo U.S. Dollar Yield (USDY) at roughly $1.398B (also as of 01/28/2026), and it places Ondo among the largest platforms by tokenized Treasury value—evidence that USDY is already operating at a scale where “new chain support” can plausibly reshape liquidity routes rather than just add optionality.

WHY SEI, AND WHY NOW

Sei is pitching itself as a settlement layer optimized for high-frequency, low-latency finance, and in its USDY post it claims infrastructure characteristics around sub-400ms time-to-finality and 12,500 TPS, explicitly framing those traits as the kind of deterministic execution environment that TradFi-style cash management and real-time collateral mobility would demand. It also makes a bolder institutional claim—that tokenized funds from managers such as BlackRock, Brevan Howard, Hamilton Lane, Laser Digital (Nomura), and Apollo are “live on the network”—which, whether one reads it as marketing or as a directional signal, reveals the strategic narrative: USDY on Sei is being positioned as the yield-bearing dollar leg of an ecosystem that wants to host institution-facing RWAs rather than merely speculate on them. The deeper point is historical: every time markets have tried to digitize short-duration government yield—whether through money-market funds, repo modernization, or ETF wrappers—the winning distribution channel has been the one that reduces operational friction for the end holder; in crypto, a chain’s throughput and UX are part of that “distribution,” because the path from idle cash to productive collateral has to be fast, cheap, and reliable to compete with off-chain alternatives.

THE REAL TEST: LIQUIDITY IS A BEHAVIOR, NOT A LISTING

The optimistic take is straightforward: if USDY becomes a default high-quality collateral unit inside Sei lending markets, then “Treasury yield” stops being a passive holding and becomes a programmable balance-sheet primitive that can power leverage, market-making, and cross-chain treasury routing, which is the kind of utility stablecoins themselves rarely provide without external yield wrappers. The skeptical take is equally important: new-chain deployments often create a short-term narrative spike that looks like “liquidity growth” before real usage proves it, and the difference between a meaningful RWA beachhead and a temporary incentives mirage will show up in whether borrowers and protocols repeatedly choose USDY over non-yielding stables once the novelty fades. Still, even under conservative assumptions, USDY’s move onto a performance-first chain lands at a moment when tokenized Treasuries have already become a large, measurable market, and when USDY itself is already operating at billion-dollar scale—conditions that make this launch feel less like another integration headline and more like a small but concrete step toward turning on-chain finance into a place where cash management behaves like cash management again.

Read More:

From NYSE to Ondo: Who Wins the Tokenized Securities Race?

From Treasuries to Stocks: Ondo’s Bid to Build a “Wall Street 2.0” Onchain